Your Cuyahoga county real estate tax bills images are ready in this website. Cuyahoga county real estate tax bills are a topic that is being searched for and liked by netizens now. You can Find and Download the Cuyahoga county real estate tax bills files here. Get all royalty-free images.

If you’re searching for cuyahoga county real estate tax bills images information connected with to the cuyahoga county real estate tax bills topic, you have visit the right blog. Our website always provides you with suggestions for downloading the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Cuyahoga County Real Estate Tax Bills. Located at the County Administrative Headquarters 2079 E 9th. There are currently eight options for paying property taxes. View Pay Your Tax Bill. Cuyahoga County Administrative Headquarters.

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group From waller.com

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group From waller.com

Cuyahoga County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cuyahoga County Ohio. Roughly 88000 Cuyahoga County homeowners are taking advantage of the. There are currently eight options for paying property taxes. Cuyahoga County taxpayers are able search their property tax bills for the first half of 2014 at the website above by using their parcel number owners last name owners address or AFN number. It is expected that tax bills will be in hand approximately 20 days prior to the deadline per state law. Property tax bills are due Thursday in Cuyahoga County.

2079 East Ninth Street.

Postmark is not honored regarding penalty assessments. Located at the County Administrative Headquarters 2079 E 9th. 2079 East Ninth Street. The funds collected from property taxes provide vital revenue to educate our local youth to provide police and fire protection maintain our great libraries and support county services such as job creation and business attraction. In Strongsville voters are rejecting a. Cuyahoga County Administrative Headquarters.

Source: waller.com

Source: waller.com

CLEVELAND Ohio WOIO - More than 230000 Cuyahoga County residents will soon receive their property tax bills. CLEVELAND The Cuyahoga County Treasury has mailed property tax bills to over 230000 county residents. Cuyahoga County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cuyahoga County Ohio. To avoid long lines residents should consider paying property taxes. Postmark is not honored regarding penalty assessments.

Source: pinterest.com

Source: pinterest.com

Cuyahoga County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cuyahoga County Ohio. Cuyahoga County property tax deadline moved to Jan. Located at the County Administrative Headquarters 2079 E 9th. Property tax bills are due Thursday in Cuyahoga County. Postmark is not honored regarding penalty assessments.

