Your Commercial real estate vs multifamily images are ready. Commercial real estate vs multifamily are a topic that is being searched for and liked by netizens now. You can Find and Download the Commercial real estate vs multifamily files here. Download all free vectors.

If you’re searching for commercial real estate vs multifamily images information linked to the commercial real estate vs multifamily interest, you have come to the right blog. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Commercial Real Estate Vs Multifamily. When multi family real estate is in. However in recent years as the US has increasingly urbanized and multifamily properties have become more institutional in nature with costly design and vast amenities and now increasingly owned by some of the nations largest institutional investors multifamily. Purchasing a residential rental property is another common and popular method of investing in real estate. Properties with 5 units typically qualify for a different type of financing which is usually more expensive than properties that are considered strictly residential.

Single Family Versus Multifamily Real Estate Investing Infographic Real Estate Finance Investing Infographic Real Estate Investing Real Estate Infographic From pinterest.com

Single Family Versus Multifamily Real Estate Investing Infographic Real Estate Finance Investing Infographic Real Estate Investing Real Estate Infographic From pinterest.com

If you believe real estate is a great investment you could probably see benefits from both multifamily and single-family investments. In the past multifamily properties were regarded less as commercial real estate assets and more closely associated with other residential assets such as single-family homes. In multi-family real estate buildings with two to four units are considered residential properties. Multi-family real estate is a specific commercial real estate product type. Other Things to Consider Before Investing in Multi Family Homes. Condos duplexes and quadruplexes make up residential real estate while office retail industrial multifamily of five units or more hotel and special purpose buildings are considered commercial real estate.

Know which type of multi family investment properties for sale you want to start looking for.

All real estate properties Multi-Family included are classified into three asset. Every time someone moves out of one of your single-property homes as an investor you lose money. Keeping an open mind and understanding that they both have. Apr 24 2020 Commercial multifamily investing is one of many strategies to invest in real estate. Purchasing a residential rental property is another common and popular method of investing in real estate. But as a multifamily and commercial real estate investor your loan is secured through the larger pool of tenants.

Source: br.pinterest.com

Source: br.pinterest.com

5 Reasons Houses are better than Multifamily Units – Residential vs Commercial Real Estate - YouTube. Beyond this initial definition specifics vary by location and the size of the structure. The Stock Market Average annual returns in long-term real estate investing vary by the area of concentration in the sector. When multi family real estate is in. Although their purpose is to house tenants apartment buildings are considered commercial real estate investments.

Source: pinterest.com

Source: pinterest.com

Commercial real estate loans and multifamily financing have a lot of similarities but they are two distinctly different types of funding. However in recent years as the US has increasingly urbanized and multifamily properties have become more institutional in nature with costly design and vast amenities and now increasingly owned by some of the nations largest institutional investors multifamily. In multi-family real estate buildings with two to four units are considered residential properties. Multi-family real estate is a specific commercial real estate product type. COMMENT your investing tips below on houses vs units –.

Source: pinterest.com

Source: pinterest.com

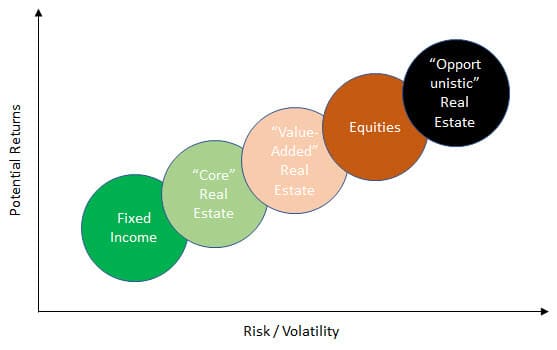

Investing at least 20 of your portfolio in alternatives like commercial real estate is known as the 20 rule. This report is one in a multi-part series covering multi-family real estate a sub-sector of the commercial real estate investment banking market. 5 Reasons Houses are better than Multifamily Units – Residential vs Commercial Real Estate - YouTube. Earn better returns and grow long-term wealth through commercial multifamily real estate investing. In contrast commercial property is anything with five or more units.

Source: in.pinterest.com

Source: in.pinterest.com

However there is a marked distinction between what is considered a residential and what is considered a commercial real estate CRE investment. The simplest form of multi-family housing is a two-unit eg a. In the past multifamily properties were regarded less as commercial real estate assets and more closely associated with other residential assets such as single-family homes. Other Things to Consider Before Investing in Multi Family Homes. Multi-family properties consist of.

Source: pinterest.com

Source: pinterest.com

Multi-Family Commercial Real Estate property is one that is comprised of five or more units. Larger multifamily properties those with five or more units start to fall into the commercial real estate category. If you believe real estate is a great investment you could probably see benefits from both multifamily and single-family investments. Multi-family real estate is a specific commercial real estate product type. Investing at least 20 of your portfolio in alternatives like commercial real estate is known as the 20 rule.

Source: br.pinterest.com

Source: br.pinterest.com

Other Things to Consider Before Investing in Multi Family Homes. COMMENT your investing tips below on houses vs units –. When multi family real estate is in. The Stock Market - Master Multifamily Real Estate Returns vs. Apr 24 2020 Commercial multifamily investing is one of many strategies to invest in real estate.

