Your Commercial real estate loan analysis images are ready. Commercial real estate loan analysis are a topic that is being searched for and liked by netizens today. You can Find and Download the Commercial real estate loan analysis files here. Download all royalty-free images.

If you’re looking for commercial real estate loan analysis pictures information related to the commercial real estate loan analysis interest, you have visit the right site. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

Commercial Real Estate Loan Analysis. Numbers are the gritty details of a propertythe years dates prices and measurements associated with it. The debt service coverage ratio and the loan to value ratio are the traditional methods used in commercial real estate loan underwriting. As for the terms they commonly range from 20-25 years. The commercial real estate loan process complexity and the timeline vary greatly in comparison to the residential side.

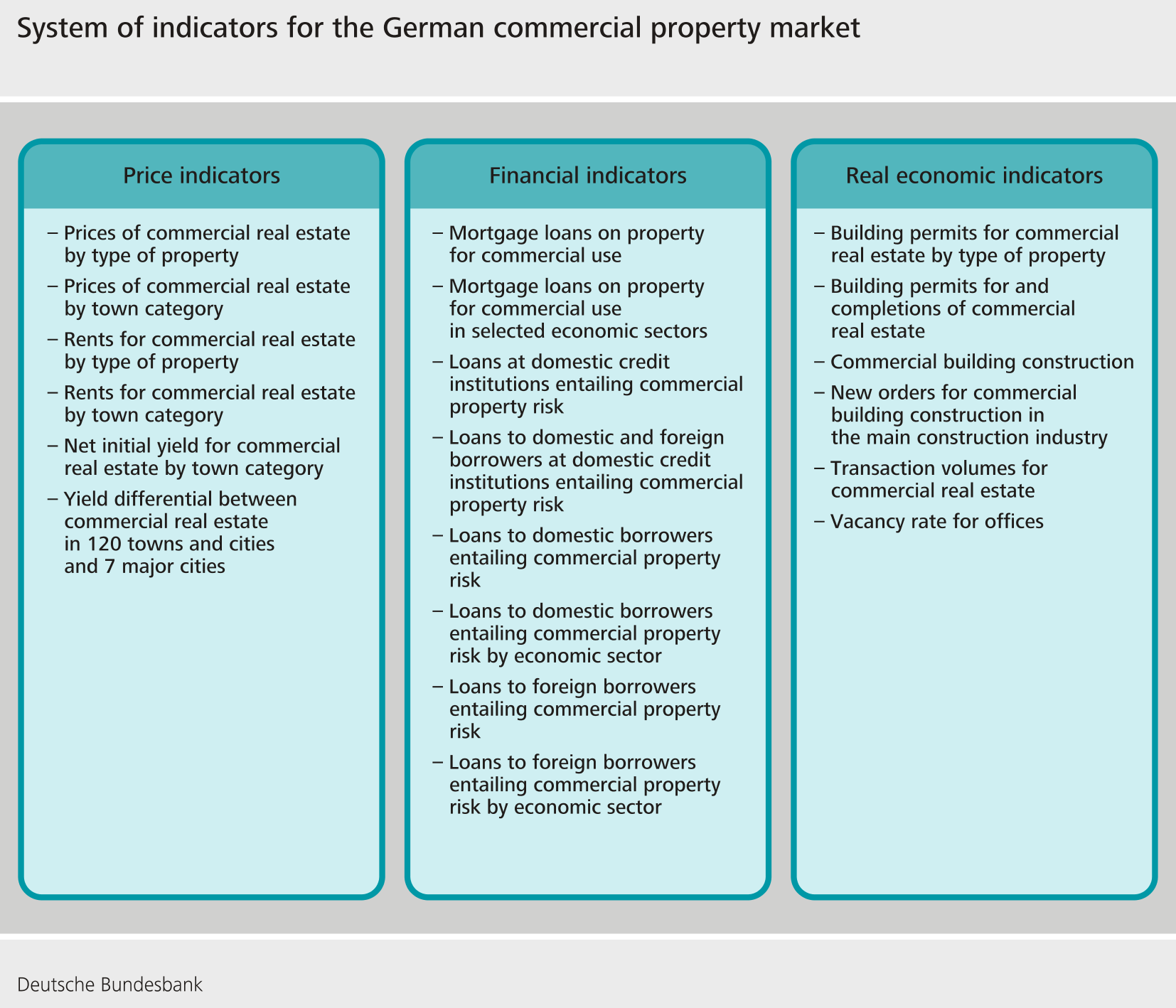

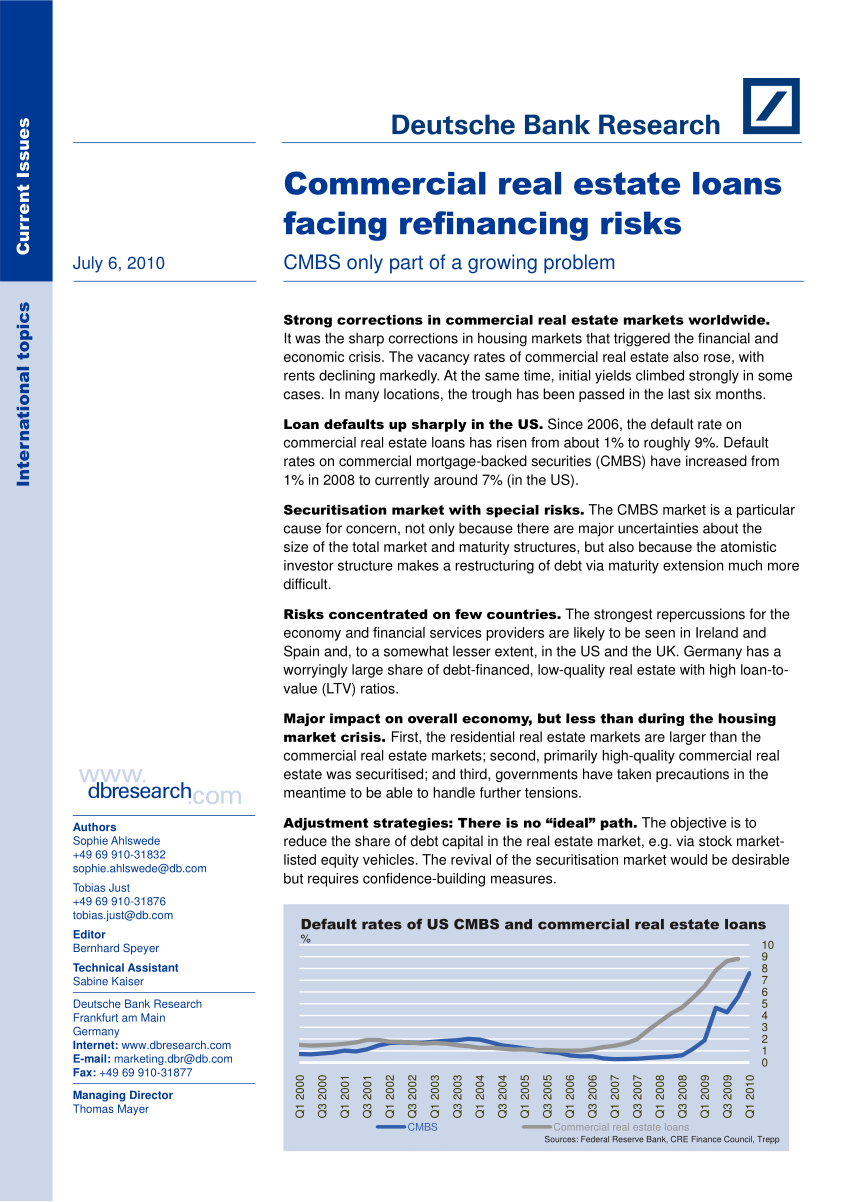

System Of Indicators For The German Commercial Property Market Deutsche Bundesbank From bundesbank.de

