Your Commercial real estate depreciation life images are available. Commercial real estate depreciation life are a topic that is being searched for and liked by netizens today. You can Get the Commercial real estate depreciation life files here. Download all royalty-free photos and vectors.

If you’re looking for commercial real estate depreciation life pictures information related to the commercial real estate depreciation life interest, you have pay a visit to the ideal site. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

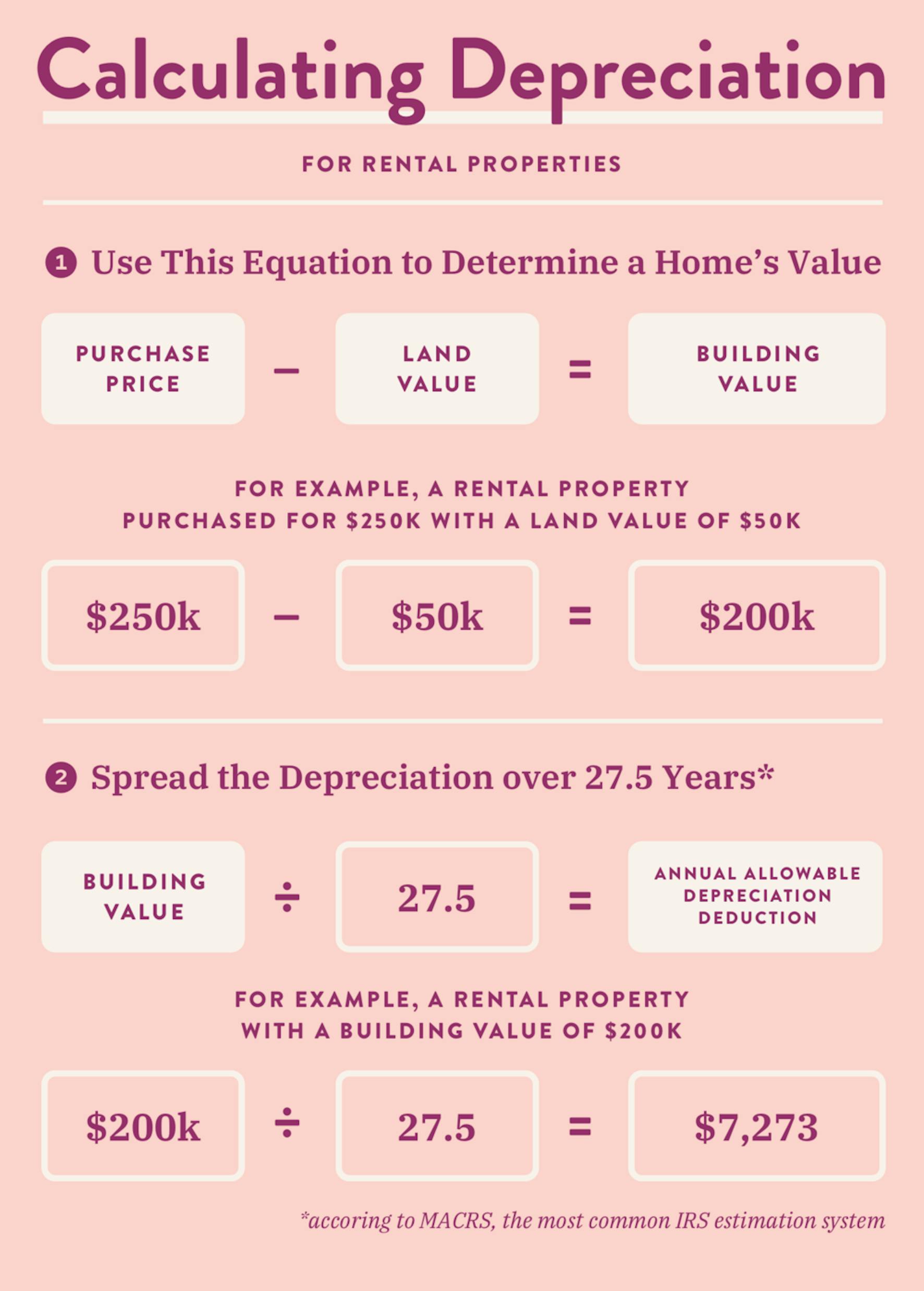

Commercial Real Estate Depreciation Life. The Internal Revenue Service IRS allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. The IRS depreciates residential rental buildings over 275 years and retail and other commercial structures over 39 years. If your heating bill for the year for the entire house was 600 60 600. 7 days ago Substantially unchanged are the rules regarding depreciation tax lives of commercial real property 39 years and residential real property 27 12 years.

