Your Cook county real estate taxes senior exemption images are ready. Cook county real estate taxes senior exemption are a topic that is being searched for and liked by netizens today. You can Download the Cook county real estate taxes senior exemption files here. Find and Download all free photos.

If you’re searching for cook county real estate taxes senior exemption pictures information linked to the cook county real estate taxes senior exemption keyword, you have come to the right site. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Cook County Real Estate Taxes Senior Exemption. Cook County Senior Citizen Property Tax Exemption Deadline. All exemptions are applied to second installment property tax bills issued in summer. All senior citizens must apply every year with the Cook County Assessors Office to qualify for the exemption. Heres a link to the law itself.

Home Page From legacy.cookcountyassessor.com

Home Page From legacy.cookcountyassessor.com

Have owned and occupied the home on January 1 2019 and January 1 2020 and have been responsible for the 2019 and 2020 taxes to be eligible for Tax Year 2020 payable in 2021. Most homeowners are eligible for this exemption if they meet the requirements for the Homeowner Exemption and were 65 years of age or older during calendar year 2020. It allows qualified seniors to defer a maximum of 5000 per tax year this includes 1st and 2nd installments on their primary home. Heres a link to the law itself. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions. The Disabled Persons Homeowner Exemption allows an annual 2000 reduction in EAV.

Have owned and occupied the home on January 1 2019 and January 1 2020 and have been responsible for the 2019 and 2020 taxes to be eligible for Tax Year 2020 payable in 2021.

Your local tax rate is determined each year by the Cook County Clerk and can be found on your second-installment tax bill or by contacting the Cook County Clerks Office at 312-603-6566. Senior Citizen Exemption Application Cook County Assessors Office To apply for the Senior Exemption for tax year 2020 see documents required and application instructions here. March 1 To claim the senior citizen property tax exemption in Cook County you must apply by March 1 even if youve applied before. All exemptions are applied to second installment property tax bills issued in summer. Exemptions reduce the Equalized Assessed Value EAV of your home which is multiplied by the tax rate to determine your tax bill. There are currently four exemptions that must be applied for or renewed annually.

