Your Cook county treasurer real estate tax bill images are available in this site. Cook county treasurer real estate tax bill are a topic that is being searched for and liked by netizens now. You can Get the Cook county treasurer real estate tax bill files here. Get all free photos and vectors.

If you’re searching for cook county treasurer real estate tax bill pictures information related to the cook county treasurer real estate tax bill topic, you have visit the right site. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

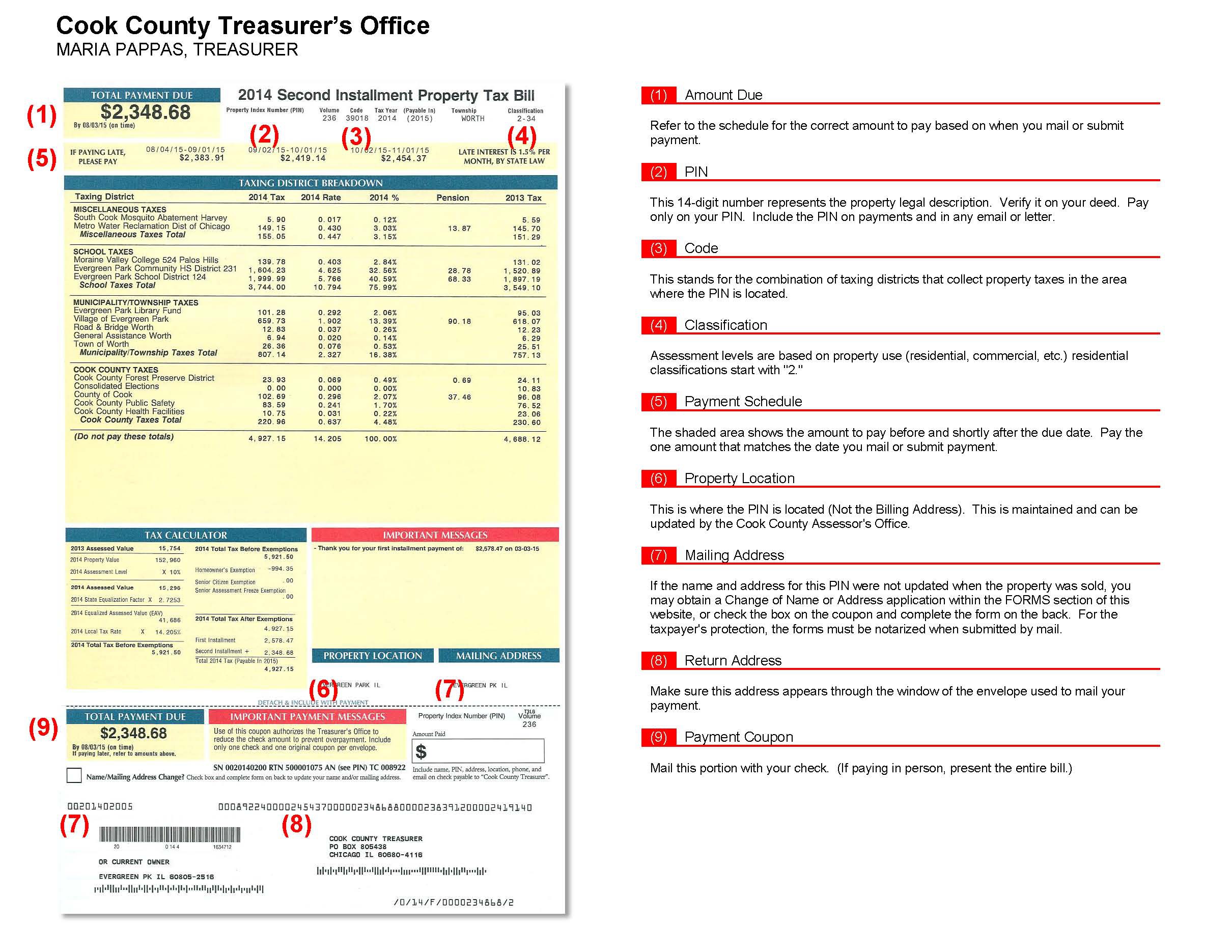

Cook County Treasurer Real Estate Tax Bill. 30000 Cook County Homeowners to get 83 Million in Automatic Property Tax. Cook County collects on average 138 of a propertys assessed fair market value as property tax. Houses 2 days ago Cook County Illinois Property Taxes - 2021. By visiting the Clerks Office on the 4th Floor of the Cook County.

