Your Commercial real estate leverage ratio images are ready in this website. Commercial real estate leverage ratio are a topic that is being searched for and liked by netizens now. You can Find and Download the Commercial real estate leverage ratio files here. Get all royalty-free photos and vectors.

If you’re searching for commercial real estate leverage ratio pictures information linked to the commercial real estate leverage ratio keyword, you have pay a visit to the ideal blog. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

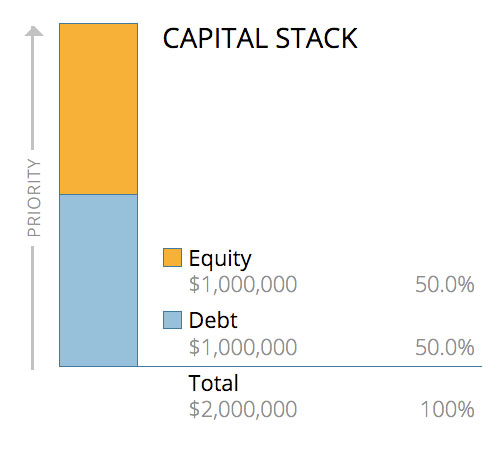

Commercial Real Estate Leverage Ratio. Example of Leveraging Consider the common real estate purchase requirement of a 20 down payment. Closing Inventory 100 Total Assets. Loan to Value Ratio Loan Amount x 100 Market Value 2056000 x 100. Loan-to-value Loan-to-value ratio LTV is calculated by dividing the loan amount over the appraised property value.

Enduring Yield European Commercial Real Estate Debt Man Institute Man Group From man.com

Enduring Yield European Commercial Real Estate Debt Man Institute Man Group From man.com

Typically Loan-To-Value Ratios for commercial real estate loans are capped at 75 or 80. A negative scenario for this type of company could be when its. A company that has high operating leverage bears a large proportion of fixed costs in its operations and is a capital intensive firm. A higher DE ratio indicates a higher default risk for the real estate company. On top of the main wage earners salary it includes the salaries of the households other wage. Typically offerings with high LTV ratios are higher risk as.