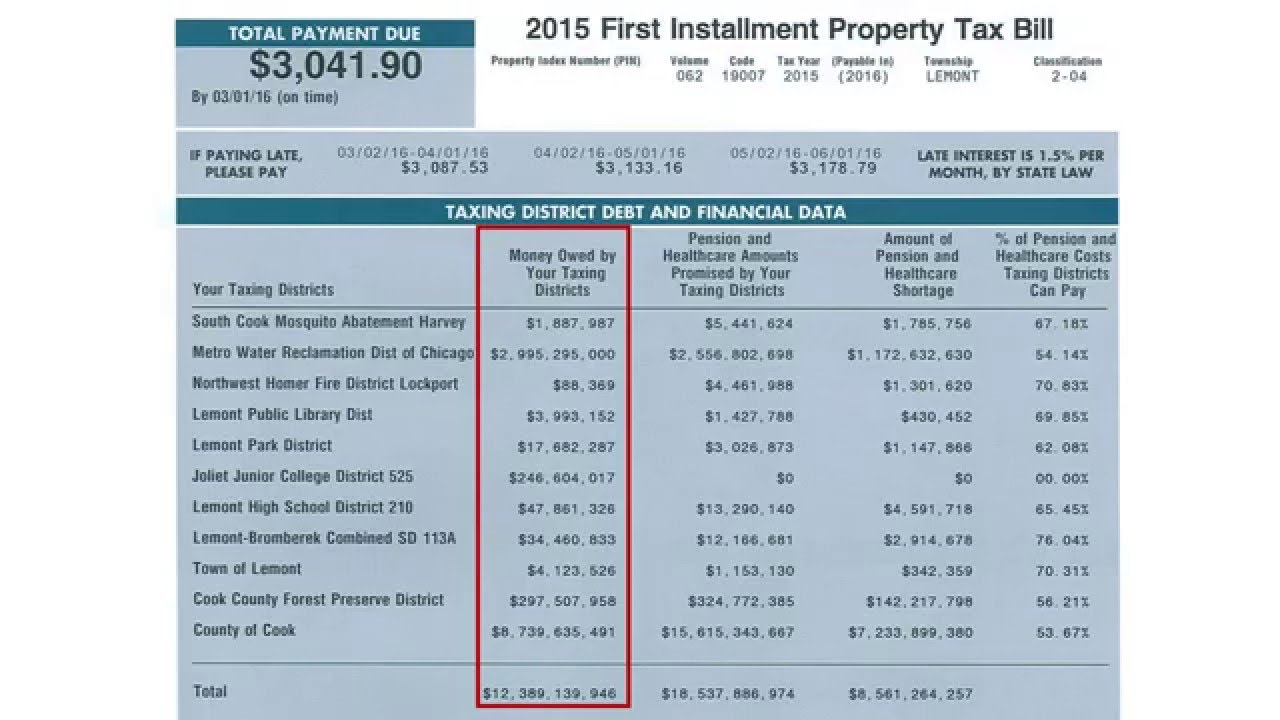

Source: cookcountytreasurer.com

Source: cookcountytreasurer.com

All exemptions are applied to second installment property tax bills issued in summer. If after you search by PIN and find you did not receive an exemption click More Exemption Information under Exemptions on the next page to. All exemptions are applied to second installment property tax bills issued in summer. The amount of exemption is the increase in the current years equalized assessed value EAV above the 1977 EAV up to a maximum of 7000 in Cook County and 6000 in all other counties. Cook County Senior Citizen Property Tax Exemption Deadline.

Source: abc7chicago.com

Source: abc7chicago.com

The Senior Citizen Real Estate Tax Deferral Program The Senior Citizen Real Estate Tax Deferral program is a tax-relief program that works like a loan. The amount of exemption is the increase in the current years equalized assessed value EAV above the 1977 EAV up to a maximum of 7000 in Cook County and 6000 in all other counties. Seniors not currently receiving the exemption and those who turned 65 in 2019 must apply for the senior exemption in. Are there other property tax savings available to seniors. How are Senior Exemption savings calculated.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

The Senior Citizen Homestead Exemption reduces the EAV of your home by 8000. Friday is application deadline for Cook County senior property tax exemption Friday March 30 2018 CHICAGO WLS – Friday is the deadline for seniors in Cook County to apply for exemptions on. Homeowner Exemption Application Senior Exemption Application Homeowner Exemption Waiver Senior Freeze Exemption Application Senior Freeze Exemption Certificate of Error 2015 Senior Freeze Exemption Certificate of Error 2016 Senior Freeze Exemption Certificate of Error 2017 Senior Freeze Exemption Certificate of Error 2018 Homeowner Exemption Certificate of Error Senior Citizen Exemption. Be a senior citizen with an annual household income of 65000 or less. Heres a link to the law itself.

Source: fausettlaw.com

Source: fausettlaw.com

The Senior Citizen Homestead Exemption reduces the EAV of your home by 8000. All exemptions are applied to second installment property tax bills issued in summer. Be a senior citizen with an annual household income of 65000 or less. What Is the Senior Citizen Exemption. A Senior Exemption is calculated by multiplying the Senior Exemption savings amount 8000 by your local tax rate.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

If after you search by PIN and find you did not receive an exemption click More Exemption Information under Exemptions on the next page to. The Homeowner Exemption Senior Citizen Homestead Exemption Senior Citizen Assessment Freeze Exemption and the Home Improvement Exemption. This exemption also allows when applicable up to a 70000 reduction in assessed value for federally approved specially adapted housing. All exemptions are applied to second installment property tax bills issued in summer. Be a senior citizen with an annual household income of 65000 or less.

There are currently four exemptions that must be applied for or renewed annually. This exemption also allows when applicable up to a 70000 reduction in assessed value for federally approved specially adapted housing. March 1 To claim the senior citizen property tax exemption in Cook County you must apply by March 1 even if youve applied before. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions. Seniors not currently receiving the exemption and those who turned 65 in 2019 must apply for the senior exemption in.

Source: chicagotribune.com

Source: chicagotribune.com

The senior property tax exemption is just 8000 in Cook County Illinois and this is actually an increase up from 5000 in 2018. The Cook County Assessors Office also administers the Senior Exemption. How are Senior Exemption savings calculated. Heres a link to the law itself. The Disabled Persons Homeowner Exemption allows an annual 2000 reduction in EAV.