Source: pinterest.com

Source: pinterest.com

Although their purpose is to house tenants apartment buildings are considered commercial real estate investments. All real estate properties Multi-Family included are classified into three asset. Multi-family real estate can take many forms. Other Things to Consider Before Investing in Multi Family Homes. For a commercial real estate loan lenders will want to see your real estate investing track record and review any experience you have with rental property management.

Source: pinterest.com

Source: pinterest.com

COMMENT your investing tips below on houses vs units –. The Stock Market Average annual returns in long-term real estate investing vary by the area of concentration in the sector. Multi-family real estate is a specific commercial real estate product type. But as a multifamily and commercial real estate investor your loan is secured through the larger pool of tenants. Home About Us Submit Request Asset Types Contact Us commercial-real-estate-news-florida Multi-family SUBMIT REQUESTS AT BOTTOM OF PAGE CENTRAL FLORIDA Beach Front HUGE VALUE ADD 8 CAP 32 MIL 36 UNITS BELOW MARKET RENTS 400-500 per unit ACROSS THE STREET FROM THE BEACH 99.

Source: ar.pinterest.com

Source: ar.pinterest.com

Commercial real estate can be broken down into four main categories also called asset classes or property types. They may even require a higher down payment of 25 compared to 20 for a residential real estate loan. When multi family real estate is in. All real estate properties Multi-Family included are classified into three asset. 5 Reasons Houses are better than Multifamily Units – Residential vs Commercial Real Estate - YouTube.

Source: pinterest.com

Source: pinterest.com

Purchasing a residential rental property is another common and popular method of investing in real estate. Multifamily office retail and industrial assets but also smaller categories such as hospitality land or mixed use with specific characteristics. Multi-family real estate is a specific commercial real estate product type. Real Estate vs Traditional Investments Since 2000 direct real estate investments have outperformed traditional investments. Purchasing a residential rental property is another common and popular method of investing in real estate.

Source: pinterest.com

Source: pinterest.com

The term multi-family is generally used to differentiate this type of housing from single family homes condominiums townhouses and other housing types that are generally owned by one person for use by one household. When multi family real estate is in. Earn better returns and grow long-term wealth through commercial multifamily real estate investing. Average 20-year returns in commercial real estate slightly outperform the SP 500 Index running at around 95. When you consider it you come to the realization its a win-win when you have numerous units that help you lower your loss concerns as an investor when your loan note comes due.

Source: pinterest.com

Source: pinterest.com

OFF MARKET COMMERCIAL REAL ESTATE. Properties with 5 units typically qualify for a different type of financing which is usually more expensive than properties that are considered strictly residential. Rental Property VS Commercial Multifamily Updated. Other Things to Consider Before Investing in Multi Family Homes. Earn better returns and grow long-term wealth through commercial multifamily real estate investing.

Source: pinterest.com

Source: pinterest.com

Earn better returns and grow long-term wealth through commercial multifamily real estate investing. In multi-family real estate buildings with two to four units are considered residential properties. COMMENT your investing tips below on houses vs units –. When you consider it you come to the realization its a win-win when you have numerous units that help you lower your loss concerns as an investor when your loan note comes due. Commercial real estate loans and multifamily financing have a lot of similarities but they are two distinctly different types of funding.

Source: id.pinterest.com

Source: id.pinterest.com

Commercial real estate can be broken down into four main categories also called asset classes or property types. Earn better returns and grow long-term wealth through commercial multifamily real estate investing. Rental Property VS Commercial Multifamily Updated. Then youre ready to use our Property Finder Tool to find the best one right now. OFF MARKET COMMERCIAL REAL ESTATE.

Source: pinterest.com

Source: pinterest.com

And that distinction dramatically changes the way purchases are financed. The Stock Market - Master Multifamily Real Estate Returns vs. For a commercial real estate loan lenders will want to see your real estate investing track record and review any experience you have with rental property management. But as a multifamily and commercial real estate investor your loan is secured through the larger pool of tenants. Multi-family real estate is a specific commercial real estate product type.

Source: pinterest.com

Source: pinterest.com

If you believe real estate is a great investment you could probably see benefits from both multifamily and single-family investments. Multi-family properties consist of. If you are buying multi family real. Each one having pros and cons for both investors and tenants. Multi-Family Commercial Real Estate property is one that is comprised of five or more units.

Source: pinterest.com

Source: pinterest.com

Multi-Family Commercial Real Estate property is one that is comprised of five or more units. Other Things to Consider Before Investing in Multi Family Homes. Multi-family real estate can take many forms. They may even require a higher down payment of 25 compared to 20 for a residential real estate loan. However there is a marked distinction between what is considered a residential and what is considered a commercial real estate CRE investment.

Source: pinterest.com

Source: pinterest.com

Properties with 5 units typically qualify for a different type of financing which is usually more expensive than properties that are considered strictly residential. Commercial real estate can be broken down into four main categories also called asset classes or property types. Condos duplexes and quadruplexes make up residential real estate while office retail industrial multifamily of five units or more hotel and special purpose buildings are considered commercial real estate. Multifamily office retail and industrial assets but also smaller categories such as hospitality land or mixed use with specific characteristics. The Stock Market - Master Multifamily Real Estate Returns vs.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial real estate vs multifamily by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.