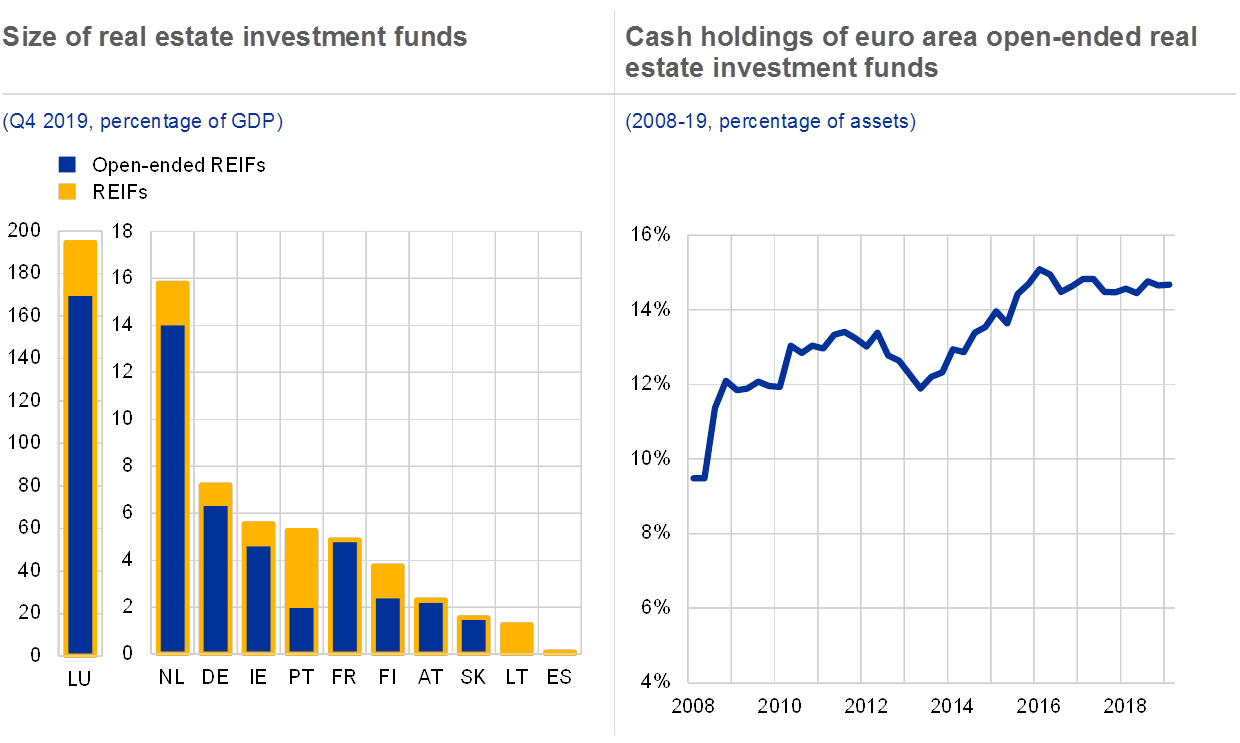

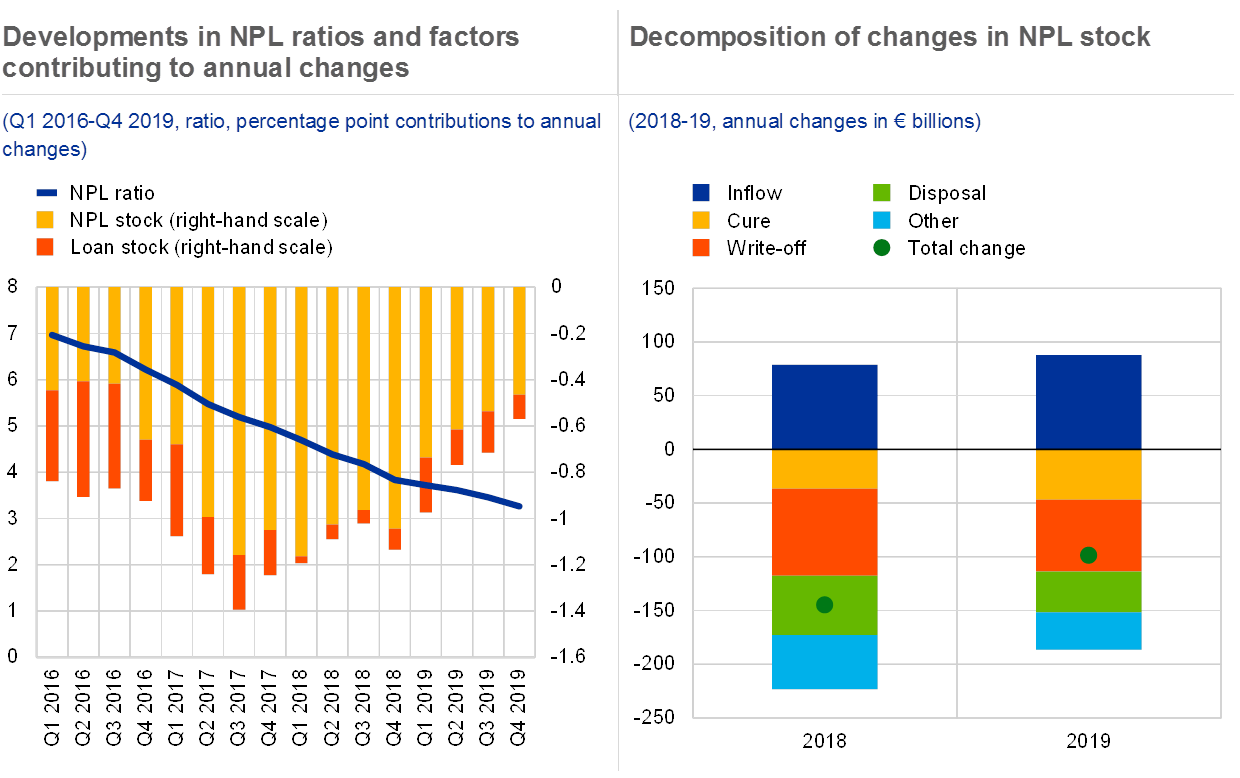

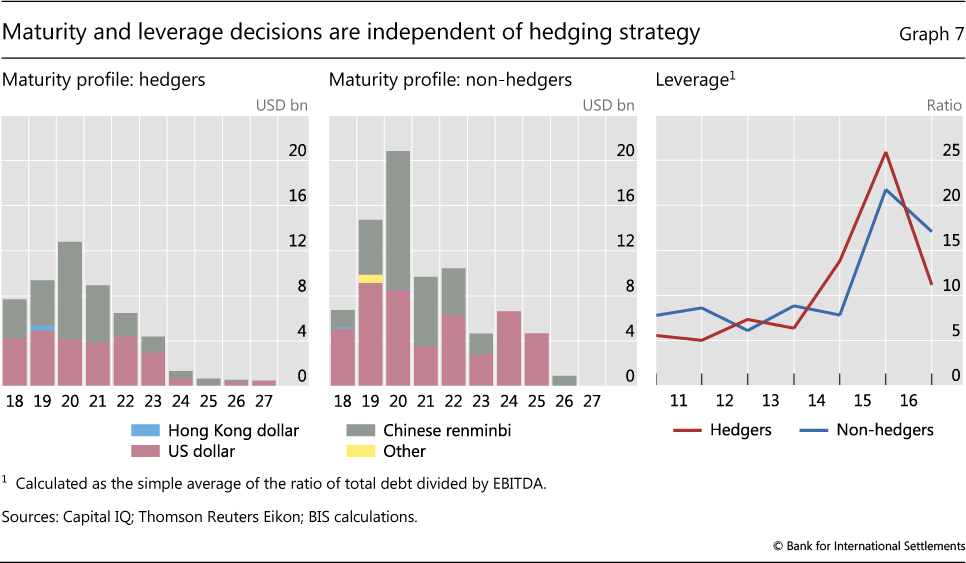

