Your Cook county real estate tax payments images are ready. Cook county real estate tax payments are a topic that is being searched for and liked by netizens today. You can Download the Cook county real estate tax payments files here. Download all free images.

If you’re searching for cook county real estate tax payments images information related to the cook county real estate tax payments keyword, you have pay a visit to the right blog. Our site frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

Cook County Real Estate Tax Payments. The extension offered by the County is among the efforts to protect the financial wellbeing of residents. Property owners who need to pay real estate taxes by legal description must make a formal request with the Cook County Assessors Office at 312-603-6526. Under state law late property tax payments are charged 15 percent of the total property taxes owed per month which is collected by the Cook County Treasurer. If you pay by escrow contact your lender prior to attempting to pay early to avoid double payments.

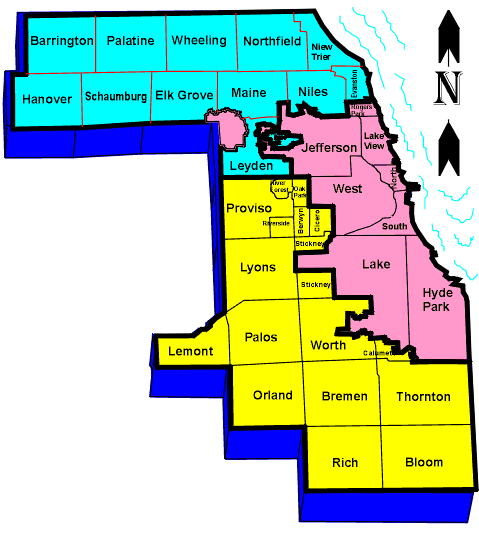

Cook County Assessment Townships Maps Raila Associates P C From railapc.com

Cook County Assessment Townships Maps Raila Associates P C From railapc.com

The median amount of real estate taxes paid annually by Cook County residents is 4984 and the median home value in the area is 237200. Pay by direct debit from your checking or savings account. You will receive a receipt. The extension offered by the County is among the efforts to protect the financial wellbeing of residents. Cook Countys Resources and Response to Coronavirus COVID-19 To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. For example a taxpayer with an annual tax bill of 5200 will only be able to defer 5000.

After the due date for real estate and business personal property interest on unpaid tax bills is applied in compliance with Georgia Code OCGA.

Delinquent Property Tax Search Cook County Clerks Office. Property owners who need to pay real estate taxes by legal description must make a formal request with the Cook County Assessors Office at 312-603-6526. For prior tax years and status please check with the Cook County Clerks Office for more information. Thats relatively low compared to home values in other counties that include major cities like New York County and Los Angeles County. Cook County collects on average 138 of a propertys assessed fair market value as property tax. Sample Tax Rate your tax rate could vary X 10.

Estimated Tax Bill in Dollars. If you are unable to pay online you may pay at any of the nearly 400 Chase Bank locations in Illinois including those located outside of Cook County. General for Tax Year 2018 taxes due in 2019. Check the hours of your branch. The Second Installment is due August 3.

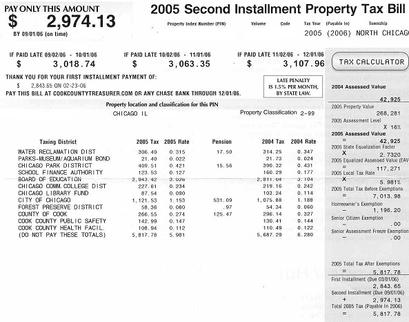

Source: chicagoclosings.com

Source: chicagoclosings.com

Property owners can pay without any interest charge through October 1 2020 thanks to an ordinance urged. 8 days ago The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Pay by direct debit from your checking or savings account. The easiest and fastest way to pay your Cook County Property Tax Bill is online. The Cook County Board approved some relief for property taxpayers today agreeing to waive late-payment interest penalties for two months.

Cook County Treasurers Office - Chicago Illinois. General for Tax Year 2018 taxes due in 2019. Sample Tax Rate your tax rate could vary X 10. If you do not know your PIN use the Search by Property Address link. The office is located at 118 N.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

Estimated Tax Bill in Dollars. For example a taxpayer with an annual tax bill of 5200 will only be able to defer 5000. Thats relatively low compared to home values in other counties that include major cities like New York County and Los Angeles County. It will be the taxpayers responsibility to pay the remaining 200 to the Cook County Treasurers Office. The lien fee amount for that year is not included in the 5000 cap.

Source: medium.com

Source: medium.com

If you do not know your PIN use the Search by Property Address link. The office is located at 118 N. Pay by direct debit from your checking or savings account. The easiest and fastest way to pay your Cook County Property Tax Bill is online. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website.

General for the Tax Year 2020 due in 2021. Cook County Extends Property Tax Payment Deadline May 21 2020 On Thursday May 21 Cook County extended the deadline for property tax payments in response to the COVID-19 pandemic. The median amount of real estate taxes paid annually by Cook County residents is 4984 and the median home value in the area is 237200. If you pay by escrow contact your lender prior to attempting to pay early to avoid double payments. Property owners who need to pay real estate taxes by legal description must make a formal request with the Cook County Assessors Office at 312-603-6526.