System Of Indicators For The German Commercial Property Market Deutsche Bundesbank From bundesbank.de

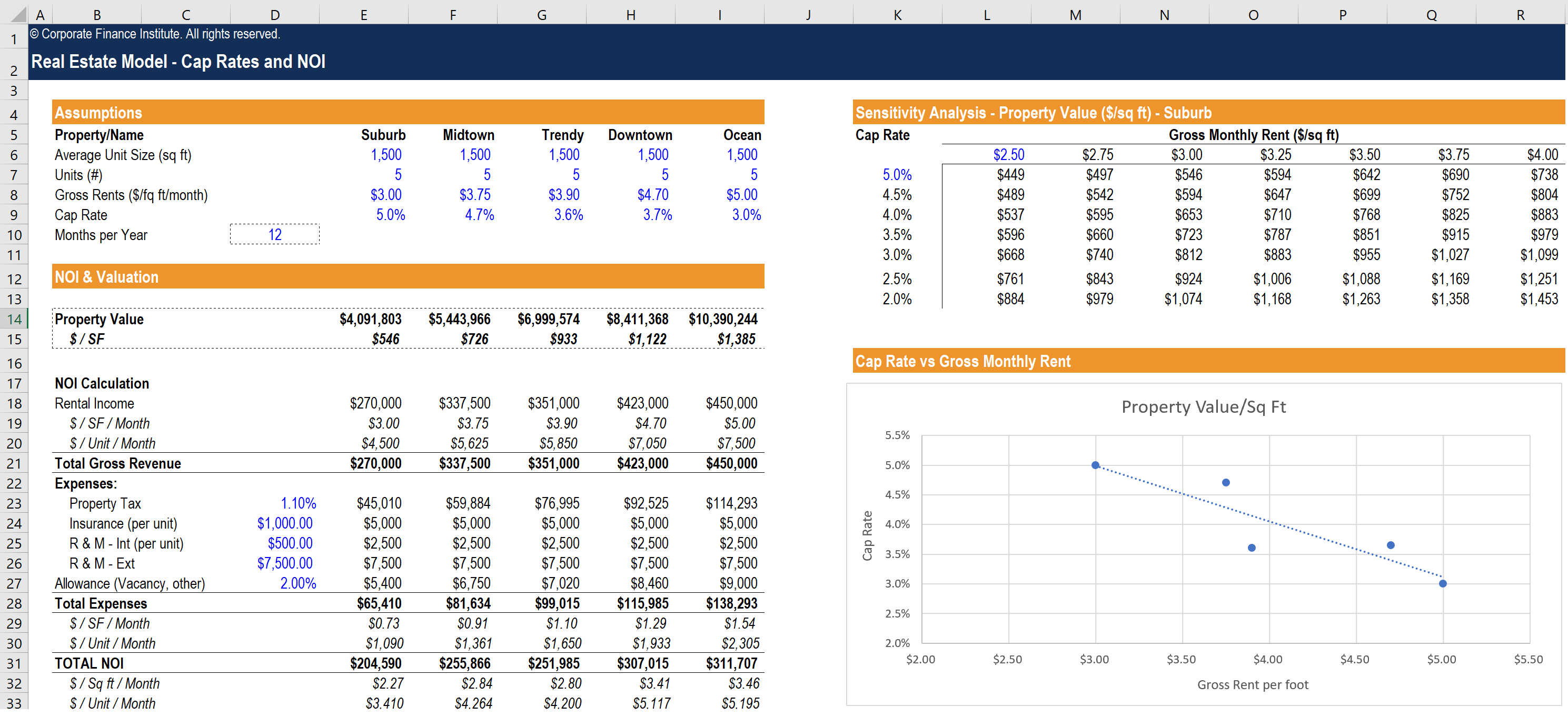

Commercial Real Estate Credit Analysis. The course begins with a framework to evaluate and mitigate credit risk then explores various property types and discusses external and property-specific risks. The purpose of the maximum loan analysis is to determine the maximum supportable loan amount based on the NOI the DSCR and the LTV requirements. Commercial Real Estate Analysis Foundations provides you with an end-to-end loan underwriting process for CRE finance and banking. The logjam of troubled US. The commercial real estate loan process works differently and takes much more time documentation and communication.

