Your Connecticut real estate conveyance tax return images are ready. Connecticut real estate conveyance tax return are a topic that is being searched for and liked by netizens today. You can Get the Connecticut real estate conveyance tax return files here. Download all free photos and vectors.

If you’re searching for connecticut real estate conveyance tax return pictures information linked to the connecticut real estate conveyance tax return topic, you have visit the right blog. Our website frequently provides you with hints for viewing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

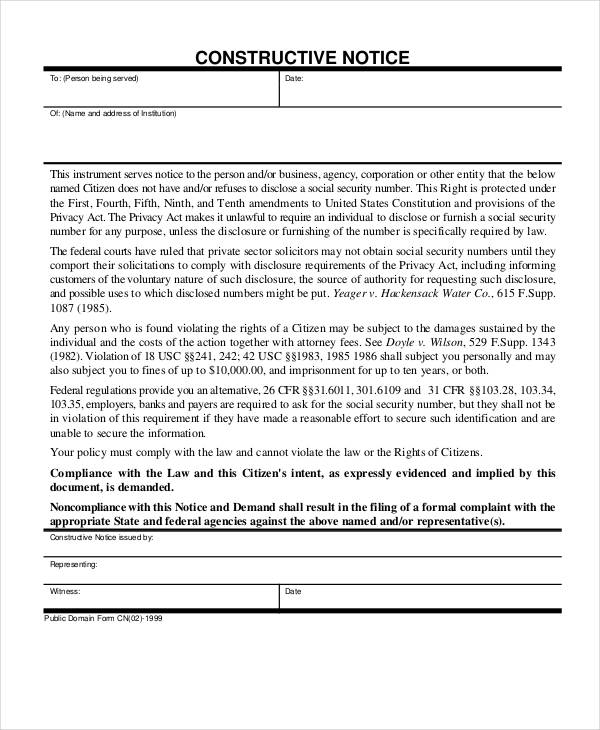

Connecticut Real Estate Conveyance Tax Return. Information for Connecticut Real Estate Conveyance Tax Return or more than one granteebuyer complete OP-236 Schedule B - Grantees Supplemental Information for Connecticut Real Estate Conveyance Tax Return and provide all the required information. 0417 Complete Form OP-236 in blue or black ink only- FEIN SSN 4. A fillable online version is available here. For example if you sell your home for 800000 you will pay the state a conveyance tax of 6000.

Transferring Property Ownership Pros Cons Other Options From americanfinancing.net

Transferring Property Ownership Pros Cons Other Options From americanfinancing.net

Real Estate Conveyance Tax. Real Estate Conveyance Tax Return OP-236 This is a Connecticut form that can be used for Real Estate Conveyance within Statewide Department Of Revenue Services. 1 increasing tax on residential estate sold for more than 800000 from50 to75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv. Connecticut Real Estate Conveyance Tax Return Rev. 4 days ago. 2 and increasing tax on conveyance to a financial institution of a property with a delinquent mortgage from 050 to 075 in Subdiv.

Effective July 1 2020 there will be three 3 tiers for the rate payable to the State of Connecticut.

1 increasing tax on residential estate sold for more than 800000 from50 to75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv. Real Estate Conveyance Tax Return OP-236 The Connecticut Real Estate Conveyance Tax Return OP-236 also contains the Town Clerks Copy Schedule A and Schedule B. The enhancement will allow for more efficient processing of the thousands of CT Form OP-236 submissions received annually. A resident estate is an estate of a decedent who was domiciled in. Grantor Grantors Attorney or Grantors Authorized Agent. 2 and increasing tax on conveyance to a financial institution of a property with a delinquent mortgage from 050 to 075 in Subdiv.

Source: deeds.com

Source: deeds.com

8 Zeilen Connecticut Real Estate Conveyance Tax Return - Fillable - This return can only be used for. The tax applies only to the value of the estate above the threshold. Estate income tax filing requirement. For 2020 that threshold is 51 million. 2 and increasing tax on conveyance to a financial institution of a property with a delinquent mortgage from 050 to 075 in Subdiv.