Cook County Treasurer Maria Pappas Wants To Help Black Homeowners Who Could Lose Houses To Unpaid Property Taxes Abc7 Chicago From abc7chicago.com

Cook County Treasurer Maria Pappas Wants To Help Black Homeowners Who Could Lose Houses To Unpaid Property Taxes Abc7 Chicago From abc7chicago.com

For information on prior years taxes have your 14-digit Property Index Number PIN ready and contact the County Clerks Real Estate Tax Services Division. Select the blue box labeled Pay Online for Free Search by property address or enter your Property. The Cook County Assessors Office also administers the Senior Freeze Exemption. It reflects new tax rates levies changes in assessments and any dollars saved by. Search to see a 5-year history of the original tax amounts billed for a PIN. The office is located at 118 N.

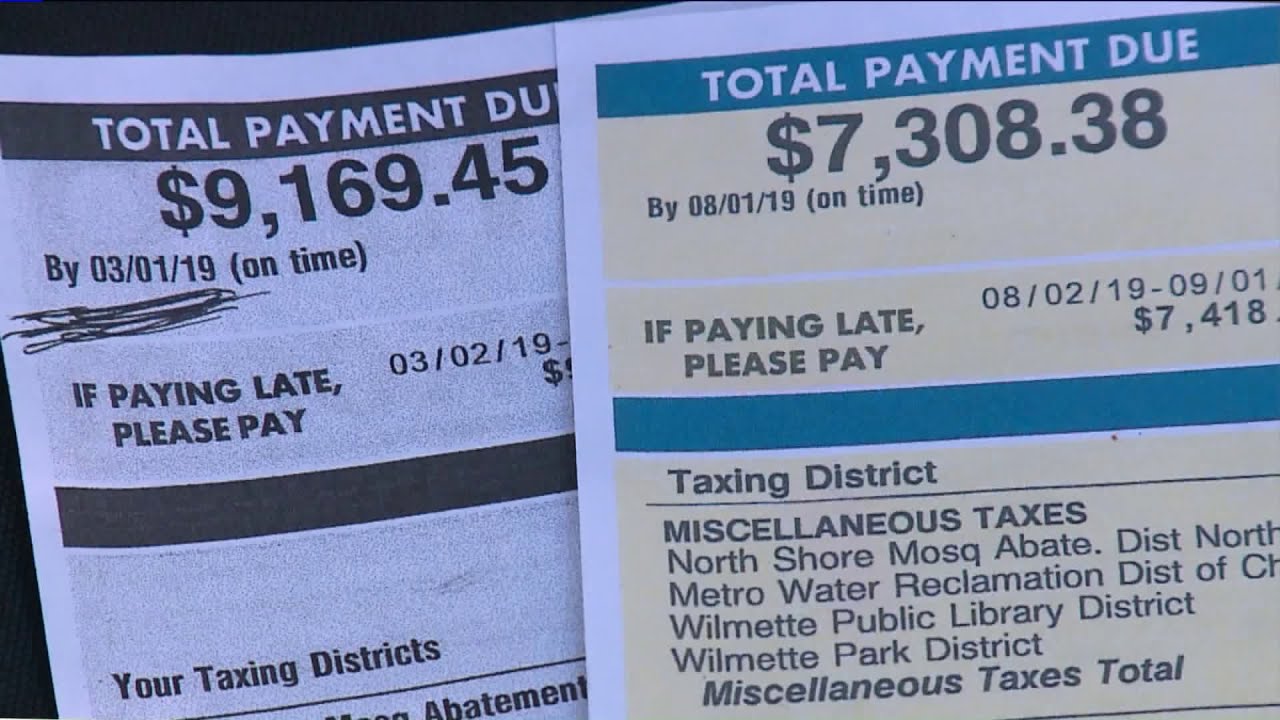

Cook County Treasurer Maria Pappas said nearly 25000 homeowners who have second installment tax bills due Aug.

Select the blue box labeled Pay Online for Free Search by property address or enter your Property. 83 Million in Cook County Property Tax Refunds To Go To Nearly 30000 Homeowners. Select the blue box labeled Pay Online for Free Search by property address or enter your Property. For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills. The current tax bill can be obtained from the Cook County Treasurers Office. The Second Installment of Cook County property tax bills will start to arrive in mailboxes today and property owners have until October 1 2020 to pay without any late chargeTreasurer Maria Pappas said.

Source: youtube.com

Source: youtube.com

To receive a duplicate of the current tax bill by mail you may also visit the Treasurers Web site at. For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. Search to see a 5-year history of the original tax amounts billed for a PIN. The second installment property tax bill is mailed and due in late summer.

Source: abc7chicago.com

Source: abc7chicago.com

By law the first installment property tax bill is exactly 55 percent of the previous years total tax amount. The Second Installment of Cook County property tax bills will start to arrive in mailboxes today and property owners have until October 1 2020 to pay without any late chargeTreasurer Maria Pappas said. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. Search to see a 5-year history of the original tax amounts billed for a PIN. The second installment property tax bill is mailed and due in late summer.

