Your Commercial real estate underwriting guidelines images are available in this site. Commercial real estate underwriting guidelines are a topic that is being searched for and liked by netizens today. You can Download the Commercial real estate underwriting guidelines files here. Find and Download all royalty-free photos.

If you’re looking for commercial real estate underwriting guidelines images information connected with to the commercial real estate underwriting guidelines topic, you have visit the ideal site. Our site always gives you suggestions for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

Commercial Real Estate Underwriting Guidelines. They typically asked the borrower to provide a simple financial statement with a credit check and that was the extent of the credit items required. Underwriting evaluates your honesty and creditworthiness as a borrower. Common hazards include deficiencies in electrical components heating systems and housekeeping. Knowing the hazards lets you adequately price the risk based on current conditions.

Mortgage Due Diligence Real Estate Investment Trust Mortgage Mortgage Companies From pinterest.com

Mortgage Due Diligence Real Estate Investment Trust Mortgage Mortgage Companies From pinterest.com

Investors will underwrite or model the prospective investment in order to forecast the return that can be expected if the investment is pursued. Their duties are to write reports that evaluate the risk or potential loss on proposals and suggest contingencies to account for unforeseen circumstances. Thats because underwriting reveals the truth about you as a loan applicant and about the property youre seeking to invest in. Investigate sponsor credit history and financials. Does his house payment exceed 25 of his gross income. Seven Ratios of Commercial Loan Underwriting.

The process of underwriting is crucial for the lender of a commercial real estate loan.

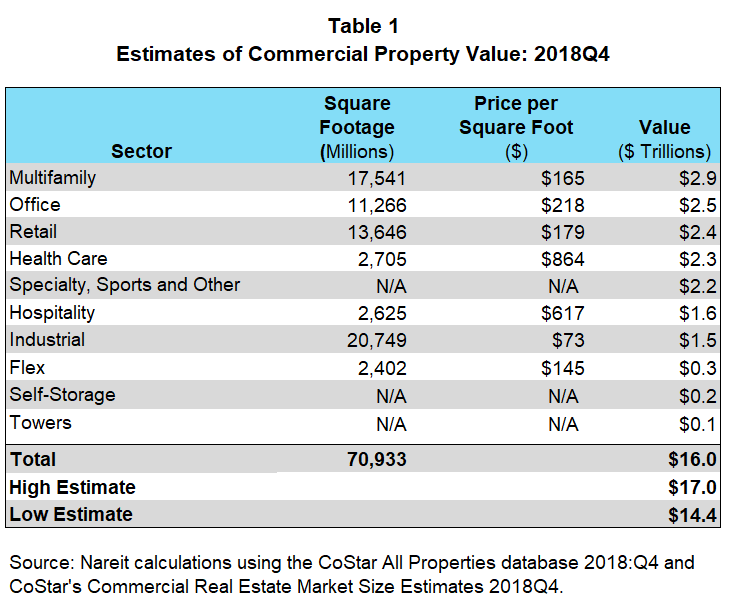

Underwriting is the process of establishing both the risk and potential return of all types of investments whether it be a real estate investor purchasing a building a bank issuing a loan or an investment banker evaluating a stock. QUANTITATIVE ANALYSIS GUIDELINES The underwriting guidelines that a financial institution applies to its real estate loan decisions are an important part of quantitative analysis. Generally commercial lenders will require a minimum of 20 of the purchase price to be paid by the buyer when applying for a commercial loan. Possible lender adjustments to NOI include increasing the vacancy and credit loss. Underwriting evaluates your honesty and creditworthiness as a borrower. A key component of commercial real estate underwriting is to evaluate tenant payments in terms of both the amounts tenants are paying and when.

Source: investmentbank.com

Source: investmentbank.com

The Basics of Underwriting for Real Estate. Understand the difference between due diligence and underwriting as it relates to each loan request. Does his house payment exceed 25 of his gross income. When underwriting is used in real estate it is generally used as a tool for evaluating the value of a building based on the buildings projected cash flows. For national banks underwriting refers to the terms and conditions under which they extend or renew credit such as financial and collateral requirements repayment programs maturities pricing and covenants.

