Your Connecticut real estate tax records images are ready in this website. Connecticut real estate tax records are a topic that is being searched for and liked by netizens today. You can Download the Connecticut real estate tax records files here. Download all free photos and vectors.

If you’re looking for connecticut real estate tax records pictures information related to the connecticut real estate tax records keyword, you have come to the ideal blog. Our site always gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Connecticut Real Estate Tax Records. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only. During a real estate transaction a seller can also expect to pay a range of 025 to 050 of their home sale toward municipal taxes. Connecticut state law authorizes the taxation of property including real estate motor vehicles business-owned personal property and some personal property that individuals own. The state will not accept copies.

Property Record Cards Town Of Fairfield Connecticut From fairfieldct.org

Property Record Cards Town Of Fairfield Connecticut From fairfieldct.org

Tax Records include property tax assessments property appraisals and income tax records. State law also provides an additional exemption for veterans and disabled veterans who are eligible for the basic exemption and who can meet certain income limits. The seller must pay the tax before the deed can be recorded. Land and land improvements are considered real property while mobile property is classified as personal property. Download this form and complete using Adobe Acrobat. A resident estate is an estate of a decedent who was domiciled in.

State law also provides an additional exemption for veterans and disabled veterans who are eligible for the basic exemption and who can meet certain income limits.

NETR Online Connecticut Public Records Search Connecticut Records Connecticut Property Tax Connecticut Property Search Connecticut Assessor Property Data Store Public Records Online. Download this form and complete using Adobe Acrobat. A Greenwich Property Records Search locates real estate documents related to property in Greenwich Connecticut. Connecticut Real Estate Conveyance Tax Return -Fillable -This return can only be used for conveyance dates prior to 712020. Several government offices in Greenwich and Connecticut state maintain Property Records. If you are closing on June 30 but not recording until July 1 then the new state conveyance tax will apply.

Source: searchpropertydata.com

Source: searchpropertydata.com

Connecticut state law authorizes the taxation of property including real estate motor vehicles business-owned personal property and some personal property that individuals own. A Stamford Property Records Search locates real estate documents related to property in Stamford Connecticut. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only. A resident estate is an estate of a decedent who was domiciled in. Use our free Connecticut property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Source: townofcolebrook.org

Source: townofcolebrook.org

Public Property Records provide information on land homes and commercial properties in Stamford including titles property deeds mortgages property tax assessment records and other documents. Eligibility and key dates are. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents. For 2020 that threshold is 51 million. Tax Records include property tax assessments property appraisals and income tax records.

Source: hrblock.com

Source: hrblock.com

Connecticut Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in CT. Instructions for the OP-236 Real Estate Conveyance Tax. Its important to know that the lesser fee is a base price but can increase depending on the municipality where a property is located. Stonington Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Stonington Connecticut. Connecticut Assessor and Property Tax Records Directory About Assessor and Property Tax Records in Connecticut Real and personal property tax records are kept by the Tax Assessor in each Connecticut Town.

Source: suburbs101.com

Source: suburbs101.com

Several government offices in CT state maintain Property Records which are a valuable tool for. Local governmental officials administer the property assessment and taxation. Connecticut Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in CT. Find Property Data Real Estate Appraisals Assessments Property Taxes Land Records GIS Maps and Parcel Viewer in Connecticut. Connecticut Assessor and Property Tax Records Directory About Assessor and Property Tax Records in Connecticut Real and personal property tax records are kept by the Tax Assessor in each Connecticut Town.

Source: ctmirror.org

Source: ctmirror.org

Connecticut also imposes a 111 controlling interest transfer tax on real estate transferred through the sale or transfer of a business entity that owns an interest in Connecticut real property valued at least 2000 or more. A Greenwich Property Records Search locates real estate documents related to property in Greenwich Connecticut. Stonington Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Stonington Connecticut. The tax applies only to the value of the estate above the threshold. NETR Online Connecticut Public Records Search Connecticut Records Connecticut Property Tax Connecticut Property Search Connecticut Assessor Property Data Store Public Records Online.

Source: propertyshark.com

Source: propertyshark.com

Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only. For 2020 that threshold is 51 million. Use our free Connecticut property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Connecticut Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in CT. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents.

