Your Commercial real estate market trends 2013 images are available in this site. Commercial real estate market trends 2013 are a topic that is being searched for and liked by netizens today. You can Find and Download the Commercial real estate market trends 2013 files here. Get all royalty-free vectors.

If you’re looking for commercial real estate market trends 2013 images information linked to the commercial real estate market trends 2013 topic, you have come to the right blog. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

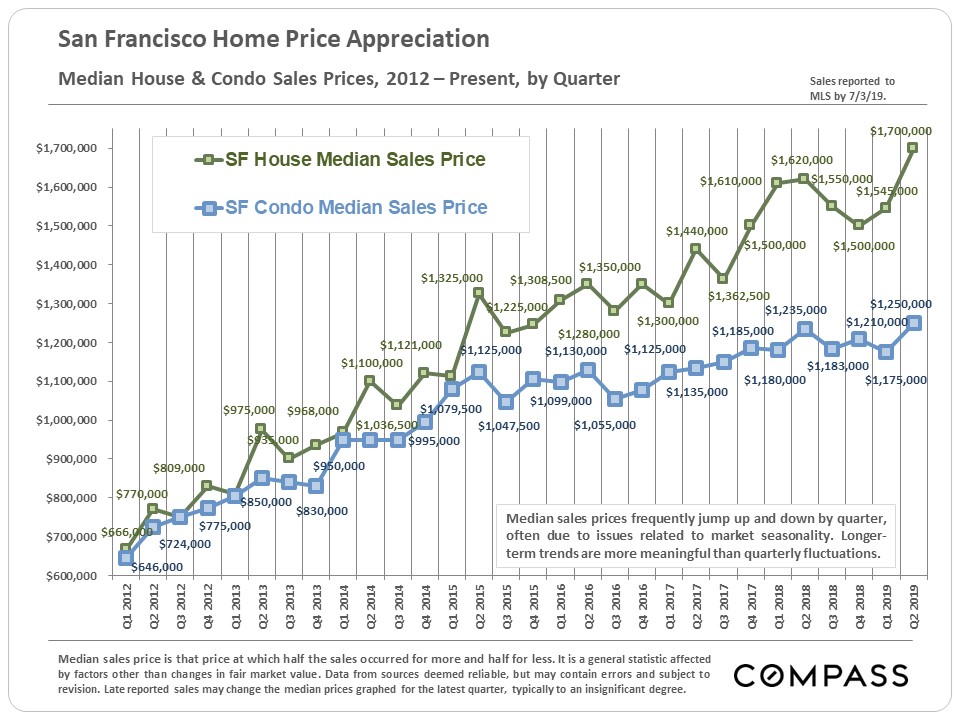

Commercial Real Estate Market Trends 2013. A significant portion or 478 of the industrys Schedule A real estate. Forty-seven percent expect a rental decline and 49 anticipate an. The sweet spot will remain properties and office buildings that weigh in. These include market data economic demographic and lifestyle and property data.

2013 Nar Commercial Member Profile Infographic Realtor Org Real Estate Infographic Commercial Real Estate Broker Real Estate Trends From pinterest.com

2013 Nar Commercial Member Profile Infographic Realtor Org Real Estate Infographic Commercial Real Estate Broker Real Estate Trends From pinterest.com

