Your Commercial real estate funding sources images are available. Commercial real estate funding sources are a topic that is being searched for and liked by netizens now. You can Get the Commercial real estate funding sources files here. Find and Download all royalty-free photos.

If you’re looking for commercial real estate funding sources images information linked to the commercial real estate funding sources interest, you have pay a visit to the right site. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

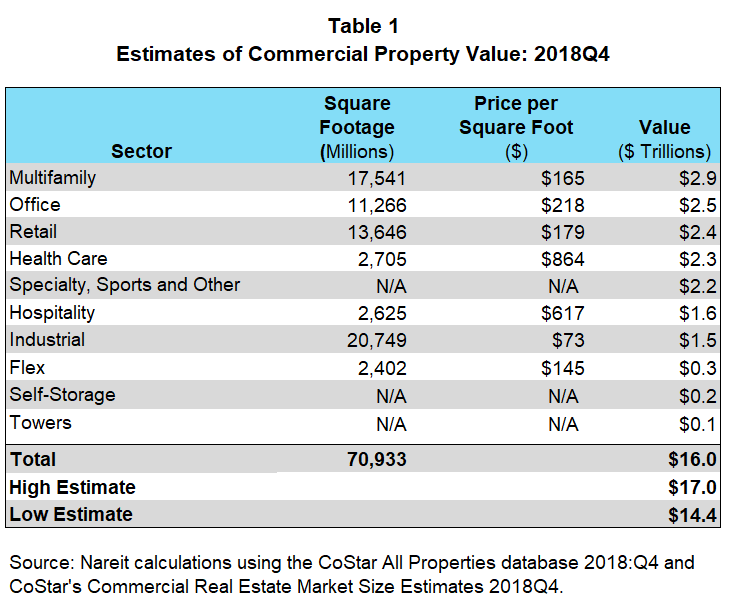

Commercial Real Estate Funding Sources. Capital Stack in Real Estate Project Finance When it comes to funding real estate project finance the capital stack includes several considerations as follows. In real estate project finance equity used to fund the project is usually repaid at the end of a specific time horizon. Targeted Applicants Not specified. Banks that provide CRE financing include.

Real Estate Private Equity Overview Careers Salaries Interviews From mergersandinquisitions.com

Real Estate Private Equity Overview Careers Salaries Interviews From mergersandinquisitions.com

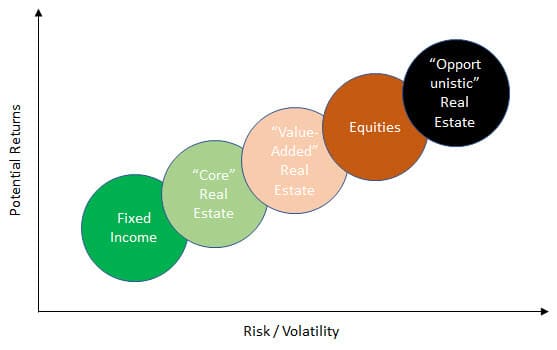

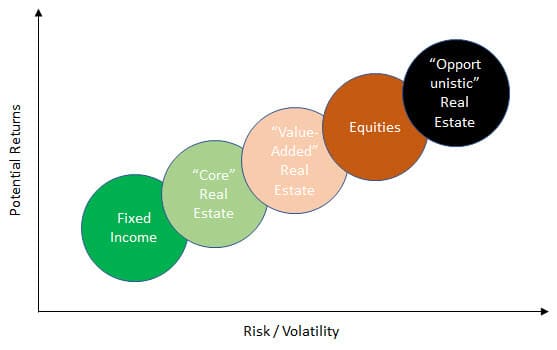

In my experience few people fully understand these four buckets of capital let alone how the various capital sources work together to get a real estate deal done. Public equity public debt private equity or private debt. Capital Stack in Real Estate Project Finance When it comes to funding real estate project finance the capital stack includes several considerations as follows. Traditional loans are those you would receive from a bank or an institutionalized lender. Flip Funding specializes in offering financing solutions for commercial and investment real estate nationwide. Source Commercial Funding are renowned leaders in the commercial finance industry are here to meet the specific financing needs of your upcoming project.

