Your Commercial real estate loan rates 2016 images are ready in this website. Commercial real estate loan rates 2016 are a topic that is being searched for and liked by netizens today. You can Get the Commercial real estate loan rates 2016 files here. Find and Download all free images.

If you’re looking for commercial real estate loan rates 2016 images information connected with to the commercial real estate loan rates 2016 topic, you have come to the ideal site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

Commercial Real Estate Loan Rates 2016. Capitalization rate Cap Rate The value of a CRE property is determined based on the yield or discount rate otherwise known as cap rate. The commercial mortgage rates of commercial real estate lenders are fairly predictable. If you want to use an SBA loan to buy commercial real estate there are two loan programs to look into. The average interest rate on a commercial real estate loan is about 22 to 18.

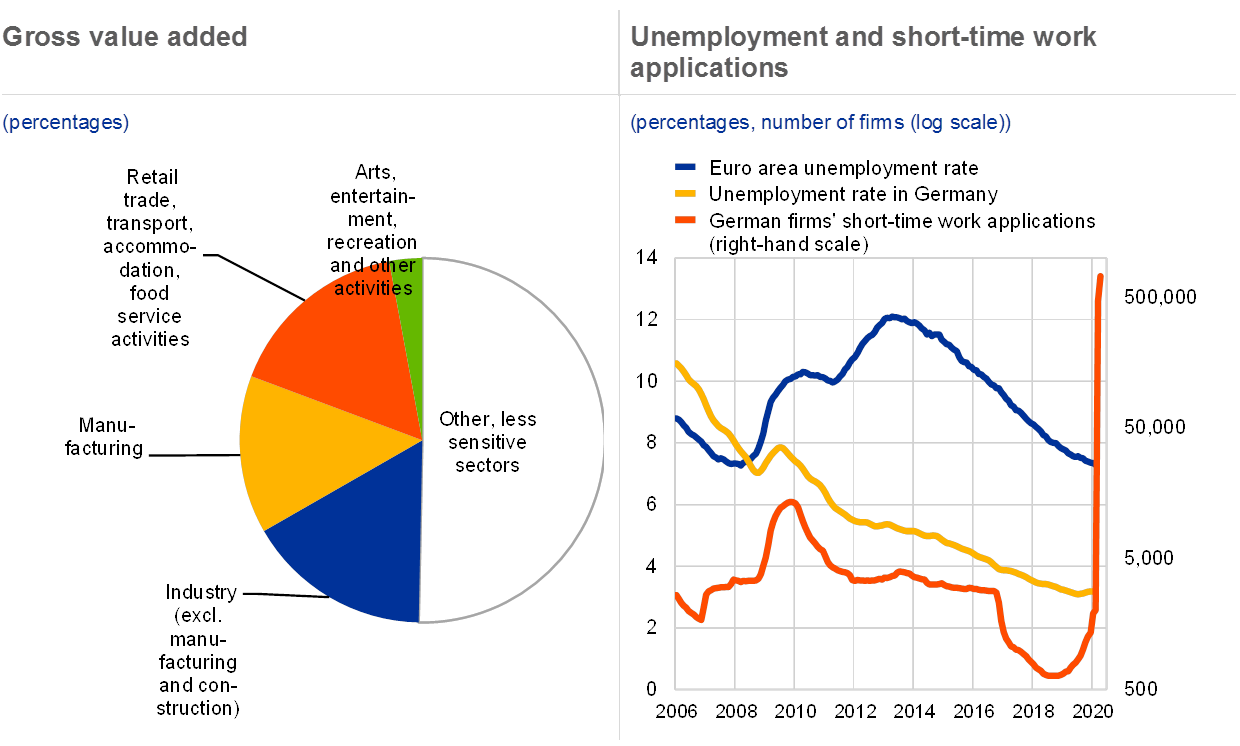

Financial Stability Review May 2020 From ecb.europa.eu

Financial Stability Review May 2020 From ecb.europa.eu

The benefits of purchasing commercial investment property includes lower commercial real estate loan rates Of course interest rates are going to depend on the type of building and property that you are investing in but interest rates have been seen as low as 25 percent. Commercial Real Estate Financing Rates Facing A Technical Default. Commercial loan rates are typically higher than residential mortgage rates and this site explains why. Commercial Mortgage Rates As Low As 312. Capitalization rate Cap Rate The value of a CRE property is determined based on the yield or discount rate otherwise known as cap rate. It will also teach you how to accurately predict commercial mortgage rates - not just today but also in the future.