Source: pinterest.com

Source: pinterest.com

Income-producing real estate includes real estate held for lease to third parties and nonresidential real estate that is occupied by its owner or a related party. Recommend credit enhancements earn-outs holdbacks reserves and appropriate release parameters. The first step in commercial real estate loan underwriting is determining the appropriate net operating income. Unlike residential lending commercial real estate properties are viewed more conservatively. The remaining 80 can be in the form of a commercial mortgage provided by either a bank or commercial mortgage company.

Source: reit.com

Source: reit.com

While a commercial loan a commercial real estate loan is not the same as a C I loan. The process of underwriting is crucial for the lender of a commercial real estate loan. If youre underwriting a commercial property everyone benefits when you give your insured recommendations for reducing hazards and improving protection deficiencies at the property. The Basics of Underwriting for Real Estate. By McGraw-Hill with The McGraw-Hill Real Estate Pocket Guidefollowing in 1979.

Source: gowercrowd.com

Source: gowercrowd.com

Unlike residential lending commercial real estate properties are viewed more conservatively. Many underwriters will audit leases to determine how much income the property will generate for how long and how consistently. Understand the difference between due diligence and underwriting as it relates to each loan request. He also has written 40 professional articles and over 20 cases on real estate management which became the focus of his latest book Cases in Commercial Real Estate Investingpublished in July 2005. A commercial real estate underwriter examines loan requests that involve commercial buildings and projects.

Source: aquilacommercial.com

Source: aquilacommercial.com

Investigate sponsor credit history and financials. Generally commercial lenders will require a minimum of 20 of the purchase price to be paid by the buyer when applying for a commercial loan. Recommend credit enhancements earn-outs holdbacks reserves and appropriate release parameters. Income-producing real estate includes real estate held for lease to third parties and nonresidential real estate that is occupied by its owner or a related party. Seven Ratios of Commercial Loan Underwriting.

Source: gresb.com

Source: gresb.com

Possible lender adjustments to NOI include increasing the vacancy and credit loss. FCT strengthens Underwriting Guidelines to address Growing Incidents of Commercial Real Estate Fraud OAKVILLE ONTARIO February 28 2013 FCT First Canadian Title Canadas leading provider of title insurance continues to revise its guidelines to track the growing incidents of commercial real estate. Investors will underwrite or model the prospective investment in order to forecast the return that can be expected if the investment is pursued. The remaining 80 can be in the form of a commercial mortgage provided by either a bank or commercial mortgage company. Generally commercial lenders will require a minimum of 20 of the purchase price to be paid by the buyer when applying for a commercial loan.

Source: pinterest.com

Source: pinterest.com

Critically review third party reports. There is of course a wide range of borrower financial measures that would be important to consider including historical and projected financial performance. The Basics of Underwriting for Real Estate. Their duties are to write reports that evaluate the risk or potential loss on proposals and suggest contingencies to account for unforeseen circumstances. For national banks underwriting refers to the terms and conditions under which they extend or renew credit such as financial and collateral requirements repayment programs maturities pricing and covenants.

Source: pinterest.com

Source: pinterest.com

Income-producing real estate includes real estate held for lease to third parties and nonresidential real estate that is occupied by its owner or a related party. Not all properties and borrowers fit into the same box. Underwriting and diligence are different. Does his house payment exceed 25 of his gross income. Commercial Real Estate Lending.

Source: rolandberger.com

Source: rolandberger.com

Commercial real estate CRE lending includes acquisition development and construction ADC financing and the financing of income-producing real estate. The borrower will typically submit a rent roll and a proforma but the lender will almost always construct their own proforma for loan underwriting purposes which may result in a different NOI calculation. Do not rely on the Appraiser to carry out your property due diligence. When you add in his car payments credit card payments and student loan payments is the borrower spending. Borrower underwriting guidelines have changed dramatically in recent years.

Source: pinterest.com

Source: pinterest.com

The borrower will typically submit a rent roll and a proforma but the lender will almost always construct their own proforma for loan underwriting purposes which may result in a different NOI calculation. The process of underwriting is crucial for the lender of a commercial real estate loan. Understand the difference between due diligence and underwriting as it relates to each loan request. The borrower will typically submit a rent roll and a proforma but the lender will almost always construct their own proforma for loan underwriting purposes which may result in a different NOI calculation. Lease reviews rollover and TILC analysis.

