Your Custodial ira account real estate images are ready. Custodial ira account real estate are a topic that is being searched for and liked by netizens today. You can Get the Custodial ira account real estate files here. Get all free images.

If you’re searching for custodial ira account real estate images information linked to the custodial ira account real estate topic, you have pay a visit to the ideal blog. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

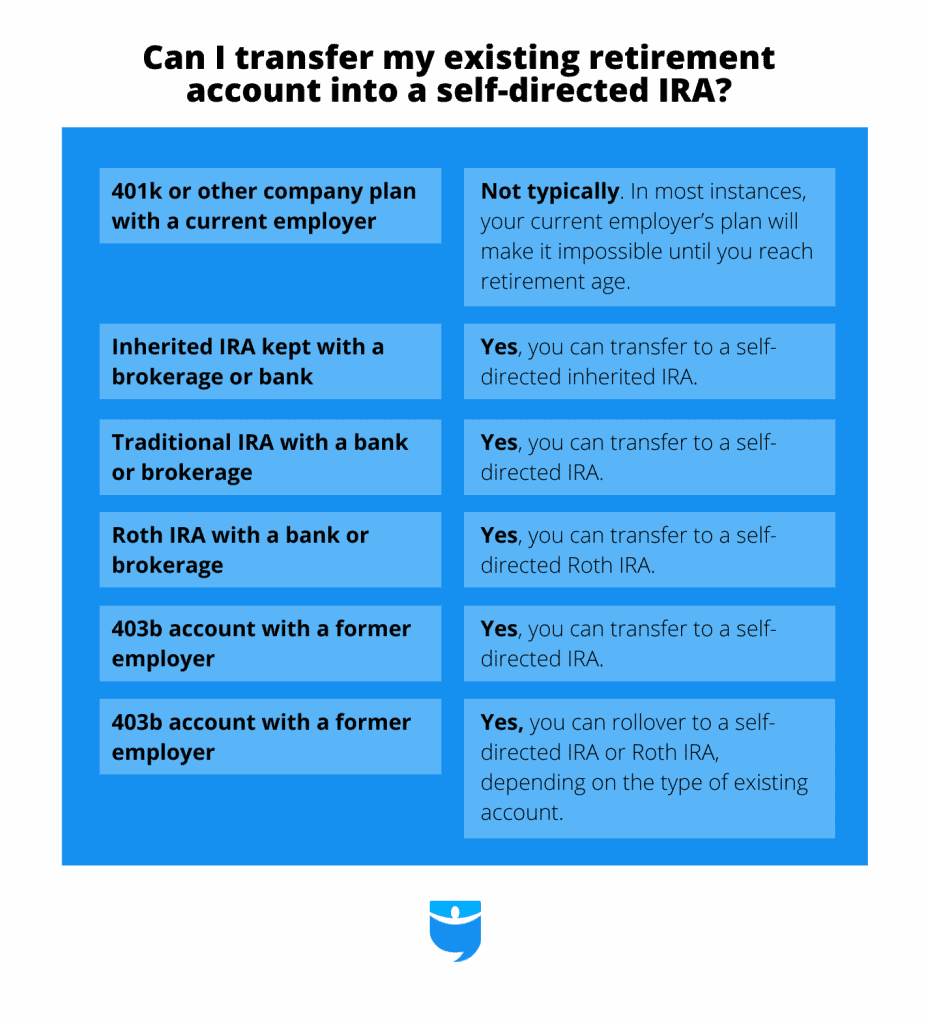

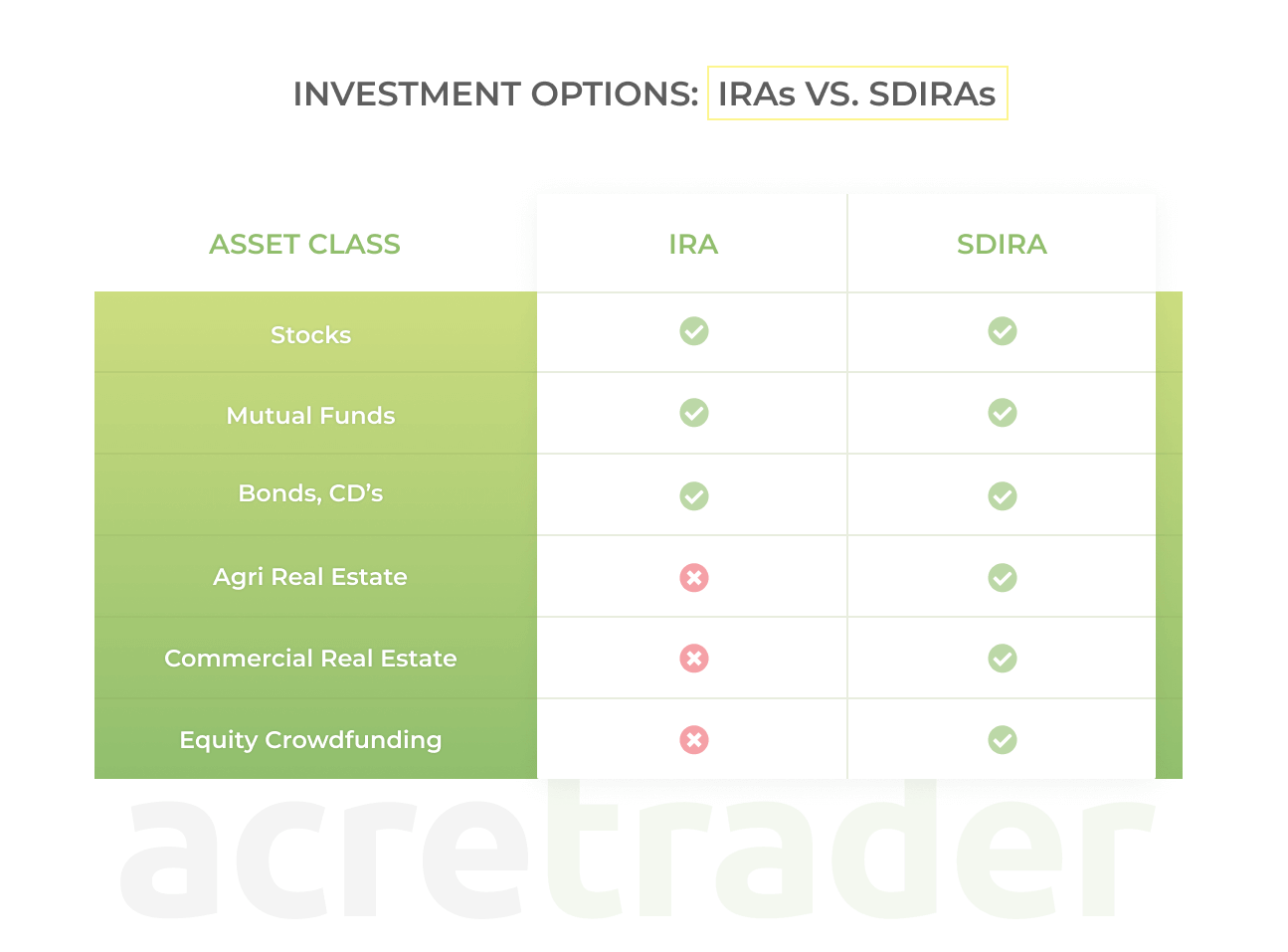

Custodial Ira Account Real Estate. To invest in alternative assets such as real estate or private equity with your retirement savings you need a self-directed IRA. A custodial IRA is a type of retirement account that you can set up for your child. Self-Directed IRAs Individual Retirement Accounts are accounts that allow you to invest in alternative assets like real estate or small businesses. Real Estate in an IRA Can be Purchased without 100 Funding from Your IRA.

Non Recourse Loan Lender Self Directed Ira Benefits First Western Federal Savings Bank From myiralender.com

Non Recourse Loan Lender Self Directed Ira Benefits First Western Federal Savings Bank From myiralender.com