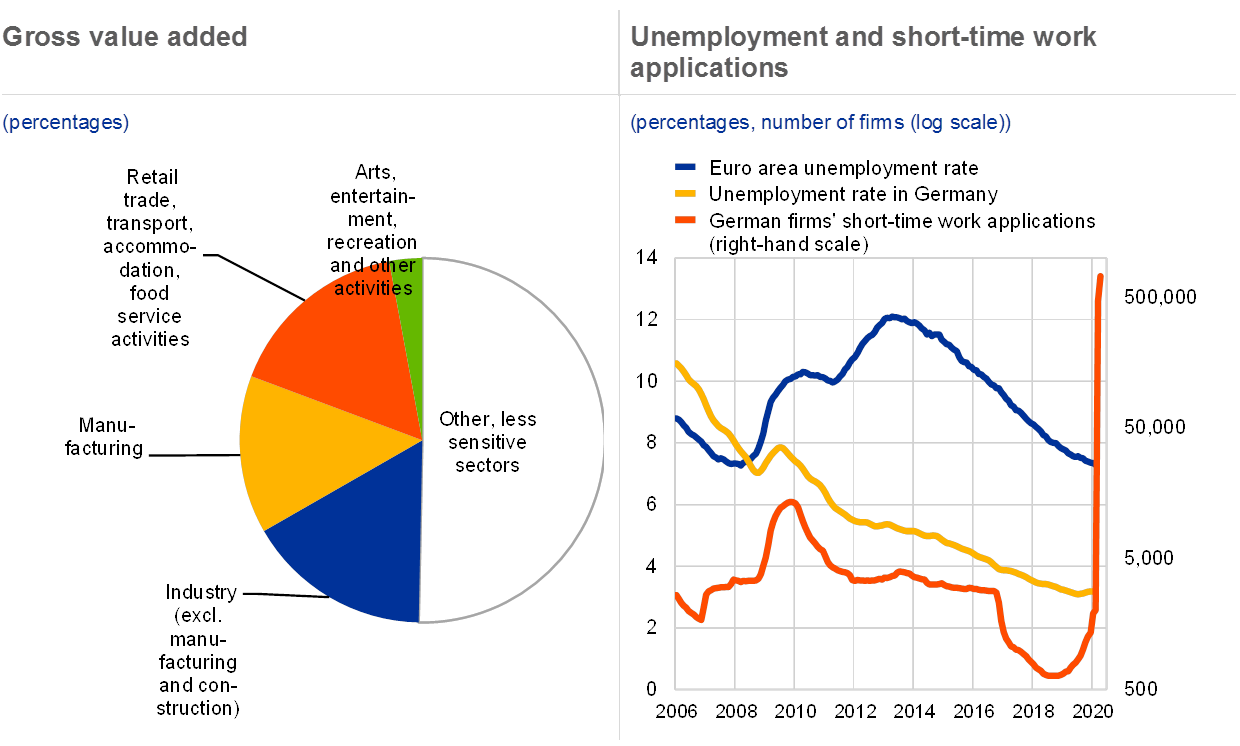

These instruments can act as a brake on imprudent lending and lower both the.