Adaptive reuse of old industrial buildings warehouses and large commercial spaces to a multi-tenant facility United States.

There are several sources to finance a real estate business but the most popular of them all are listed below. Capital for commercial real estate investments is generally sourced from one or more of the following buckets. If youre new to commercial real estate financing youll want to get a firm understanding of the differences between a residential and commercial mortgage loan. LRG works with clients to purchase or refinance all types of commercial properties with private funding sources. What You Should Know 1. Commercial Real Estate Loans.

Source: statista.com

Source: statista.com

Seeking financing from family friends co-workers or people youve met at your local real estate investing meetups are all potential sources of private money. Residential real estate uses a debt-to-income formula for judging your ability to repay a loan while the commercial real estate is based on the debt coverage service ratio formula to qualify. Type of Fund Loan. In real estate project finance equity used to fund the project is usually repaid at the end of a specific time horizon. Local Initiative Support Corporation LISC 500000 to 5000000.

Source: wallstreetprep.com

Source: wallstreetprep.com

In real estate project finance equity used to fund the project is usually repaid at the end of a specific time horizon. Traditional Commercial Real Estate Funding. Banks that provide CRE financing include. In my experience few people fully understand these four buckets of capital let alone how the various capital sources work together to get a real estate deal done. Residential real estate uses a debt-to-income formula for judging your ability to repay a loan while the commercial real estate is based on the debt coverage service ratio formula to qualify.

Source: pinterest.com

Source: pinterest.com

Financing sourced from individual private rather than institutional investors. Commercial Real Estate Loans. An equity investor funds a percentage of a commercial real estate transaction. Commercial Source Funding offers several lending programs that allows us to work with just about all of our clients needs. Private lenders will consider the borrower s experience in.

Source: pinterest.com

Source: pinterest.com

The lender essentially wants to make certain the borrower can repay the loan thus requiring borrowers to provide financial track records to secure a loan. They feature loan programs of up to 10000000 for new construction rehab rental multi-family mixed-use and commercial properties. In addition LRG has extensive financing contacts for large development projects including real estate construction for resorts and multi-family properties. Seeking financing from family friends co-workers or people youve met at your local real estate investing meetups are all potential sources of private money. Type of Fund Loan.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

What You Should Know 1. Let Us Help You Finance Your Next Commercial Real Estate Purchase We can help business organizations of all sizes get the financing needed to purchase either owner or non-owner occupied commercial real estate. Private lenders will consider the borrower s experience in. They feature loan programs of up to 10000000 for new construction rehab rental multi-family mixed-use and commercial properties. These concepts are primarily rooted in the retail sector such as grocery fast food daycares automotive and gas stations as these product types were consistently essential for.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Traditional Commercial Real Estate Funding. What You Should Know 1. An equity investor funds a percentage of a commercial real estate transaction. Private lenders can be anyone with access to capital. Although most commercial real estate is purchased by business entities such as corporations developers and business partnerships it can easily be completed as an individual investor.

Source: pinterest.com

Source: pinterest.com

Traditional Commercial Real Estate Funding. Accredited Investors Only Yes EquityMultiple focuses almost entirely on institutional commercial real estate and it also offers equity preferred equity and senior debt investments. Local Initiative Support Corporation LISC 500000 to 5000000. Commercial Real Estate Loans. Flip Funding specializes in offering financing solutions for commercial and investment real estate nationwide.

Source: reit.com

Source: reit.com

An equity investor funds a percentage of a commercial real estate transaction. Financing sourced from individual private rather than institutional investors. They feature loan programs of up to 10000000 for new construction rehab rental multi-family mixed-use and commercial properties. In real estate project finance equity used to fund the project is usually repaid at the end of a specific time horizon. What You Should Know 1.

