Your Commercial real estate debt placement images are ready. Commercial real estate debt placement are a topic that is being searched for and liked by netizens today. You can Download the Commercial real estate debt placement files here. Download all royalty-free photos and vectors.

If you’re searching for commercial real estate debt placement images information connected with to the commercial real estate debt placement interest, you have visit the right site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

Commercial Real Estate Debt Placement. Distributions from cash flow and distributions from a capital event ie. At Guardian Property Advisors we are prepared to provide the commercial real estate financing solutions your organization needs and wants in all 50 states. A good broker can save a project a lot more than the cost of this fee. As the debt landscape changes it is important more than ever to have a trusted advisor marketing your opportunity to a wide variety of debt providers.

Commercial Real Estate Debt In A Covid 19 World J P Morgan Asset Management From am.jpmorgan.com

Commercial Real Estate Debt In A Covid 19 World J P Morgan Asset Management From am.jpmorgan.com

My fundamental understanding of commercial real estate risk and the best ways to mitigate risk through loan structure will provide the confidence and certainty of execution that you require. Our relationship with the nations premier financial institutions and real estate capital providers enables clients to obtain financing. CONNECT WITH FINANCING EQUITY 1. In addition to the finance business Matthews responsibilities include sourcing and executing loan sale restructuring and. At Guardian Property Advisors we are prepared to provide the commercial real estate financing solutions your organization needs and wants in all 50 states. We provide clients access to valuable relationships offering debt and equity solutions for nearly every type of commercial real estate investment.

This form of investment in real estate is generally thought of as high risk high return given that the invested capital is most often the first dollar in and the last dollar out.

The comprehensive process we run wherein lenders compete for your business ensures you receive the best terms and execution for your deal. Capital Market Funds LLC continues its historical relationships with local regional and national banks along with conduits CMBS loan providers. However every Broker is entitled to pick the salary they are comfortable with. Commercial banking institutions Small Business Administration SBA. From our glossary of commercial real estate terms. This form of investment in real estate is generally thought of as high risk high return given that the invested capital is most often the first dollar in and the last dollar out.

Source: urbancoreadvisors.com

Source: urbancoreadvisors.com

The strategy specializes in debt-driven opportunities across the Real Estate groups six areas of investment focus commercial real estate real estate-related corporate investments structure finance commercial NPLs residential real estate and non-US. As the debt landscape changes it is important more than ever to have a trusted advisor marketing your opportunity to a wide variety of debt providers. After that its a 5050 fee split until you make a certain interval usually around 750000 in fees which bumps the brokers. Debt Placement C4 Financial provides innovative and comprehensive financing packages for commercial real estate investment optimization. My fundamental understanding of commercial real estate risk and the best ways to mitigate risk through loan structure will provide the confidence and certainty of execution that you require.

Source: am.jpmorgan.com

Source: am.jpmorgan.com

Commercial banking institutions Small Business Administration SBA. Private Placement Debt Before there was a public bond market or a Securities and Exchange Commission the private placement market was actively providing capital to borrowers. Capital Market Funds LLC specialized in commercial real estate debt placement. This form of investment in real estate is generally thought of as high risk high return given that the invested capital is most often the first dollar in and the last dollar out. A waterfall also known as a waterfall model or structure is a legal term used in an Operating Agreement that describes how money is paid when it is paid and to whom it is paid in commercial real estate equity investments.

Source: sharplaunch.com

Source: sharplaunch.com

Debt Placement Fee. CONNECT WITH FINANCING EQUITY 1. For any commercial real estate program to be successful you need access to a consistent reliable source of capital. Matthew Polci serves as a Senior Vice President in the Debt Equity Finance Group at Mission Capital where he is responsible for the origination structuring and placement of commercial real estate transactions on behalf of owners investors and developers nationwide. My fundamental understanding of commercial real estate risk and the best ways to mitigate risk through loan structure will provide the confidence and certainty of execution that you require.

Source: cushmanwakefield.com

Source: cushmanwakefield.com

This is a fee that is often paid to an outside broker which is standard industry practice for lining up debt. My fundamental understanding of commercial real estate risk and the best ways to mitigate risk through loan structure will provide the confidence and certainty of execution that you require. As the debt landscape changes it is important more than ever to have a trusted advisor marketing your opportunity to a wide variety of debt providers. Commercial Mortgage Loans AUM NAV 74 Bn 3 Commercial Mortgage Loans AUM GMV We seek to identify institutional quality 4 commercial mortgages that offer higher relative value than similarly rated corporate bonds. Debt Placement Fee.

