Your Commercial real estate mortgage rates california images are ready in this website. Commercial real estate mortgage rates california are a topic that is being searched for and liked by netizens now. You can Download the Commercial real estate mortgage rates california files here. Find and Download all free photos and vectors.

If you’re looking for commercial real estate mortgage rates california pictures information related to the commercial real estate mortgage rates california topic, you have pay a visit to the right blog. Our site always gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

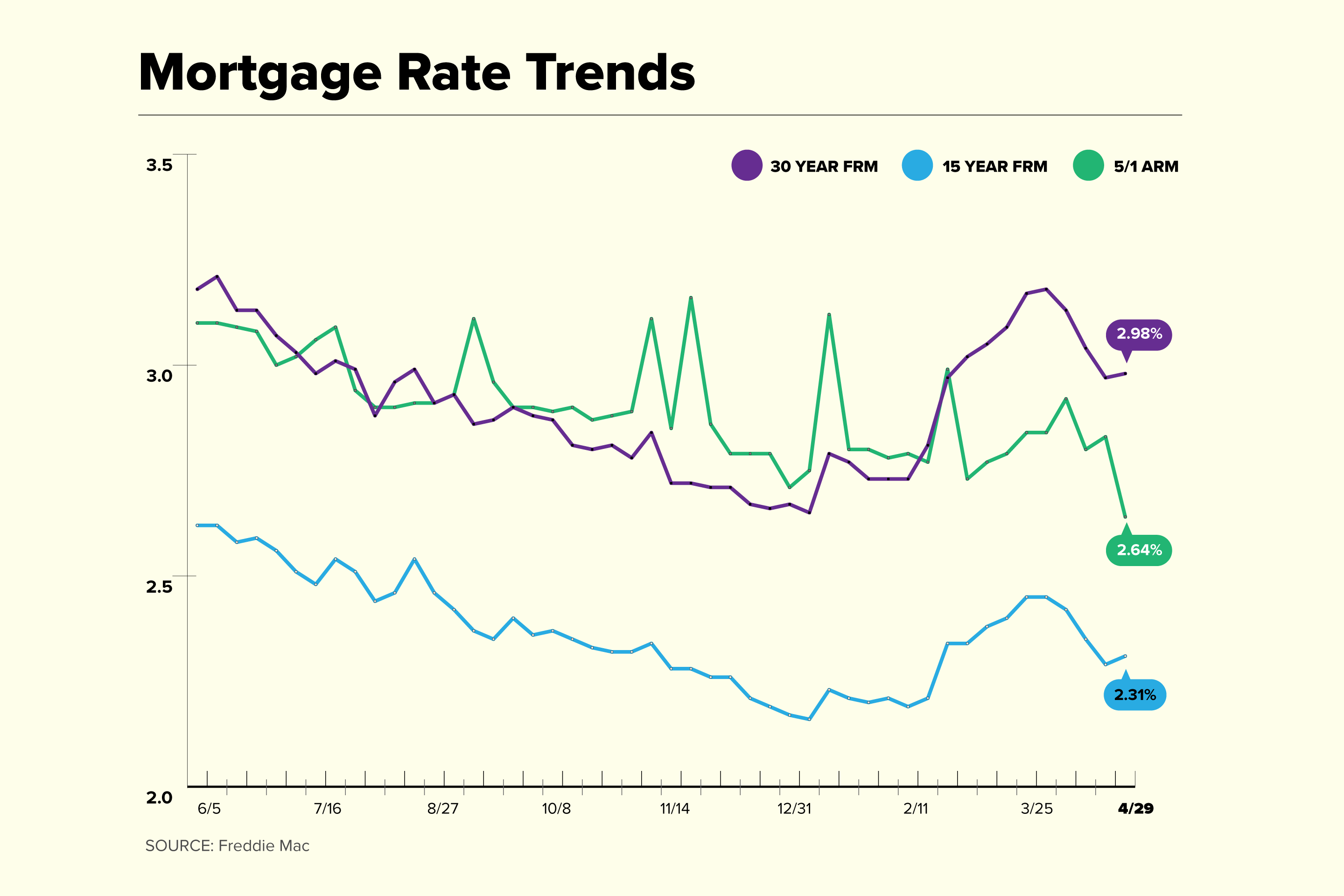

Commercial Real Estate Mortgage Rates California. Depending on your creditworthiness and type of loan real estate loan rates and commercial mortgage rates range anywhere from less than 3 to about 15. However borrowers can typically expect commercial mortgage rates with banks between 3 and 625 though they can certainly exceed this range. Below you will find the lending areas and the property types CLD provides in California. When you are ready to start the process apply online here or contact one of our Mortgage Advisors at 800 927-6560.

Commercial Loan Repayment Calculator Commercial Loans Commercial Commercial Real Estate From ro.pinterest.com

Commercial Loan Repayment Calculator Commercial Loans Commercial Commercial Real Estate From ro.pinterest.com

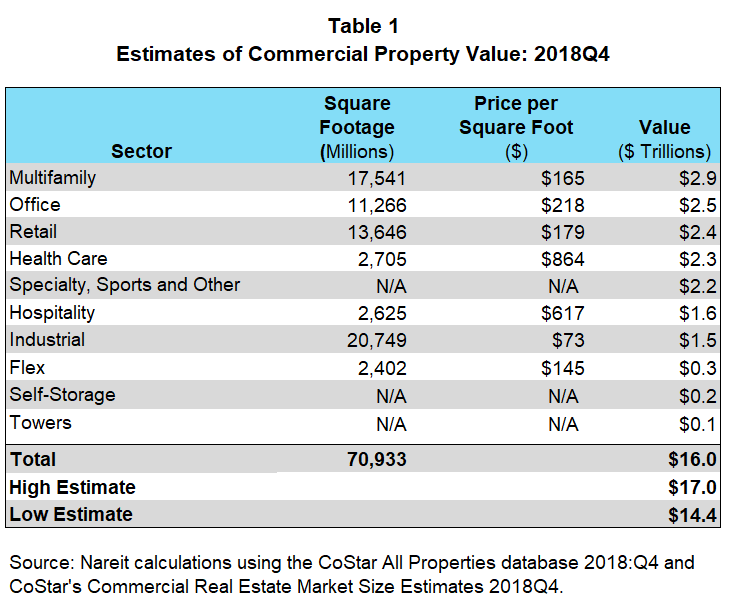

Today commercial real estate loan rates are low compared to previous eras. Crefcoa provides commercial mortgages for traditional property types located in California through its Cal Series Commercial Loan program. Indeed all sectors of commercial real estate are doing quite well seeing record rents and sales