Source: pinterest.com

Source: pinterest.com

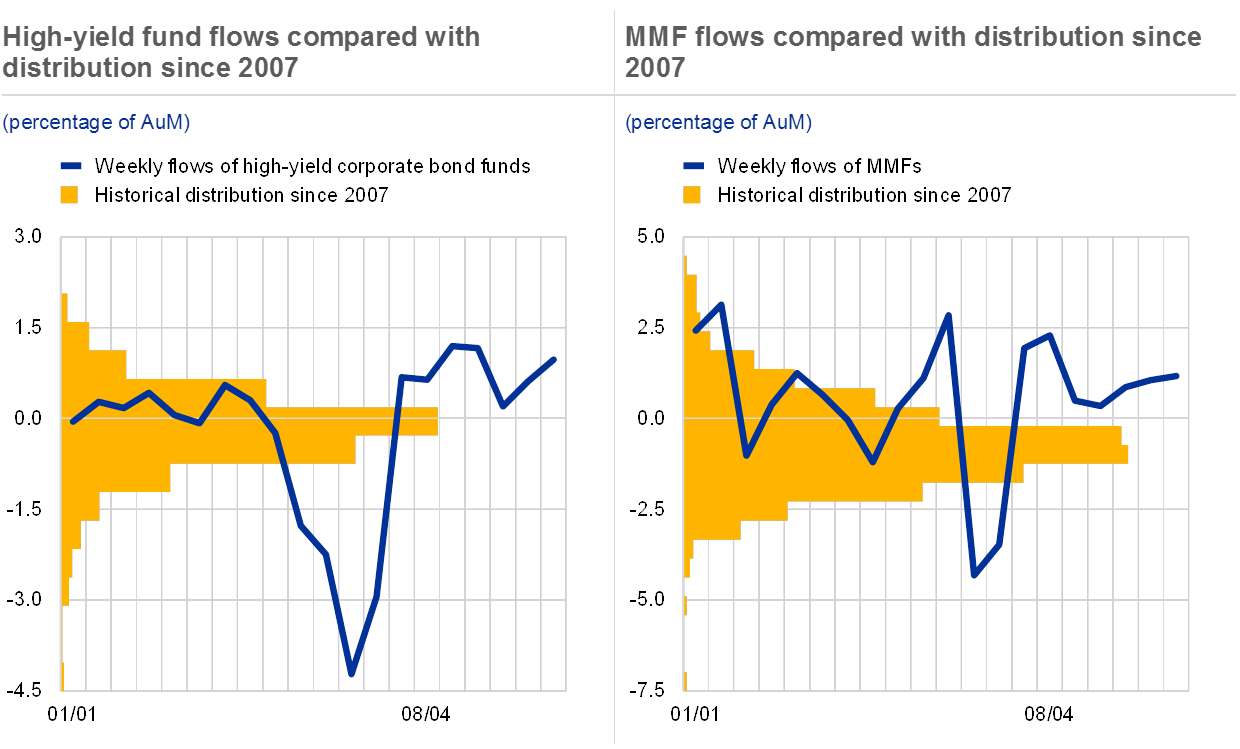

Let Us Help You Finance Your Next Commercial Real Estate Purchase We can help business organizations of all sizes get the financing needed to purchase either owner or non-owner occupied commercial real estate. Let Us Help You Finance Your Next Commercial Real Estate Purchase We can help business organizations of all sizes get the financing needed to purchase either owner or non-owner occupied commercial real estate. To qualify for a commercial. Traditional loans are those you would receive from a bank or an institutionalized lender. 6 days ago As discussed commercial real estate financing is provided by a variety of sources including banks independent lenders insurance companies pension funds private investors and the SBA.