How To Assess A Real Estate Investment Trust Reit From investopedia.com

How To Assess A Real Estate Investment Trust Reit From investopedia.com

Some commercial real estate investors have initially been reticent due to the high payoff ratios of cost segregation for commercial real estate. The amendment is retroactive to January 1 2018. Owners of commercial real estate can reduce their tax bill by depreciating the value of their property over a set period of time the buildings useful life as defined by the IRS. However commercial properties that were acquired before May 13 1993 but after 1986 use a 315-year depreciation table. GDS is the default system and it specifies a recovery period of 39 years. The IRS depreciates residential rental buildings over 275 years and retail and other commercial structures over 39 years.

If your heating bill for the year for the entire house was 600 60 600.

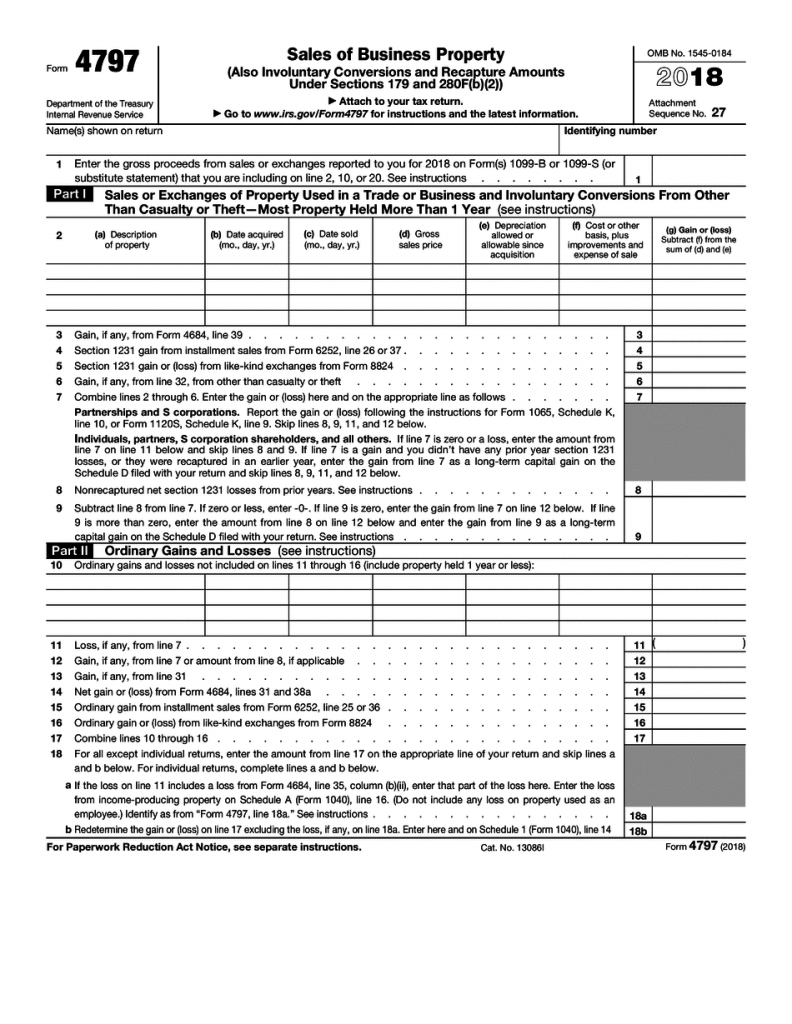

In other words a 1000 to 10000 return not counting possible recapture Advantages and disadvantages of cost segregation. Commercial and residential building assets can be depreciated either over 39-year straight-line for commercial property or a 275-year straight line for residential property as. 179 limitincreases to 1 million from Verified Just Now Url. If in the first year you use the property for less than a full year you must prorate your depreciation deduction for the number of months in use. Also unchanged are the long-term capital gain tax rates generally 20 the application of the 38 Medicare Surtax or the Section 1250 unrecapture rules. To create a universally applicable process the IRS has set depreciation periods for real estate.