Types Of Commercial Loans.

Typical size of the loan. We provide financing in all 50 states. The average interest rate on a commercial real estate loan is about 22 to 18. If you want to use an SBA loan to buy commercial real estate there are two loan programs to look into. Commercial Real Estate Loans All Commercial Banks Percent Change at Annual Rate Quarterly Seasonally Adjusted Q4 2004 to Q1 2021 6 days ago Finance Rate on Personal Loans at Commercial Banks 24 Month Loan. Commercial Mortgage Rates As Low As 312.

Source: bankerstrust.com

Source: bankerstrust.com

The actual interest rate you secure depends on the type of loan you choose your qualifications as a borrower and the type of building or project youre financing. Commercial mortgage borrowers on smaller deals deals of less than around 2 million will probably have to pay a commercial mortgage rate that is around 050 higher. Types Of Commercial Loans. Multifamily Office Retail Industrial HospitalsHealthcare Self-Storage Hotel Mixed Use and Churches. It will also teach you how to accurately predict commercial mortgage rates - not just today but also in the future.

Source: ecb.europa.eu

Source: ecb.europa.eu

Commercial Mortgage Rates Terms The following commercial mortgage rates and terms were extracted from the most recent edition of. We provide loans for the following properties but not limited to. Capitalization rate Cap Rate The value of a CRE property is determined based on the yield or discount rate otherwise known as cap rate. 35 to 6 fixed rate on SBA part fixed or floating on the banking sector 500000 in most cases. And now is the prime time to take out a commercial real estate loaninterest rates are at historic lows currently averaging between 4 and 6.

Source: pinterest.com

Source: pinterest.com

316 to 391 Fixed Computed based on five-year Treasuries plus 275 to 35. Nearly all of the commercial mortgage experts agreed that long-term interest rates are likely to remain advantageous to borrowers in 2015. 525 to 875 variable 100000 85-0. Commercial mortgage borrowers on smaller deals deals of less than around 2 million will probably have to pay a commercial mortgage rate that is around 050 higher. We provide financing in all 50 states.

Source: pinterest.com

Source: pinterest.com

Please note we are only licenced to work with properties that are zoned commercial. Lenders may require collateral. Commercial Real Estate Loans All Commercial Banks Percent Change at Annual Rate Quarterly Seasonally Adjusted Q4 2004 to Q1 2021 6 days ago Finance Rate on Personal Loans at Commercial Banks 24 Month Loan. The average interest rate on a commercial real estate loan is about 22 to 18. Current Commercial Real Estate Mortgage Rates and Terms.