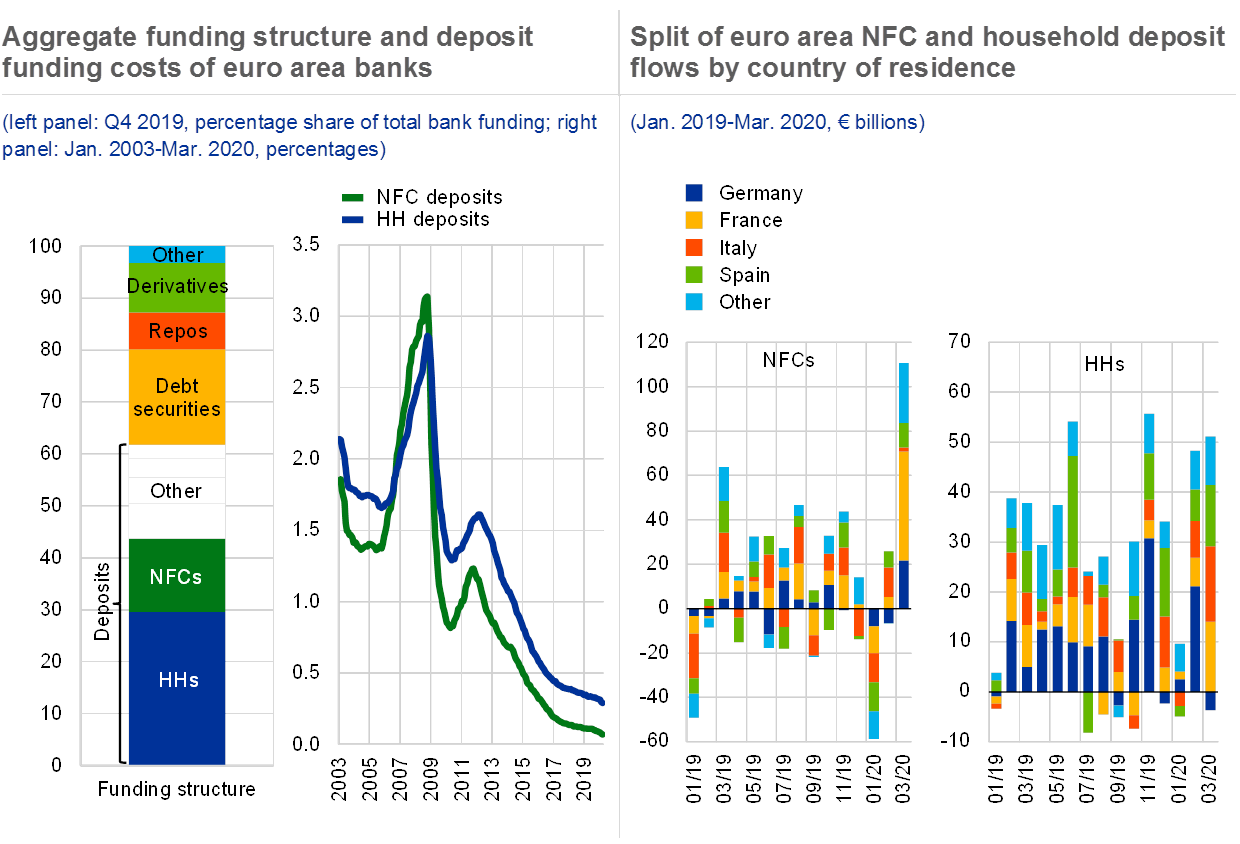

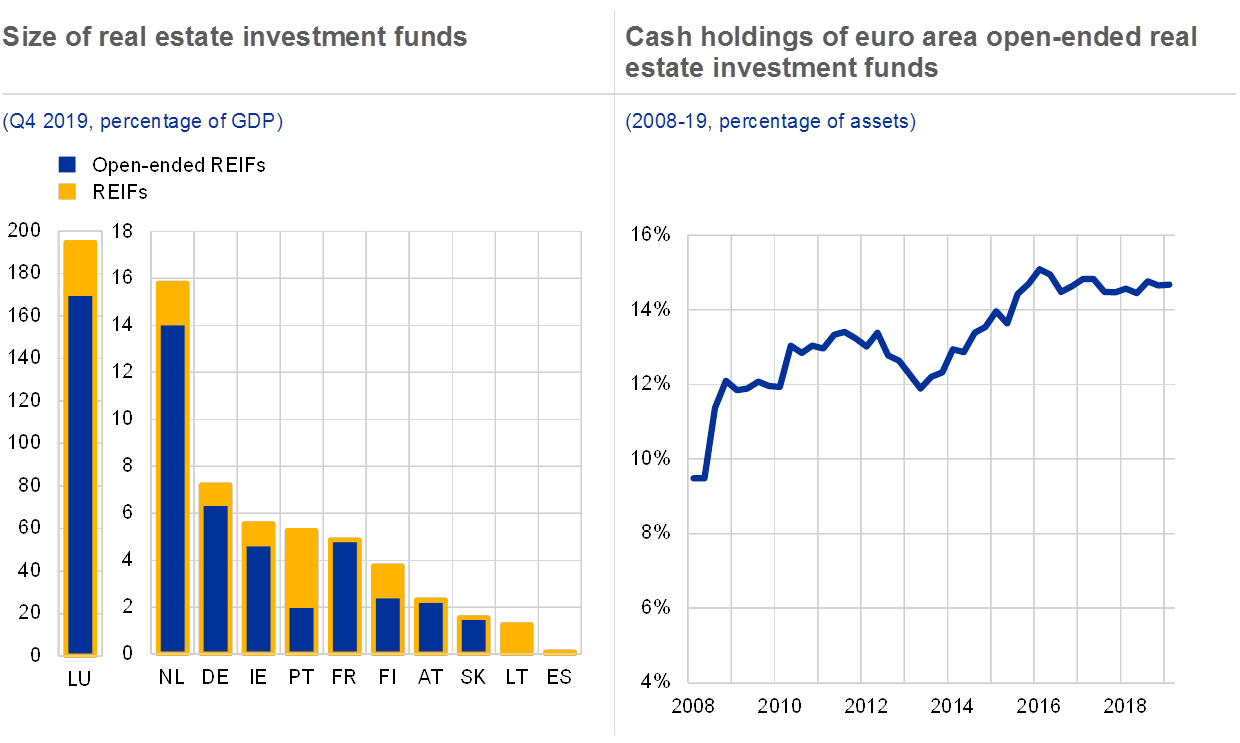

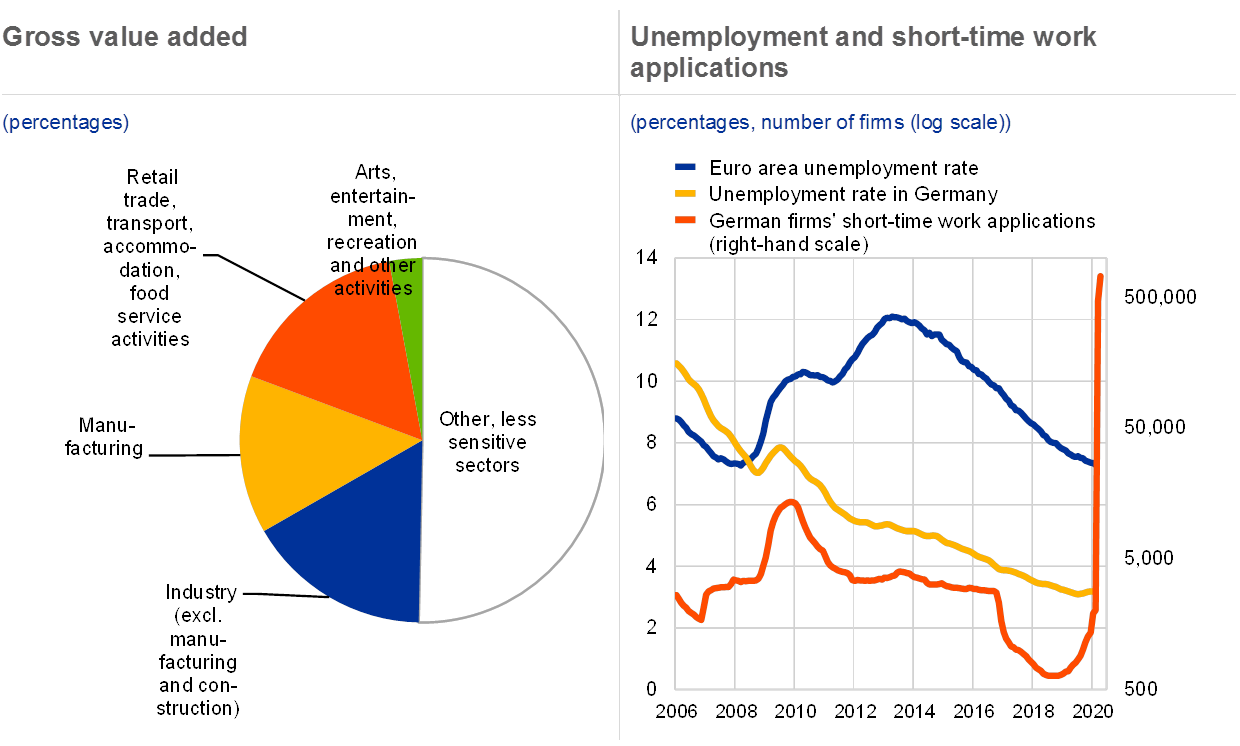

Source: ecb.europa.eu

Source: ecb.europa.eu

In addition LRG has extensive financing contacts for large development projects including real estate construction for resorts and multi-family properties. Private lenders can be anyone with access to capital. There are several sources to finance a real estate business but the most popular of them all are listed below. Five Major Types of Commercial Real Estate Finance Sources. The lender essentially wants to make certain the borrower can repay the loan thus requiring borrowers to provide financial track records to secure a loan.

Source: ecb.europa.eu

Source: ecb.europa.eu

What You Should Know 1. To qualify for a commercial. Public equity public debt private equity or private debt. Although most commercial real estate is purchased by business entities such as corporations developers and business partnerships it can easily be completed as an individual investor. The lender essentially wants to make certain the borrower can repay the loan thus requiring borrowers to provide financial track records to secure a loan.

Source: investopedia.com

Source: investopedia.com

There are several sources to finance a real estate business but the most popular of them all are listed below. Private money is exactly what it sounds like. In real estate project finance equity used to fund the project is usually repaid at the end of a specific time horizon. Capital Stack in Real Estate Project Finance When it comes to funding real estate project finance the capital stack includes several considerations as follows. Private lenders can be anyone with access to capital.