Source: cushmanwakefield.com

Source: cushmanwakefield.com

In addition to the finance business Matthews responsibilities include sourcing and executing loan sale restructuring and. Commercial Mortgage Loans AUM NAV 74 Bn 3 Commercial Mortgage Loans AUM GMV We seek to identify institutional quality 4 commercial mortgages that offer higher relative value than similarly rated corporate bonds. I began my career in real estate bankingbrokerage in 2000 and Ive been responsible for structuring and placing over 20 billion in debt and equity financings. Real estate and pursues a wide range of investments including CMBS commercial and residential mortgages mezzanine loans and. Our experts can arrange competitive commercial real estate debt placement through our extensive capital network.

Source: equitymultiple.com

Source: equitymultiple.com

Initial issuers were railroads mining and canal companies deals that might be. At Guardian Property Advisors we are prepared to provide the commercial real estate financing solutions your organization needs and wants in all 50 states. Our experts can arrange competitive commercial real estate debt placement through our extensive capital network. Master of Advanced Studies in Real Estate Real Estate Debt als alternative Anlageklasse für Schweizer Pensionskassen und Versicherungen Verfasserin. In addition to the finance business Matthews responsibilities include sourcing and executing loan sale restructuring and.

Source: pinterest.com

Source: pinterest.com

Real Estate Debt Placement Commercial Brokers International assists clients on an array of debt structures with the most competitive programs on the market. We provide clients access to valuable relationships offering debt and equity solutions for nearly every type of commercial real estate investment. Private Placement Debt Before there was a public bond market or a Securities and Exchange Commission the private placement market was actively providing capital to borrowers. I have established deep relationships with capital providers. The structuring and placement of complex financial products is a crucial part of what Madison Partners does for many West Coast commercial property owners.

Source: pinterest.com

Source: pinterest.com

So if you want to make minimum wage your desk fee would be around 30K. InterPres combines its in-depth knowledge of debt structuring and placement with our extensive commercial real estate experience to provide prudent advice to investors seeking capital to acquire or finance commercial real estate investments. This form of investment in real estate is generally thought of as high risk high return given that the invested capital is most often the first dollar in and the last dollar out. So if you want to make minimum wage your desk fee would be around 30K. Participation Structures Whole Loan Originations Commingled Vehicles Other Structured Solutions 1.

Source: pinterest.com

Source: pinterest.com

Debt Placement Fee. Debt Placement Fee. Commercial banking institutions Small Business Administration SBA. I work in Debt Placement at what sounds like a similar firm. For any commercial real estate program to be successful you need access to a consistent reliable source of capital.

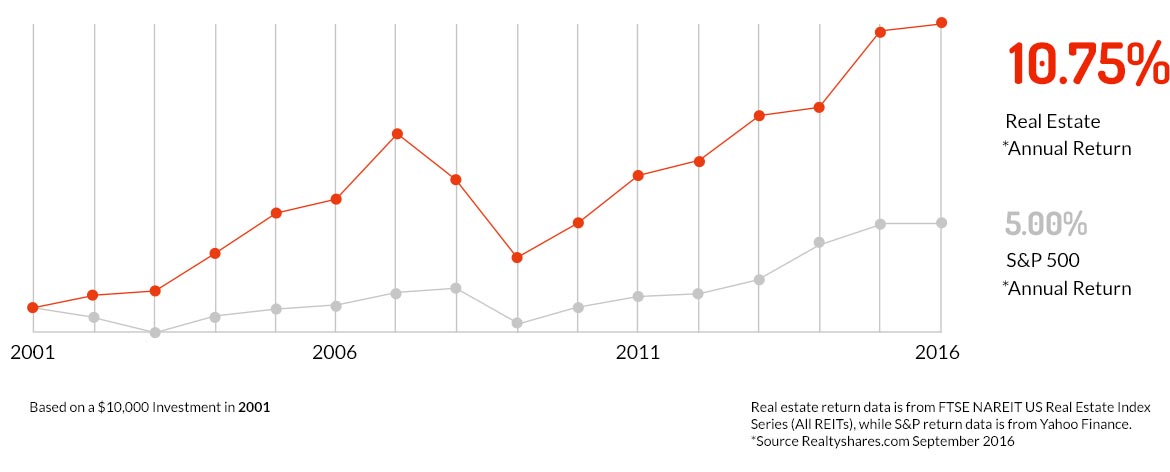

Source: utahpropertyinvestors.com

Source: utahpropertyinvestors.com

However every Broker is entitled to pick the salary they are comfortable with. By managing the financing process for you we take on the burden of interfacing with the capital provider to ensure. At Guardian Property Advisors we are prepared to provide the commercial real estate financing solutions your organization needs and wants in all 50 states. Capital Market Funds LLC continues its historical relationships with local regional and national banks along with conduits CMBS loan providers. I have established deep relationships with capital providers.