Source: pinterest.com

Source: pinterest.com

83 Million in Cook County Property Tax Overpayments will be Refunded Automatically. Sample Tax Rate your tax rate could vary X 10. For tax information andor a copy of your bill you must contact the Cook County Treasurers Office. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. Search to see a 5-year history of the original tax amounts billed for a PIN.

Source: medium.com

Source: medium.com

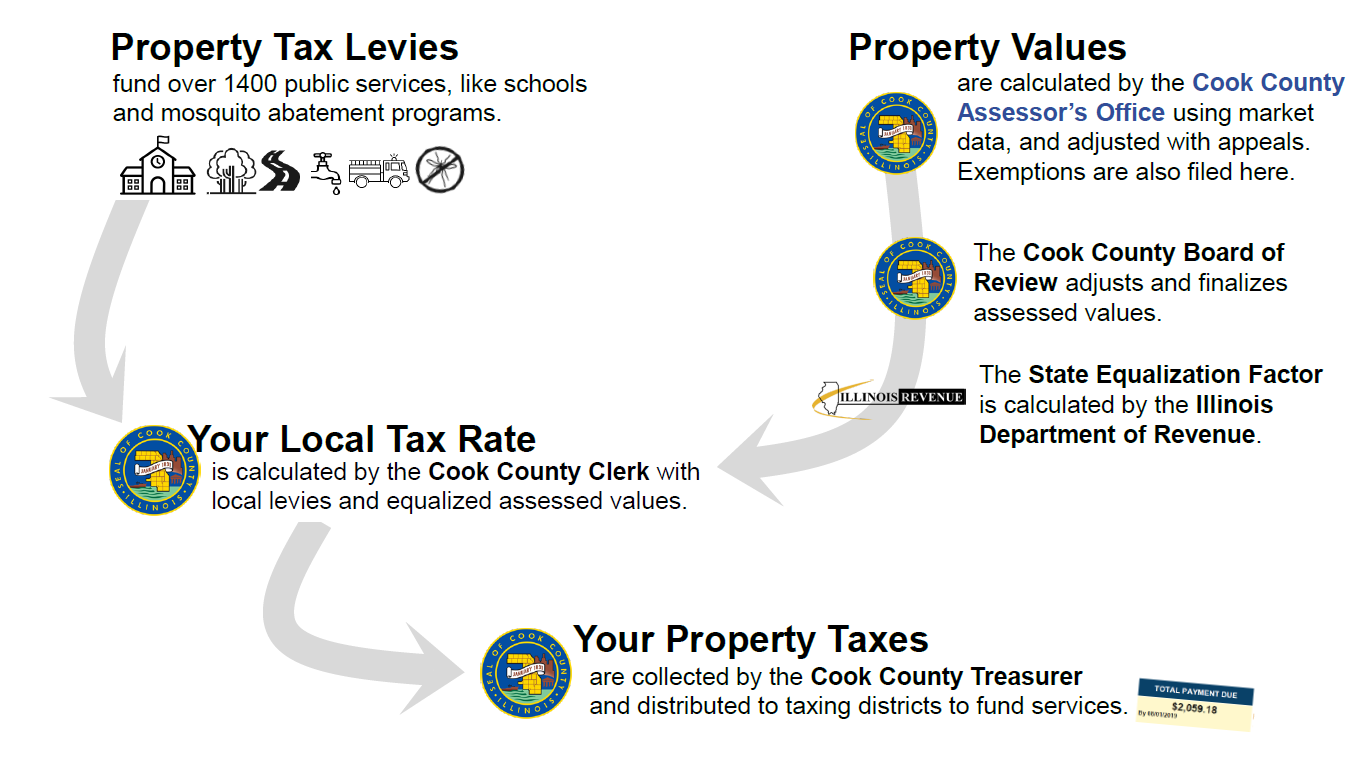

The Cook County Treasurers Office mails tax bills and collects payments. 4 days ago The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Your local tax rate is determined each year by the Cook County Clerk and can be found on your second-installment tax bill or by contacting the Cook County Clerks Office at 312-603-6566. Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. Cook County Treasurer Maria Pappas said nearly 25000 homeowners who have second installment tax bills due Aug.

