Your Convert 401k to real estate investment images are available. Convert 401k to real estate investment are a topic that is being searched for and liked by netizens now. You can Download the Convert 401k to real estate investment files here. Download all free photos and vectors.

If you’re looking for convert 401k to real estate investment images information related to the convert 401k to real estate investment keyword, you have visit the right site. Our site always provides you with hints for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Convert 401k To Real Estate Investment. 401k Real Estate Investment - Broad Financial. Unlike a self-directed IRA a 401k plan doesnt have the ability to invest in real estate. For a Solo 401K plan the IRS lists approved investments. Make no mistake about it the 401k investment vehicle is an excellent choice as a means to save for retirement.

How To Invest In Real Estate With Your Retirement Ira Or 401k Roll Over 401k To Ira Youtube From youtube.com

How To Invest In Real Estate With Your Retirement Ira Or 401k Roll Over 401k To Ira Youtube From youtube.com

When you do this youll be rolling over your investment. For a Solo 401K plan the IRS lists approved investments. Locate real estate that you wish to purchase and tell your self-directed IRA trustee to make these purchases for you using IRA funds. Under ERISA or the Employee Retirement Income Security Act 1974 certain rules apply to investments in retirement plans. A lot of experts recommend that you rollover your 401k into a self-directed IRA. You net 800 a month for that house for the next 20 years.

For a Solo 401K plan the IRS lists approved investments.

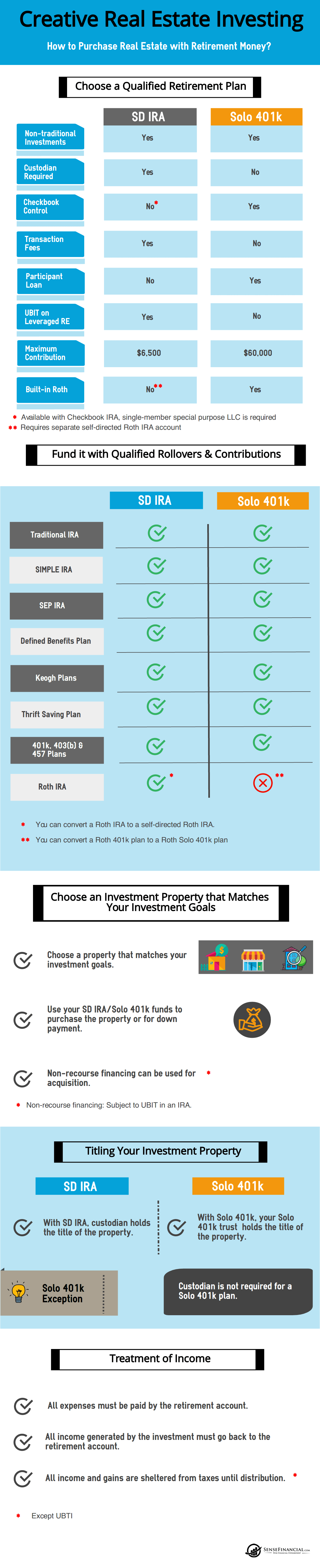

But the main problem with a 401k lies with its restrictions. This flies in the face of most real estate investing advice. Using an IRA account to buy real estate is not for those who lack the time and expertise to manage such an investment. An important thing for beginner real estate investors to understand is that a traditional 401k wont allow you to invest directly in real estate. Primarily were going to be discussing investing using your 401k plan. Although you cannot invest directly in real estate in a 401 k account you can rollover your 401 k into an IRA tax-free and then use the proceeds to invest in real.

Source: mysolo401k.net

Source: mysolo401k.net

Houses 2 days ago To convert 401k assets into real estate you must roll over the funds into a real estate IRA. Houses 2 days ago To convert 401k assets into real estate you must roll over the funds into a real estate IRA. Whats important to know is that a traditional 401 k will not allow you to invest directly into real estate. You must no longer be employed with the company maintaining the 401k plan to roll it over and the real estate must be investment property exclusively to comply with IRS regulations. You net 800 a month for that house for the next 20 years.

Source: mysolo401k.net

Source: mysolo401k.net

You must no longer be employed with the company maintaining the 401k plan to roll it over and the real estate must be investment property exclusively to comply with IRS regulations. Primarily were going to be discussing investing using your 401k plan. Real estate investing has created many success stories and made a lot more millionaires than 401K. Unlike a self-directed IRA a 401k plan doesnt have the ability to invest in real estate. This flies in the face of most real estate investing advice.

Source: mysolo401k.net

Source: mysolo401k.net

If you have left the employer sponsoring the plan you should have no problem moving it to a self-directed IRA. Taking on debt always equals taking on risk so avoid it no matter what. Comparing investing in real estate vs. Locate real estate that you wish to purchase and tell your self-directed IRA trustee to make these purchases for you using IRA funds. This is why you need to have a self-directed 401k plan this is basically a do-it-yourself retirement plan that you manage.