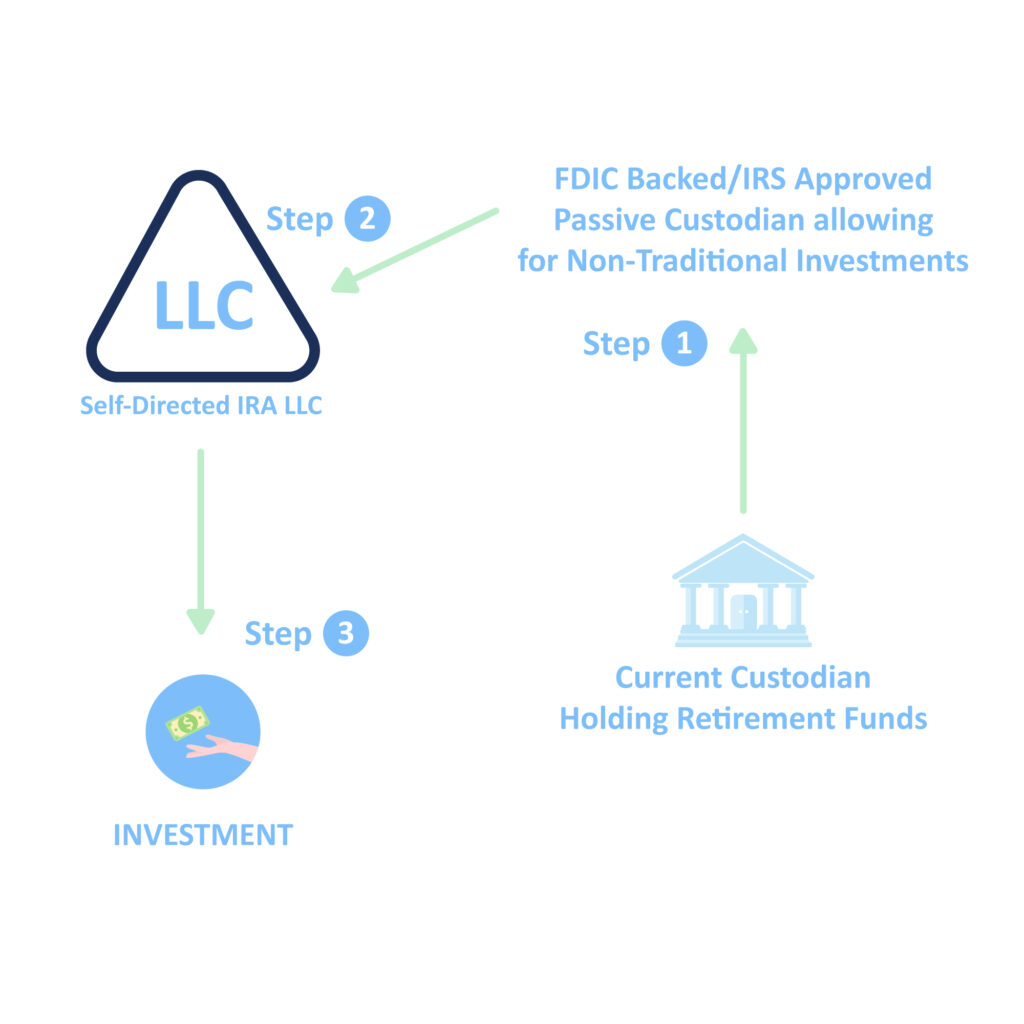

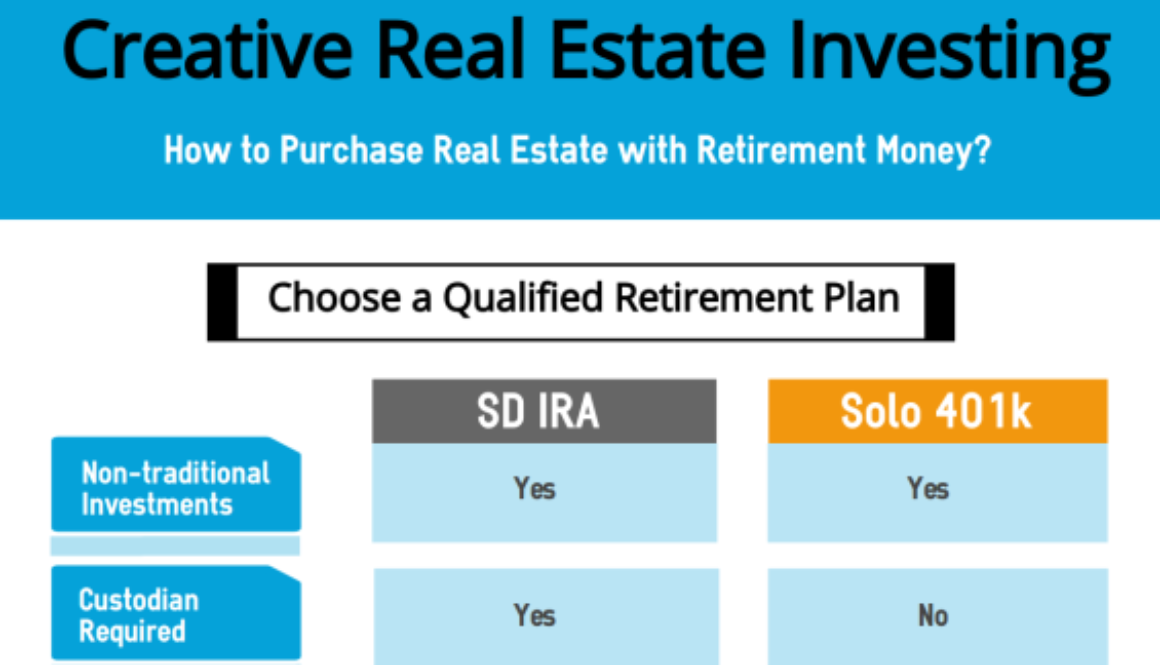

One way that you can do this is to set up a custodial IRA for your child. Finding a Custodian for Real Estate IRAs As IRAs have special tax benefits an IRA must have a custodian that keeps track of and reports to the IRS on deposits withdrawals and year-end balances. As a self-directed IRA custodian Advanta IRA allows investments in real estate private equity gold and all other alternative assets. Self-Directed IRAs Individual Retirement Accounts are accounts that allow you to invest in alternative assets like real estate or small businesses. IRA Custodians Administrators and Promoters. To buy and own property via your IRA you will still need a custodian an entity specializing in self-directed accounts that will manage the transaction associated paperwork and financial.

Unlike your typical 401 k or Roth IRA these Self-Directed IRAs require a qualified custodian to process transactions hold the assets and keep records for the IRS.

Custodians also called trustees are different depending on the type of IRA. Marketable securities such as mutual funds or stocks do not require any effort in choosing a custodian however IRAs that hold alternative investments like private notes precious metals or real estate need a. Custodians also called trustees are different depending on the type of IRA. Per the rules of the Internal Revenue Service such IRA custodians have to be financial institutions that are approved. An IRA custodian is commonly represented by some form of a financial institution. If you wanted to buy a rental property you would open an IRA custodial account transfer cash from an existing IRA account or possibly 401k into the custodial account.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

One way that you can do this is to set up a custodial IRA for your child. One of the biggest advantages that young people have is time. Marketable securities such as mutual funds or stocks do not require any effort in choosing a custodian however IRAs that hold alternative investments like private notes precious metals or real estate need a. Once the Custodial IRA is open all assets are managed by the custodian until the child reaches age 18 or 21 in some states. A custodial account is generally created by a parent or grandparent for the benefit of a minor child or grandchild.

Source: sdirahandbook.com

Source: sdirahandbook.com

Per the rules of the Internal Revenue Service such IRA custodians have to be financial institutions that are approved. Many custodians will allow you to open what is called a self-directed IRA. This would likely be a brokerage or a bank. In the words of Kathy Fettke Co-CEO and Co-Founder of RealWealth A self-directed Individual Retirement Arrangement IRA is an individual retirement account that allows the account owner to direct the account trustee to make a broader range of investments beyond stocks and bonds including. Per the rules of the Internal Revenue Service such IRA custodians have to be financial institutions that are approved.

