Your County of henrico real estate tax bill images are ready in this website. County of henrico real estate tax bill are a topic that is being searched for and liked by netizens now. You can Get the County of henrico real estate tax bill files here. Get all free images.

If you’re looking for county of henrico real estate tax bill images information connected with to the county of henrico real estate tax bill interest, you have come to the right blog. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

County Of Henrico Real Estate Tax Bill. REAL ESTATE TAX Real estate in Henrico County is assessed at 100 of market value and taxed at 87 per 100 of assessed value. Administer laws pertaining to the real estate assessment process. Residential real property owned and occupied by the homeowner as evidenced by a Homeowners Exemption OR. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

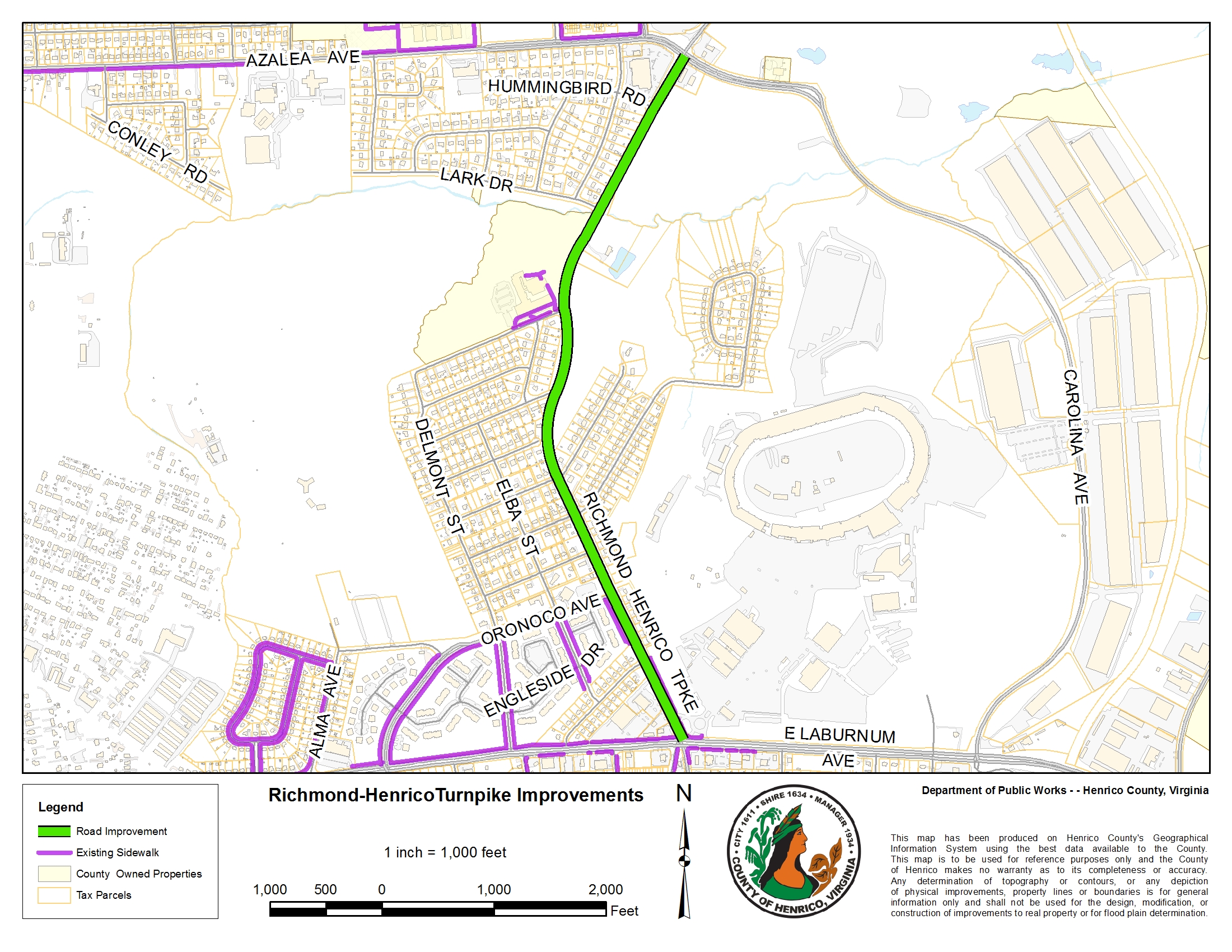

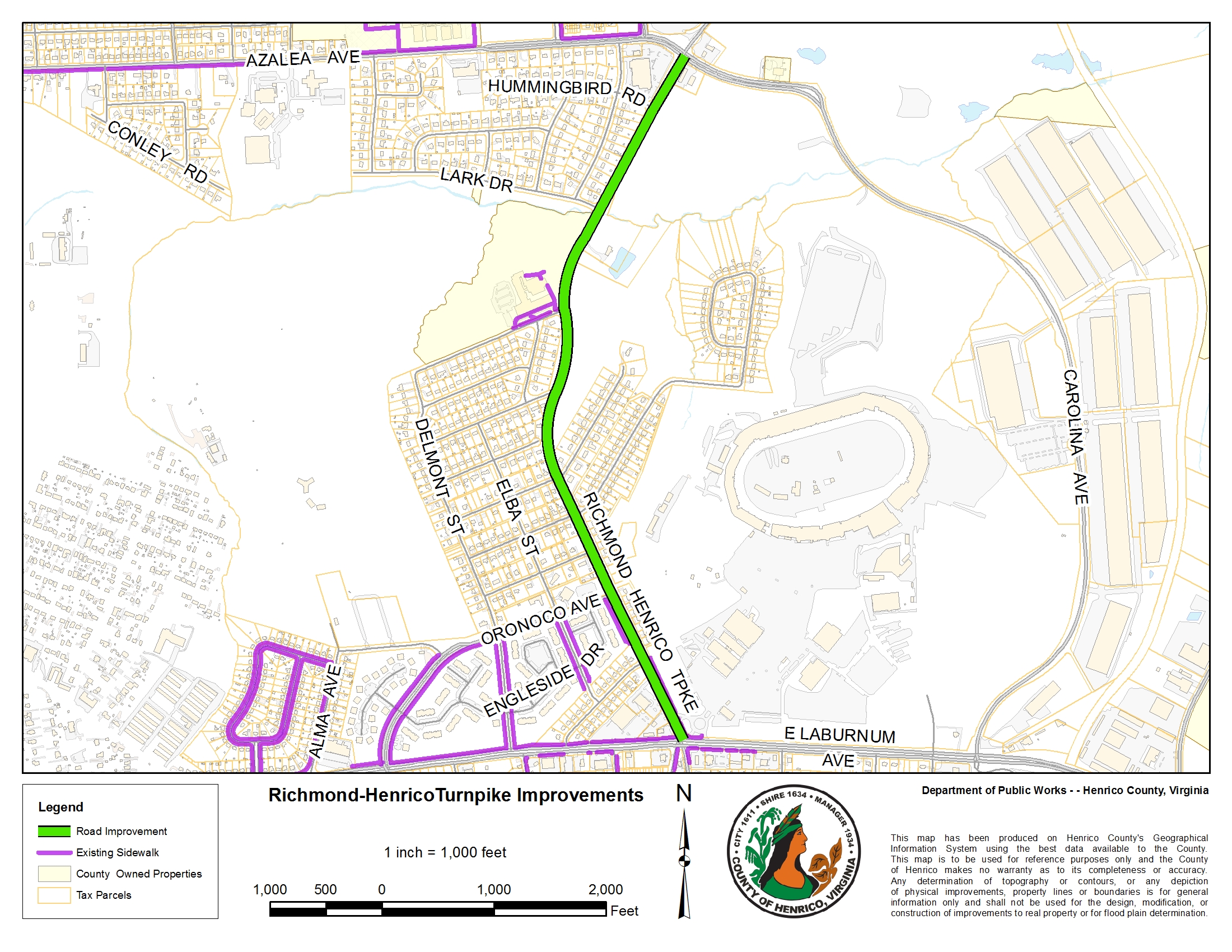

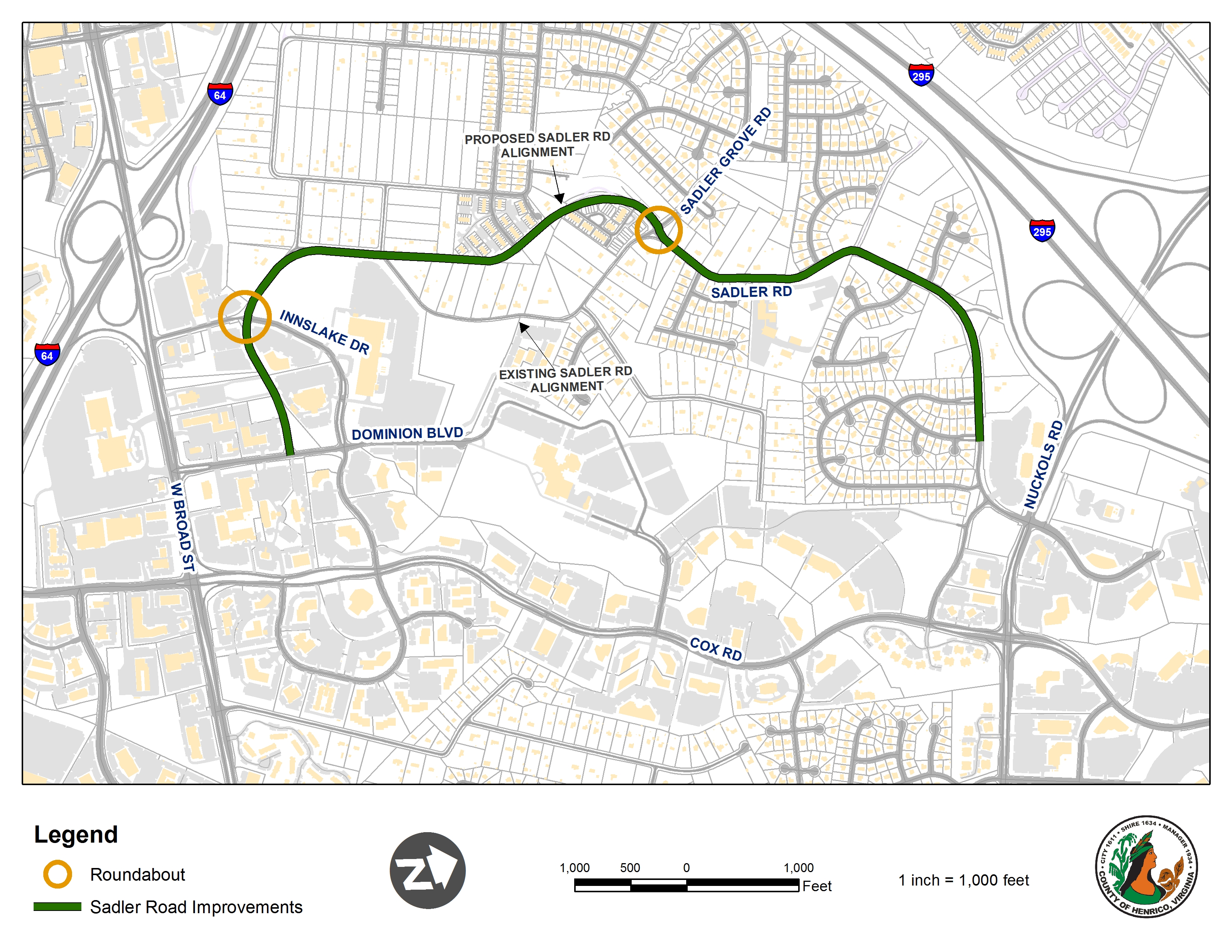

Richmond Henrico Turnpike Improvements Henrico County Virginia From henrico.us

Richmond Henrico Turnpike Improvements Henrico County Virginia From henrico.us

Lebanon County Treasurer 400 South 8th Street Room 103 Lebanon PA 17042. Henrico County is poised to again boost its tax relief program for seniors. The County assumes no liability for your use of the data. The County does not warrant that the information is accurate complete or timely and the data is offered for general information. Contact your application administrator. The Real Estate Tax Advantage Program currently cuts up to the first 2500 from the tax bills of qualifying seniors and.

Real Estate Tax Due Dates.

About henrico county real estate tax bills. Henricos tax rate is 87 cents per 100 of assessed value meaning that the average real estate tax bill for Henrico homeowners will increase by about 92. Real Property Owned and operated by a taxpayer that qualifies as a small business. REAL ESTATE TAX Real estate in Henrico County is assessed at 100 of market value and taxed at 87 per 100 of assessed value. Find property records for Henrico County. Tax Rate The Real Estate tax rate is 087 per 10000 of the assessed value.