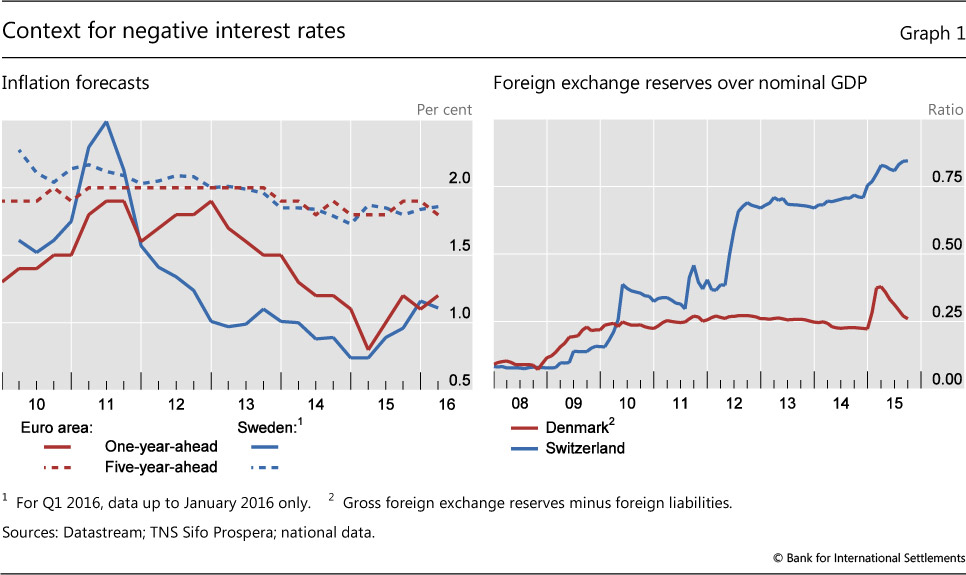

Source: bis.org

Source: bis.org

Rates will stay low for at least the next year despite a rising probability that the Federal Open Market Committee raises the federal funds rate in 2015 Mr. If you want to use an SBA loan to buy commercial real estate there are two loan programs to look into. Commercial property values in the United States are down by more than one third from their peak and the delinquency rate on commercial real estate loans has risen to more than 8 double the rate at end-2008 and more than four times the rate at end-2006. Please note we are only licenced to work with properties that are zoned commercial. Each of the following strengths will argue for a lower interest.

Source: statista.com

Source: statista.com

Nearly all of the commercial mortgage experts agreed that long-term interest rates are likely to remain advantageous to borrowers in 2015. Type of loan Average prices. To find a commercial loan suitable for your needs use our loan finder tool. Commercial Mortgage Rates As Low As 312. 312-620-6447 Lets Talk About How We Can Help You Revolving Lines of Credit.

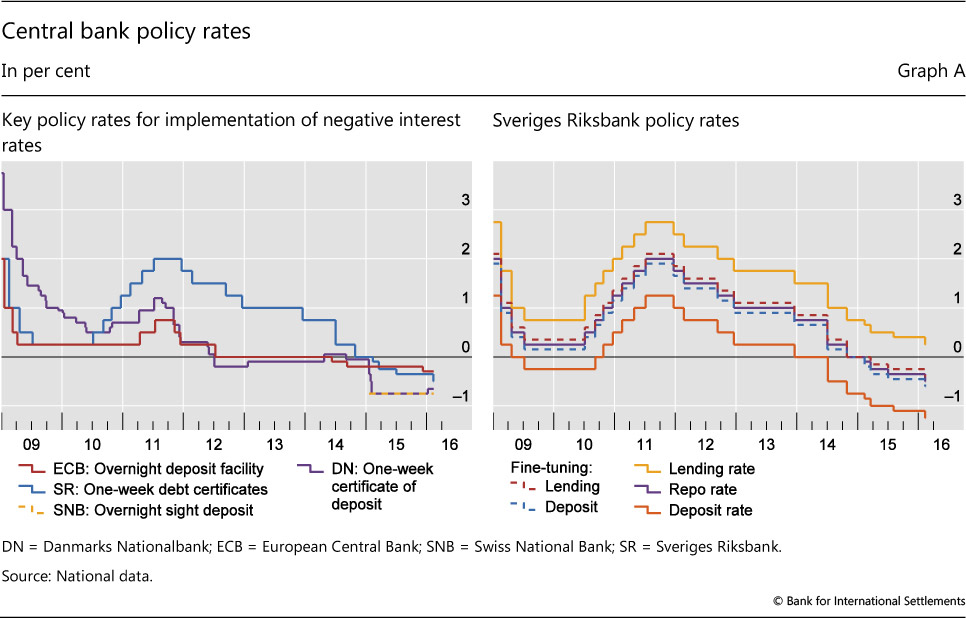

Source: bis.org

Source: bis.org

Lenders may require collateral. If you want to use an SBA loan to buy commercial real estate there are two loan programs to look into. Average transaction-based cap rates for all property types fell to 63 at YE2016 from 64 in YE2015 and 74 in YE2010 per RCA data. SBA 504 Loan. Lenders may require collateral.