Source: solobuildingblogs.com

Source: solobuildingblogs.com

Unless there is a big change in adjusted basis or useful life this amount will stay the same throughout the time you depreciate the property. The Internal Revenue Service IRS allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. Unless there is a big change in adjusted basis or useful life this amount will stay the same throughout the time you depreciate the property. The new law expands the. Commercial and residential building assets can be depreciated either over 39-year straight-line for commercial property or a 275-year straight line for residential property as.

Source: thanmerrill.com

Source: thanmerrill.com

For commercial real estate it. Instead the agency requires you. If your heating bill for the year for the entire house was 600 60 600. GDS is the default system and it specifies a recovery period of 39 years. 179 limitincreases to 1 million from Verified Just Now Url.

Source: commercialcafe.com

Source: commercialcafe.com

For residential properties the depreciation period is 275 years. Owners of commercial real estate can reduce their tax bill by depreciating the value of their property over a set period of time the buildings useful life as defined by the IRS. For residential properties the useful life is considered to be 275 years while commercial properties get a longer 39-year lifespan. The new law expands the. Some commercial real estate investors have initially been reticent due to the high payoff ratios of cost segregation for commercial real estate.

Source: patriotsoftware.com

Source: patriotsoftware.com

For residential properties the depreciation period is 275 years. Also unchanged are the long-term capital gain tax rates generally 20 the application of the 38 Medicare Surtax or the Section 1250 unrecapture rules. For buildings placed in service after 1986 you use the Modified Accelerated Cost Recovery System or MACRS which specifies recovery periods for depreciable assets. Commercial buildings are considered nonresidential real property. Some commercial real estate investors have initially been reticent due to the high payoff ratios of cost segregation for commercial real estate.

Source: realestate.com.au

Source: realestate.com.au

The IRS depreciates residential rental buildings over 275 years and retail and other commercial structures over 39 years. For residential properties the depreciation period is 275 years. Owners of commercial real estate can reduce their tax bill by depreciating the value of their property over a set period of time the buildings useful life as defined by the IRS. GDS is the default system and it specifies a recovery period of 39 years. If in the first year you use the property for less than a full year you must prorate your depreciation deduction for the number of months in use.

Source: fool.com

Source: fool.com

You can deduct as a rental expense 10 of any expense that must be divided between rental use and personal use. Commercial buildings are considered nonresidential real property. 4 days ago How tax reform affects the commercial real estate industry Posted. 179 limitincreases to 1 million from Verified Just Now Url. This gives you your yearly depreciation deduction.

Source: inside1031.com

Source: inside1031.com

So you would deduct an annual depreciation expense on your. Heres a quick look at how commercial real estate depreciation works. The CARES Act amends the TCJA to reduce the depreciable life of QIP from 39 years to 15 years thereby making QIP eligible for 100 percent of the expanded bonus depreciation provisions in the TCJA. The Internal Revenue Service IRS allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. If your heating bill for the year for the entire house was 600 60 600.

Source: fool.com

Source: fool.com

For residential properties the depreciation period is 275 years. The Internal Revenue Service IRS allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. Accounting for depreciation at tax time will reduce ones taxable wages and shelter their money from the government effectively netting them more money each year. However the tax law that went into effect in 2018 expanded the depreciation rules for non residential rental property. For commercial real estate it.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Heres a quick look at how commercial real estate depreciation works. In other words a 1000 to 10000 return not counting possible recapture Advantages and disadvantages of cost segregation. Commercial buildings are considered nonresidential real property. 4 days ago How tax reform affects the commercial real estate industry Posted. The new law expands the.