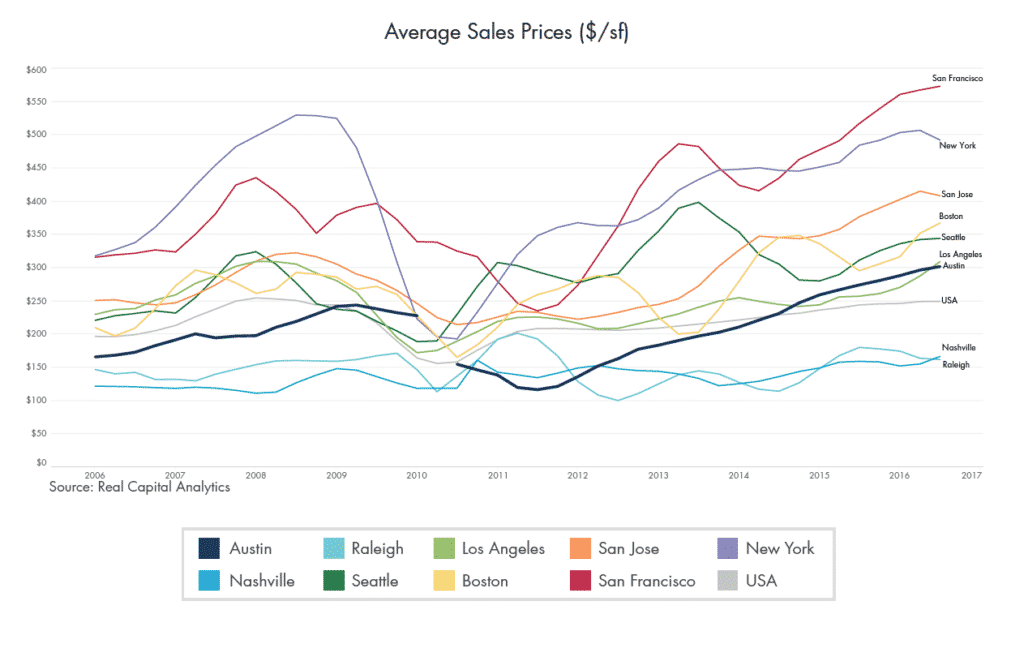

Forty-seven percent expect a rental decline and 49 anticipate an. The gains in activity and prices will be a welcome relief but will leave many homeowners still. Germany is the most populated country in Europe making it one of the largest players on the real estate market. Examples of large companies like Apple Inc buyingleasing commercial space in emerging economies is a sign of the. The supply of products priced below Rs 3000 per sq ft is reducing markedly. For starters the prices of real estate property continue to skyrocket which is being driven by a variety of factors.

Both types of data are needed to make informed observations and decisions about market trends and forecasts.