Source: ecb.europa.eu

Source: ecb.europa.eu

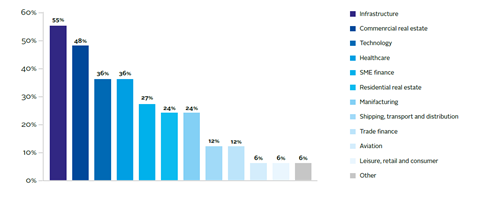

Capital for commercial real estate investments is generally sourced from one or more of the following buckets. Opportunistic lenders fund properties that pose a higher investment. Private money is exactly what it sounds like. Local Initiative Support Corporation LISC 500000 to 5000000. In addition LRG has extensive financing contacts for large development projects including real estate construction for resorts and multi-family properties.

Source: sharplaunch.com

Source: sharplaunch.com

Adaptive reuse of old industrial buildings warehouses and large commercial spaces to a multi-tenant facility United States. What You Should Know 1. Capital for commercial real estate investments is generally sourced from one or more of the following buckets. Five Major Types of Commercial Real Estate Finance Sources. Type of Fund Loan.

Source: unpri.org

Source: unpri.org

Private lenders will consider the borrower s experience in. To qualify for a commercial. Financing sourced from individual private rather than institutional investors. Local Initiative Support Corporation LISC 500000 to 5000000. Banks that provide CRE financing include.

Source: pinterest.com

Source: pinterest.com

They feature loan programs of up to 10000000 for new construction rehab rental multi-family mixed-use and commercial properties. To qualify for a commercial. In my experience few people fully understand these four buckets of capital let alone how the various capital sources work together to get a real estate deal done. The lender essentially wants to make certain the borrower can repay the loan thus requiring borrowers to provide financial track records to secure a loan. In addition LRG has extensive financing contacts for large development projects including real estate construction for resorts and multi-family properties.

Source: ecb.europa.eu

Source: ecb.europa.eu

In real estate project finance equity used to fund the project is usually repaid at the end of a specific time horizon. If youre new to commercial real estate financing youll want to get a firm understanding of the differences between a residential and commercial mortgage loan. An equity investor funds a percentage of a commercial real estate transaction. Traditional loans are those you would receive from a bank or an institutionalized lender. Capital Stack in Real Estate Project Finance When it comes to funding real estate project finance the capital stack includes several considerations as follows.

Source: sharplaunch.com

Source: sharplaunch.com

Traditional loans are those you would receive from a bank or an institutionalized lender. An equity investor funds a percentage of a commercial real estate transaction. Traditional loans are those you would receive from a bank or an institutionalized lender. Commercial Real Estate Loans. In real estate project finance equity used to fund the project is usually repaid at the end of a specific time horizon.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial real estate funding sources by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.