Your Conduit financing commercial real estate images are available in this site. Conduit financing commercial real estate are a topic that is being searched for and liked by netizens now. You can Find and Download the Conduit financing commercial real estate files here. Get all free images.

If you’re looking for conduit financing commercial real estate pictures information related to the conduit financing commercial real estate interest, you have visit the right site. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

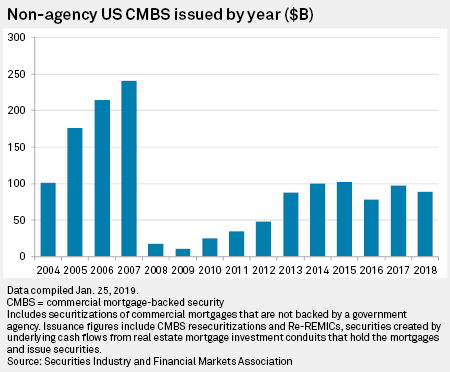

Conduit Financing Commercial Real Estate. Interest rates being low are often the biggest selling point. CMBS stands for commercial mortgage backed securities and is often referred to as a conduit loan. Our extensive experience enables us to ensure that your financing always meets your distinct needs. Conduit financing is available for acquisition or refinance of commercial properties nationwide.

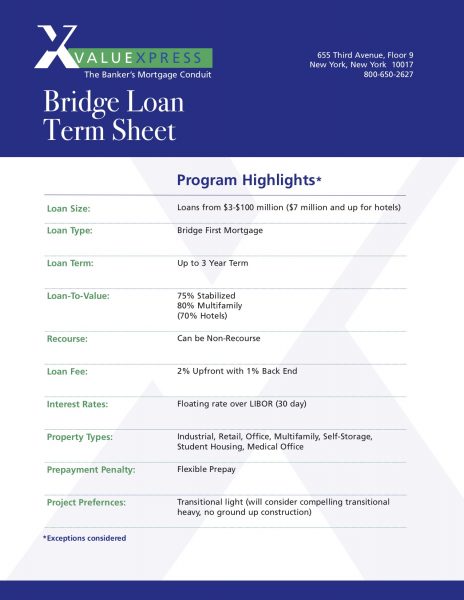

The Conduit Mortgage Team has managed to strengthen through multiple credit cycles and build strong relationships with investment professionals in the structured products market. CMBS conduit loans are fixed-rate senior mortgage loans secured by stabilized income-producing commercial real estate properties. Whether youre investing in real estate or buying owner-occupied properties CounselPro Lending has numerous commercial real estate financing options to facilitate your purchase. Crefcoas CMBS Commercial Mortgage Backed Securities Conduit Loan program provides low permanent fixed rate commercial real estate loans for the acquisition or refinance of stabilized income producing commercial real estate properties located in most market sectors including small and medium markets for commercial mortgages up to 50 million. What is a conduit loan. Conventional and SBA Loans.

Interest rates being low are often the biggest selling point.

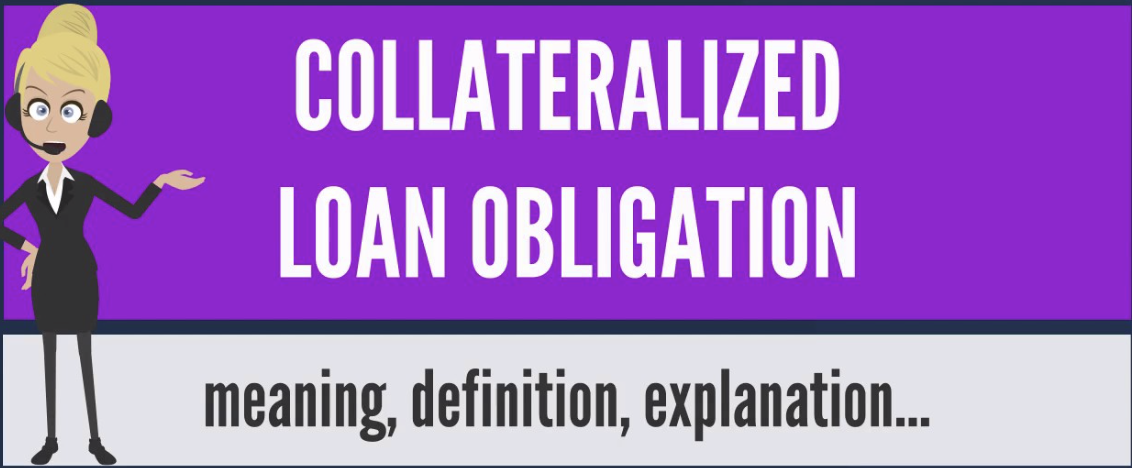

CMBS stands for commercial mortgage backed security as these loans are later pooled with similar loans and packaged into bonds that can be sold to investors on the secondary market. Conduit loans are available for many different types of income producing commercial real estate properties including multifamily properties self storage facilities hotel office buildings i ndustrial buildings warehouse and retail properties. If you were to get a traditional loan the interest alone could cripple you. These loans are packaged and sold by conduit lenders commercial banks investment banks or syndicates of banks. Extensive Network in Global Capital Markets. Conduit Finance have provide a broad range of corporate finance services since 2007.