Source: medium.com

Source: medium.com

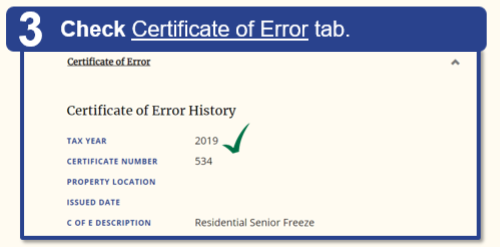

Your local tax rate is determined each year by the Cook County Clerk and can be found on your second-installment tax bill or by contacting the Cook County Clerks Office at 312-603-6566. Pappas Office is to begin printing the Second Installment property tax bills for Tax Year 2019 in mid-June. If you pay by escrow contact your lender prior to attempting to pay early to avoid double payments. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

The Cook County Assessors Office also administers the Senior Freeze Exemption. If your early payment is received by December 31st the First Installment tax bill which will be mailed in late January will reflect that payment. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Pappas Office is to begin printing the Second Installment property tax bills for Tax Year 2019 in mid-June. Property owners can pay without any interest charge through October 1 2020 thanks to an ordinance urged by Pappas and passed by the Board of.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. To receive a duplicate of the current tax bill by mail you may also visit the Treasurers Web site at. Estimated Tax Bill in Dollars. Clark St Room 112 Chicago Illinois. The Cook County Treasurers Office mails tax bills and collects payments.

Source: westsuburbanjournal.com

Source: westsuburbanjournal.com

If your early payment is received by December 31st the First Installment tax bill which will be mailed in late January will reflect that payment. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. Cook County Treasurer Maria Pappas said nearly 25000 homeowners who have second installment tax bills due Aug. Pappas Office is to begin printing the Second Installment property tax bills for Tax Year 2019 in mid-June.

The current tax bill can be obtained from the Cook County Treasurers Office. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. By visiting the Clerks Office on the 4th Floor of the Cook County. Select the blue box labeled Pay Online for Free Search by property address or enter your Property. The Cook County Assessors Office also administers the Senior Freeze Exemption.

Source: pinterest.com

Source: pinterest.com

Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. It reflects new tax rates levies changes in assessments and any dollars saved by. Select the blue box labeled Pay Online for Free Search by property address or enter your Property. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. Houses 2 days ago Cook County Illinois Property Taxes - 2021.

Source: cookcountytreasurer.com

Source: cookcountytreasurer.com

Property owners can pay without any interest charge through October 1 2020 thanks to an ordinance urged by Pappas and passed by the Board of. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. The office is located at 118 N. For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills. The current tax bill can be obtained from the Cook County Treasurers Office.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

The Second Installment is due August 3. Estimated Tax Bill in Dollars. Select the blue box labeled Pay Online for Free Search by property address or enter your Property. Are there other property tax savings available to seniors. For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills.

Cook County Treasurer Maria Pappas said nearly 25000 homeowners who have second installment tax bills due Aug. Are there other property tax savings available to seniors. For information on prior years taxes have your 14-digit Property Index Number PIN ready and contact the County Clerks Real Estate Tax Services Division. Clark St Room 112 Chicago Illinois. Property tax bills are mailed twice a year by the Cook County Treasurer.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

If your early payment is received by December 31st the First Installment tax bill which will be mailed in late January will reflect that payment. Your local tax rate is determined each year by the Cook County Clerk and can be found on your second-installment tax bill or by contacting the Cook County Clerks Office at 312-603-6566. Cook County collects on average 138 of a propertys assessed fair market value as property tax. By visiting the Clerks Office on the 4th Floor of the Cook County. Houses 2 days ago Cook County Illinois Property Taxes - 2021.

Estimated Tax Bill in Dollars. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. By law the first installment property tax bill is exactly 55 percent of the previous years total tax amount. 1 showing a zero balance will receive refunds between July 1 and Aug. The current tax bill can be obtained from the Cook County Treasurers Office.

Source: pinterest.com

Source: pinterest.com

Clark St Room 112 Chicago Illinois. 4 days ago The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. The Cook County Treasurers Office mails tax bills and collects payments. Select the blue box labeled Pay Online for Free Search by property address or enter your Property. For information on prior years taxes have your 14-digit Property Index Number PIN ready and contact the County Clerks Real Estate Tax Services Division.

Source: kensington-research.com

Source: kensington-research.com

The Cook County Treasurers Office mails tax bills and collects payments. Tax bills for previous years are handled by the Cook County Clerks Office. The Treasurers phone number is 312 443-5100 and the County Clerks phone number is 312 603-5656. Cook County Real Estate Tax Bill. To receive a duplicate of the current tax bill by mail you may also visit the Treasurers Web site at.

Cook County Real Estate Tax Bill. Search to see a 5-year history of the original tax amounts billed for a PIN. For tax information andor a copy of your bill you must contact the Cook County Treasurers Office. Pappas Office is to begin printing the Second Installment property tax bills for Tax Year 2019 in mid-June. The second installment property tax bill is mailed and due in late summer.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cook county treasurer real estate tax bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.