Source: henrico.us

Source: henrico.us

Details about this incident are available via debug id 535045. The County does not warrant that the information is accurate complete or timely and the data is offered for general information. The Division is utilizing a Computer Assisted Mass Appraisal system CAMA to accomplish this. All of the Henrico County information on this page has been verified and checked for accuracy. Bills are mailed in early May.

Source: henrico.us

Source: henrico.us

The Real Estate Assessment Division maintains the County Land Book and performs assessments for tax purposes of all real estate in the County. Administer laws pertaining to the real estate assessment process. If any of the links or phone numbers provided no longer work please let us know and we will update this page. Henricos tax rate is 87 cents per 100 of assessed value meaning that the average real estate tax bill for Henrico homeowners will increase by about 92. The real estate tax on regular accounts is billed semi-annually.

Source: henrico.us

Source: henrico.us

Popular Search Homes For Sale In Hoschton And Braselton Ga Homes For Sale In 30549 Houses For Rent North Natomas Homes For Rent 95835 Houses For Rent Natomas Sacramento Houses For Rent In Natomas Ca Home For Sale With Acreage Hiram Ga Houses For Sale Homes For Sale Jackson Tn Home. The County makes a variety of information and datasets Data available for download through this website henricous and other applicable Henrico County-owned web properties The Website. Bills are mailed in early May. The Real Estate Assessment Division maintains the County Land Book and performs assessments for tax purposes of all real estate in the County. Henricos tax rate is 87 cents per 100 of assessed value meaning that the average real estate tax bill for Henrico homeowners will increase by about 92.

While the Real Estate Division has worked to ensure that the assessment data contained herein is accurate Henrico County assumes no liability for any errors omissions. The Real Estate Tax Advantage Program currently cuts up to the first 2500 from the tax bills of qualifying seniors and. For additional information call 8045014263. The certificate holder is an independent investor who actually pays the tax for a property owner in. Lebanon County Treasurer 400 South 8th Street Room 103 Lebanon PA 17042.

Source: henrico.us

Source: henrico.us

About Assessments Beginning in February of each year all property owners are mailed a notice of as. A tax certificate is an enforceable first lien against the property for unpaid real estate property tax. The tax certificate sale must be held 60 days after the date of delinquency or June 1 whichever is later per Florida Statute 197402. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. Residential real property owned and occupied by the homeowner as evidenced by a Homeowners Exemption OR.

Source: henricocitizen.com

Source: henricocitizen.com

Tax Rate The Real Estate tax rate is 087 per 10000 of the assessed value. Payments may be made to the county tax collector or treasurer instead of the assessor. All of the Henrico County information on this page has been verified and checked for accuracy. Lebanon County Treasurer 400 South 8th Street Room 103 Lebanon PA 17042. Henrico County now offers paperless personal property and real estate tax bills.

Source: henrico.us

Source: henrico.us

The filing deadline is April 1. Houses 1 days ago The County has a Real Estate Advantage program REAP for property owners who meet certain criteria are age 65 or older or who may be disabled. The County assumes no liability for your use of the data. About henrico county real estate tax bills. Non-confidential real estate assessment records are public information under Virginia law and Internet display of non-confidential property information is specifically authorized by Virginia Code 581-31222.

Source: henrico.us

Source: henrico.us

Find property records for Henrico County. Popular Search Homes For Sale In Hoschton And Braselton Ga Homes For Sale In 30549 Houses For Rent North Natomas Homes For Rent 95835 Houses For Rent Natomas Sacramento Houses For Rent In Natomas Ca Home For Sale With Acreage Hiram Ga Houses For Sale Homes For Sale Jackson Tn Home. The tax certificate sale must be held 60 days after the date of delinquency or June 1 whichever is later per Florida Statute 197402. Administer laws pertaining to the real estate assessment process. The Divisions primary functions include.

Source: henricocitizen.com

Source: henricocitizen.com

About Assessments Beginning in February of each year all property owners are mailed a notice of as. Details about this incident are available via debug id 535045. The Real Estate Tax Advantage Program currently cuts up to the first 2500 from the tax bills of qualifying seniors and. The County assumes no liability for your use of the data. Henrico County is poised to again boost its tax relief program for seniors.