Source: foresitecre.com

Source: foresitecre.com

Speritas Capital Partners arranges commercial mortgage-backed securities CMBS conduit loans that can be used for acquiring or refinancing commercial real estate properties. Our extensive experience enables us to ensure that your financing always meets your distinct needs. CMBS conduit loans are fixed-rate senior mortgage loans secured by stabilized income-producing commercial real estate properties. CMBS loans also known as conduit loans have emerged as one of the most popular forms of commercial real estate financing in recent years. Conduit loans are commercial mortgages that are pooled together and sold to investors on a secondary market.

CMBS stands for commercial mortgage backed securities and is often referred to as a conduit loan. CMBS stands for commercial mortgage backed security as these loans are later pooled with similar loans and packaged into bonds that can be sold to investors on the secondary market. The main differences relate to prepayment and loan administration as well as the flexibility you have in negotiating loan terms. Conduit loans are secured by a first-position mortgage on a income producing commercial property which in most cases is cash-flowing and stabilized. The term real estate mortgage investment conduit REMIC refers to a special purpose vehicle SPV or debt instrument that pools mortgage loans together and issues mortgage-backed securities.

Source: valuexpress.com

Source: valuexpress.com

The Conduit Mortgage Team has managed to strengthen through multiple credit cycles and build strong relationships with investment professionals in the structured products market. Commercial real estate owners seeking financing have a wide array of lending options in todays market including life insurance companies CMBS conduits banks agencies pension funds and private equity funds. Conduit loans are commercial mortgages that are pooled together and sold to investors on a secondary market. The Conduit Mortgage Team has managed to strengthen through multiple credit cycles and build strong relationships with investment professionals in the structured products market. As borrowers seek the most competitive permanent financing terms life insurance companies and securitized.

Source: commercialloandirect.com

Source: commercialloandirect.com

This type of loan plays an intricate role when it comes to commercial real estate financing. CMBS stands for commercial mortgage backed securities and is often referred to as a conduit loan. Extensive Network in Global Capital Markets. The main differences relate to prepayment and loan administration as well as the flexibility you have in negotiating loan terms. There are many commercial property types that qualify.

Source: syntheticassets.wordpress.com

Source: syntheticassets.wordpress.com

The Conduit Mortgage Team has managed to strengthen through multiple credit cycles and build strong relationships with investment professionals in the structured products market. Speritas Capital Partners arranges commercial mortgage-backed securities CMBS conduit loans that can be used for acquiring or refinancing commercial real estate properties. Conduit Finance have provide a broad range of corporate finance services since 2007. A conduit loan - also known as a CMBS loan Commercial Mortgage Backed Security - is a type of commercial mortgage that is packaged into a pool with other similar type commercial loans and securitized and sold in the secondary market to institutional investors. Borrowers seeking higher leverage and lower fixed-rates tend to prefer a conduit loan compared with.

Source: commercialobserver.com

Source: commercialobserver.com

Conduit loans are commercial mortgages that are pooled together and sold to investors on a secondary market. This type of loan plays an intricate role when it comes to commercial real estate financing. We offer loans worth over 100 million. Conventional and SBA Loans. The main differences relate to prepayment and loan administration as well as the flexibility you have in negotiating loan terms.

Source: pecunica.com

Source: pecunica.com

Conduit financing is available for acquisition or refinance of commercial properties nationwide. Hotel Conduit Mortgages CMBS loans are a type of commercial real estate that is secured by a first-position mortgage on a commercial property. What is a conduit loan. The main differences relate to prepayment and loan administration as well as the flexibility you have in negotiating loan terms. Conduit Finance have provide a broad range of corporate finance services since 2007.

Source: nealfunding.com

Source: nealfunding.com

With transactional and portfolio management experience across debt and mezzanine finance for businesses operating in Property SME and Corporate sectors. CMBS stands for commercial mortgage backed securities and is often referred to as a conduit loan. Conduit loans are commercial mortgages that are pooled together and sold to investors on a secondary market. CMBS stands for commercial mortgage backed security as these loans are later pooled with similar loans and packaged into bonds that can be sold to investors on the secondary market. As borrowers seek the most competitive permanent financing terms life insurance companies and securitized.

