Your Cook county real estate tax portal images are ready. Cook county real estate tax portal are a topic that is being searched for and liked by netizens now. You can Get the Cook county real estate tax portal files here. Download all free vectors.

If you’re looking for cook county real estate tax portal images information linked to the cook county real estate tax portal keyword, you have come to the ideal site. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Cook County Real Estate Tax Portal. Cook County Property Tax PortalHomes Details. Click here to download the Cook County Assessors Property Tax Rate Simulator. Payments Check Your Payment Status or Make an Online Payment. Cook County Property Tax Portal.

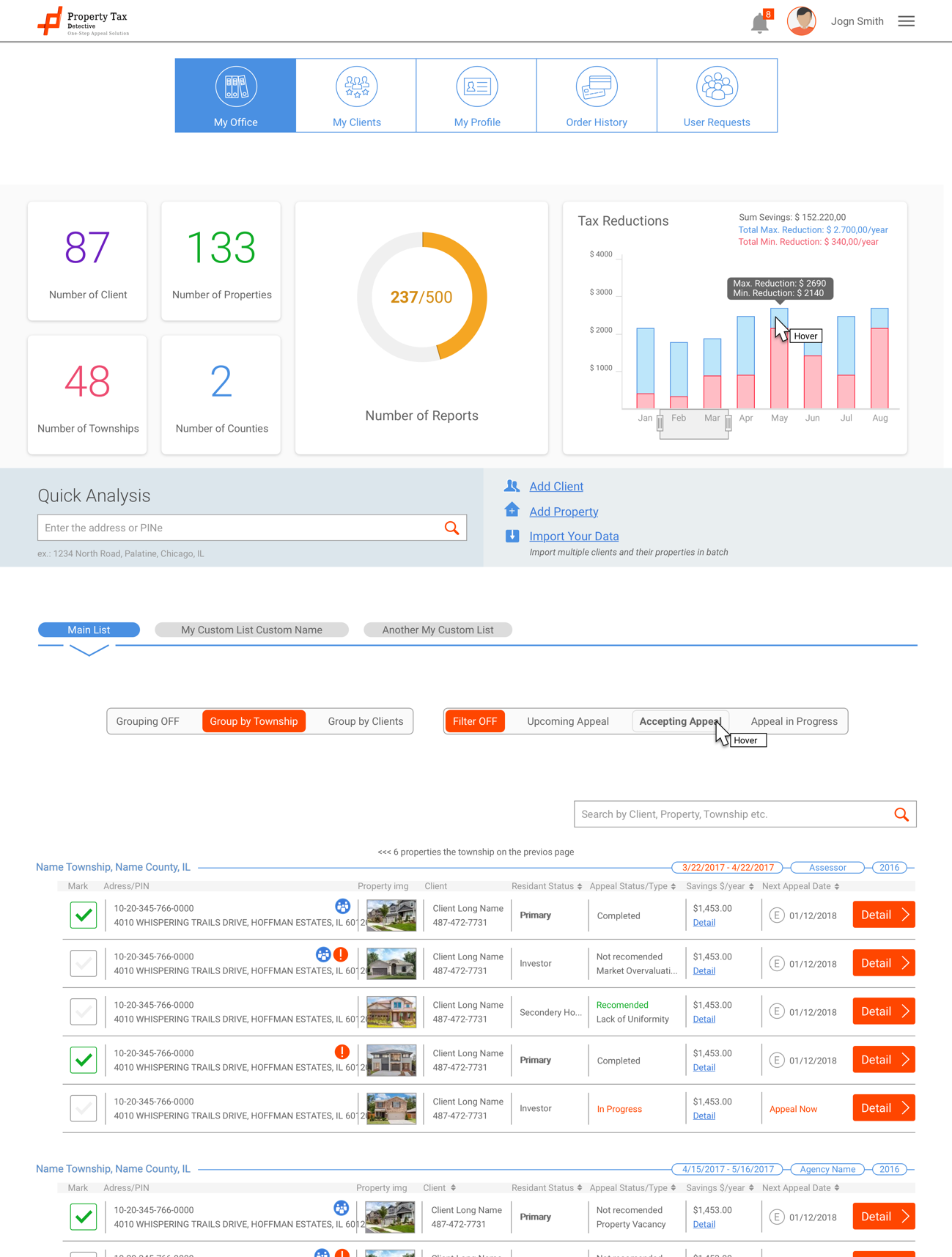

Property Tax Appeals In Cook County From propertytaxdetective.com

Property Tax Appeals In Cook County From propertytaxdetective.com

Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all. Property taxes were due Tuesday March 2 2021 but there is no late fee for those paying their bill through Monday May 3 2021 Cook County Treasurer Maria Pappas said todayThe Cook County Board of Commissioners in November waived for two months the 15 percent per month late fee on Tax Year 2020 First Installment property taxes. Cook County Property Tax Portal. Update March 18 2021. Real Estate Tax Redemption. Cook County Treasurers Office 118 North Clark Street Room 112 Chicago Illinois 60602.