Source: thevillagernewspaper.com

Source: thevillagernewspaper.com

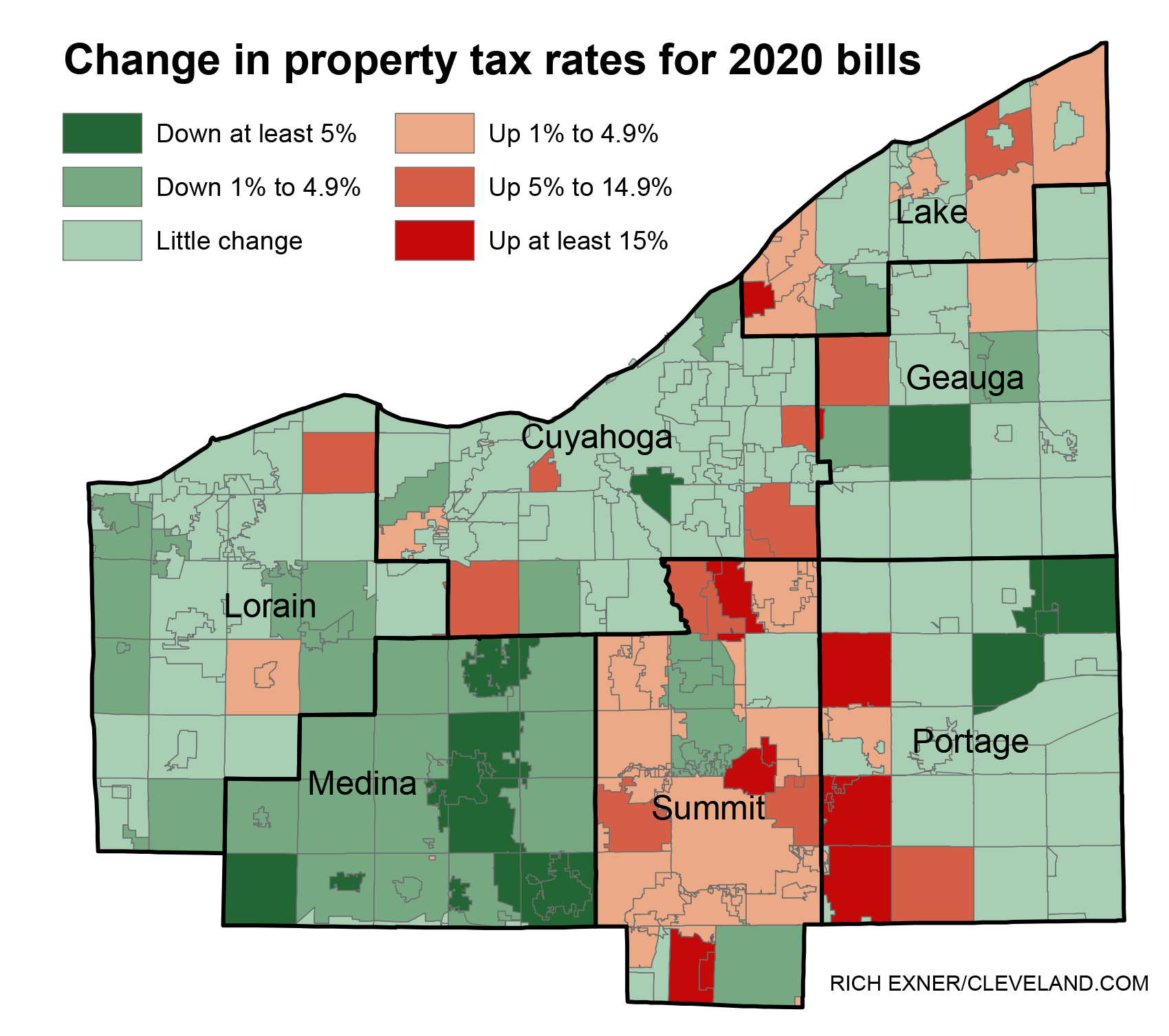

Cuyahoga County taxpayers are able search their property tax bills for the first half of 2014 at the website above by using their parcel number owners last name owners address or AFN number. The last day to pay without penalty is Thursday January 21 2016. Pay by e-check or creditdebit card. The Annual Interest Rate for delinquent real estate taxes is 12 per written order of the Cuyahoga County Treasurer as certified by the Ohio Tax Commissioner. Your 2020 property value was used to calculate your current tax bill.

Source: slideshare.net

Source: slideshare.net

CUYAHOGA COUNTY OH The 2019 second half real estate tax deadline has been extended by four weeks to August 13 2020. This move was recently approved by the State Tax Commissioner. CLEVELAND The Cuyahoga County Treasury has mailed property tax bills to over 230000 county residents. Cuyahoga County Administrative Headquarters. Cuyahoga County taxpayers are able search their property tax bills for the first half of 2014 at the website above by using their parcel number owners last name owners address or AFN number.

Source: in.pinterest.com

Source: in.pinterest.com

The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt 25000 for qualifying Veterans of the market value of their homes from all local property taxes. The last day to pay without penalty is Thursday January 21 2016. They are maintained by various government offices in Cuyahoga County Ohio State and at the Federal level. In Strongsville voters are rejecting a. Our information indicates that this property does not currently benefit from any exemptions therefore the taxable value is.

Source: inmyarea.com

Source: inmyarea.com

Exemptions are available in Cuyahoga County which may lower the propertys tax bill. 2079 East Ninth Street. 30 for all after snafu with bills in 3 cities Posted Jan 15 2020 The new property tax deadline in Cuyahoga County. The countys treasury department announced on Monday that the bills have been mailed. The last day to pay without penalty is Thursday January 21 2016.

Source: hrblock.com

Source: hrblock.com

2079 East Ninth Street. Our information indicates that this property does not currently benefit from any exemptions therefore the taxable value is. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Certain types of Tax Records are available to the general public while some Tax Records are. This move was recently approved by the State Tax Commissioner.