Source: henrico.us

Source: henrico.us

The certificate holder is an independent investor who actually pays the tax for a property owner in. The tax certificate sale must be held 60 days after the date of delinquency or June 1 whichever is later per Florida Statute 197402. REAL ESTATE TAX Real estate in Henrico County is assessed at 100 of market value and taxed at 87 per 100 of assessed value. All of the Henrico County information on this page has been verified and checked for accuracy. Henricos tax rate is 87 cents per 100 of assessed value meaning that the average real estate tax bill for Henrico homeowners will increase by about 92.

Source: henrico.us

Source: henrico.us

All of the Henrico County information on this page has been verified and checked for accuracy. The Divisions primary functions include. Henricos tax rate is 87 cents per 100 of assessed value meaning that the average real estate tax bill for Henrico homeowners will increase by about 92. Paying Your Property Tax The Henrico County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. The Division is utilizing a Computer Assisted Mass Appraisal system CAMA to accomplish this.

Source: henrico.us

Source: henrico.us

The Real Estate Assessment Division maintains the County Land Book and performs assessments for tax purposes of all real estate in the County. Paying Your Property Tax The Henrico County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. For Prior year tax information contact the TAX CLAIM department 717 228-4416. Popular Search Homes For Sale In Hoschton And Braselton Ga Homes For Sale In 30549 Houses For Rent North Natomas Homes For Rent 95835 Houses For Rent Natomas Sacramento Houses For Rent In Natomas Ca Home For Sale With Acreage Hiram Ga Houses For Sale Homes For Sale Jackson Tn Home. Server Redirection in progress.

Source: henrico.us

Source: henrico.us

Non-confidential real estate assessment records are public information under Virginia law and Internet display of non-confidential property information is specifically authorized by Virginia Code 581-31222. Lebanon County Treasurer 400 South 8th Street Room 103 Lebanon PA 17042. The Division is utilizing a Computer Assisted Mass Appraisal system CAMA to accomplish this. Real Estate Tax Due Dates. The Real Estate Tax Advantage Program currently cuts up to the first 2500 from the tax bills of qualifying seniors and.

Source: keitercpa.com

Source: keitercpa.com

A tax certificate is an enforceable first lien against the property for unpaid real estate property tax. If any of the links or phone numbers provided no longer work please let us know and we will update this page. Other Lebanon County Real Estate Tax. The County makes a variety of information and datasets Data available for download through this website henricous and other applicable Henrico County-owned web properties The Website. There are five districts within the County that have additional rates which range from 003 to 031 per 100.

Source: henrico.us

Source: henrico.us

The median property tax in Henrico County Virginia is 176200. Bills are mailed in early May. Henrico County now offers paperless personal property and real estate tax bills. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. For Prior year tax information contact the TAX CLAIM department 717 228-4416.

Source: henrico.us

Source: henrico.us

Payments may be made to the county tax collector or treasurer instead of the assessor. You can either mail the form to our office along with a check for the property taxes due and documentation showing how you were impacted by COVID-19 and supporting the criteria that you qualify under. The Real Estate Tax Advantage Program currently cuts up to the first 2500 from the tax bills of qualifying seniors and. While the Real Estate Division has worked to ensure that the assessment data contained herein is accurate Henrico County assumes no liability for any errors omissions. Henrico County now offers paperless personal property and real estate tax bills.

Source: henrico.us

Source: henrico.us

Tax Rate The Real Estate tax rate is 087 per 10000 of the assessed value. Henricos tax rate is 87 cents per 100 of assessed value meaning that the average real estate tax bill for Henrico homeowners will increase by about 92. The County does not warrant that the information is accurate complete or timely and the data is offered for general information. REAL ESTATE TAX Real estate in Henrico County is assessed at 100 of market value and taxed at 87 per 100 of assessed value. Lebanon County Treasurer 400 South 8th Street Room 103 Lebanon PA 17042.

Source: henricolibrary.org

Source: henricolibrary.org

The median property tax in Henrico County Virginia is 176200. The Divisions primary functions include. Payments may be made to the county tax collector or treasurer instead of the assessor. The County makes a variety of information and datasets Data available for download through this website henricous and other applicable Henrico County-owned web properties The Website. Houses 1 days ago The County has a Real Estate Advantage program REAP for property owners who meet certain criteria are age 65 or older or who may be disabled.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title county of henrico real estate tax bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.