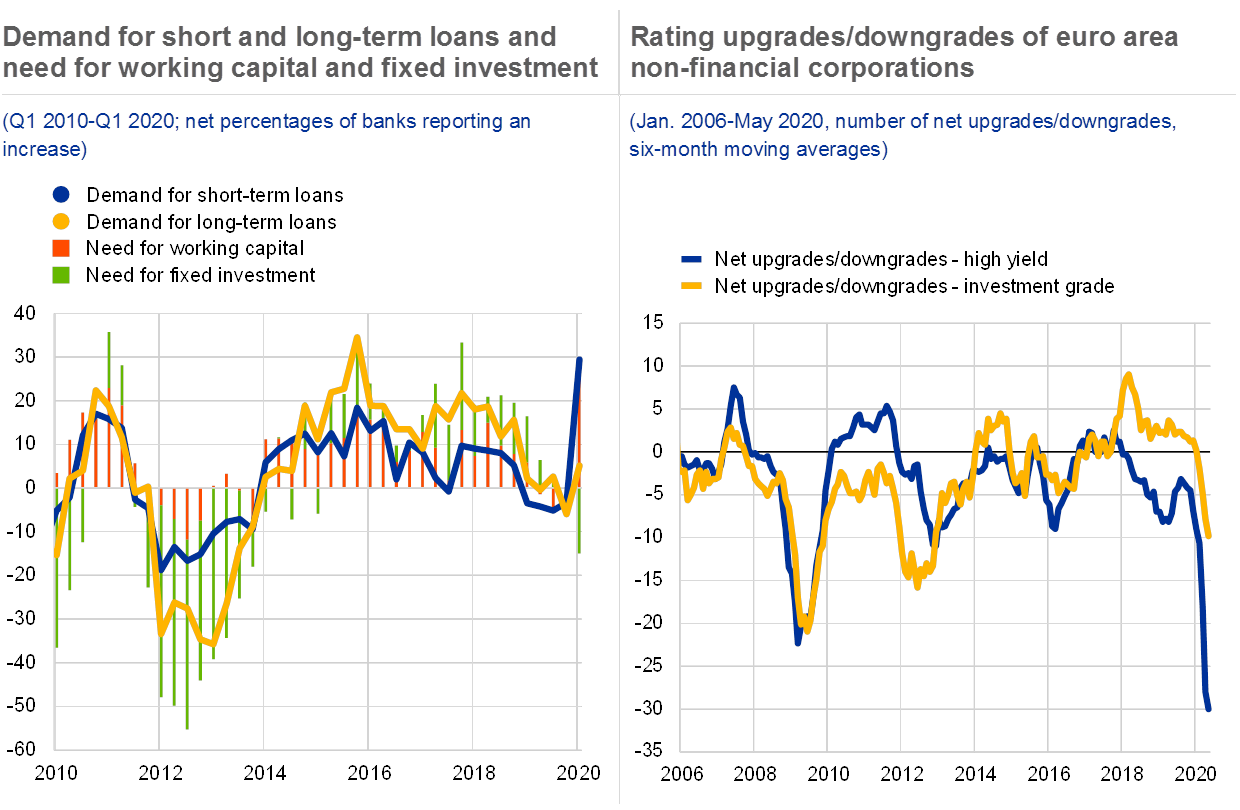

Source: ecb.europa.eu

Source: ecb.europa.eu

However if you actually need a commercial real estate loan. Our goal here is not to give you a firm quote but rather to get you within the noise range. 312-620-6447 Lets Talk About How We Can Help You Revolving Lines of Credit. Rates will stay low for at least the next year despite a rising probability that the Federal Open Market Committee raises the federal funds rate in 2015 Mr. But before you fill out that application lets take a look at the different types of loans and what you can expect from each.

Source: ecb.europa.eu

Source: ecb.europa.eu

35 to 6 fixed rate on SBA part fixed or floating on the banking sector 500000 in most cases. Find The Commercial Mortgage Lender You Need in Seconds. 525 to 875 variable 100000 85-0. If the low interest rate environment persists prices are likely to move higher for both. Rates will stay low for at least the next year despite a rising probability that the Federal Open Market Committee raises the federal funds rate in 2015 Mr.