Source: clevelandjewishnews.com

Source: clevelandjewishnews.com

It is expected that tax bills will be in hand approximately 20 days prior to the deadline per state law. In order to avoid long lines residents should consider paying property taxes on-line or by phone. Your 2020 property value was used to calculate your current tax bill. Cuyahoga County Ohio - The Cuyahoga County Treasury has mailed property tax bills to over 300000 county residents. St Cleveland OH for check or money order payments.

Source: kevindcampbell.ca

Source: kevindcampbell.ca

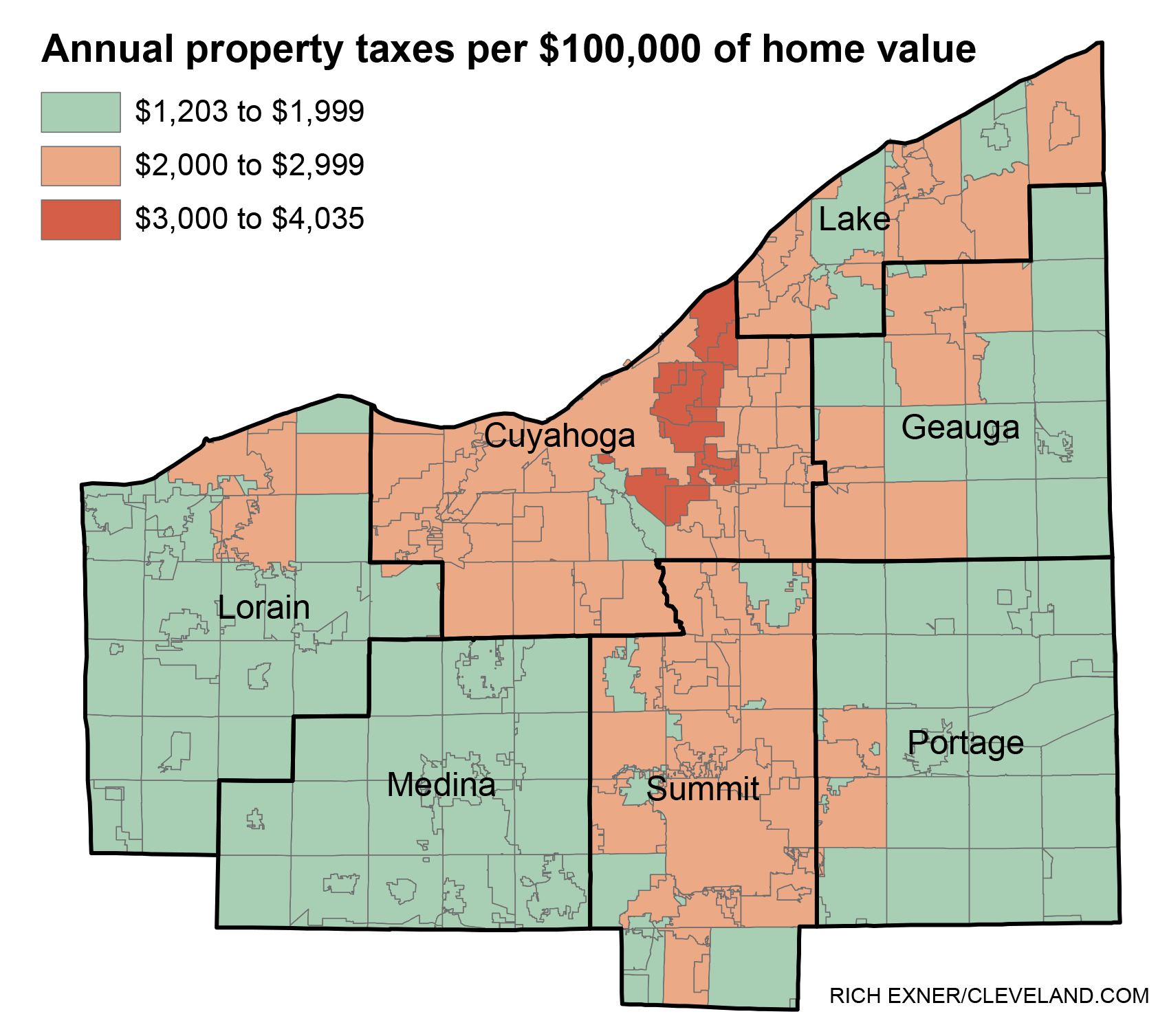

It is expected that tax bills will be in hand approximately 20 days prior to the deadline per state law. Mail your check or money order and the bottom portion of your tax bill. The Annual Interest Rate for delinquent real estate taxes is 12 per written order of the Cuyahoga County Treasurer as certified by the Ohio Tax Commissioner. Certain types of Tax Records are available to the general public while some Tax Records are. For example an eligible owner of a home with a market value of 100000 will be billed as if the home were valued at 75000.