Loan to Value Ratio Loan Amount x 100 Market Value 2056000 x 100. Small changes in sales volume would result in a large change in earnings and return on investment. A company that has high operating leverage bears a large proportion of fixed costs in its operations and is a capital intensive firm. Based on Effective Gross Income. While overall asset values in the US. This is the ratio of debt payments to the household gross income.

Source: crowdstreet.com

Source: crowdstreet.com

Default Ratio Operating Expenses Debt Service x 100 Effective Gross Income 58000 180538 x 100 292230 8163. Commercial Real Estate is an information-imperfect industry and a non-homogenous asset class. Leverage is using debt to increase the potential return on investment. In most cases a 20 down payment and a good credit history gets you 100 of the property and house you want. Tools for real estate can target excessive growth and leverage by restricting the size of loans relative to the value of the property the loan-to-value ratio or interest or debt servicing relative to the borrowers income the interest coverage ratio ICR or debt service coverage ratio DSCR.

Source: forbes.com

Source: forbes.com

Become a CRE Power Player. Loan to Value Ratio Loan Amount x 100 Market Value 2056000 x 100. In most cases a 20 down payment and a good credit history gets you 100 of the property and house you want. Become a CRE Power Player. Leverage is magic in commercial real estate.

Source: realcrowd.com

Source: realcrowd.com

An operating leverage ratio refers to the percentage or ratio of fixed costs to variable costs. These instruments can act as a brake on imprudent lending and lower both the. The first ratio commercial lenders look at is the Loan-To-Value Ratio. This new underwriting ratio in commercial real estate finance is called the Debt Yield Ratio and this ratio is limiting large commercial loans to just 58 to 63 loan-to-value. In commercial real estate market value can be impacted by the location of the property major market versus rural demand for that asset type multifamily office space storage etc installed amenities and more.