prices. Find best commercial mortgage brokers and lenders in Laguna Niguel California to finance your next real estate project. However borrowers can typically expect commercial mortgage rates with banks between 3 and 625 though they can certainly exceed this range. A high foreclosure rate yields a lower real estate value for any particular location.

Crefcoa provides commercial mortgages for traditional property types located in California through its Cal Series Commercial Loan program.

CLD originates loans for its parent company CLD Financial. However borrowers can typically expect commercial mortgage rates with banks between 3 and 625 though they can certainly exceed this range. Find best commercial mortgage brokers and lenders in Palos Verdes Estates California to finance your next real estate project. The actual interest rate you secure depends on the type of loan you choose your qualifications as a borrower and the type of building or project youre financing. California commercial loans that meet your individual needs and investment objectives. Available for commercial mortgage refinancing or acquisition.

Source: commercialloandirect.com

Source: commercialloandirect.com

The average interest rate on a commercial real estate loan is about 22 to 18. Indeed all sectors of commercial real estate are doing quite well seeing record rents and sales prices. The actual interest rate you secure depends on the type of loan you choose your qualifications as a borrower and the type of building or project youre financing. Quickly apply online and receive up to 5 mortgage loan offers from Laguna Niguel top commercial real estate mortgage firms in Orange County. The rate of foreclosures is an important economic factor when it comes to real estate.