Source: trustetc.com

Source: trustetc.com

A custodial account is generally created by a parent or grandparent for the benefit of a minor child or grandchild. These other options include using undivided interest and partnering with others including other account holders non-IRA funds. You can purchase property in more ways than just an outright purchase of the full amount from your account. Many custodians will allow you to open what is called a self-directed IRA. In fact many do because of the concerns mentioned herein.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

Custodians also called trustees are different depending on the type of IRA. Many custodians will allow you to open what is called a self-directed IRA. A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income. This would likely be a brokerage or a bank. Many investors choose a custodian for.

Source: equitymultiple.com

Source: equitymultiple.com

When you put money into a custodial account you make a gift to the minor beneficiary of the accounteven though the minor does not control the account. An IRA is a custodial account and it requires a custodian to maintain its tax-advantaged status. The account creator usually acts as the accounts custodian. Real Estate in an IRA Can be Purchased without 100 Funding from Your IRA. A custodial account is generally created by a parent or grandparent for the benefit of a minor child or grandchild.

Source: trustetc.com

Source: trustetc.com

Once the Custodial IRA is open all assets are managed by the custodian until the child reaches age 18 or 21 in some states. These Individual Retirement Accounts custodians have the job of protecting your assets in your IRA. Thats because IRA custodians can prohibit their accounts from holding real estate. Unlike your typical 401 k or Roth IRA these Self-Directed IRAs require a qualified custodian to process transactions hold the assets and keep records for the IRS. By getting started investing for their retirement at an early age they will have compound interest on their side.

Source: azirarealestate.com

Source: azirarealestate.com

Real Estate in an IRA Can be Purchased without 100 Funding from Your IRA. The account creator usually acts as the accounts custodian. One of the biggest advantages that young people have is time. Self-Directed IRAs Individual Retirement Accounts are accounts that allow you to invest in alternative assets like real estate or small businesses. One way that you can do this is to set up a custodial IRA for your child.

Source: sdirahandbook.com

Source: sdirahandbook.com

One way that you can do this is to set up a custodial IRA for your child. A custodial IRA is a type of retirement account that you can set up for your child. What is a Custodial IRA. Thats because IRA custodians can prohibit their accounts from holding real estate. This would likely be a brokerage or a bank.