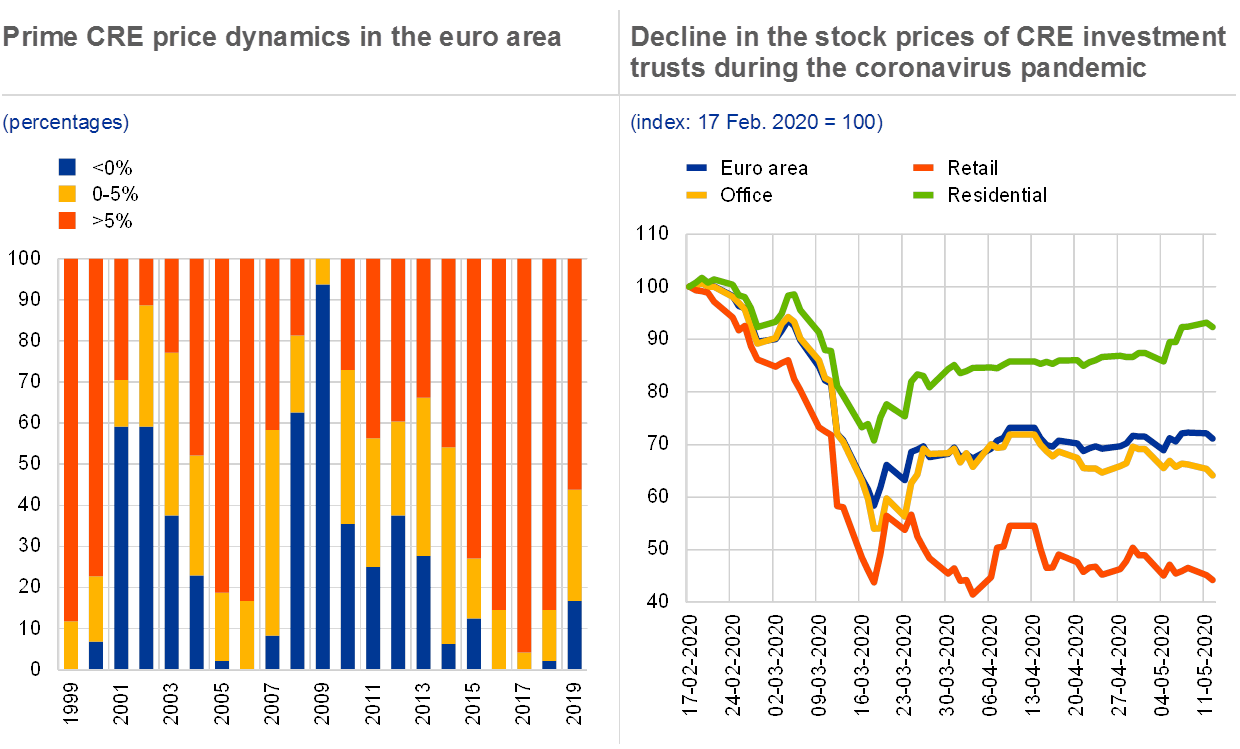

Source: ecb.europa.eu

Source: ecb.europa.eu

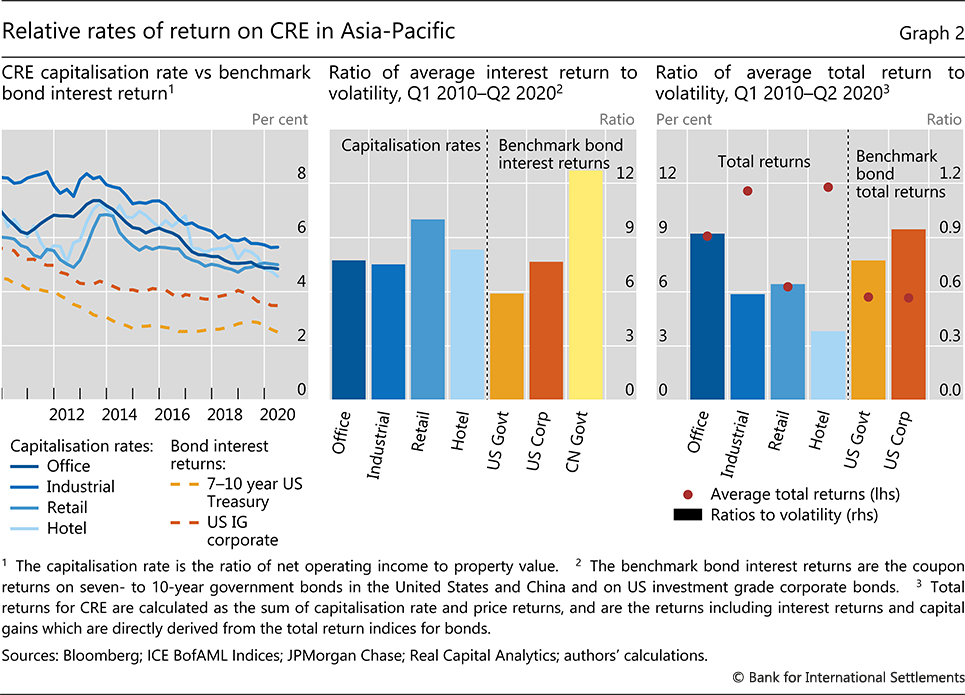

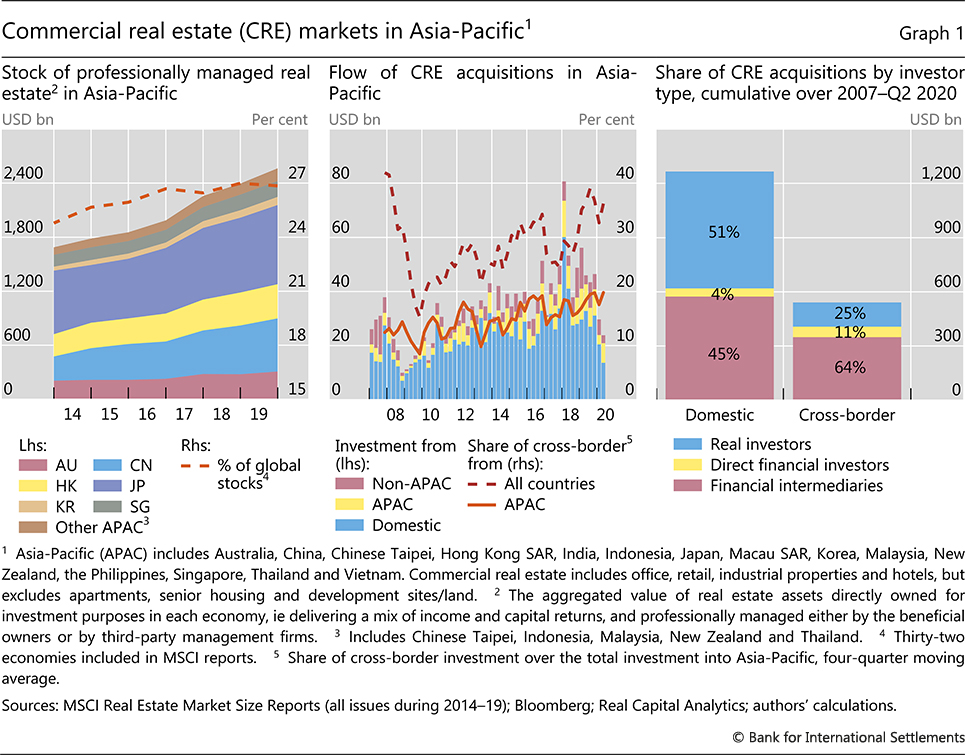

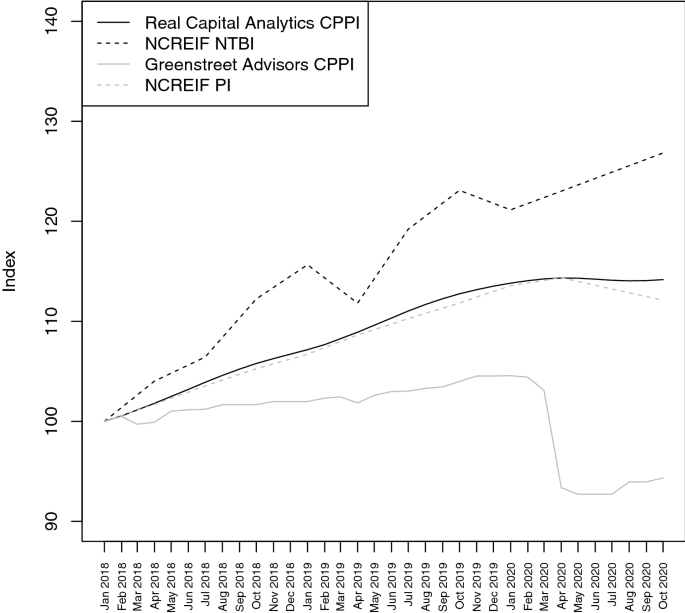

Estimated mean reversion in price appreciation of at least 25 over relatively short. This is the ratio of debt payments to the household gross income. As of 2017 the ratio of commercial real estate debt to GDP 209 remains more than 22 percentage points below its previous peak. Debt Service Ratio DSR Net Operating Income Debt Service 234230 180538 130. View All CRE Power Players.