However according to the Comptrollers Handbook for Commercial Real Estate a recommended minimum acceptable debt yield is 10.

We are committed to the timely delivery of consistent and accurate. With a commercial real estate loan you can plan on interest rates starting as low as 425. Apply to Commercial Real Estate Agent Investment Banking Analyst Paid Intern and more. Loan analysis gives the creditor a measure of safety on the loan by determining the probability that the borrower will pay back the loan principal Principal Payment A principal payment is a payment toward the original amount of a loan that is owed. In this program participants build Excel models for real estateproperty financial analysis in actual commercial real estate financing situations. Commercial Real Estate Credit Analysis.

Source: bundesbank.de

Source: bundesbank.de

Thats right this kind of financing can have rates lower than an auto loan. This reflects close linkages with general economic. As for the terms they commonly range from 20-25 years. With a commercial real estate loan you can plan on interest rates starting as low as 425. Despite the low interest rates the amounts start around 250000 and can go all the way up to 5000000.

![]() Source: wellsfargo.com

Source: wellsfargo.com

However according to the Comptrollers Handbook for Commercial Real Estate a recommended minimum acceptable debt yield is 10. The purpose of the maximum loan analysis is to determine the maximum supportable loan amount based on the NOI the DSCR and the LTV requirements. The program addresses cash flow analysis asset coverage financial ratios and property valuation approaches to help determine the CRE loan amount and concludes with CRE loan underwriting and loan. We describe what you need to know about the process for getting a commercial real estate loan. Using a clear practical framework and real-world applications this program supports career advancement for both junior lending officers and.

Source: pinterest.com

Source: pinterest.com

Once a lender calculates the correct net operating income they will then calculate the above mentioned loan to value and debt service coverage ratios. Loan analysis gives the creditor a measure of safety on the loan by determining the probability that the borrower will pay back the loan principal Principal Payment A principal payment is a payment toward the original amount of a loan that is owed. We describe what you need to know about the process for getting a commercial real estate loan. Commercial Real Estate Analysis Foundations provides you with an end-to-end loan underwriting process for CRE finance and banking. In this program participants build Excel models for real estateproperty financial analysis in actual commercial real estate financing situations.

Source: altusgroup.com

Source: altusgroup.com

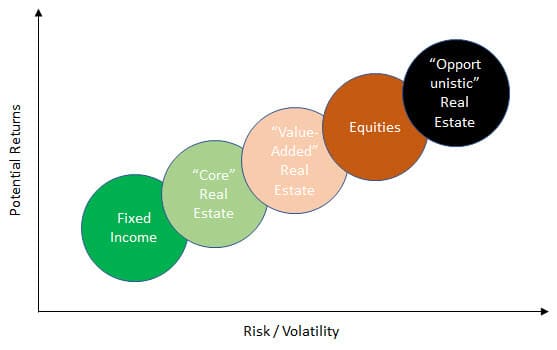

Thats right this kind of financing can have rates lower than an auto loan. Armada Analytics provides high-quality commercial real estate analysis services tailored specifically to each of our clients needs. Home Services Commercial Real Estate Analysis. The four things almost all commercial real estate professionals will be looking for in their property analysis are numbers narratives indications and assurance. Analyzing Commercial Real Estate ACRE provides an analytical framework for assessing risks associated with commercial real estate and improving the quality of lending decisions.