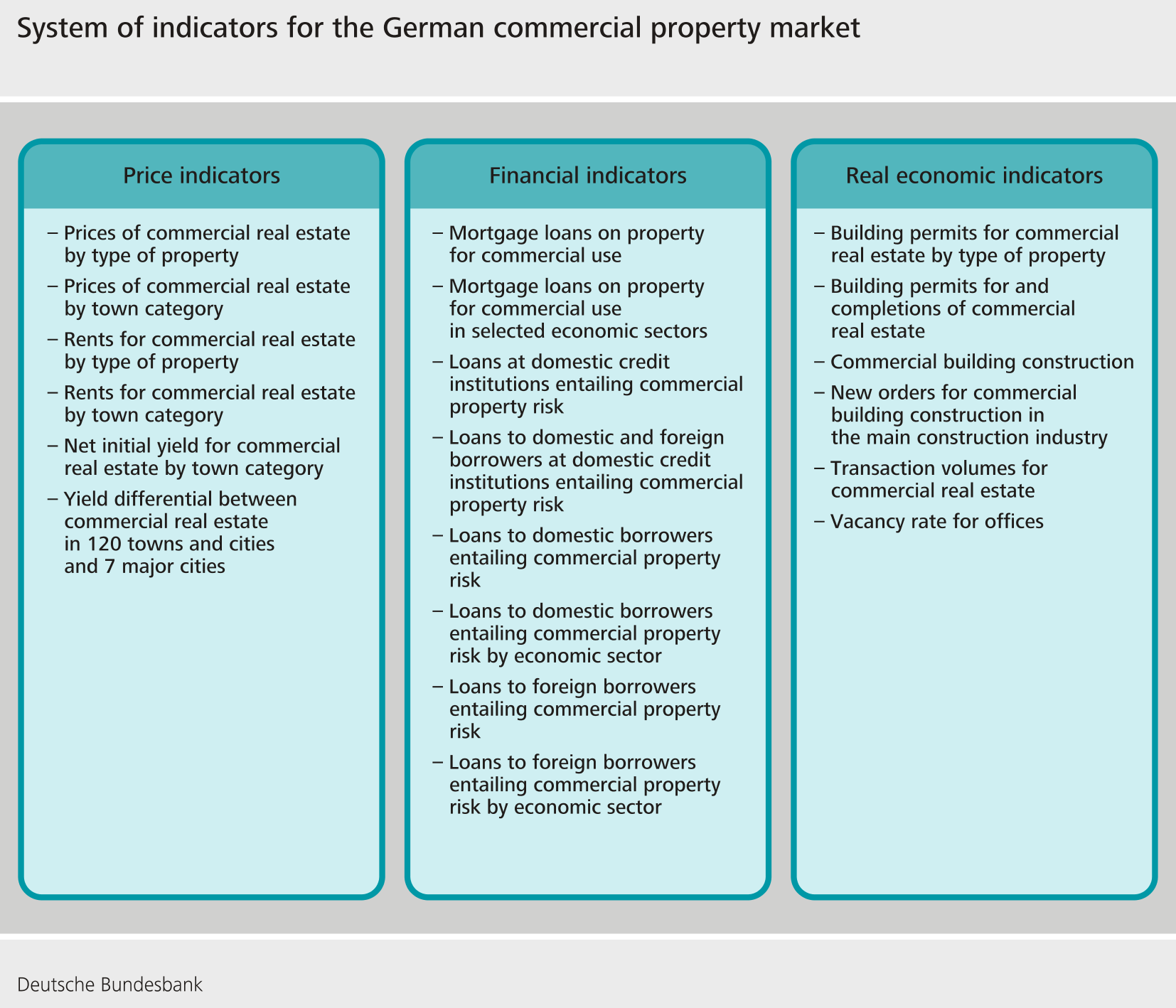

Source: bundesbank.de

Source: bundesbank.de

By McGraw-Hill with The McGraw-Hill Real Estate Pocket Guidefollowing in 1979. Their duties are to write reports that evaluate the risk or potential loss on proposals and suggest contingencies to account for unforeseen circumstances. Critically examine historical cash flows and rent roll to identify issues and prepare proforma underwriting. He has been awarded The Louise L. Underwriting Commercial Real Estate Acquisitions.