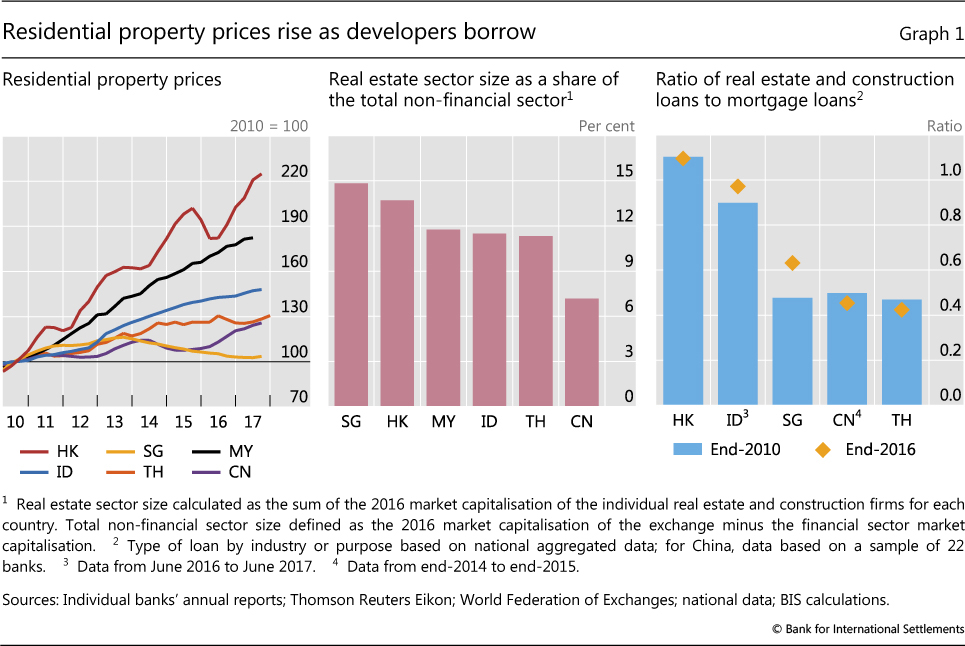

Source: bis.org

Source: bis.org

Typically offerings with high LTV ratios are higher risk as. Lets look at this transaction in detail to see how the investor can. The LTV equals the amount of the commercial mortgage divided by the market value of the property as determined by a commercial appraisal. Leverage specialises in the sale of both commercial real estate portfolios and individual assets across South Africa. A higher DE ratio indicates a higher default risk for the real estate company.

Source: bis.org

Source: bis.org

Tools for real estate can target excessive growth and leverage by restricting the size of loans relative to the value of the property the loan-to-value ratio or interest or debt servicing relative to the borrowers income the interest coverage ratio ICR or debt service coverage ratio DSCR. Leverage occurs when money is borrowed at a certain interest rate that is less than the rate of return on a commercial property. View All CRE Power Players. A company that has high operating leverage bears a large proportion of fixed costs in its operations and is a capital intensive firm. Loan-to-value Loan-to-value ratio LTV is calculated by dividing the loan amount over the appraised property value.

Source: bis.org

Source: bis.org

Closing Inventory 100 Total Assets. Debt Service Ratio DSR Net Operating Income Debt Service 234230 180538 130. Commercial real estate capital structure looks to be quite weak due to high leverage combined with strong mean reversion in prices. Leverage is using debt to increase the potential return on investment. View All CRE Power Players.

Source: ecb.europa.eu

Source: ecb.europa.eu

Based on Effective Gross Income. A higher DE ratio indicates a higher default risk for the real estate company. As of 2017 the ratio of commercial real estate debt to GDP 209 remains more than 22 percentage points below its previous peak. Lets look at this transaction in detail to see how the investor can. While overall asset values in the US.

Source: ecb.europa.eu

Source: ecb.europa.eu

A negative scenario for this type of company could be when its. Leveraging real estate means you provide 20-30 percent of the total purchase price or a 28 ratio in order to control a piece of real estate worth much more than your initial investment all. 22 Zeilen Solvency Ratios. On top of the main wage earners salary it includes the salaries of the households other wage. Default Ratio Operating Expenses Debt Service x 100 Effective Gross Income 58000 180538 x 100 292230 8163.

Source: realcrowd.com

Source: realcrowd.com

Become a CRE Power Player. Become a CRE Power Player. As of 2017 the ratio of commercial real estate debt to GDP 209 remains more than 22 percentage points below its previous peak. Leverage occurs when money is borrowed at a certain interest rate that is less than the rate of return on a commercial property. Small changes in sales volume would result in a large change in earnings and return on investment.