Source: civiclab.us

Source: civiclab.us

If you do not know your PIN use the Search by Property Address link. The Second Installment of Cook County property tax bills will start to arrive in mailboxes today and property owners have until October 1 2020 to pay without any late chargeTreasurer Maria Pappas said. Cook County Extends Property Tax Payment Deadline May 21 2020 On Thursday May 21 Cook County extended the deadline for property tax payments in response to the COVID-19 pandemic. You will receive a receipt. If you do not know your PIN use the Search by Property Address link.

Source: loopnorth.com

Source: loopnorth.com

The Assessment by Legal Application may also be found on the assessors website at. 8 days ago The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. If you pay by escrow contact your lender prior to attempting to pay early to avoid double payments. For example a taxpayer with an annual tax bill of 5200 will only be able to defer 5000. After the due date for real estate and business personal property interest on unpaid tax bills is applied in compliance with Georgia Code OCGA.

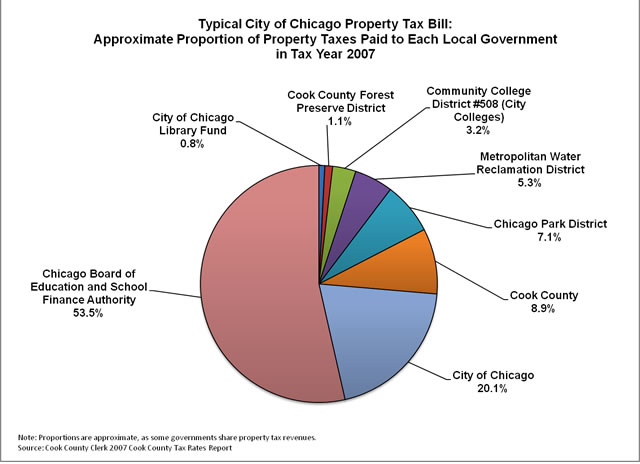

Source: civicfed.org

Source: civicfed.org

The extension offered by the County is among the efforts to protect the financial wellbeing of residents. Delinquent Property Tax Search Cook County Clerks Office. General for Tax Year 2018 taxes due in 2019. 8 days ago The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Houses 2 days ago If you need to locate a PIN from an address go to the Cook County Assessors website.

Source: civicfed.org

Source: civicfed.org

Property owners can pay without any interest charge through October 1 2020 thanks to an ordinance urged. The easiest and fastest way to pay your Cook County Property Tax Bill is online. Property owners who need to pay real estate taxes by legal description must make a formal request with the Cook County Assessors Office at 312-603-6526. The Assessment by Legal Application may also be found on the assessors website at. The Cook County Board approved some relief for property taxpayers today agreeing to waive late-payment interest penalties for two months.

Source: chicagoclosings.com

Source: chicagoclosings.com

You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. Property Tax Portal Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. MARIA PAPPAS COOK COUNTY TREASURER. You will receive a receipt. Check the hours of your branch.

Source: civicfed.org

Source: civicfed.org

Check the hours of your branch. Thats relatively low compared to home values in other counties that include major cities like New York County and Los Angeles County. Clark St Room 112 Chicago Illinois. The Second Installment is due August 3. General for Tax Year 2018 taxes due in 2019.

Source: cookcountytreasurer.com

Source: cookcountytreasurer.com

If you do not know your PIN use the Search by Property Address link. Check the hours of your branch. Visit the bank and bring your entire original tax bill. Property owners can pay without any interest charge through October 1 2020 thanks to an ordinance urged. The Second Installment of Cook County property tax bills will start to arrive in mailboxes today and property owners have until October 1 2020 to pay without any late chargeTreasurer Maria Pappas said.

Source: bettergov.org

Source: bettergov.org

If you do not know your PIN use the Search by Property Address link. How much tax can be deferred. If you are unable to pay online you may pay at any of the nearly 400 Chase Bank locations in Illinois including those located outside of Cook County. MARIA PAPPAS COOK COUNTY TREASURER. Taxes you can pay at a community bank.

Source: cookcountyassessor.com

Source: cookcountyassessor.com

Houses 2 days ago If you need to locate a PIN from an address go to the Cook County Assessors website. Property owners can pay without any interest charge through October 1 2020 thanks to an ordinance urged. Cook County Treasurers Office - Chicago Illinois. Sample Tax Rate your tax rate could vary X 10. Pay by direct debit from your checking or savings account.

Source: chicagorealtor.com

Source: chicagorealtor.com

Additionally a penalty of 10 will apply to all taxes. Taxes you can pay at a community bank. For prior tax years and status please check with the Cook County Clerks Office for more information. The Assessment by Legal Application may also be found on the assessors website at. The Second Installment of Cook County property tax bills will start to arrive in mailboxes today and property owners have until October 1 2020 to pay without any late chargeTreasurer Maria Pappas said.

Cook Countys Resources and Response to Coronavirus COVID-19 To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. Visit the bank and bring your entire original tax bill. For example a taxpayer with an annual tax bill of 5200 will only be able to defer 5000. The Cook County Board approved some relief for property taxpayers today agreeing to waive late-payment interest penalties for two months. The office is located at 118 N.

Source: brookfieldil.gov

Source: brookfieldil.gov

General for the Tax Year 2019 due in 2020. General for Tax Year 2018 taxes due in 2019. Cook Countys Resources and Response to Coronavirus COVID-19 To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. General for the Tax Year 2020 due in 2021. If you do not know your PIN use the Search by Property Address link.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cook county real estate tax payments by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.