Source: ecb.europa.eu

Source: ecb.europa.eu

Nearly all of the commercial mortgage experts agreed that long-term interest rates are likely to remain advantageous to borrowers in 2015. Multifamily Office Retail Industrial HospitalsHealthcare Self-Storage Hotel Mixed Use and Churches. Our goal here is not to give you a firm quote but rather to get you within the noise range. Capitalization rate Cap Rate The value of a CRE property is determined based on the yield or discount rate otherwise known as cap rate. At the peak of the CRE price cycle cap rates averaged a low of 645 in 2007 and reached an average high of 82 in 2009.

Source: bankerstrust.com

Source: bankerstrust.com

If you want to use an SBA loan to buy commercial real estate there are two loan programs to look into. Commercial mortgage interest rates are typically higher than residential mortgage rates usually between 051 higher. We provide loans for the following properties but not limited to. Average transaction-based cap rates for all property types fell to 63 at YE2016 from 64 in YE2015 and 74 in YE2010 per RCA data. But before you fill out that application lets take a look at the different types of loans and what you can expect from each.

Source: ecb.europa.eu

Source: ecb.europa.eu

If the low interest rate environment persists prices are likely to move higher for both. Commercial Real Estate Financing Rates Facing A Technical Default. The commercial mortgage rates of commercial real estate lenders are fairly predictable. Current Commercial Real Estate Mortgage Rates and Terms. It will also teach you how to accurately predict commercial mortgage rates - not just today but also in the future.

Source: ecb.europa.eu

Source: ecb.europa.eu

Average transaction-based cap rates for all property types fell to 63 at YE2016 from 64 in YE2015 and 74 in YE2010 per RCA data. Multifamily Office Retail Industrial HospitalsHealthcare Self-Storage Hotel Mixed Use and Churches. And now is the prime time to take out a commercial real estate loaninterest rates are at historic lows currently averaging between 4 and 6. Type of loan Average prices. Lenders may require collateral.

Source: infochoice.com.au

Source: infochoice.com.au

Rates will stay low for at least the next year despite a rising probability that the Federal Open Market Committee raises the federal funds rate in 2015 Mr. Commercial property values in the United States are down by more than one third from their peak and the delinquency rate on commercial real estate loans has risen to more than 8 double the rate at end-2008 and more than four times the rate at end-2006. Capitalization rate Cap Rate The value of a CRE property is determined based on the yield or discount rate otherwise known as cap rate. We provide loans for the following properties but not limited to. Commercial Mortgage Rates As Low As 312.

Source: sciencedirect.com

Source: sciencedirect.com

Commercial Mortgage Rates Terms The following commercial mortgage rates and terms were extracted from the most recent edition of. We provide loans for the following properties but not limited to. Commercial mortgage borrowers on smaller deals deals of less than around 2 million will probably have to pay a commercial mortgage rate that is around 050 higher. Lenders may require collateral. It will also teach you how to accurately predict commercial mortgage rates - not just today but also in the future.

Source: ecb.europa.eu

Source: ecb.europa.eu

SBA 504 Loan. Average transaction-based cap rates for all property types fell to 63 at YE2016 from 64 in YE2015 and 74 in YE2010 per RCA data. Repayment terms go up to 25 years on real estate transactions and interest rates ranged from 55 to 1125 as of April 2020. It will also teach you how to accurately predict commercial mortgage rates - not just today but also in the future. Find The Commercial Mortgage Lender You Need in Seconds.

Source: ecb.europa.eu

Source: ecb.europa.eu

We provide loans for the following properties but not limited to. Rates will stay low for at least the next year despite a rising probability that the Federal Open Market Committee raises the federal funds rate in 2015 Mr. Commercial Mortgage Rates As Low As 312. Commercial loan rates are typically higher than residential mortgage rates and this site explains why. Most commercial investment permanent loans as opposed to multifamily loans have monthly payments that are amortized over 25 years.

Source: ecb.europa.eu

Source: ecb.europa.eu

If youre just browsing and learning today you should click on the Knowledge Base tab above. We provide financing in all 50 states. Commercial property values in the United States are down by more than one third from their peak and the delinquency rate on commercial real estate loans has risen to more than 8 double the rate at end-2008 and more than four times the rate at end-2006. 525 to 875 variable 100000 85-0. Typical loan term.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial real estate loan rates 2016 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.