Source: houselogic.com

Source: houselogic.com

Veterans Exemption Tax Relief Program State law provides a basic 1000 property tax exemption for certain honorably discharged Veterans who actively served at least 90 days during war time or their survivors. Local governmental officials administer the property assessment and taxation. For conveyances of real property or permanent easements you must submit a completed original State of Connecticut Real Estate Conveyance Tax Return M-45. Connecticut Assessor and Property Tax Records Directory About Assessor and Property Tax Records in Connecticut Real and personal property tax records are kept by the Tax Assessor in each Connecticut Town. Eligibility and key dates are.

Source: realtor.com

Source: realtor.com

For conveyances of real property or permanent easements you must submit a completed original State of Connecticut Real Estate Conveyance Tax Return M-45. If you are a seller and wish not to pay the increase in the conveyance tax then your sale must be recorded no later than June 30. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only. This form must be accompanied by. Our property records tool can return a variety of information about your property that affect your property tax.

Source: br.pinterest.com

Source: br.pinterest.com

NETR Online Connecticut Public Records Search Connecticut Records Connecticut Property Tax Connecticut Property Search Connecticut Assessor Property Data Store Public Records Online. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only. Connecticut Real Estate Conveyance Tax Return -Fillable -This return can only be used for conveyance dates prior to 712020. If you are a seller and wish not to pay the increase in the conveyance tax then your sale must be recorded no later than June 30. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of.

Source: mytaxbill.org

Source: mytaxbill.org

There are 19 eligible areas throughout Connecticut considered targeted investment communities where taxes are heightened. Public Property Records provide information on land homes and commercial properties in Greenwich including titles property deeds mortgages property tax assessment records and other documents. Find Property Data Real Estate Appraisals Assessments Property Taxes Land Records GIS Maps and Parcel Viewer in Connecticut. Local governmental officials administer the property assessment and taxation. Connecticut state law authorizes the taxation of property including real estate motor vehicles business-owned personal property and some personal property that individuals own.

Source: portal.ct.gov

Source: portal.ct.gov

For conveyances of real property or permanent easements you must submit a completed original State of Connecticut Real Estate Conveyance Tax Return M-45. Several government offices in Greenwich and Connecticut state maintain Property Records. Local governmental officials administer the property assessment and taxation. A Greenwich Property Records Search locates real estate documents related to property in Greenwich Connecticut. Several government offices in CT state maintain Property Records which are a valuable tool for.

Instructions for the OP-236 Real Estate Conveyance Tax. Several government offices in Stamford and Connecticut state maintain Property Records. Land and land improvements are considered real property while mobile property is classified as personal property. Download this form and complete using Adobe Acrobat. State law also provides an additional exemption for veterans and disabled veterans who are eligible for the basic exemption and who can meet certain income limits.

Source: realtor.com

Source: realtor.com

Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold. NETR Online Connecticut Public Records Search Connecticut Records Connecticut Property Tax Connecticut Property Search Connecticut Assessor Property Data Store Public Records Online. Connecticut Real Estate Conveyance Tax Return -Fillable -This return can only be used for conveyance dates prior to 712020. Our property records tool can return a variety of information about your property that affect your property tax. Stonington Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Stonington Connecticut.

Source: fairfieldct.org

Source: fairfieldct.org

Use our free Connecticut property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Veterans Exemption Tax Relief Program State law provides a basic 1000 property tax exemption for certain honorably discharged Veterans who actively served at least 90 days during war time or their survivors. Connecticut also imposes a 111 controlling interest transfer tax on real estate transferred through the sale or transfer of a business entity that owns an interest in Connecticut real property valued at least 2000 or more. A Stamford Property Records Search locates real estate documents related to property in Stamford Connecticut. The state will not accept copies.

Source: ctmirror.org

Source: ctmirror.org

A Connecticut Property Records Search locates real estate documents related to property in CT. Several government offices in Stamford and Connecticut state maintain Property Records. Use our free Connecticut property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. For 2020 that threshold is 51 million. The tax is designed to apply to real estate transfers that are not.