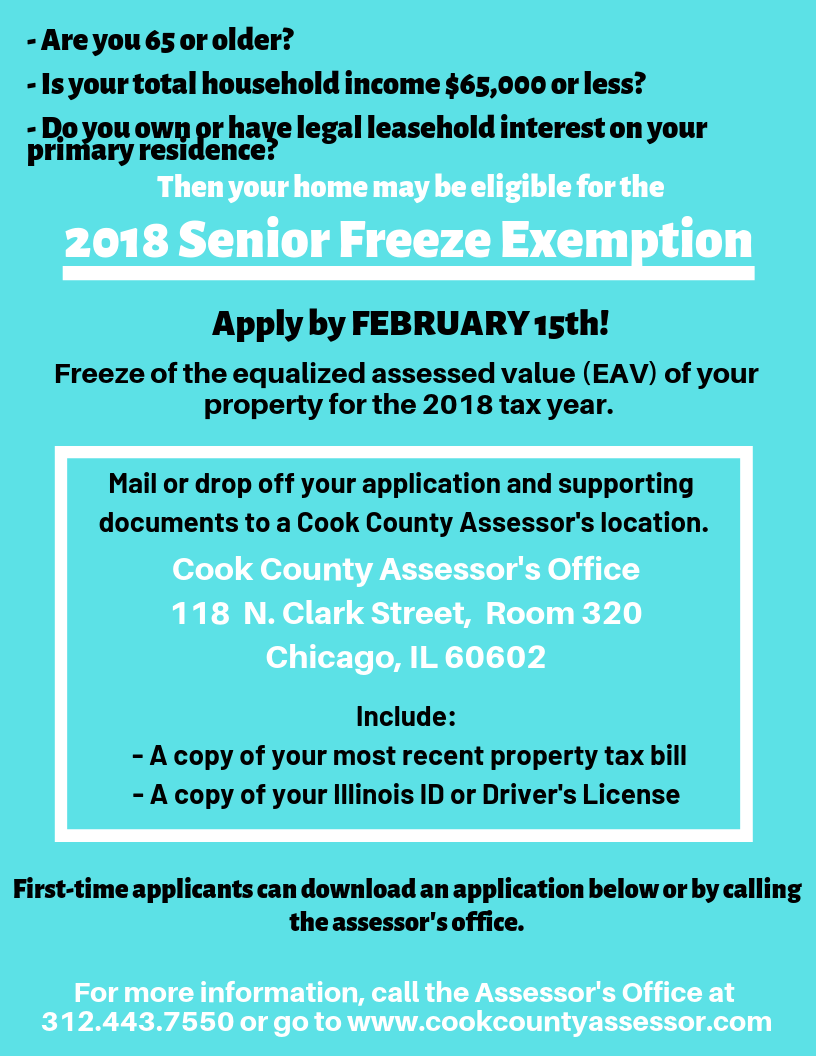

Source: 44thward.org

Source: 44thward.org

The Disabled Persons Homeowner Exemption allows an annual 2000 reduction in EAV. The amount of exemption is the increase in the current years equalized assessed value EAV above the 1977 EAV up to a maximum of 7000 in Cook County and 6000 in all other counties. Homeowner Exemption Application Senior Exemption Application Homeowner Exemption Waiver Senior Freeze Exemption Application Senior Freeze Exemption Certificate of Error 2015 Senior Freeze Exemption Certificate of Error 2016 Senior Freeze Exemption Certificate of Error 2017 Senior Freeze Exemption Certificate of Error 2018 Homeowner Exemption Certificate of Error Senior Citizen Exemption. Friday is application deadline for Cook County senior property tax exemption Friday March 30 2018 CHICAGO WLS – Friday is the deadline for seniors in Cook County to apply for exemptions on. My parent passed away in 2020 is the property still eligible for the Senior Exemption.

The senior property tax exemption is just 8000 in Cook County Illinois and this is actually an increase up from 5000 in 2018. Your local tax rate is determined each year by the Cook County Clerk and can be found on your second-installment tax bill or by contacting the Cook County Clerks Office at 312-603-6566. Property tax exemptions are provided for owners with the following situations. The Cook County Treasurers Office offers a Senior Citizens Tax Deferral program please contact their office at 312 443-5100. Cook County retirees and other older homeowners may reduce their tax bills by hundreds or even thousands of dollars a year by taking advantage of the Senior Citizen Homestead Exemption.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

The Homeowner Exemption Senior Citizen Homestead Exemption Senior Citizen Assessment Freeze Exemption and the Home Improvement Exemption. The affiant can use this form to attest that they occupied a home as their principal residence. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions. The bill championed by Cook County Assessor Fritz Kaegi and Illinois House Assistant Majority Leader Fred Crespo amends the Illinois Property Tax Code to allow for the automatic renewal of the Senior Citizen Exemption for persons who had received this exemption in the year prior. Seniors not currently receiving the exemption and those who turned 65 in 2019 must apply for the senior exemption in.