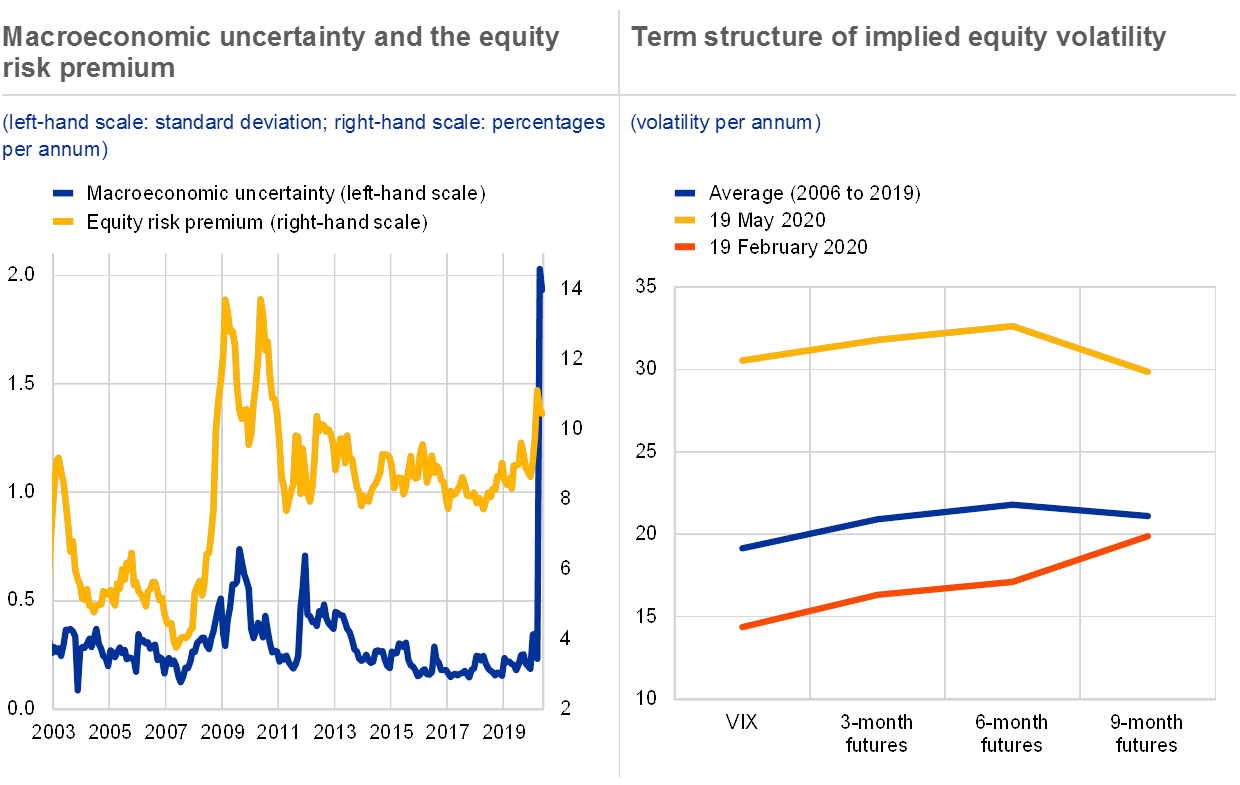

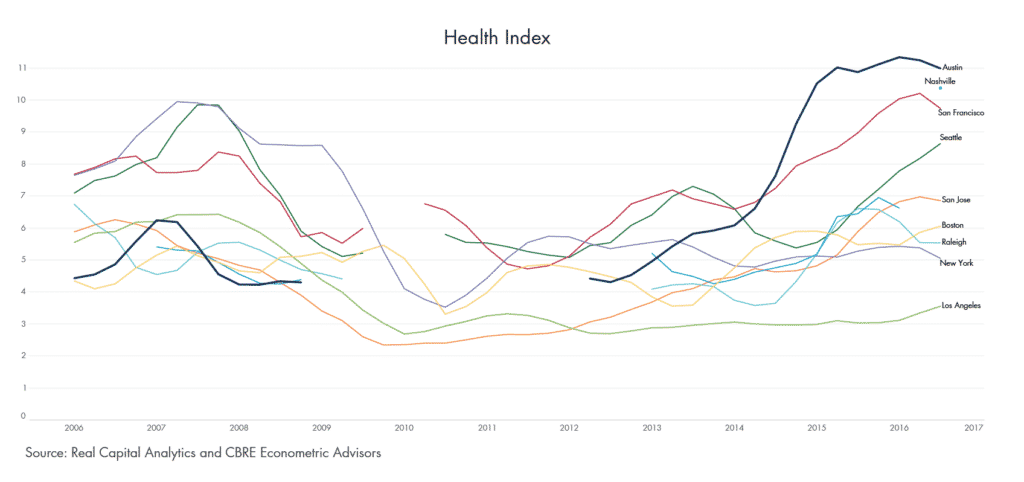

Commercial real estate activity is one of the key tangible barometers to track the health of the economy of a regioncountry. The constantly changing landscape with its cyclical swings commercial real estate activity is a leading indicator for expected expansionary activities of business entities. Employment is an important economic indicator because it provides insight into the nature of the demand for space. Other factors include the ongoing economic downturn and the. US Census Bureau data shows from 2012 to 2017 e-commerce sales grew 144 percent annually up from 11 percent during 20072012. Emerging Trends in Real Estate Europe 2013 3 Optimism has returned to Europes real estate industry.

Source: ecb.europa.eu

Source: ecb.europa.eu

Different types of employment generate demand for different types of real estate. Equity for investment in prime commercial real estate. Germany is the most populated country in Europe making it one of the largest players on the real estate market. 6 Industrial space mirrored this trend as demand growth rose from 07. Examples of large companies like Apple Inc buyingleasing commercial space in emerging economies is a sign of the.

Source: tranio.com

Source: tranio.com

Rental rates were higher in 65of CCIM member responses. Commercial real estate continues to improve at a moderate pace much in line with our previous forecast update from six months ago. Continuing uncertainty about the pandemic froze transaction deal volume in 2020 and put significant pressure on property types like hotel and retail said Victor Calanog Head of CRE Economics for Moodys Analytics REIS. A significant portion or 478 of the industrys Schedule A real estate. The housing market will improve moderately in 2013 but nobody will mistake this for a boom.

Source: urban.jrc.ec.europa.eu

Source: urban.jrc.ec.europa.eu

The virus is likely to affect commercial real estate CRE throughout 2021 and beyond. In predicting 2013 market trends he says size will continue to matter when it comes to selling commercial real estate. From the various areas of commercial real estate to the housing market the COVID-19 pandemic has accelerated change and shifted the outlook across asset classes. Other factors include the ongoing economic downturn and the. It also includes a survey of CCIM.

Source: pinterest.com

Source: pinterest.com

The supply of products priced below Rs 3000 per sq ft is reducing markedly. Some asset classes are seeing more negative impacts. Om Ahuja the CEO of Residential Services of JLL says that the supply trends in real estate indicate that it is in a state of flux. 6 Industrial space mirrored this trend as demand growth rose from 07. In contrast North American respondents expectations are balanced.