Source: urbancoreadvisors.com

Source: urbancoreadvisors.com

I began my career in real estate bankingbrokerage in 2000 and Ive been responsible for structuring and placing over 20 billion in debt and equity financings. This is a fee that is often paid to an outside broker which is standard industry practice for lining up debt. Debt Placement C4 Financial provides innovative and comprehensive financing packages for commercial real estate investment optimization. Our relationship with the nations premier financial institutions and real estate capital providers enables clients to obtain financing. Capital Market Funds LLC specialized in commercial real estate debt placement.

Source: br.pinterest.com

Source: br.pinterest.com

Our experts can arrange competitive commercial real estate debt placement through our extensive capital network. CONNECT WITH FINANCING EQUITY 1. The comprehensive process we run wherein lenders compete for your business ensures you receive the best terms and execution for your deal. We provide clients access to valuable relationships offering debt and equity solutions for nearly every type of commercial real estate investment. I began my career in real estate bankingbrokerage in 2000 and Ive been responsible for structuring and placing over 20 billion in debt and equity financings.

Source: investmentbank.com

Source: investmentbank.com

The typical fee is between 25 and 75 of total debt depending on deal size. Real Estate Debt Placement Commercial Brokers International assists clients on an array of debt structures with the most competitive programs on the market. 1 8604 Volketswil kreicherterbluewinch 044 491 18 08 Eingereicht bei. Private Placement Debt Before there was a public bond market or a Securities and Exchange Commission the private placement market was actively providing capital to borrowers. Debt Placement Fee.

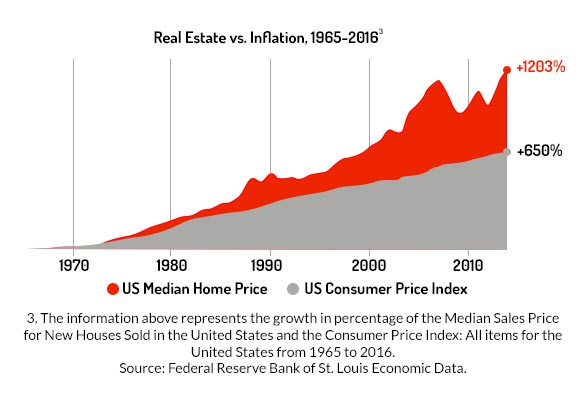

Source: utahpropertyinvestors.com

Source: utahpropertyinvestors.com

For any commercial real estate program to be successful you need access to a consistent reliable source of capital. 1 8604 Volketswil kreicherterbluewinch 044 491 18 08 Eingereicht bei. We provide clients access to valuable relationships offering debt and equity solutions for nearly every type of commercial real estate investment. Master of Advanced Studies in Real Estate Real Estate Debt als alternative Anlageklasse für Schweizer Pensionskassen und Versicherungen Verfasserin. Real estate and pursues a wide range of investments including CMBS commercial and residential mortgages mezzanine loans and.

Source: preqin.com

Source: preqin.com

As the debt landscape changes it is important more than ever to have a trusted advisor marketing your opportunity to a wide variety of debt providers. The comprehensive process we run wherein lenders compete for your business ensures you receive the best terms and execution for your deal. Our desk fee is usually some multiple of the brokers salary 15 - 20xs. My fundamental understanding of commercial real estate risk and the best ways to mitigate risk through loan structure will provide the confidence and certainty of execution that you require. Master of Advanced Studies in Real Estate Real Estate Debt als alternative Anlageklasse für Schweizer Pensionskassen und Versicherungen Verfasserin.

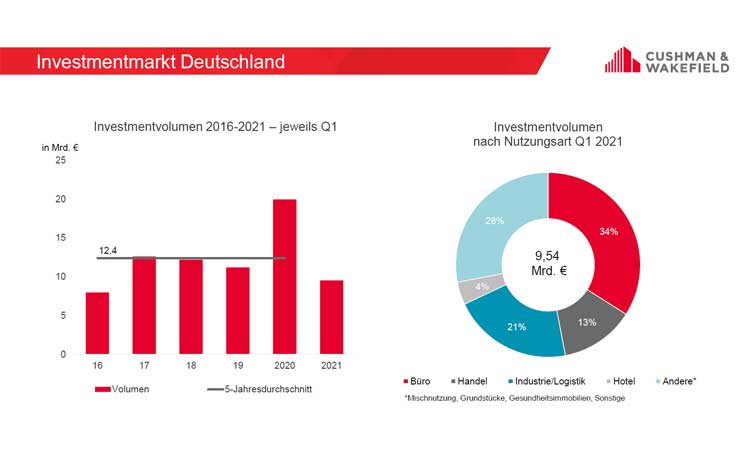

Source: cushmanwakefield.com

Source: cushmanwakefield.com

Capital Market Funds LLC continues its historical relationships with local regional and national banks along with conduits CMBS loan providers. We also have life-insurance. As the debt landscape changes it is important more than ever to have a trusted advisor marketing your opportunity to a wide variety of debt providers. Our experts can arrange competitive commercial real estate debt placement through our extensive capital network. Our desk fee is usually some multiple of the brokers salary 15 - 20xs.