Source: pinterest.com

Source: pinterest.com

Below you will find the lending areas and the property types CLD provides in California. Reali is a brokerage that offers California sellers a discounted listing fee of 2500 5000 or 10000 see the full breakdown here. Find best commercial mortgage brokers and lenders in Palos Verdes Estates California to finance your next real estate project. SBA loan rates range from 2231 to 1125 depending on the program and length of loan. Naturally lower LTV generally demands lower commercial mortgage rates.

Source:

Source:

Naturally lower LTV generally demands lower commercial mortgage rates. Below you will find the lending areas and the property types CLD provides in California. Commercial mortgage rates start as low as 301 as of April 18th 2021 No upfront application or processing fees. Quickly apply online and receive up to 5 mortgage loan offers from Palos Verdes Estates top commercial real estate mortgage firms in Los Angeles County. This highly competitive program provides low fixed rates ability to lock rate at application and fixed rate terms up to 15 years.

Source: in.pinterest.com

Source: in.pinterest.com

Our Mortgage Advisors can assist customers in selecting the best commercial loan to fit the customer and the property. Below you will find the lending areas and the property types CLD provides in California. Our multifamily platform includes FHA Conduit Conventional Insurance USDA Bridge SBA and Construction loans. The average interest rate on a commercial real estate loan is about 22 to 18. The rate of foreclosures is an important economic factor when it comes to real estate.

Source: ar.pinterest.com

Source: ar.pinterest.com

A business with an NOI of 500000 per year and a prospective loan amount of 7000000 will have a debt yield ratio of 00714 or 714 meaning even if the property is foreclosed out the gate the lender will receive a 714 return. For every 10000 houses in Los Angeles 10 houses go through foreclosure. CLD originates loans for its parent company CLD Financial. Quickly apply online and receive up to 5 mortgage loan offers from Laguna Niguel top commercial real estate mortgage firms in Orange County. Up to 80 LTV on multifamily 75 on commercial 90 with SBA Terms and amortizations up to 30 years.

Source: pl.pinterest.com

Source: pl.pinterest.com

CLD is currently targeting owner occupied and investment properties over 1 Million. The index rates are dynamic and rely on several factors. CLD is currently targeting owner occupied and investment properties over 1 Million. California commercial loans that meet your individual needs and investment objectives. Commercial mortgage rates vary based on a variety of factors including those listed above.

Source: reit.com

Source: reit.com

The index rates are dynamic and rely on several factors. Low rates 75-90 LTV 30-yr am and 0 prepay commercial mortgages for California properties. The index rates are dynamic and rely on several factors. A business with an NOI of 500000 per year and a prospective loan amount of 7000000 will have a debt yield ratio of 00714 or 714 meaning even if the property is foreclosed out the gate the lender will receive a 714 return. California Commercial Real Estate Loan Program.

![]() Source: commercialloandirect.com

Source: commercialloandirect.com

The rate of foreclosures is an important economic factor when it comes to real estate. When you are ready to start the process apply online here or contact one of our Mortgage Advisors at 800 927-6560. California Commercial Loan Lenders. Commercial mortgage rates vary based on a variety of factors including those listed above. Our multifamily platform includes FHA Conduit Conventional Insurance USDA Bridge SBA and Construction loans.

Source: pl.pinterest.com

Source: pl.pinterest.com

Commercial mortgage rates vary based on a variety of factors including those listed above. Low rates 75-90 LTV 30-yr am and 0 prepay commercial mortgages for California properties. The rate of foreclosures is an important economic factor when it comes to real estate. California Commercial Loan Lenders. A business with an NOI of 500000 per year and a prospective loan amount of 7000000 will have a debt yield ratio of 00714 or 714 meaning even if the property is foreclosed out the gate the lender will receive a 714 return.