Source: spglobal.com

Source: spglobal.com

Analyzing Commercial Real Estate ACRE provides an analytical framework for assessing risks associated with commercial real estate and improving the quality of lending decisions. Apply to Commercial Real Estate Agent Investment Banking Analyst Paid Intern and more. Analyzing Commercial Real Estate ACRE provides an analytical framework for assessing risks associated with commercial real estate and improving the quality of lending decisions. However the problem with using only these two ratios is that they are. The debt service coverage ratio and the loan to value ratio are the traditional methods used in commercial real estate loan underwriting.

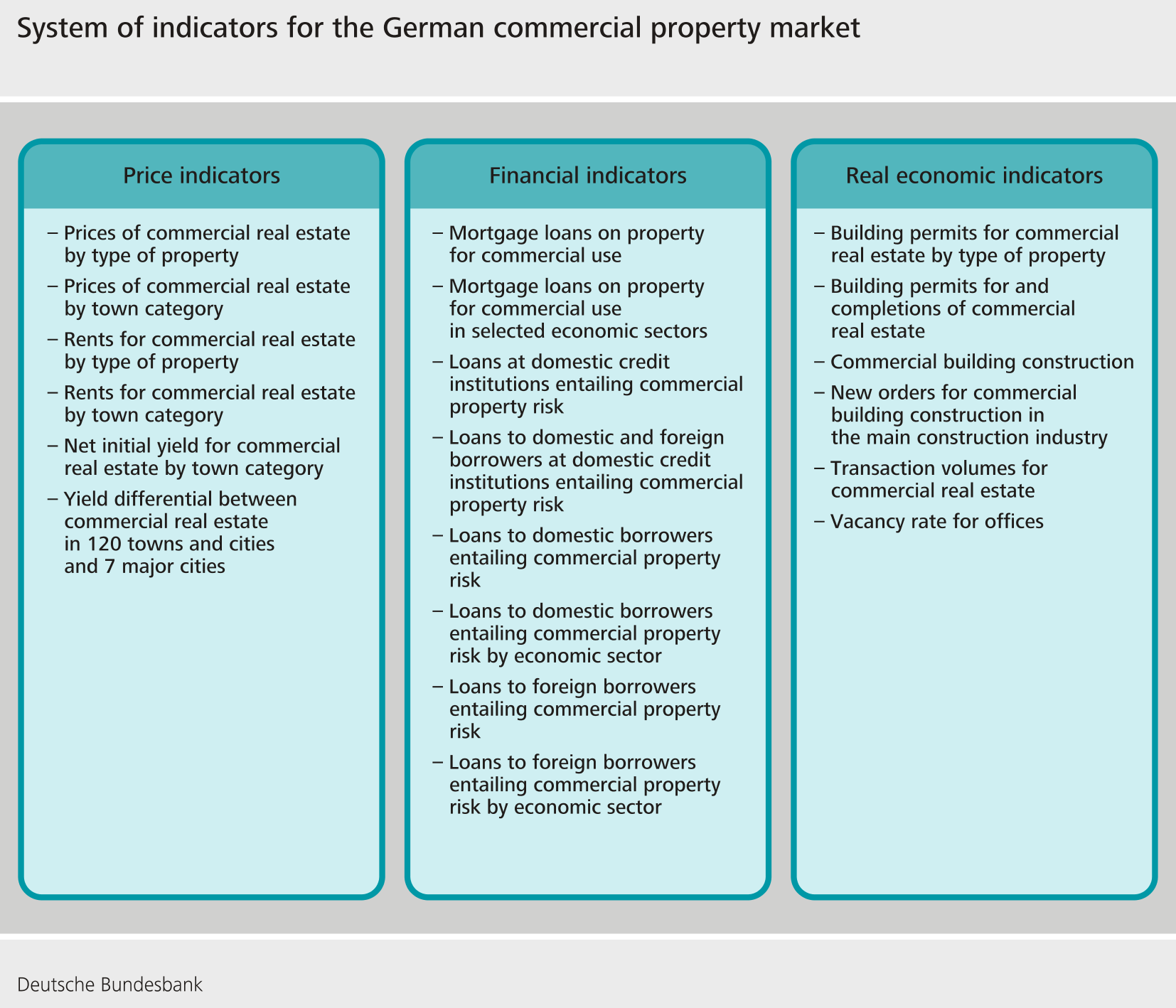

Source: reit.com

Source: reit.com

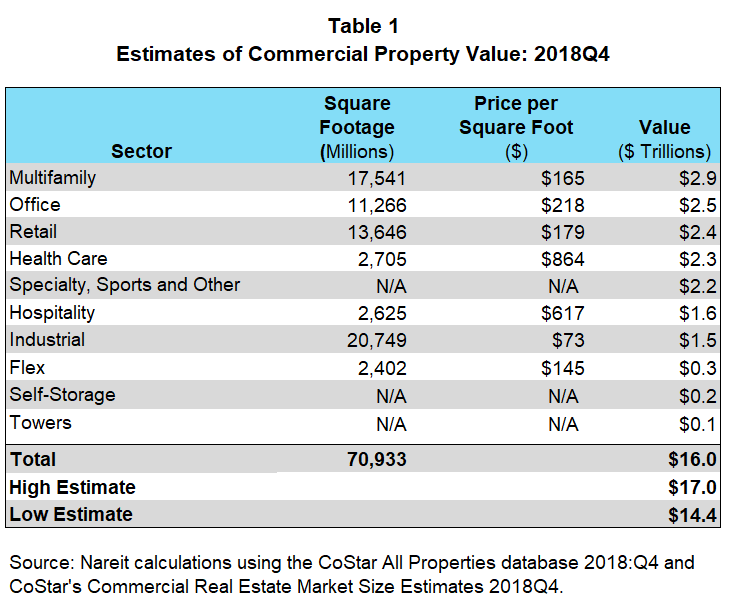

Commercial real estate loans is beginning to break suggesting the market is freeing itself of an overhang that has chilled investor activity and threatened the economy. Despite the low interest rates the amounts start around 250000 and can go all the way up to 5000000. Thats right this kind of financing can have rates lower than an auto loan. The logjam of troubled US. The commercial real estate loan process works differently and takes much more time documentation and communication.

Source: gresb.com

Source: gresb.com

However the problem with using only these two ratios is that they are. As for the terms they commonly range from 20-25 years. Home Services Commercial Real Estate Analysis. Debt Yield vs Loan to Value Ratio. Commercial real estate loans is beginning to break suggesting the market is freeing itself of an overhang that has chilled investor activity and threatened the economy.

Source: naic.org

Source: naic.org

With a commercial real estate loan you can plan on interest rates starting as low as 425. The course begins with a framework to evaluate and mitigate credit risk then explores various property types and discusses external and property-specific risks. Maximum Loan Analysis. Using a clear practical framework and real-world applications this program supports career advancement for both junior lending officers and. Home Services Commercial Real Estate Analysis.

