Your County of fairfax real estate tax bill images are ready. County of fairfax real estate tax bill are a topic that is being searched for and liked by netizens today. You can Find and Download the County of fairfax real estate tax bill files here. Download all royalty-free photos and vectors.

If you’re looking for county of fairfax real estate tax bill pictures information related to the county of fairfax real estate tax bill topic, you have visit the ideal blog. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

County Of Fairfax Real Estate Tax Bill. This site provides assessed values and physical characteristics for all residential and commercial properties. This is more than double the statewide median which currently stands at 2322. The Department of Tax Administrations DTA Revenue Collection Division is responsible for collecting taxes fees and miscellaneous revenues for Fairfax County. After you choose the tax bills that you wish to pay you will be offered multiple ways to pay those taxes.

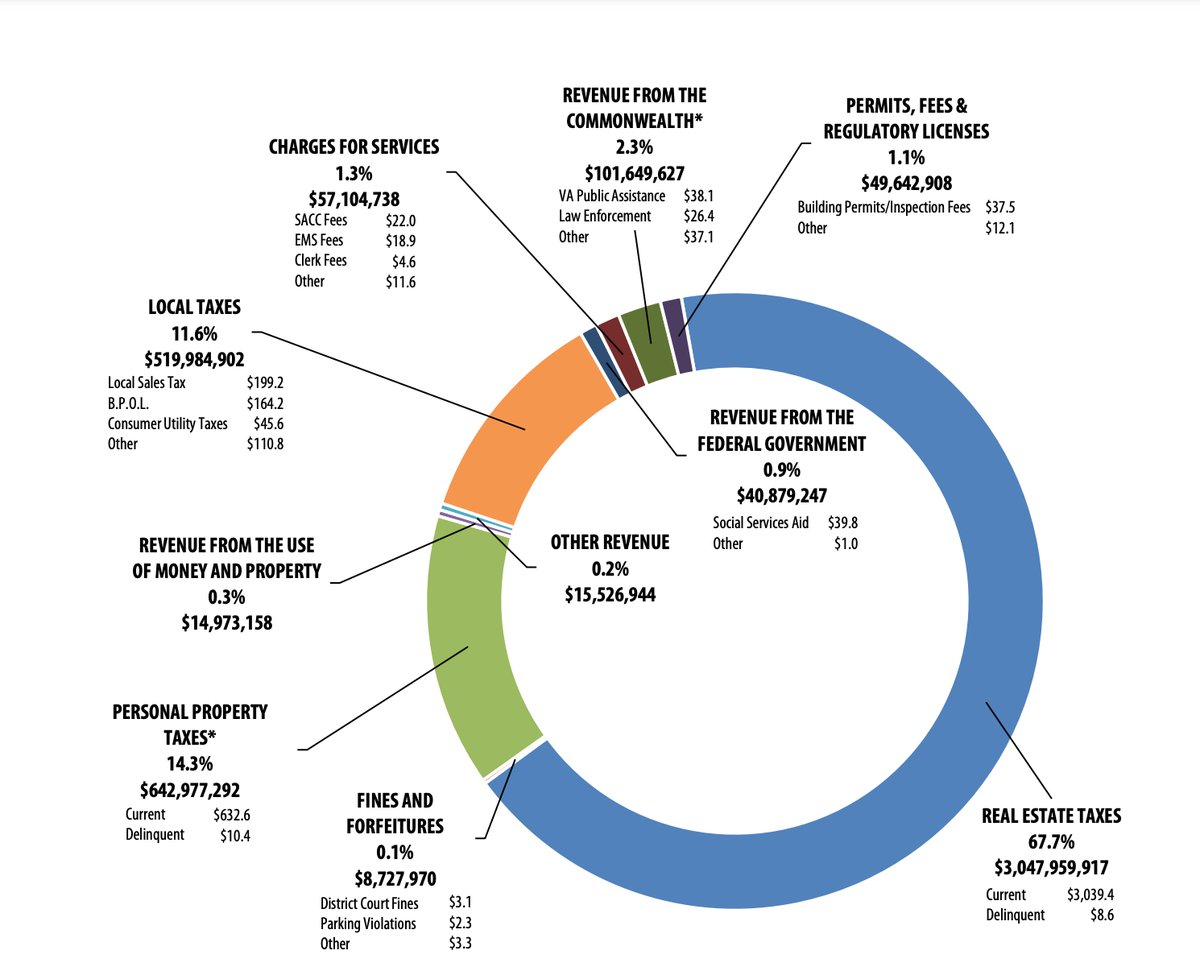

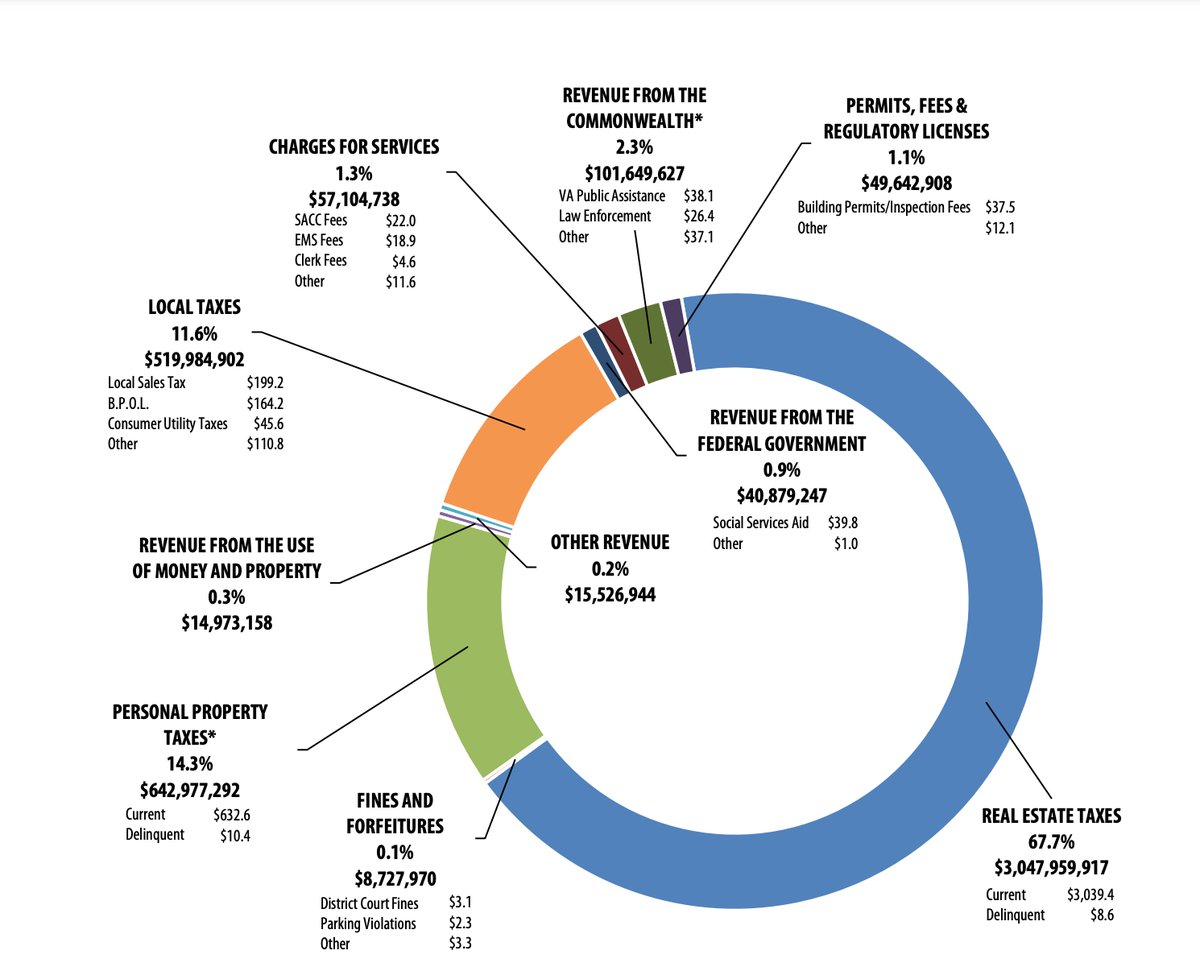

Proposed Fairfax County Budget Reduces Real Estate Tax Rate By A Cent Alexandria Living Magazine From alexandrialivingmagazine.com

Proposed Fairfax County Budget Reduces Real Estate Tax Rate By A Cent Alexandria Living Magazine From alexandrialivingmagazine.com

Houses 8 days ago The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. Fairfax county real estate tax bill. Fairfax County VA Property Tax Calculator - SmartAsset 2 days ago Fairfax County homeowners pay a median annual property tax bill of 5641. For example if a new family room and kitchen addition is built and completed on June 15 a supplemental bill would. Our tax specialists can provide assistance with county tax-related issues including payments refunds payment plans. Select the Tax Bill Payment option which is the 6 th option.

FAIRFAX VA On Tuesday the Fairfax County Board of Supervisors voted for one-month extensions on the first installment of real estate taxes as well as.