Source: pinterest.com

Source: pinterest.com

QUANTITATIVE ANALYSIS GUIDELINES The underwriting guidelines that a financial institution applies to its real estate loan decisions are an important part of quantitative analysis. Investors will underwrite or model the prospective investment in order to forecast the return that can be expected if the investment is pursued. Seven Ratios of Commercial Loan Underwriting. Investigate sponsor credit history and financials. By McGraw-Hill with The McGraw-Hill Real Estate Pocket Guidefollowing in 1979.

Source: tr.pinterest.com

Source: tr.pinterest.com

A commercial real estate underwriter examines loan requests that involve commercial buildings and projects. Knowing the hazards lets you adequately price the risk based on current conditions. Their duties are to write reports that evaluate the risk or potential loss on proposals and suggest contingencies to account for unforeseen circumstances. FCT strengthens Underwriting Guidelines to address Growing Incidents of Commercial Real Estate Fraud OAKVILLE ONTARIO February 28 2013 FCT First Canadian Title Canadas leading provider of title insurance continues to revise its guidelines to track the growing incidents of commercial real estate. Does his house payment exceed 25 of his gross income.

Source: pinterest.com

Source: pinterest.com

Thats because underwriting reveals the truth about you as a loan applicant and about the property youre seeking to invest in. They typically asked the borrower to provide a simple financial statement with a credit check and that was the extent of the credit items required. When underwriting is used in real estate it is generally used as a tool for evaluating the value of a building based on the buildings projected cash flows. Understand the difference between due diligence and underwriting as it relates to each loan request. Income-producing real estate includes real estate held for lease to third parties and nonresidential real estate that is occupied by its owner or a related party.

Source: pinterest.com

Source: pinterest.com

Many underwriters will audit leases to determine how much income the property will generate for how long and how consistently. A key component of commercial real estate underwriting is to evaluate tenant payments in terms of both the amounts tenants are paying and when. FCT strengthens Underwriting Guidelines to address Growing Incidents of Commercial Real Estate Fraud OAKVILLE ONTARIO February 28 2013 FCT First Canadian Title Canadas leading provider of title insurance continues to revise its guidelines to track the growing incidents of commercial real estate. By McGraw-Hill with The McGraw-Hill Real Estate Pocket Guidefollowing in 1979. Underwriting and diligence are different.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

A commercial real estate underwriter examines loan requests that involve commercial buildings and projects. Responsibilities include determining a borrowers creditworthiness by using data such as their job and credit history and recommending any changes to the loan coverage. Knowing the hazards lets you adequately price the risk based on current conditions. When underwriting is used in real estate it is generally used as a tool for evaluating the value of a building based on the buildings projected cash flows. Thats because underwriting reveals the truth about you as a loan applicant and about the property youre seeking to invest in.

Source: in.pinterest.com

Source: in.pinterest.com

Generally commercial lenders will require a minimum of 20 of the purchase price to be paid by the buyer when applying for a commercial loan. Knowing the hazards lets you adequately price the risk based on current conditions. Commercial Real Estate Lending. Investors will underwrite or model the prospective investment in order to forecast the return that can be expected if the investment is pursued. QUANTITATIVE ANALYSIS GUIDELINES The underwriting guidelines that a financial institution applies to its real estate loan decisions are an important part of quantitative analysis.

Source: adventuresincre.com

Source: adventuresincre.com

QUANTITATIVE ANALYSIS GUIDELINES The underwriting guidelines that a financial institution applies to its real estate loan decisions are an important part of quantitative analysis. Possible lender adjustments to NOI include increasing the vacancy and credit loss. Does his house payment exceed 25 of his gross income. A commercial real estate underwriter examines loan requests that involve commercial buildings and projects. Common hazards include deficiencies in electrical components heating systems and housekeeping.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate underwriting guidelines by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.