Source: researchgate.net

Source: researchgate.net

The debt service coverage ratio and the loan to value ratio are the traditional methods used in commercial real estate loan underwriting. The purpose of the maximum loan analysis is to determine the maximum supportable loan amount based on the NOI the DSCR and the LTV requirements. Using a clear practical framework and real-world applications this program supports career advancement for both junior lending officers and. Once a lender calculates the correct net operating income they will then calculate the above mentioned loan to value and debt service coverage ratios. In this program participants build Excel models for real estateproperty financial analysis in actual commercial real estate financing situations.

Source: eloquens.com

Source: eloquens.com

The debt service coverage ratio and the loan to value ratio are the traditional methods used in commercial real estate loan underwriting. The debt service coverage ratio and the loan to value ratio are the traditional methods used in commercial real estate loan underwriting. Numbers are the gritty details of a propertythe years dates prices and measurements associated with it. The commercial real estate loan process complexity and the timeline vary greatly in comparison to the residential side. Analyzing Commercial Real Estate ACRE provides an analytical framework for assessing risks associated with commercial real estate and improving the quality of lending decisions.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The debt service coverage ratio and the loan to value ratio are the traditional methods used in commercial real estate loan underwriting. Part of the complexity is that each lending institution goes by slightly different lending. As for the terms they commonly range from 20-25 years. The four things almost all commercial real estate professionals will be looking for in their property analysis are numbers narratives indications and assurance. The course begins with a framework to evaluate and mitigate credit risk then explores various property types and discusses external and property-specific risks.