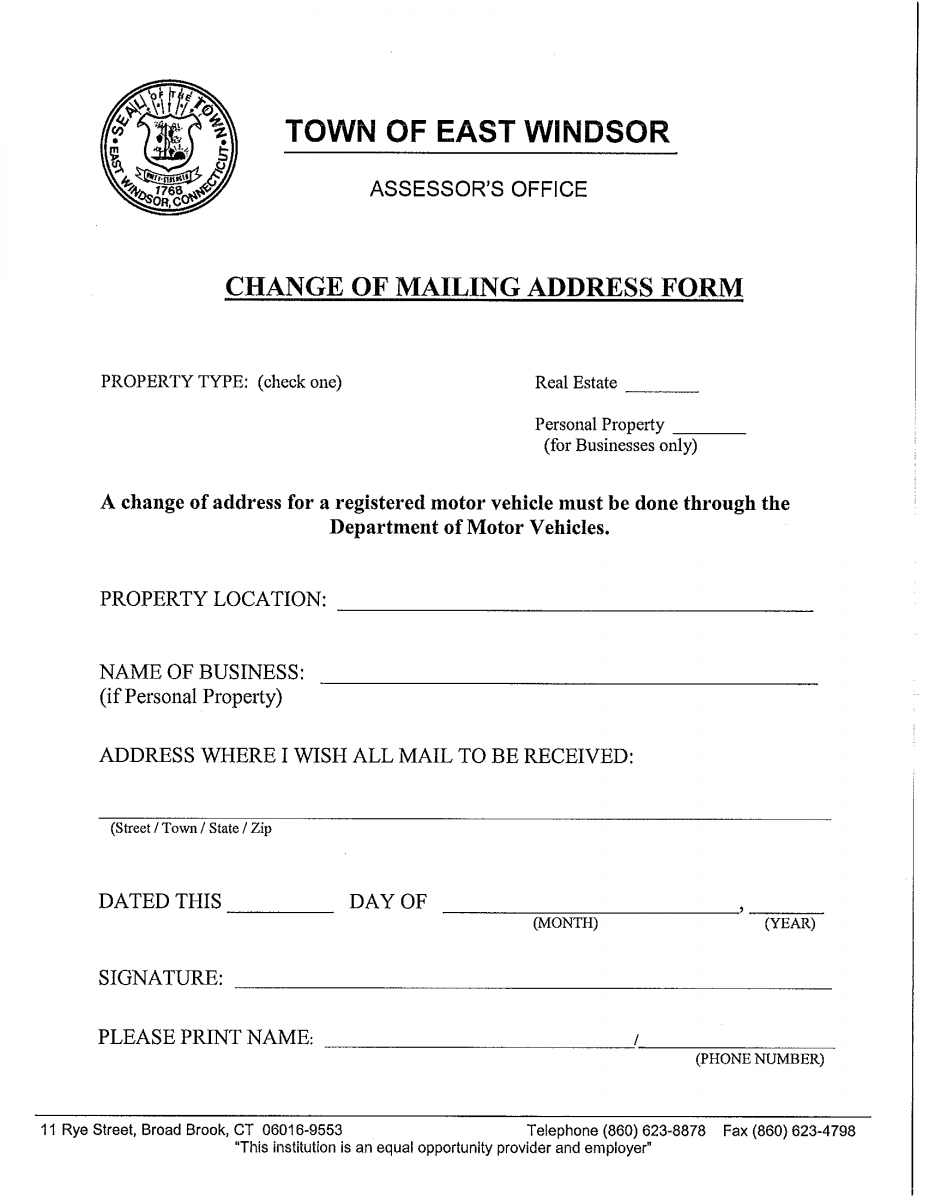

Source: eastwindsor-ct.gov

Source: eastwindsor-ct.gov

Use our free Connecticut property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. The tax applies only to the value of the estate above the threshold. Connecticut Real Estate Conveyance Tax Return -Fillable -This return can only be used for conveyance dates prior to 712020. Tax Records include property tax assessments property appraisals and income tax records. Connecticut also imposes a 111 controlling interest transfer tax on real estate transferred through the sale or transfer of a business entity that owns an interest in Connecticut real property valued at least 2000 or more.

Source: realtor.com

Source: realtor.com

The tax applies only to the value of the estate above the threshold. Connecticut also imposes a 111 controlling interest transfer tax on real estate transferred through the sale or transfer of a business entity that owns an interest in Connecticut real property valued at least 2000 or more. Tax Records include property tax assessments property appraisals and income tax records. INCREASE OF STATE CONVEYANCE TAX IN CONNECTICUT EFFECTIVE JULY 1 2020 By Judith Ellenthal Esq. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold.

Source: realtor.com

Source: realtor.com

Land and land improvements are considered real property while mobile property is classified as personal property. NETR Online Connecticut Public Records Search Connecticut Records Connecticut Property Tax Connecticut Property Search Connecticut Assessor Property Data Store Public Records Online. The tax is designed to apply to real estate transfers that are not. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold. A check for local conveyance taxes made payable to the Town of Coventry.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title connecticut real estate tax records by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.