Source: cleveland.com

Source: cleveland.com

View Pay Your Tax Bill. The countys treasury department announced on Monday that the bills have been mailed. Cuyahoga County Administrative Headquarters. These are deducted from the assessed value giving the propertys taxable value. The Annual Interest Rate for delinquent real estate taxes is 12 per written order of the Cuyahoga County Treasurer as certified by the Ohio Tax Commissioner.

Source: cleveland.com

Source: cleveland.com

View Pay Your Tax Bill. Cuyahoga County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cuyahoga County Ohio. Cuyahoga County Administrative Headquarters. Mail your check or money order and the bottom portion of your tax bill. The funds collected from property taxes provide vital revenue to educate our local youth to provide police and fire protection maintain our great libraries and support county services such as job creation and business attraction.

Source: cleveland.com

Source: cleveland.com

Cuyahoga County taxpayers are able search their property tax bills for the first half of 2014 at the website above by using their parcel number owners last name owners address or AFN number. CUYAHOGA COUNTY OH The 2019 second half real estate tax deadline has been extended by four weeks to August 13 2020. Cost for 100000 home. Located at the County Administrative Headquarters 2079 E 9th. Pay by e-check or creditdebit card.

The funds collected from property taxes provide vital revenue to educate our local youth to provide police and fire protection maintain our great libraries and support county services such as job creation and attraction. These are deducted from the assessed value giving the propertys taxable value. 30 for all after snafu with bills in 3 cities Posted Jan 15 2020 The new property tax deadline in Cuyahoga County. 2079 East Ninth Street. Levies that passed during 2020 which appear on your current tax bill are.

Source: thevillagernewspaper.com

Source: thevillagernewspaper.com

Cuyahoga County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cuyahoga County Ohio. They are a valuable tool for the real estate. Property tax bills are due Thursday in Cuyahoga County. It is expected that tax bills will be in hand approximately 20 days prior to the deadline per state law. The funds collected from property taxes provide vital revenue to educate our local youth to provide police and fire protection maintain our great libraries and support county services such as job creation and attraction.

Source: coronavirus.kjk.com

Source: coronavirus.kjk.com

St Cleveland OH for check or money order payments. CLEVELAND Property tax bills for Cuyahoga County residents are now available online through the County Treasurers website at httptreasurercuyahogacountyusen-USview-pay-tax-billaspx. 2079 East Ninth Street. Your 2020 property value was used to calculate your current tax bill. View Pay Your Tax Bill.

Source: thevillagernewspaper.com

Source: thevillagernewspaper.com

Cost for 100000 home. The countys treasury department announced on Monday that the bills have been mailed. Levies that passed during 2020 which appear on your current tax bill are. CLEVELAND The Cuyahoga County Treasury Department mailed property tax bills to over 300000 county residents. They are a valuable tool for the real estate.

Source: pinterest.com

Source: pinterest.com

CLEVELAND Ohio WOIO - More than 230000 Cuyahoga County residents will soon receive their property tax bills. CLEVELAND Ohio WOIO - More than 230000 Cuyahoga County residents will soon receive their property tax bills. There are currently eight options for paying property taxes. Call 1-800-272-9829 to pay by creditdebit card for Spanish speaking. Cost for 100000 home.

Source: cleveland.com

Source: cleveland.com

The interest charge is assessed as follows. Cuyahoga County property tax deadline moved to Jan. CLEVELAND Property tax bills for Cuyahoga County residents are now available online through the County Treasurers website at httptreasurercuyahogacountyusen-USview-pay-tax-billaspx. Cuyahoga County Ohio - The Cuyahoga County Treasury has mailed property tax bills to over 300000 county residents. This move was recently approved by the State Tax Commissioner.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cuyahoga county real estate tax bills by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.