Source: pinterest.com

Source: pinterest.com

The commercial real estate loan process complexity and the timeline vary greatly in comparison to the residential side. Numbers are the gritty details of a propertythe years dates prices and measurements associated with it. In past financial crises unsustainable developments in commercial real estate CRE markets in some European Union EU countries resulted in severe losses for the financial system possibly also with consequences for the real economy. Commercial Real Estate Analysis Foundations provides you with an end-to-end loan underwriting process for CRE finance and banking. Armada Analytics provides high-quality commercial real estate analysis services tailored specifically to each of our clients needs.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Case studies of income-producing property including office buildings industrial parks and shopping centers immerse participants in the standard techniques used in real world data gathering and modeling in Excel. We describe what you need to know about the process for getting a commercial real estate loan. CRE markets tend to be significantly more cyclical than residential real estate RRE markets. Thats right this kind of financing can have rates lower than an auto loan. Once a lender calculates the correct net operating income they will then calculate the above mentioned loan to value and debt service coverage ratios.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Apply to Commercial Real Estate Agent Investment Banking Analyst Paid Intern and more. The program addresses cash flow analysis asset coverage financial ratios and property valuation approaches to help determine the CRE loan amount and concludes with CRE loan underwriting and loan. In past financial crises unsustainable developments in commercial real estate CRE markets in some European Union EU countries resulted in severe losses for the financial system possibly also with consequences for the real economy. The course begins with a framework to evaluate and mitigate credit risk then explores various property types and discusses external and property-specific risks. The commercial real estate loan process works differently and takes much more time documentation and communication.

Source: spglobal.com

Source: spglobal.com

Commercial real estate loans is beginning to break suggesting the market is freeing itself of an overhang that has chilled investor activity and threatened the economy. Debt Yield vs Loan to Value Ratio. The purpose of the maximum loan analysis is to determine the maximum supportable loan amount based on the NOI the DSCR and the LTV requirements. Case studies of income-producing property including office buildings industrial parks and shopping centers immerse participants in the standard techniques used in real world data gathering and modeling in Excel. In this program participants build Excel models for real estateproperty financial analysis in actual commercial real estate financing situations.

Source: youtube.com

Source: youtube.com

Maximum Loan Analysis. Part of the complexity is that each lending institution goes by slightly different lending. Analyzing Commercial Real Estate ACRE provides an analytical framework for assessing risks associated with commercial real estate and improving the quality of lending decisions. However the problem with using only these two ratios is that they are. Maximum Loan Analysis.

The commercial real estate loan process complexity and the timeline vary greatly in comparison to the residential side. As for the terms they commonly range from 20-25 years. Using a clear practical framework and real-world applications this program supports career advancement for both junior lending officers and. We describe what you need to know about the process for getting a commercial real estate loan. Thats right this kind of financing can have rates lower than an auto loan.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

In past financial crises unsustainable developments in commercial real estate CRE markets in some European Union EU countries resulted in severe losses for the financial system possibly also with consequences for the real economy. Loan analysis gives the creditor a measure of safety on the loan by determining the probability that the borrower will pay back the loan principal Principal Payment A principal payment is a payment toward the original amount of a loan that is owed. Case studies of income-producing property including office buildings industrial parks and shopping centers immerse participants in the standard techniques used in real world data gathering and modeling in Excel. Commercial Real Estate Analysis Foundations provides you with an end-to-end loan underwriting process for CRE finance and banking. Home Services Commercial Real Estate Analysis.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial real estate loan analysis by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.