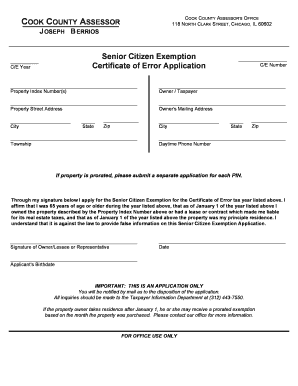

Source: signnow.com

Source: signnow.com

March 1 To claim the senior citizen property tax exemption in Cook County you must apply by March 1 even if youve applied before. Friday is application deadline for Cook County senior property tax exemption Friday March 30 2018 CHICAGO WLS – Friday is the deadline for seniors in Cook County to apply for exemptions on. Property tax exemptions are provided for owners with the following situations. A Senior Exemption is calculated by multiplying the Senior Exemption savings amount 8000 by your local tax rate. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions.

Source: pdffiller.com

Source: pdffiller.com

Exemptions can reduce your tax bill. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions. Are there other property tax savings available to. Exemptions can reduce your tax bill. Exemptions reduce the Equalized Assessed Value EAV of your home which is multiplied by the tax rate to determine your tax bill.

Cook County homeowners may take advantage of several valuable property-tax-saving exemptions. Exemptions reduce the Equalized Assessed Value EAV of your home which is multiplied by the tax rate to determine your tax bill. Are there other property tax savings available to. Cook County retirees and other older homeowners may reduce their tax bills by hundreds or even thousands of dollars a year by taking advantage of the Senior Citizen Homestead Exemption. Have owned and occupied the home on January 1 2019 and January 1 2020 and have been responsible for the 2019 and 2020 taxes to be eligible for Tax Year 2020 payable in 2021.

Source: 44thward.org

Source: 44thward.org

The Homeowner Exemption Senior Citizen Homestead Exemption Senior Citizen Assessment Freeze Exemption and the Home Improvement Exemption. To apply for the senior freeze exemption the applicant must. Most homeowners are eligible for this exemption if they meet the requirements for the Homeowner Exemption and were 65 years of age or older during calendar year 2020. The affiant can use this form to attest that they occupied a home as their principal residence. Are there other property tax savings available to seniors.

Source: legacy.cookcountyassessor.com

Source: legacy.cookcountyassessor.com

Your local tax rate is determined each year by the Cook County Clerk and can be found on your second-installment tax bill or by contacting the Cook County Clerks Office at 312-603-6566. Are there other property tax savings available to. All senior citizens must apply every year with the Cook County Assessors Office to qualify for the exemption. Full details are available on the Cook County Assessors Office web site on the Exemption Descriptions page. Cook County Senior Citizen Property Tax Exemption Deadline.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

My parent passed away in 2020 is the property still eligible for the Senior Exemption. As of March 23 2020 the Cook County Assessors Office will accept this form without notarization but it must be printed signed by the affiants hand scanned or otherwise imaged and then uploaded as a supporting document accompanying your exemption application. The Senior Citizen Real Estate Tax Deferral Program The Senior Citizen Real Estate Tax Deferral program is a tax-relief program that works like a loan. The Cook County Treasurers Office offers a Senior Citizens Tax Deferral program please contact their office at 312 443-5100. March 1 To claim the senior citizen property tax exemption in Cook County you must apply by March 1 even if youve applied before.

Source: medium.com

Source: medium.com

How are Senior Exemption savings calculated. As of March 23 2020 the Cook County Assessors Office will accept this form without notarization but it must be printed signed by the affiants hand scanned or otherwise imaged and then uploaded as a supporting document accompanying your exemption application. Full details are available on the Cook County Assessors Office web site on the Exemption Descriptions page. A Senior Exemption is calculated by multiplying the Senior Exemption savings amount 8000 by your local tax rate. Exemptions reduce the Equalized Assessed Value EAV of your home which is multiplied by the tax rate to determine your tax bill.

Source: gonggershowitz.com

Source: gonggershowitz.com

Cook County retirees and other older homeowners may reduce their tax bills by hundreds or even thousands of dollars a year by taking advantage of the Senior Citizen Homestead Exemption. The Senior Citizen Real Estate Tax Deferral Program The Senior Citizen Real Estate Tax Deferral program is a tax-relief program that works like a loan. Senior Citizen Exemption Application Cook County Assessors Office To apply for the Senior Exemption for tax year 2020 see documents required and application instructions here. By performing the search you will see a 5-year history of the exemptions applied to your PIN. What Is the Senior Citizen Exemption.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cook county real estate taxes senior exemption by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.