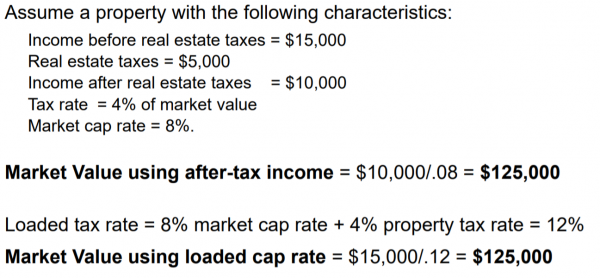

This tool is a Microsoft Excel file.

118 North Clark Street Third Floor Room 320 Chicago IL 60602. Cook Countys Resources and Response to Coronavirus COVID-19 To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. Cook County Property Tax PortalHomes Details. The Second Installment is due August 3 but property owners can pay without any interest charge through October 1 2020 thanks to. Property Tax Assistance Cook County Assessors Office. Any unpaid balance due.

Source: propertytaxdetective.com

Source: propertytaxdetective.com

Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. 118 North Clark Street Third Floor Room 320 Chicago IL 60602. This tool is a Microsoft Excel file. Cook County Treasurers Office 118 North Clark Street Room 112 Chicago Illinois 60602 312 443-5100.

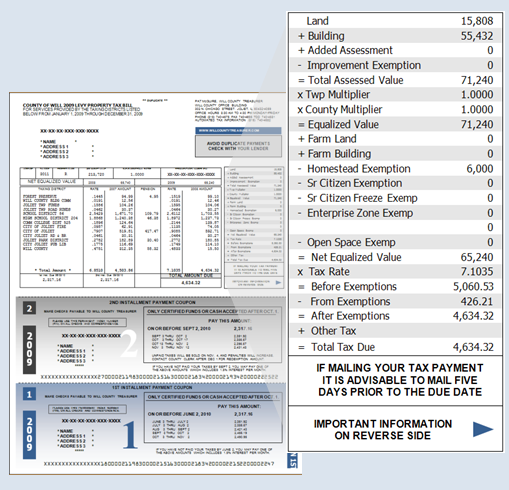

Source: willcountysoa.com

Source: willcountysoa.com

Cook County Property Tax Portal. The Assessment by Legal Application may also be found on the assessors website at. Cook County Ordinance requires that third-party payers–such as mortgage companies escrow agents or title companies–pay a 500 fee under certain circumstances. The linked file above has been updated to include Tax Year 2019 property tax bills issued in 2020. Payments Check Your Payment Status or Make an Online Payment.

Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. Houses 8 days ago Property owners who need to pay real estate taxes by legal description must make a formal request with the Cook County Assessors Office at 312-603-6526. 2019 Transcendent Technologies. If you need to locate a PIN from an address go to the Cook County Assessors website. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website.

Property Tax Portal Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. Search to see a 5-year history of the original tax amounts billed for a PIN. Update March 18 2021. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. Cook County Property Tax Portal.

Source: realestateskills.com

Source: realestateskills.com

Payments Check Your Payment Status or Make an Online Payment. Cook County Real Estate Tax Portal As the housing marketplace seems to offer your residence a Chicago dreamer may find a good piece of capital to make a stunning house styled into your own liking. Billed Amounts Tax History. Cook County Ordinance requires that third-party payers–such as mortgage companies escrow agents or title companies–pay a 500 fee under certain circumstances. Cook County Treasurers Office 118 North Clark Street Room 112 Chicago Illinois 60602.

118 North Clark Street Third Floor Room 320 Chicago IL 60602. Property Tax Assistance Cook County Assessors Office. Update December 16 2019. Cook County Property Tax Portal. Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all.

Source: propertytaxdetective.com

Source: propertytaxdetective.com

2019 Transcendent Technologies. Cook County Real Estate Tax Portal. Billed Amounts Tax HistorySearch to see a 5-year history of the original tax amounts billed for a PIN. The Senior Citizen Real Estate Tax Deferral Program. Property Tax Portal Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system.