Source: trustetc.com

Source: trustetc.com

To invest in alternative assets such as real estate or private equity with your retirement savings you need a self-directed IRA. You can purchase property in more ways than just an outright purchase of the full amount from your account. The IRS states that this must be through a passive 3rd party. Per the rules of the Internal Revenue Service such IRA custodians have to be financial institutions that are approved. If you are a parent or guardian of a young person this gives you the opportunity to save and invest for your child while retaining full control of the account until they reach adulthood.

Source: trustetc.com

Source: trustetc.com

An IRA custodian is commonly represented by some form of a financial institution. This would likely be a brokerage or a bank. Even in this case you still must check the custodial agreement. Real Estate in an IRA Can be Purchased without 100 Funding from Your IRA. If you are a parent or guardian of a young person this gives you the opportunity to save and invest for your child while retaining full control of the account until they reach adulthood.

Source: irafinancialgroup.com

Source: irafinancialgroup.com

By getting started investing for their retirement at an early age they will have compound interest on their side. One of the biggest advantages that young people have is time. As a self-directed IRA custodian Advanta IRA allows investments in real estate private equity gold and all other alternative assets. A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income. Custodians also called trustees are different depending on the type of IRA.

Source: biggerpockets.com

Source: biggerpockets.com

Updated January 15 2021 A custodial account is a financial account held in the name of a minor usually by a parent legal guardian or another relative. The account creator usually acts as the accounts custodian. Many custodians will allow you to open what is called a self-directed IRA. A custodial account is generally created by a parent or grandparent for the benefit of a minor child or grandchild. Many self-directed IRA investments particularly real estate can be rather illiquid.

Source: companiesinc.com

Source: companiesinc.com

Unlike your typical 401 k or Roth IRA these Self-Directed IRAs require a qualified custodian to process transactions hold the assets and keep records for the IRS. An IRA custodian is commonly represented by some form of a financial institution. In the words of Kathy Fettke Co-CEO and Co-Founder of RealWealth A self-directed Individual Retirement Arrangement IRA is an individual retirement account that allows the account owner to direct the account trustee to make a broader range of investments beyond stocks and bonds including. Thats because IRA custodians can prohibit their accounts from holding real estate. You can purchase property in more ways than just an outright purchase of the full amount from your account.

Source: trustetc.com

Source: trustetc.com

A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income. In fact many do because of the concerns mentioned herein. A custodial account is generally created by a parent or grandparent for the benefit of a minor child or grandchild. One of the biggest advantages that young people have is time. These other options include using undivided interest and partnering with others including other account holders non-IRA funds.

Source: acretrader.com

Source: acretrader.com

This would likely be a brokerage or a bank. Finding a Custodian for Real Estate IRAs As IRAs have special tax benefits an IRA must have a custodian that keeps track of and reports to the IRS on deposits withdrawals and year-end balances. Unlike your typical 401 k or Roth IRA these Self-Directed IRAs require a qualified custodian to process transactions hold the assets and keep records for the IRS. These other options include using undivided interest and partnering with others including other account holders non-IRA funds. In other words if you want to sell a stock in your standard IRA you can do it with the press of a button.

Source: myiralender.com

Source: myiralender.com

If you wanted to buy a rental property you would open an IRA custodial account transfer cash from an existing IRA account or possibly 401k into the custodial account. By getting started investing for their retirement at an early age they will have compound interest on their side. Thats because IRA custodians can prohibit their accounts from holding real estate. In the words of Kathy Fettke Co-CEO and Co-Founder of RealWealth A self-directed Individual Retirement Arrangement IRA is an individual retirement account that allows the account owner to direct the account trustee to make a broader range of investments beyond stocks and bonds including. As a self-directed IRA custodian Advanta IRA allows investments in real estate private equity gold and all other alternative assets.

Source: sensefinancial.com

Source: sensefinancial.com

With standard individual retirement accounts IRAs your investment options are usually restricted to securities such as stocks bonds and mutual funds. What is a Custodial IRA. An IRA is a custodial account and it requires a custodian to maintain its tax-advantaged status. Many custodians will allow you to open what is called a self-directed IRA. The custodian ensures that all of the investments are approved by the Internal.

Source: homeunion.com

Source: homeunion.com

A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income. Per the rules of the Internal Revenue Service such IRA custodians have to be financial institutions that are approved. The IRS states that this must be through a passive 3rd party. One way that you can do this is to set up a custodial IRA for your child. Real estate franchises precious metals and private equity.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title custodial ira account real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.