Houses 8 days ago The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. A supplemental tax bill based on this assessment is then issued by the Treasurers Office and due 30 days following receipt. The City of Fairfax has teamed with a third-party vendor to offer online tax payments. This is more than double the statewide median which currently stands at 2322. It is our goal to achieve the full collection of all current and delinquent charges while providing quality customer service. FAIRFAX VA On Tuesday the Fairfax County Board of Supervisors voted for one-month extensions on the first installment of real estate taxes as well as.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

FAIRFAX VA On Tuesday the Fairfax County Board of Supervisors voted for one-month extensions on the first installment of real estate taxes as well as. Supplemental Tax Bill is a tax bill generated when value changes during the year usually from permitted changes to improvements by 50000 or more subsequent to the general January 1 assessment. A third-party processing fee is assessed for creditdebit card payments. The Department of Tax Administration DTA is charged with uniformly assessing and collecting taxes and fees for Fairfax County including Real Estate tax Vehicle Car tax Vehicle Registration fees Business taxes Dog Licenses and Parking Tickets. The notices will be sent to all County real estate owners.

Source: fairfaxfederation.org

Source: fairfaxfederation.org

Tax Relief Program City of Fairfaxs Finance Office administers this program. Theres significant variation at the city level though as Great Falls and McLean have medians above 10000 while Belle Haven has the lowest median in the county at 931. Our tax specialists can provide assistance with county tax-related issues including payments refunds payment plans. Tax Relief Program City of Fairfaxs Finance Office administers this program. The tax balances on the online search system may not reflect adjustments or payments that are in transit.

Source: wtop.com

Source: wtop.com

The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax CountyDTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Welcome to the Department of Tax Administration DTA Real Estate tax payment system. The notices will be sent to all County real estate owners. Click on the Online Services tab at the top of the website. The tax balances on the online search system may not reflect adjustments or payments that are in transit.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

Click on the Online Services tab at the top of the website. The Department of Tax Administration DTA is charged with uniformly assessing and collecting taxes and fees for Fairfax County including Real Estate tax Vehicle Car tax Vehicle Registration fees Business taxes Dog Licenses and Parking Tickets. You are paying a bill to the City of Fairfax not Fairfax County. The extra tax is due for the portion of the year after this change is complete. The Department of Tax Administrations DTA Revenue Collection Division is responsible for collecting taxes fees and miscellaneous revenues for Fairfax County.

Welcome to the Department of Tax Administration DTA Real Estate tax payment system. You can also view residential sales within a propertys assessment neighborhood. FAIRFAX VA On Tuesday the Fairfax County Board of Supervisors voted for one-month extensions on the first installment of real estate taxes as well as. Real Estate Taxes Tax Administration. Click on the Online Services tab at the top of the website.

Source: pinterest.com

Source: pinterest.com

Pay Real Estate Taxes by e-Check or credit carddebit card using our online payment vendor NIC Virginia. For information pertaining to the calculation of supplemental assessments please call the Real Estate Assessment Office at 7033857840. Taxpayers are responsible for ensuring that payments are made in. Click on one of the property search links above to search by address by tax map reference number or by doing a map search. Click on the link for Personal PropertyMVLT and Real Estate.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

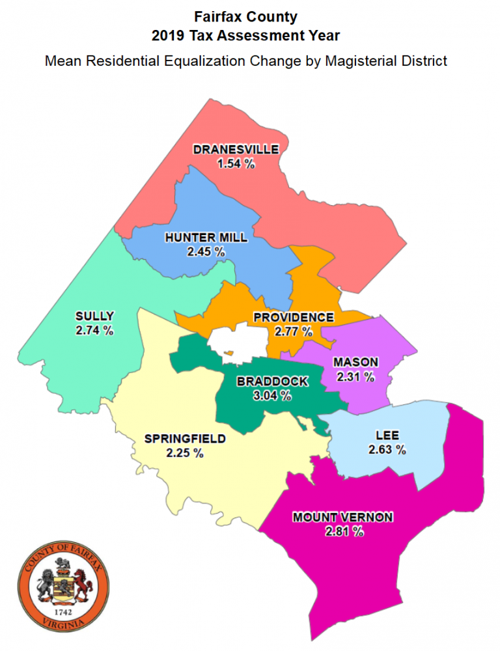

Our tax specialists can provide assistance with county tax-related issues including payments refunds payment plans. Our tax specialists can provide assistance with county tax-related issues including payments refunds payment plans. The assessment process takes place every year. Of the Countys 356171 taxable parcels 326263 experienced a value change for. Real Estate Taxes Tax Administration.