Source: propertytaxdetective.com

Source: propertytaxdetective.com

Cook County Treasurers Office 118 North Clark Street Room 112 Chicago Illinois 60602. The Assessment by Legal Application may also be found on the assessors website at. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Click here to download the Cook County Assessors Property Tax Rate Simulator. Real Estate and Tax Services Division Closed to the Public Under the current State and County Executive Orders Stay at Home Orders to limit public access to County Buildings the Cook County Clerks Office will be closed to the public until May 30 2020.

Source: pinterest.com

Source: pinterest.com

At length limousine and Taxi organizations might need to pay for extra money if they employ older motorists or if they use drivers using inferior. Cook County Ordinance requires that third-party payers–such as mortgage companies escrow agents or title companies–pay a 500 fee under certain circumstances. Property taxes were due Tuesday March 2 2021 but there is no late fee for those paying their bill through Monday May 3 2021 Cook County Treasurer Maria Pappas said todayThe Cook County Board of Commissioners in November waived for two months the 15 percent per month late fee on Tax. The linked file above has been updated to include Tax Year 2019 property tax bills issued in 2020. 9 days ago.

Source: in.pinterest.com

Source: in.pinterest.com

This tool is a Microsoft Excel file. The Assessment by Legal Application may also be found on the assessors website at. Some of the content in the Simulator is locked to prevent editingFor new or non-advanced users we recommend keeping it. If you need to locate a PIN from an address go to the Cook County Assessors website. Real Estate and Tax Services Division Closed to the Public Under the current State and County Executive Orders Stay at Home Orders to limit public access to County Buildings the Cook County Clerks Office will be closed to the public until May 30 2020.

The Assessment by Legal Application may also be found on the assessors website at. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. Property Tax Portal Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Cook County Treasurers Office 118 North Clark Street Room 112 Chicago Illinois 60602.

Source: propertytaxdetective.com

Source: propertytaxdetective.com

Payments Check Your Payment Status or Make an Online Payment. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Cook County Property Tax Portal. Click here to download the Cook County Assessors Property Tax Rate Simulator.

Source: propertytaxdetective.com

Source: propertytaxdetective.com

Cook County Property Tax Portal. Some of the content in the Simulator is locked to prevent editingFor new or non-advanced users we recommend keeping it. Any unpaid balance due. At length limousine and Taxi organizations might need to pay for extra money if they employ older motorists or if they use drivers using inferior. Payments Check Your Payment Status or Make an Online Payment.

Source: propertytaxdetective.com

Source: propertytaxdetective.com

Property taxes were due Tuesday March 2 2021 but there is no late fee for those paying their bill through Monday May 3 2021 Cook County Treasurer Maria Pappas said todayThe Cook County Board of Commissioners in November waived for two months the 15 percent per month late fee on Tax. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. Cook County Real Estate Tax Portal As the housing marketplace seems to offer your residence a Chicago dreamer may find a good piece of capital to make a stunning house styled into your own liking. Property taxes were due Tuesday March 2 2021 but there is no late fee for those paying their bill through Monday May 3 2021 Cook County Treasurer Maria Pappas said todayThe Cook County Board of Commissioners in November waived for two months the 15 percent per month late fee on Tax. Cook County Property Tax Portal.

Source: pinterest.com

Source: pinterest.com

Cook County Treasurers Office 118 North Clark Street Room 112 Chicago Illinois 60602. The Assessment by Legal Application may also be found on the assessors website at. Houses 5 days ago Property Tax Portal - Cook County Illinois. Any unpaid balance due. Search to see a 5-year history of the original tax amounts billed for a PIN.

Source: blog.rentconfident.com

Source: blog.rentconfident.com

Houses 5 days ago Property Tax Portal - Cook County Illinois. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. Property Tax Assistance Cook County Assessors Office. Cook County Property Tax PortalHomes Details. Cook County Property Tax Portal.

Source: pinterest.com

Source: pinterest.com

Cook County Property Tax Portal. Cook County Real Estate Tax Portal. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. Cook County Property Tax Portal. Cook County Property Tax PortalHomes Details.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Real Estate and Tax Services Division Closed to the Public Under the current State and County Executive Orders Stay at Home Orders to limit public access to County Buildings the Cook County Clerks Office will be closed to the public until May 30 2020. Cook Countys Resources and Response to Coronavirus COVID-19 To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cook county real estate tax portal by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.