Source: pinterest.com

Source: pinterest.com

Conduit loans are commercial mortgages that are pooled together and sold to investors on a secondary market. CMBS stands for commercial mortgage backed security as these loans are later pooled with similar loans and packaged into bonds that can be sold to investors on the secondary market. Learn more about our commercial real estate financing options. Hotel Conduit Mortgages CMBS loans are a type of commercial real estate that is secured by a first-position mortgage on a commercial property. Substantial Experience of Real Estate Financing The key principals at Conduit Real Estate have completed over 150 real estate financing transactions and funded over 15 bn of debt across the capital stack over the last 15 years.

Source: info.c-loans.com

Source: info.c-loans.com

The Conduit Mortgage Team has managed to strengthen through multiple credit cycles and build strong relationships with investment professionals in the structured products market. Conduit loans are available for many different types of income producing commercial real estate properties including multifamily properties self storage facilities hotel office buildings i ndustrial buildings warehouse and retail properties. The minimum amount that most conduit lenders. Interest rates being low are often the biggest selling point. The Conduit Division provides structured commercial finance products to a diverse group of asset classes across a wide.

Source: spglobal.com

Source: spglobal.com

As borrowers seek the most competitive permanent financing terms life insurance companies and securitized. Conduit loans are secured by a first-position mortgage on a income producing commercial property which in most cases is cash-flowing and stabilized. The minimum amount that most conduit lenders. This process is known as securitization. Conduit Finance have provide a broad range of corporate finance services since 2007.

Source: sec.gov

Source: sec.gov

There are many commercial property types that qualify. These loans are packaged and sold by conduit lenders commercial banks investment banks or syndicates of banks. The minimum amount that most conduit lenders. If you were to get a traditional loan the interest alone could cripple you. The term real estate mortgage investment conduit REMIC refers to a special purpose vehicle SPV or debt instrument that pools mortgage loans together and issues mortgage-backed securities.

Source: foresitecre.com

Source: foresitecre.com

Interest rates being low are often the biggest selling point. Conduit loans are available for many different types of income producing commercial real estate properties including multifamily properties self storage facilities hotel office buildings i ndustrial buildings warehouse and retail properties. CMBS conduit loans are fixed-rate senior mortgage loans secured by stabilized income-producing commercial real estate properties. That is why one of the biggest advantages of a conduit loan is the lower interest rates. We offer loans worth over 100 million.

Source: cpexecutive.com

Source: cpexecutive.com

When you are investing in commercial real estate you are usually working with larger price tags and more money than you would with a residential real estate purchase. When you are investing in commercial real estate you are usually working with larger price tags and more money than you would with a residential real estate purchase. The main differences relate to prepayment and loan administration as well as the flexibility you have in negotiating loan terms. The Conduit Division provides structured commercial finance products to a diverse group of asset classes across a wide. This type of loan plays an intricate role when it comes to commercial real estate financing.

Conduit Finance have provide a broad range of corporate finance services since 2007. Conventional and SBA Loans. Because these loans are securitized they behave a little differently than a traditional commercial real estate loan. The minimum amount that most conduit lenders. Extensive Network in Global Capital Markets.

Source: manhattancommercialcapital.com

Source: manhattancommercialcapital.com

A conduit loan - also known as a CMBS loan Commercial Mortgage Backed Security - is a type of commercial mortgage that is packaged into a pool with other similar type commercial loans and securitized and sold in the secondary market to institutional investors. The term real estate mortgage investment conduit REMIC refers to a special purpose vehicle SPV or debt instrument that pools mortgage loans together and issues mortgage-backed securities. As borrowers seek the most competitive permanent financing terms life insurance companies and securitized. Conduit Finance have provide a broad range of corporate finance services since 2007. Borrowers seeking higher leverage and lower fixed-rates tend to prefer a conduit loan compared with.

That is why one of the biggest advantages of a conduit loan is the lower interest rates. Hotel Conduit Mortgages CMBS loans are a type of commercial real estate that is secured by a first-position mortgage on a commercial property. The term real estate mortgage investment conduit REMIC refers to a special purpose vehicle SPV or debt instrument that pools mortgage loans together and issues mortgage-backed securities. CMBS stands for commercial mortgage backed security as these loans are later pooled with similar loans and packaged into bonds that can be sold to investors on the secondary market. Because these loans are securitized they behave a little differently than a traditional commercial real estate loan.

Source: pinterest.com

Source: pinterest.com

CMBS loans have become a very popular source of capital for commercial real estate investors looking for non-recourse financing. Commercial real estate owners seeking financing have a wide array of lending options in todays market including life insurance companies CMBS conduits banks agencies pension funds and private equity funds. This financing technique gives commercial real estate investors access to efficient capital markets funding sources. CMBS stands for commercial mortgage backed security as these loans are later pooled with similar loans and packaged into bonds that can be sold to investors on the secondary market. Conduit loans have been around since the late 1990s and are somewhat unfamiliar to most commercial real estate investors.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title conduit financing commercial real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.