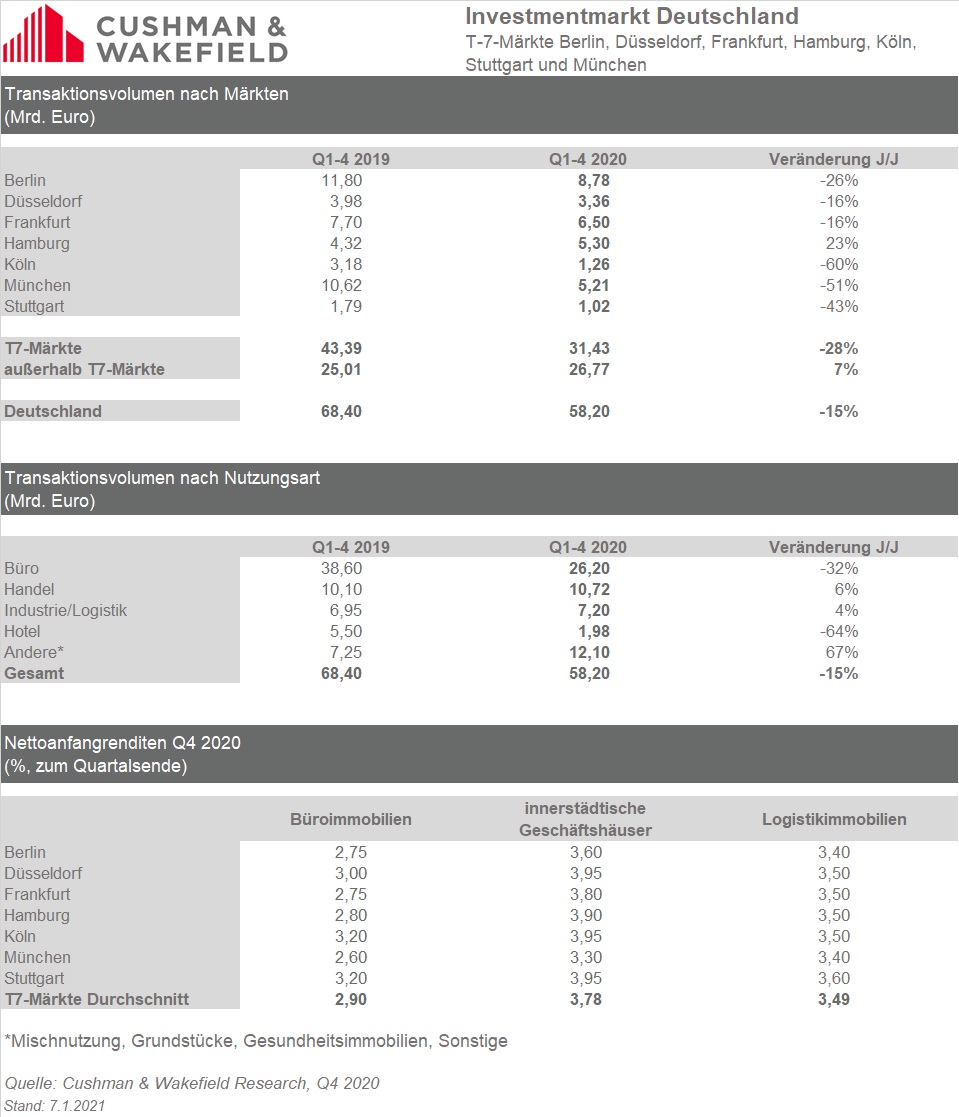

Source: cushmanwakefield.com

Source: cushmanwakefield.com

A good broker can save a project a lot more than the cost of this fee. Commercial banking institutions Small Business Administration SBA. InterPres combines its in-depth knowledge of debt structuring and placement with our extensive commercial real estate experience to provide prudent advice to investors seeking capital to acquire or finance commercial real estate investments. A waterfall also known as a waterfall model or structure is a legal term used in an Operating Agreement that describes how money is paid when it is paid and to whom it is paid in commercial real estate equity investments. Debt Placement C4 Financial provides innovative and comprehensive financing packages for commercial real estate investment optimization.

Source: pinterest.com

Source: pinterest.com

Debt Placement Fee. Our extensive network of industry relationships and capital markets knowledge allows us to source the specific types of financing our clients seek. My fundamental understanding of commercial real estate risk and the best ways to mitigate risk through loan structure will provide the confidence and certainty of execution that you require. A waterfall also known as a waterfall model or structure is a legal term used in an Operating Agreement that describes how money is paid when it is paid and to whom it is paid in commercial real estate equity investments. Participation Structures Whole Loan Originations Commingled Vehicles Other Structured Solutions 1.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate debt placement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.