Using this system you may securely. Real Estate Taxes Tax Administration. This is well above Virginias state median home value of 288800. You can also view residential sales within a propertys assessment neighborhood. The notices will be sent to all County real estate owners.

Source: insidenova.com

Source: insidenova.com

The Department of Tax Administrations DTA Revenue Collection Division is responsible for collecting taxes fees and miscellaneous revenues for Fairfax County. The extra tax is due for the portion of the year after this change is complete. Payment services on this site offer a convenient and secure option to pay your taxes. A supplemental tax bill based on this assessment is then issued by the Treasurers Office and due 30 days following receipt. Click on the Online Services tab at the top of the website.

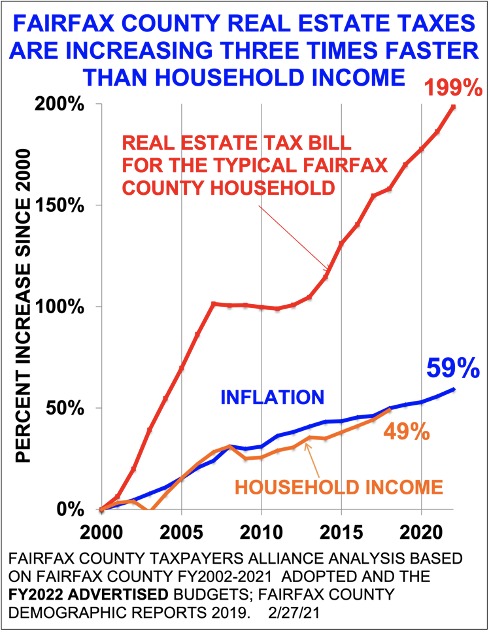

Fairfax County Real Estate Tax Bill. This is well above Virginias state median home value of 288800. This is more than double the statewide median which currently stands at 2322. Fairfax County homeowners pay a median annual property tax bill of 5641. This is more than double the statewide median which currently stands at 2322.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

Taxpayers are responsible for ensuring that payments are made in. The extra tax is due for the portion of the year after this change is complete. Real Estate Taxes Tax Administration. Welcome to the Department of Tax Administration DTA Real Estate tax payment system. Fairfax County VA Property Tax Calculator - SmartAsset 2 days ago Fairfax County homeowners pay a median annual property tax bill of 5641.

Steps to viewprint property tax payment information. Click on one of the property search links above to search by address by tax map reference number or by doing a map search. Of the Countys 356171 taxable parcels 326263 experienced a value change for. Supplemental Tax Bill is a tax bill generated when value changes during the year usually from permitted changes to improvements by 50000 or more subsequent to the general January 1 assessment. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year.

Source: patch.com

Source: patch.com

This site provides assessed values and physical characteristics for all residential and commercial properties. The tax balances on the online search system may not reflect adjustments or payments that are in transit. Real Estate Taxes Tax Administration. A third-party processing fee is assessed for creditdebit card payments. Department of Tax Administration.

Source: baconsrebellion.com

Source: baconsrebellion.com

Select Yes I accept. Fairfax-County Property Tax Records. Fairfax County Real Estate Tax Bill. Of the Countys 356171 taxable parcels 326263 experienced a value change for. Select the Tax Bill Payment option which is the 6 th option.

Source: yumpu.com

Source: yumpu.com

The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax CountyDTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. The assessment process takes place every year. You can also view residential sales within a propertys assessment neighborhood. Tax Relief Program City of Fairfaxs Finance Office administers this program. Fairfax County Real Estate Tax Bill.

If your bill does not have the City of Fairfax printed on it you are on the wrong website. The Treasurers Office assumes no responsibility for incorrect information entered by taxpayers. You can also view residential sales within a propertys assessment neighborhood. Real Estate Taxes Tax Administration. Select the Tax Bill Payment option which is the 6 th option.

Source: smartsettlements.com

Source: smartsettlements.com

If your bill does not have the City of Fairfax printed on it you are on the wrong website. This is more than double the statewide median which currently stands at 2322. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. FAIRFAX VA On Tuesday the Fairfax County Board of Supervisors voted for one-month extensions on the first installment of real estate taxes as well as. Using this system you may securely.

Fairfax County provides the option to pay most of your tax bills online. Click on one of the property search links above to search by address by tax map reference number or by doing a map search. If your bill does not have the City of Fairfax printed on it you are on the wrong website. Fairfax County VA Property Tax Calculator - SmartAsset 2 days ago Fairfax County homeowners pay a median annual property tax bill of 5641. Department of Tax Administration.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title county of fairfax real estate tax bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.