Source: deeds.com

Source: deeds.com

Grantor Grantors Attorney or Grantors Authorized Agent. 2 and increasing tax on conveyance to a financial institution of a property with a delinquent mortgage from 050 to 075 in Subdiv. The Connecticut Department of Revenue Services DRS has finalized a new CT Form OP-236 Connecticut Real Estate Conveyance Tax Return that includes a 2D Bar Code. 125 Any portion that exceeds 2500000. Instructions for the OP-236 are posted separately.

Source: deeds.com

Source: deeds.com

075 Any portion that exceeds 800000 up to 2500000. OP-236 Form Schedules DownloadFill-inSave and print when needed. Connecticut Real Estate Conveyance Tax Return Rev. The tax applies only to the value of the estate above the threshold. The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance.

Source: corkintheocean.com

Source: corkintheocean.com

New Real Estate Conveyance Tax Return Posted. The tax applies only to the value of the estate above the threshold. 075 Any portion that exceeds 800000 up to 2500000. 4 days ago. Connecticut State Department of Revenue Services.

2 and increasing tax on conveyance to a financial institution of a property with a delinquent mortgage from 050 to 075 in Subdiv. - CT filing payment deadlines for individual income tax returns extended to May 17thRead more. Connecticuts Real Estate Conveyance Tax The real estate conveyance tax has two parts. Effective July 1 2020 there will be three 3 tiers for the rate payable to the State of Connecticut. The amount of the conveyance tax is dependent on the value of the real estate property being conveyed.

Source: freeforms.com

Source: freeforms.com

In Connecticut the real estate conveyance tax is 0075 of every dollar to the State thts 34 of 1 and 0050 of every dollar to the local municipality thats 12 of 1. Grantorseller 1 last name first name middle initial Taxpayer Identification Number Grantorseller address street and number after conveyance Citytown State ZIP code FEIN SSN. 0720 Complete Form OP-236 in blue or black ink only- FEIN SSN 4. - Please check our 2021 CT Tax Filing Season FAQs - Learn more about myconneCT - Walk-in services at all DRS branch office locations remain suspended. 1 increasing tax on residential estate sold for more than 800000 from50 to75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv.

Source: deeds.com

Source: deeds.com

Instructions for the OP-236 are posted separately. 1 increasing tax on residential estate sold for more than 800000 from50 to75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv. Connecticut Real Estate Conveyance Tax Return Rev. Grantorseller 1 last name fi rst name middle initial Taxpayer Identifi cation Number Grantorseller address street and number after conveyance Citytown State ZIP code FEIN SSN 10. See Line 16a and Line 16b instructions.

Source: vermontmountainretreats.com

Source: vermontmountainretreats.com

Connecticut Real Estate Conveyance Tax Return Rev. - CT filing payment deadlines for individual income tax returns extended to May 17thRead more. Connecticuts Real Estate Conveyance Tax The real estate conveyance tax has two parts. See Line 16a and Line 16b instructions. A state tax and a municipal tax.

Source: pinterest.com

Source: pinterest.com

Grantorseller 1 last name fi rst name middle initial Taxpayer Identifi cation Number Grantorseller address street and number after conveyance Citytown State ZIP code FEIN SSN 10. However if you sell your home for 3000000 the new tiered. AN 2017 8 Revision to the Connecticut Real Estate Conveyance Tax Return and IP 2017 9 Real Estate Conveyance Tax Return Information. Recent changes to the OP-236 fillable form are as follows. Connecticut Real Estate Conveyance Tax Return Rev.

Source: pinterest.com

Source: pinterest.com

OP-236 Form Schedules DownloadFill-inSave and print when needed. 1 increasing tax on residential estate sold for more than 800000 from 50 to 75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv. 3 effective July 1 2011 and applicable to conveyances occurring on or. A fillable online version is available here. 0417 Complete Form OP-236 in blue or black ink only- FEIN SSN 4.

Source: in.pinterest.com

Source: in.pinterest.com

The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance. The fonts on the name and address fields and the property location fields are now shrink to fit thereby allowing more characters on the form. You must submit both pages DRS copy of OP-236 and the Town Clerk Copy of a completed tax return to the city or town clerk with a check for the amount on Line 20 payable to Commissioner of Revenue Services. 4 days ago. The combined rate is applied to the propertys sales price.