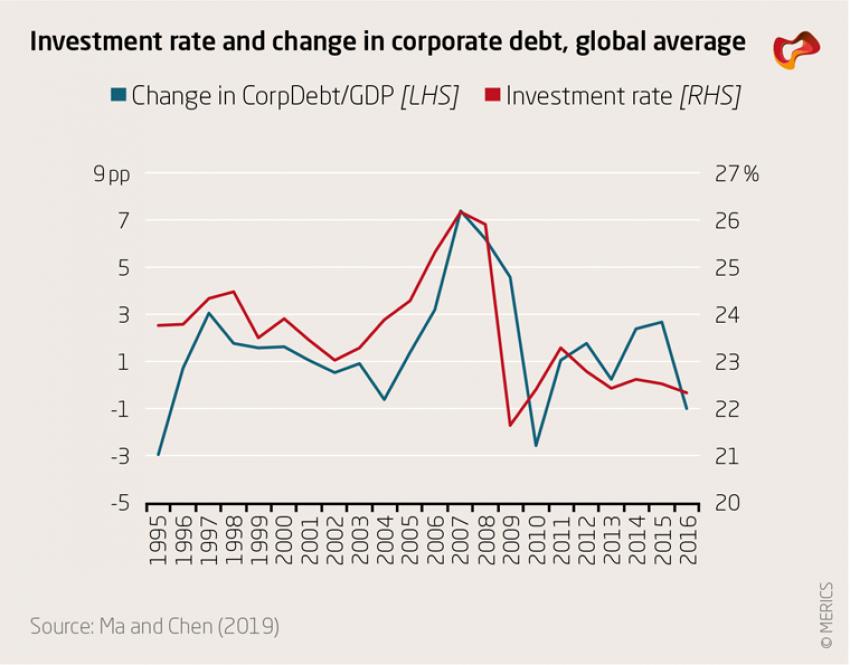

Source: merics.org

Source: merics.org

Default Ratio Breakeven cont. The most straightforward example for real estate is a mortgage where youre using your own money to leverage the purchase. Leverage is directly related to the amount of money borrowed on a deal compared to the current value and potential value of an income producing property. Leverage occurs when money is borrowed at a certain interest rate that is less than the rate of return on a commercial property. Become a CRE Power Player.

Source: man.com

Source: man.com

Loan-to-value Loan-to-value ratio LTV is calculated by dividing the loan amount over the appraised property value. Lets look at this transaction in detail to see how the investor can. The LTV equals the amount of the commercial mortgage divided by the market value of the property as determined by a commercial appraisal. A negative scenario for this type of company could be when its. Commercial Real Estate is an information-imperfect industry and a non-homogenous asset class.

Source: bis.org

Source: bis.org

Leverage specialises in the sale of both commercial real estate portfolios and individual assets across South Africa. Leverage is directly related to the amount of money borrowed on a deal compared to the current value and potential value of an income producing property. Lets look at this transaction in detail to see how the investor can. These instruments can act as a brake on imprudent lending and lower both the. This is the ratio of debt payments to the household gross income.

Source: link.springer.com

Source: link.springer.com

Based on Effective Gross Income. The most straightforward example for real estate is a mortgage where youre using your own money to leverage the purchase. This is the ratio of debt payments to the household gross income. INVEST CAPITAL email protected 1 480 613-8772. Estimated mean reversion in price appreciation of at least 25 over relatively short.

Source: ecb.europa.eu

Source: ecb.europa.eu

This percentage represents tangible assets held for sale in the ordinary course of business or goods in the process of production for such sale or materials to be consumed in the production of goods and services for sale. Estimated mean reversion in price appreciation of at least 25 over relatively short. These instruments can act as a brake on imprudent lending and lower both the. A higher DE ratio indicates a higher default risk for the real estate company. 150 The average DE.

Source: naic.org

Source: naic.org

Default Ratio Operating Expenses Debt Service x 100 Effective Gross Income 58000 180538 x 100 292230 8163. While overall asset values in the US. Debt Service Ratio DSR Net Operating Income Debt Service 234230 180538 130. 22 Zeilen Solvency Ratios. Based on Effective Gross Income.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Example of Leveraging Consider the common real estate purchase requirement of a 20 down payment. These instruments can act as a brake on imprudent lending and lower both the. An operating leverage ratio refers to the percentage or ratio of fixed costs to variable costs. Real estate companies are usually highly-leveraged due to large buyout transactions. The first ratio commercial lenders look at is the Loan-To-Value Ratio.

Source: ecb.europa.eu

Source: ecb.europa.eu

A negative scenario for this type of company could be when its. Typically Loan-To-Value Ratios for commercial real estate loans are capped at 75 or 80. Become a CRE Power Player. After the GFC commercial real estate de-levered with the ratio of commercial real estate debt to GDP falling to 191 in 2013. The first ratio commercial lenders look at is the Loan-To-Value Ratio.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial real estate leverage ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.