Source: propertyology.com.au

Source: propertyology.com.au

It also includes a survey of CCIM. Commercial real estate From the impacts of remote working to potential increased space requirements to accommodate physical distancing the office category is undergoing a shift. The virus is likely to affect commercial real estate CRE throughout 2021 and beyond. Other factors include the ongoing economic downturn and the. This first quarter 2013 edition features commentary from Lawrence Yun PhD NAR chief economist and George Ratiu manager of NARs quantitative and commercial research.

Source: ecb.europa.eu

Source: ecb.europa.eu

The sweet spot will remain properties and office buildings that weigh in. This too has been heavily affected by the COVID-19 pandemic. It also includes a survey of CCIM. Market data provides information on population characteristics from. From the various areas of commercial real estate to the housing market the COVID-19 pandemic has accelerated change and shifted the outlook across asset classes.

Source: ar.pinterest.com

Source: ar.pinterest.com

Different types of employment generate demand for different types of real estate. Examples of large companies like Apple Inc buyingleasing commercial space in emerging economies is a sign of the. Equity for investment in prime commercial real estate. National asking rents for indus-trial spaces rose 06 percent while effective rents gained 07 percent. Different types of employment generate demand for different types of real estate.

Source: aquilacommercial.com

Source: aquilacommercial.com

The gains in activity and prices will be a welcome relief but will leave many homeowners still. The gains in activity and prices will be a welcome relief but will leave many homeowners still. Examples of large companies like Apple Inc buyingleasing commercial space in emerging economies is a sign of the. Other factors include the ongoing economic downturn and the. The National Association of Realtors in association with and for members of the CCIM Institute commercial real estates the global standard for professional achievement.

Source: propertyology.com.au

Source: propertyology.com.au

In predicting 2013 market trends he says size will continue to matter when it comes to selling commercial real estate. Some asset classes are seeing more negative impacts. Examples of large companies like Apple Inc buyingleasing commercial space in emerging economies is a sign of the. Employment is an important economic indicator because it provides insight into the nature of the demand for space. Interestingly only 37 of the APAC respondents expect a decline in rents but 74 anticipate a significant increase in vacancy levels.

Source: bayareamarketreports.com

Source: bayareamarketreports.com

This first quarter 2013 edition features commentary from Lawrence Yun PhD NAR chief economist and George Ratiu manager of NARs quantitative and commercial research. The virus is likely to affect commercial real estate CRE throughout 2021 and beyond. 6 Industrial space mirrored this trend as demand growth rose from 07. Om Ahuja the CEO of Residential Services of JLL says that the supply trends in real estate indicate that it is in a state of flux. Sentiment among industry leaders about the prospects for their businesses is more positive than at any time since 2008 despite the uncertain macroeconomic outlook.

Source: de.pinterest.com

Source: de.pinterest.com

Insurance industrys CRE exposure consisted of 415 billion in directly owned properties and 396 billion in mortgage loans for total exposure of 4374 billion as of YE2015 see Table 2. Commercial real estate activity is one of the key tangible barometers to track the health of the economy of a regioncountry. The constantly changing landscape with its cyclical swings commercial real estate activity is a leading indicator for expected expansionary activities of business entities. The gains in activity and prices will be a welcome relief but will leave many homeowners still. The virus is likely to affect commercial real estate CRE throughout 2021 and beyond.

Source: pinterest.com

Source: pinterest.com

Market data provides information on population characteristics from. This first quarter 2013 edition features commentary from Lawrence Yun PhD NAR chief economist and George Ratiu manager of NARs quantitative and commercial research. The National Association of Realtors in association with and for members of the CCIM Institute commercial real estates the global standard for professional achievement. Germany is the most populated country in Europe making it one of the largest players on the real estate market. Overview of Commercial Real Estate-Market Areas-Market Trends and Influences-Economic Characteristics May 16 2013.

Source: aquilacommercial.com

Source: aquilacommercial.com

From 43 in the fourth quarter of 2009 supply in this segment will come down to 8 in the same period of 2013. Interestingly only 37 of the APAC respondents expect a decline in rents but 74 anticipate a significant increase in vacancy levels. At the same time supply in the price range of Rs 5000-10 000 per sq ft is expanding. Overview of Commercial Real Estate-Market Areas-Market Trends and Influences-Economic Characteristics May 16 2013. Some asset classes are seeing more negative impacts.