Source: investopedia.com

Source: investopedia.com

The enhancement will allow for more efficient processing of the thousands of CT Form OP-236 submissions received annually. Grantorseller 1 last name first name middle initial Taxpayer Identification Number Grantorseller address street and number after conveyance Citytown State ZIP code FEIN SSN. 26 people watched 1 In the case of any conveyance of real property which at the time of such conveyance is used for any purpose other than residential use except unimproved land the tax under said subdivision 1 shall be imposed at the rate of one and one-quarter per cent of the consideration for the interest in real property conveyed. Information for Connecticut Real Estate Conveyance Tax Return or more than one granteebuyer complete OP-236 Schedule B - Grantees Supplemental Information for Connecticut Real Estate Conveyance Tax Return and provide all the required information. 3 effective July 1 2011 and applicable to conveyances occurring on or.

Source: pinterest.com

Source: pinterest.com

Grantorseller 1 last name first name middle initial Taxpayer Identification Number Grantorseller address street and number after conveyance Citytown State ZIP code FEIN SSN. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold. Connecticut Real Estate Conveyance Tax Return Rev. - Please check our 2021 CT Tax Filing Season FAQs - Learn more about myconneCT - Walk-in services at all DRS branch office locations remain suspended. Once completed you can print both the OP-236 and the Town Clerk Copy.

Source: pinterest.com

Source: pinterest.com

4 days ago. - CT filing payment deadlines for individual income tax returns extended to May 17thRead more. 1 increasing tax on residential estate sold for more than 800000 from50 to75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv. 0720 Complete Form OP-236 in blue or black ink only- FEIN SSN 4. 26 people watched 1 In the case of any conveyance of real property which at the time of such conveyance is used for any purpose other than residential use except unimproved land the tax under said subdivision 1 shall be imposed at the rate of one and one-quarter per cent of the consideration for the interest in real property conveyed.

Source: freeforms.com

Source: freeforms.com

1 increasing tax on residential estate sold for more than 800000 from50 to75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv. Real Estate Conveyance Tax Return OP-236 This is a Connecticut form that can be used for Real Estate Conveyance within Statewide Department Of Revenue Services. Effective July 1 2020 there will be three 3 tiers for the rate payable to the State of Connecticut. - Please check our 2021 CT Tax Filing Season FAQs - Learn more about myconneCT - Walk-in services at all DRS branch office locations remain suspended. 125 Any portion that exceeds 2500000.

Source: freeforms.com

Source: freeforms.com

Grantorseller 1 last name first name middle initial Taxpayer Identification Number Grantorseller address street and number after conveyance Citytown State ZIP code FEIN SSN. Grantorseller 1 last name first name middle initial Taxpayer Identification Number Grantorseller address street and number after conveyance Citytown State ZIP code FEIN SSN. - Please check our 2021 CT Tax Filing Season FAQs - Learn more about myconneCT - Walk-in services at all DRS branch office locations remain suspended. Real Estate Conveyance Tax Return OP-236 The Connecticut Real Estate Conveyance Tax Return OP-236 also contains the Town Clerks Copy Schedule A and Schedule B. Granteebuyer last name fi rst name middle initial Taxpayer Identifi cation Number.

Source: pinterest.com

Source: pinterest.com

The amount of the conveyance tax is dependent on the value of the real estate property being conveyed. 1 increasing tax on residential estate sold for more than 800000 from 50 to 75 on the portion of sales price up to 800000 and from 1 to 125 on the portion in excess of 800000 in Subdiv. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold. Effective July 1 2020 there will be three 3 tiers for the rate payable to the State of Connecticut. Real Estate Conveyance Tax Return OP-236 The Connecticut Real Estate Conveyance Tax Return OP-236 also contains the Town Clerks Copy Schedule A and Schedule B.

Source: racciolaw.com

Source: racciolaw.com

Once completed you can print both the OP-236 and the Town Clerk Copy. The enhancement will allow for more efficient processing of the thousands of CT Form OP-236 submissions received annually. - CT filing payment deadlines for individual income tax returns extended to May 17thRead more. Real Estate Conveyance Tax Return OP-236 The Connecticut Real Estate Conveyance Tax Return OP-236 also contains the Town Clerks Copy Schedule A and Schedule B. You must submit both pages DRS copy of OP-236 and the Town Clerk Copy of a completed tax return to the city or town clerk with a check for the amount on Line 20 payable to Commissioner of Revenue Services.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title connecticut real estate conveyance tax return by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.