Source: trion-properties.com

Source: trion-properties.com

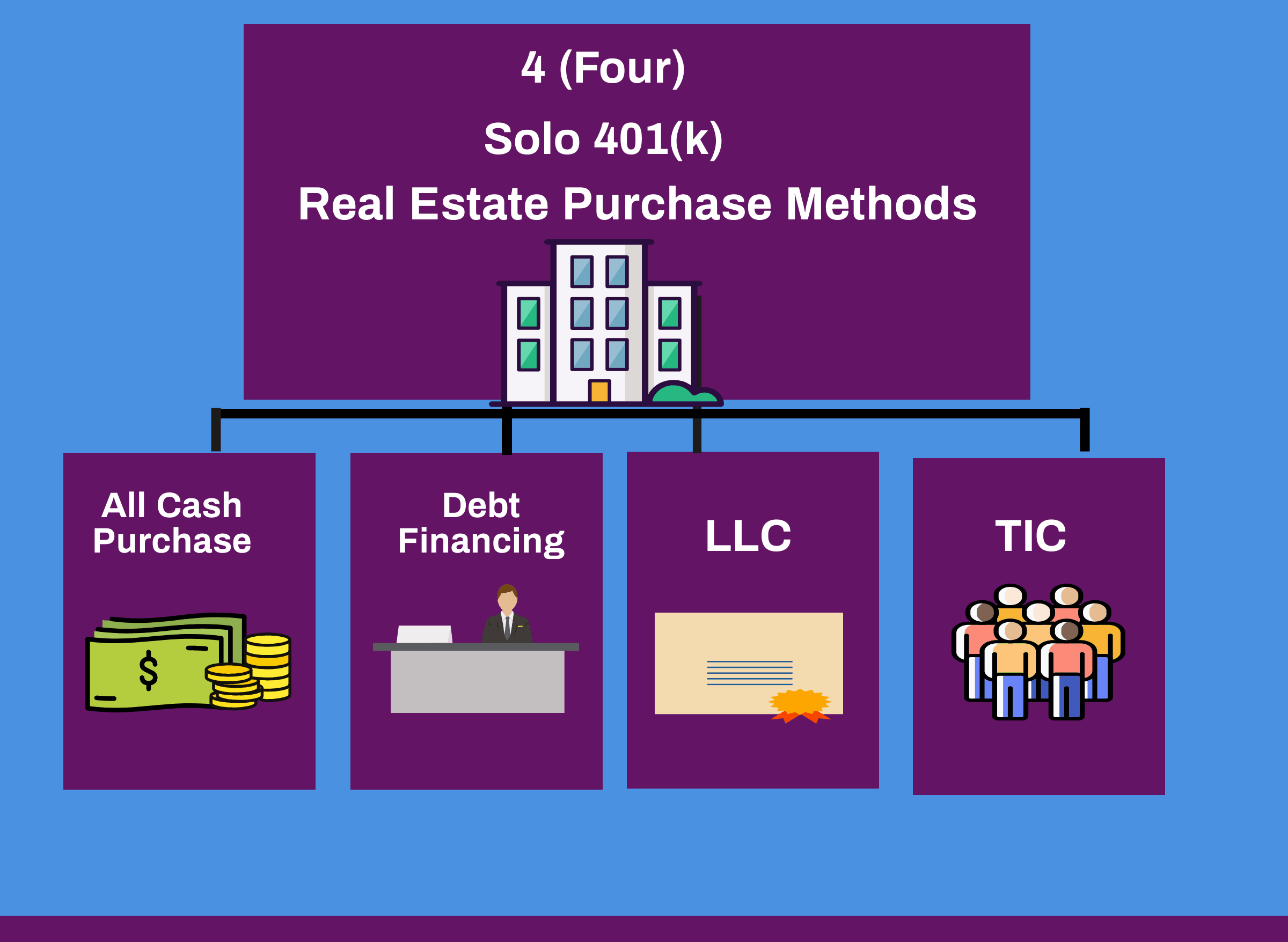

How to Use Your 401k to Buy Real Estate. Real estate investing has created many success stories and made a lot more millionaires than 401K. Many think this is the best way to invest your 401k in real estate if you want real estate as an investment choice for your retirement savings. A Solo 401K is also referred to as a Self-directed 401K. The only possibility of even putting money to work in real estate indirectly in an employer-sponsored 401k would be if theres a real estate investment fund on.

Source: trierinvestments.com

Source: trierinvestments.com

Schedule a Free Self-Directed IRA Consultation. Assume an 8 return on the 401 k for the couple in scenario 1. Locate real estate that you wish to purchase and tell your self-directed IRA trustee to make these purchases for you using IRA funds. Roll over your 401 k. You may be able to use your retirement options to invest in real estate.

Source: mysolo401k.net

Source: mysolo401k.net

After all the more money we have after quitting our jobs the more lifestyle flexibility well enjoy. Although you cannot invest directly in real estate in a 401 k account you can rollover your 401 k into an IRA tax-free and then use the proceeds to invest in real. Roll over your 401 k. Under ERISA or the Employee Retirement Income Security Act 1974 certain rules apply to investments in retirement plans. Taking on debt always equals taking on risk so avoid it no matter what.