Source: urban.jrc.ec.europa.eu

Source: urban.jrc.ec.europa.eu

This too has been heavily affected by the COVID-19 pandemic. From 43 in the fourth quarter of 2009 supply in this segment will come down to 8 in the same period of 2013. Employment is an important economic indicator because it provides insight into the nature of the demand for space. Some asset classes are seeing more negative impacts. 26 of CCIM member respondents expect rents to lag behind price growth in the upcoming two to three years.

Source: forbes.com

Source: forbes.com

The sweet spot will remain properties and office buildings that weigh in. The gains in activity and prices will be a welcome relief but will leave many homeowners still. The latest real estate trends are best described as a mixture of both positive and negative developments. Forty-seven percent expect a rental decline and 49 anticipate an. This first quarter 2013 edition features commentary from Lawrence Yun PhD NAR chief economist and George Ratiu manager of NARs quantitative and commercial research.

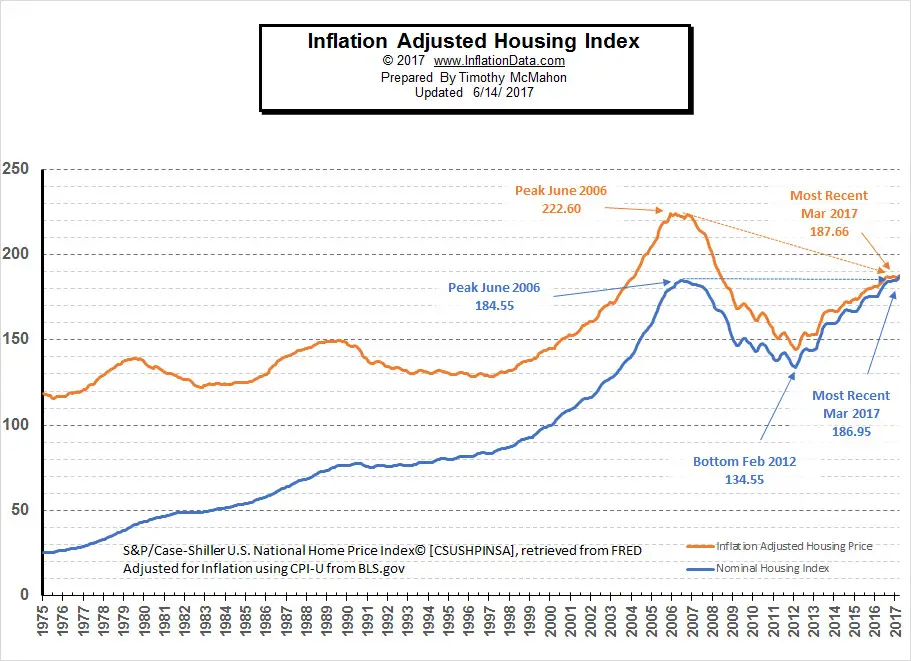

Source: inflationdata.com

Source: inflationdata.com

QUARTERLY MARKET TRENDS u NATIONAL ASSOCIATION OF REALTORS AND CCIM INSTITUTE 5 Q M Trends Q 14 Commercial Real Estate Market UPDATE improved absorption figures 30 posted gains in occupancy and all 47 had higher effective rents. 5 Furthermore e-commerce deliveries tripled between 2013 and 2018 prompting companies to seek more urban infill warehouse locations so they can provide faster deliveries to consumers. The latest real estate trends are best described as a mixture of both positive and negative developments. 26 of CCIM member respondents expect rents to lag behind price growth in the upcoming two to three years. Market data provides information on population characteristics from.

Source: housesinspain.com

Source: housesinspain.com

The supply of products priced below Rs 3000 per sq ft is reducing markedly. At the same time supply in the price range of Rs 5000-10 000 per sq ft is expanding. Insurance industrys CRE exposure consisted of 415 billion in directly owned properties and 396 billion in mortgage loans for total exposure of 4374 billion as of YE2015 see Table 2. A commercial real estate professional typically will use two primary types of data to complete a market analysis. From 43 in the fourth quarter of 2009 supply in this segment will come down to 8 in the same period of 2013.

Source: urban.jrc.ec.europa.eu

Source: urban.jrc.ec.europa.eu

The gains in activity and prices will be a welcome relief but will leave many homeowners still. At the same time supply in the price range of Rs 5000-10 000 per sq ft is expanding. For starters the prices of real estate property continue to skyrocket which is being driven by a variety of factors. Some asset classes are seeing more negative impacts. It also includes a survey of CCIM.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate market trends 2013 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.