Source: ro.pinterest.com

Source: ro.pinterest.com

California commercial loans that meet your individual needs and investment objectives. Crefcoa provides commercial mortgages for traditional property types located in California through its Cal Series Commercial Loan program. Further an underlying assumption of all rates as provided is application to a commercial mortgage at 75 LTV. 16 is the foreclosure rate of the United States. Available for commercial mortgage refinancing or acquisition.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

A business with an NOI of 500000 per year and a prospective loan amount of 7000000 will have a debt yield ratio of 00714 or 714 meaning even if the property is foreclosed out the gate the lender will receive a 714 return. For every 10000 houses in Los Angeles 10 houses go through foreclosure. Retail and office vacancies are below 10 and new construction commercial permits are up. Commercial Loan Direct CLD offers a variety of commercial loan products in California. A business with an NOI of 500000 per year and a prospective loan amount of 7000000 will have a debt yield ratio of 00714 or 714 meaning even if the property is foreclosed out the gate the lender will receive a 714 return.

Source: pinterest.com

Source: pinterest.com

California Mortgage Advisors Inc. CLD originates loans for its parent company CLD Financial. Reali is a brokerage that offers California sellers a discounted listing fee of 2500 5000 or 10000 see the full breakdown here. A high foreclosure rate yields a lower real estate value for any particular location. Up to 80 LTV on multifamily 75 on commercial 90 with SBA Terms and amortizations up to 30 years.

Source: pinterest.com

Source: pinterest.com

Further an underlying assumption of all rates as provided is application to a commercial mortgage at 75 LTV. A high foreclosure rate yields a lower real estate value for any particular location. 5 Zeilen California commercial mortgage rates start as low as 311 as of 042421 No upfront. Crefcoa provides commercial mortgages for traditional property types located in California through its Cal Series Commercial Loan program. SBA loan rates range from 2231 to 1125 depending on the program and length of loan.

Source: in.pinterest.com

Source: in.pinterest.com

Depending on your creditworthiness and type of loan real estate loan rates and commercial mortgage rates range anywhere from less than 3 to about 15. 5 Zeilen California commercial mortgage rates start as low as 311 as of 042421 No upfront. The average interest rate on a commercial real estate loan is about 22 to 18. The rate of foreclosures is an important economic factor when it comes to real estate. Our multifamily platform includes FHA Conduit Conventional Insurance USDA Bridge SBA and Construction loans.

Source: es.pinterest.com

Source: es.pinterest.com

Retail and office vacancies are below 10 and new construction commercial permits are up. Indeed all sectors of commercial real estate are doing quite well seeing record rents and sales prices. Our Mortgage Advisors can assist customers in selecting the best commercial loan to fit the customer and the property. The actual interest rate you secure depends on the type of loan you choose your qualifications as a borrower and the type of building or project youre financing. When you are ready to start the process apply online here or contact one of our Mortgage Advisors at 800 927-6560.

Source: pinterest.com

Source: pinterest.com

The average interest rate on a commercial real estate loan is about 22 to 18. California Commercial Real Estate Loan Program. California commercial loans that meet your individual needs and investment objectives. The index rates are dynamic and rely on several factors. A business with an NOI of 500000 per year and a prospective loan amount of 7000000 will have a debt yield ratio of 00714 or 714 meaning even if the property is foreclosed out the gate the lender will receive a 714 return.

Source: ar.pinterest.com

Source: ar.pinterest.com

Naturally lower LTV generally demands lower commercial mortgage rates. California Commercial Real Estate Loan Program. Quickly apply online and receive up to 5 mortgage loan offers from Palos Verdes Estates top commercial real estate mortgage firms in Los Angeles County. Up to 80 LTV on multifamily 75 on commercial 90 with SBA Terms and amortizations up to 30 years. Available for commercial mortgage refinancing or acquisition.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

A business with an NOI of 500000 per year and a prospective loan amount of 7000000 will have a debt yield ratio of 00714 or 714 meaning even if the property is foreclosed out the gate the lender will receive a 714 return. The rate of foreclosures is an important economic factor when it comes to real estate. You need a professional broker to guide for commercial real estate loans. Find best commercial mortgage brokers and lenders in Palos Verdes Estates California to finance your next real estate project. California Mortgage Advisors Inc.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate mortgage rates california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.