Your Cook county real estate tax bill copy images are ready. Cook county real estate tax bill copy are a topic that is being searched for and liked by netizens today. You can Download the Cook county real estate tax bill copy files here. Get all free photos.

If you’re searching for cook county real estate tax bill copy pictures information connected with to the cook county real estate tax bill copy topic, you have pay a visit to the ideal site. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

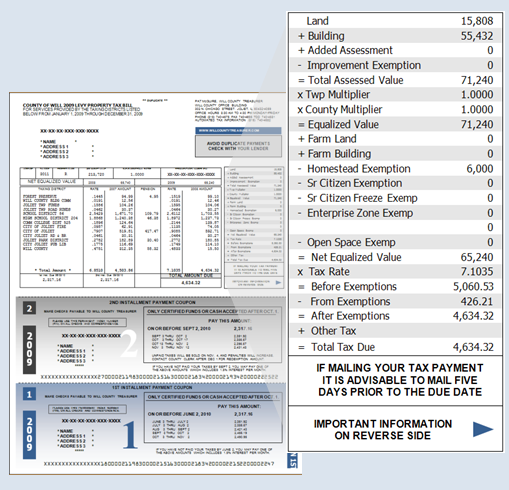

Cook County Real Estate Tax Bill Copy. They are a valuable tool for the real estate. If you pay by escrow contact your lender prior to attempting to pay early to avoid double payments. Your first installment is due at the beginning of March. 83 Million in Cook County Property Tax Refunds To Go To Nearly 30000 Homeowners.

Articles By Tag North Canton Oh Real Estate For Sale Dehoff Realtors Dehoff Blog From dehoff.com

Articles By Tag North Canton Oh Real Estate For Sale Dehoff Realtors Dehoff Blog From dehoff.com

Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills. 83 Million in Cook County Property Tax Refunds To Go To Nearly 30000 Homeowners. By law the first installment property tax bill is exactly 55 percent of the previous years total tax amount. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Sign up to receive tax bills by email.

For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills. The second installment property tax bill is mailed and due in late summer. If you know your propertys Property Index Number or PIN a 14-digit number found on your property tax bill type that into the search bar. You can also call the Cook County Clerks Office Mapping Department at. 04540 50691. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Source: blog.rentconfident.com

Source: blog.rentconfident.com

If your early payment is received by December 31st the First Installment tax bill which will be mailed in late. Read The Pappas Study. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. They are maintained by various government offices in Cook County Illinois State and at the Federal level. You can also call the Cook County Clerks Office Mapping Department at.

Source: anmtg.com

Source: anmtg.com

Head over to the County Recorders website and click to access the 2020 Search portal. Tax bills for previous years are handled by the Cook County Clerks Office. They are maintained by various government offices in Cook County Illinois State and at the Federal level. You can also call the Cook County Clerks Office Mapping Department at. By law the first installment property tax bill is exactly 55 percent of the previous years total tax amount.

Source: dehoff.com

Source: dehoff.com

It reflects new tax rates levies changes in assessments and any dollars saved by. Cook County collects on average 138 of a propertys assessed fair market value as property tax. 4 days ago The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Property tax exemptions are provided for owners with the following situations. Find out if your delinquent taxes have been sold.

Source: willcountysoa.com

Source: willcountysoa.com

Your first installment is due at the beginning of March. Property tax exemptions are provided for owners with the following situations. Tax rate Tax amount. For information on prior years taxes have your 14-digit Property Index Number PIN ready and contact the County Clerks Real Estate Tax Services Division. Cook County allows you to retrieve copies of your deed online for a small fee.

Source: chicagorealtor.com

Source: chicagorealtor.com

The Treasurers phone number is 312 443-5100 and the County Clerks phone number is 312 603-5656. If you pay by escrow contact your lender prior to attempting to pay early to avoid double payments. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. 83 Million in Cook County Property Tax Refunds To Go To Nearly 30000 Homeowners. Cook County Real Estate Tax Bill.

The office is located at 118 N. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. 00320 3573. For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills.

Source: hotelzodiacobolsena.site

Source: hotelzodiacobolsena.site

They are maintained by various government offices in Cook County Illinois State and at the Federal level. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site. Forest Preserve District of Cook County. Northwest Mosquito Abatement District.

Source: malawillinois.com

Source: malawillinois.com

They are maintained by various government offices in Cook County Illinois State and at the Federal level. Cook County collects on average 138 of a propertys assessed fair market value as property tax. See local governments debt and pensions. 83 Million in Cook County Property Tax Overpayments will be Refunded Automatically. 00010 112.

By law the first installment property tax bill is exactly 55 percent of the previous years total tax amount. Tax bills for previous years are handled by the Cook County Clerks Office. For a fee the Cook County Clerks Office can provide maps of Cook County a tax map of a specific area or parcel and copies of the official legal description of the property used for taxation purposes. 00320 3573. Cook Countys Resources and Response to Coronavirus COVID-19 To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer.

Source: adespresso.com

Source: adespresso.com

00590 6588. 00010 112. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. 04540 50691. For tax information andor a copy of your bill you must contact the Cook County Treasurers Office at 312-443-5100 or visit their website at.

Source: academia.edu

Source: academia.edu

00300 3350. Read The Pappas Study. See local governments debt and pensions. Northwest Mosquito Abatement District. For this reason the Clerks Office generates the message about prior years taxes that appears in the Important Messages box on the tax bills.

Source: houselogic.com

Source: houselogic.com

Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. The second installment property tax bill is mailed and due in late summer. If you pay by escrow contact your lender prior to attempting to pay early to avoid double payments. Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. By visiting the Clerks Office on the 4th Floor of the Cook County.

83 Million in Cook County Property Tax Overpayments will be Refunded Automatically. Cook County Property Records are real estate documents that contain information related to real property in Cook County Illinois. The office is located at 118 N. Houses 2 days ago Cook County Illinois Property Taxes - 2021. The second installment property tax bill is mailed and due in late summer.

Source: listwithclever.com

Source: listwithclever.com

Clark St Room 112 Chicago Illinois. Read The Pappas Study. Northwest Mosquito Abatement District. The office is located at 118 N. Property tax exemptions are provided for owners with the following situations.

Source: pinterest.com

Source: pinterest.com

They are maintained by various government offices in Cook County Illinois State and at the Federal level. You also can check and update key information about your property such as. 00590 6588. By visiting the Clerks Office on the 4th Floor of the Cook County. Cook Countys Resources and Response to Coronavirus COVID-19 To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer.

Source: fool.com

Source: fool.com

Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. Cook County allows you to retrieve copies of your deed online for a small fee. Sign up to receive tax bills by email. Houses 2 days ago Cook County Illinois Property Taxes - 2021. Northwest Mosquito Abatement District.

Source: pinterest.com

Source: pinterest.com

83 Million in Cook County Property Tax Overpayments will be Refunded Automatically. Download a copy of your tax bill. 00590 6588. Head over to the County Recorders website and click to access the 2020 Search portal. You may pay at the Cook County Treasurers Office with an original early payment coupon or a PDF tax bill downloadable from this site.

Source: hrblock.com

Source: hrblock.com

Select the blue box labeled Pay Online for Free Search by property address or enter your Property Index Number PIN. 04540 50691. They are a valuable tool for the real estate. Cook County Real Estate Tax Bill. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cook county real estate tax bill copy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.