Source: sdirahandbook.com

Source: sdirahandbook.com

Primarily were going to be discussing investing using your 401k plan. 401k Real Estate Investment - Broad Financial. If you have sufficient cash available in the account. The only possibility of even putting money to work in real estate indirectly in an employer-sponsored 401k would be if theres a real estate investment fund on. Houses 2 days ago To convert 401k assets into real estate you must roll over the funds into a real estate IRA.

Source: irafinancialgroup.com

Source: irafinancialgroup.com

Your 401 k plan documents must allow for the purchase of real estate which is not always the case especially with 401 k plans that cover many employees. Due to the magic of compounding after 30 years they would have 39244530 in a pre-tax account. Roll over your 401 k. You may be able to use your retirement options to invest in real estate. Locate real estate that you wish to purchase and tell your self-directed IRA trustee to make these purchases for you using IRA funds.

Source: mysolo401k.net

Source: mysolo401k.net

You net 800 a month for that house for the next 20 years. For a Solo 401K plan the IRS lists approved investments. Primarily were going to be discussing investing using your 401k plan. Due to the magic of compounding after 30 years they would have 39244530 in a pre-tax account. Make no mistake about it the 401k investment vehicle is an excellent choice as a means to save for retirement.

Source: morrisinvest.com

Source: morrisinvest.com

A Roth conversion is available for most forms of a 401k to help an account owner take advantage of tax-free income growth. How to Use Your 401k to Buy Real Estate. Self Directed 401k Real Estate - How to Invest in Real Estate with Self Directed 401k also known as Solo 41k Self Employed 401k or Individual 401k. Houses 2 days ago To convert 401k assets into real estate you must roll over the funds into a real estate IRA. After all the more money we have after quitting our jobs the more lifestyle flexibility well enjoy.

Source:

Source:

You net 800 a month for that house for the next 20 years. Real estate investing has created many success stories and made a lot more millionaires than 401K. How to Start Investing in Real Estate in Six Steps. You can use 401k funds to invest in real estate if you can roll over the funds out of the plan into a self-directed IRA. How Can I Turn My 401K Into Real Estate.

Source: youtube.com

Source: youtube.com

You can use 401k funds to invest in real estate if you can roll over the funds out of the plan into a self-directed IRA. Taking on debt always equals taking on risk so avoid it no matter what. After all the more money we have after quitting our jobs the more lifestyle flexibility well enjoy. Schedule a Free Self-Directed IRA Consultation. Locate real estate that you wish to purchase and tell your self-directed IRA trustee to make these purchases for you using IRA funds.

Source: mysolo401k.net

Source: mysolo401k.net

Your 401 k plan documents must allow for the purchase of real estate which is not always the case especially with 401 k plans that cover many employees. Many forms of accounts could qualify for a real estate purchasing including simple IRA SEP 403b and other sponsored plans. Houses 2 days ago To convert 401k assets into real estate you must roll over the funds into a real estate IRA. When youre ready to start buying investment property here are the guidelines to follow. A lot of experts recommend that you rollover your 401k into a self-directed IRA.

Source: line.17qq.com

Source: line.17qq.com

3 Real estate income is pretty much tax free anyway so what do you really gain by leaving it in a tax free vehicle that is only temporarily tax free - youll pay when you end up pulling that real estate out of the 401k. Roll over your 401 k. Why Investing In Real Estate Is Better Than Saving In A 401k. How to Use Your 401k to Buy Real Estate. 3 Real estate income is pretty much tax free anyway so what do you really gain by leaving it in a tax free vehicle that is only temporarily tax free - youll pay when you end up pulling that real estate out of the 401k.

Source: solo401k.com

Source: solo401k.com

You may be able to use your retirement options to invest in real estate. You can use 401k funds to invest in real estate if you can roll over the funds out of the plan into a self-directed IRA. Comparing investing in real estate vs. 401k Real Estate Investment - Broad Financial. Primarily were going to be discussing investing using your 401k plan.

Source: mysolo401k.net

Source: mysolo401k.net

Locate real estate that you wish to purchase and tell your self-directed IRA trustee to make these purchases for you using IRA funds. An important thing for beginner real estate investors to understand is that a traditional 401k wont allow you to invest directly in real estate. Taking on debt always equals taking on risk so avoid it no matter what. How to Use Your 401k to Buy Real Estate. Those rules include that you cannot invest in art gems antiques.

Source: reiclub.com

Source: reiclub.com

A Roth conversion is available for most forms of a 401k to help an account owner take advantage of tax-free income growth. Your 401 k plan documents must allow for the purchase of real estate which is not always the case especially with 401 k plans that cover many employees. Comparing investing in real estate vs. 401 k Scenario 1 Max out 401 k contribution and let it grow for 30 years. Taking on debt always equals taking on risk so avoid it no matter what.

Source: mysolo401k.net

Source: mysolo401k.net

Due to the magic of compounding after 30 years they would have 39244530 in a pre-tax account. If the Solo 401K Plan Documents allow it then yes you can use it to invest in Real Estate. Roll over your 401 k. Locate real estate that you wish to purchase and tell your self-directed IRA trustee to make these purchases for you using IRA funds. A Solo 401K is also referred to as a Self-directed 401K.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title convert 401k to real estate investment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.