Source: thanmerrill.com

Source: thanmerrill.com

Depreciation for commercial properties is on a more extended basis of 39 years. However the tax law that went into effect in 2018 expanded the depreciation rules for non residential rental property. 179 limitincreases to 1 million from Verified Just Now Url. Additional gain on sale if a sale occurs prior to the property going into an estate. Also unchanged are the long-term capital gain tax rates generally 20 the application of the 38 Medicare Surtax or the Section 1250 unrecapture rules.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

The IRS depreciates residential rental buildings over 275 years and retail and other commercial structures over 39 years. 179 limitincreases to 1 million from Verified Just Now Url. So you would deduct an annual depreciation expense on your. This useful life of the property doesnt include the land value only the building and improvements. In general real property and improvements to real property are depreciated over either 275 years residential property or 39 years commercial property.

Source: retipster.com

Source: retipster.com

Depreciation for commercial properties is on a more extended basis of 39 years. So you would deduct an annual depreciation expense on your. Also unchanged are the long-term capital gain tax rates generally 20 the application of the 38 Medicare Surtax or the Section 1250 unrecapture rules. However the tax law that went into effect in 2018 expanded the depreciation rules for non residential rental property. The IRS depreciates residential rental buildings over 275 years and retail and other commercial structures over 39 years.

Source: fastcapital360.com

Source: fastcapital360.com

The IRS depreciates residential rental buildings over 275 years and retail and other commercial structures over 39 years. For residential properties the depreciation period is 275 years. If your heating bill for the year for the entire house was 600 60 600. In the past major improvements such as HVAC replacements and roofs were caught by this rule. Year-one pay back ratios are often 101 to 1001.

Source: fool.com

Source: fool.com

The CARES Act amends the TCJA to reduce the depreciable life of QIP from 39 years to 15 years thereby making QIP eligible for 100 percent of the expanded bonus depreciation provisions in the TCJA. 4 days ago How tax reform affects the commercial real estate industry Posted. The General Depreciation System or GDS and the Alternative Depreciation System or ADS. Some commercial real estate investors have initially been reticent due to the high payoff ratios of cost segregation for commercial real estate. That means investors who rent out commercial real estate may deduct a portion of the buildings original cost each year over the course of 40 or so years.

Source: chamberofcommerce.org

Source: chamberofcommerce.org

Additional gain on sale if a sale occurs prior to the property going into an estate. The new law expands the. The Internal Revenue Service IRS allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. Depreciation CommercialIndustrial Structures we correlate the row for an effective age of fourteen 14 years with the typical life expectancy column for thirty-five 35 years and find the normal depreciation. Additional gain on sale if a sale occurs prior to the property going into an estate.

Source: wealthfit.com

Source: wealthfit.com

Massive depreciation in the early years leads to massive tax savings. This useful life of the property doesnt include the land value only the building and improvements. In general real property and improvements to real property are depreciated over either 275 years residential property or 39 years commercial property. 179 limitincreases to 1 million from Verified Just Now Url. However the tax law that went into effect in 2018 expanded the depreciation rules for non residential rental property.

Source: investopedia.com

Source: investopedia.com

However commercial properties that were acquired before May 13 1993 but after 1986 use a 315-year depreciation table. Heres a quick look at how commercial real estate depreciation works. 7 days ago Substantially unchanged are the rules regarding depreciation tax lives of commercial real property 39 years and residential real property 27 12 years. Because commercial real estate is considered an asset rather than an expense the Internal Revenue Service wont let you write off its cost in the year you buy it. However commercial properties that were acquired before May 13 1993 but after 1986 use a 315-year depreciation table.

Source: researchgate.net

Source: researchgate.net

Massive depreciation in the early years leads to massive tax savings. However commercial properties that were acquired before May 13 1993 but after 1986 use a 315-year depreciation table. In other words a 1000 to 10000 return not counting possible recapture Advantages and disadvantages of cost segregation. Accounting for depreciation at tax time will reduce ones taxable wages and shelter their money from the government effectively netting them more money each year. The new law expands the.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate depreciation life by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.