Your Commercial real estate debt investment images are ready. Commercial real estate debt investment are a topic that is being searched for and liked by netizens now. You can Download the Commercial real estate debt investment files here. Find and Download all free images.

If you’re looking for commercial real estate debt investment pictures information connected with to the commercial real estate debt investment keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

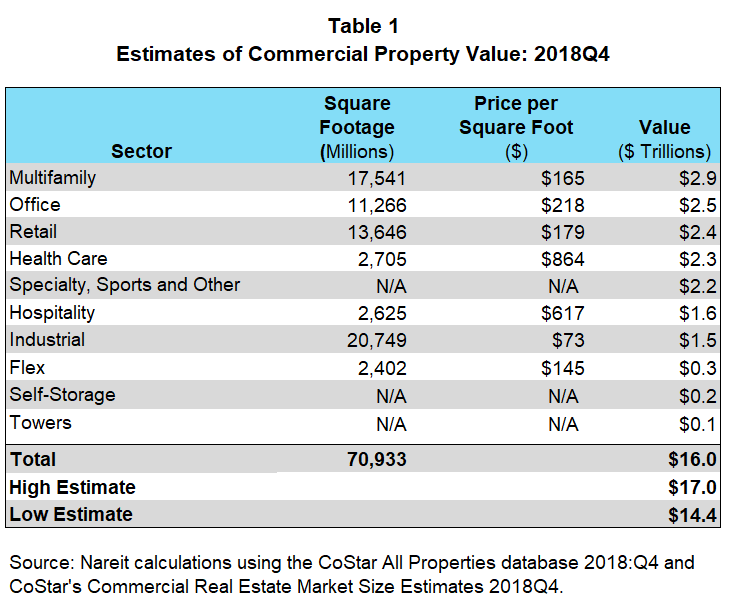

Commercial Real Estate Debt Investment. Apollo Commercial Real Estate Finance Inc. Roughly 430 billion in commercial and multifamily real estate debt matures in 2021 forcing lenders and borrowers to come to terms about what buildings are worth in. 27 2021 at 924 am. In most cases if you have renters youre probably in the commercial real estate business.

How To Make Money In Real Estate From investopedia.com

How To Make Money In Real Estate From investopedia.com

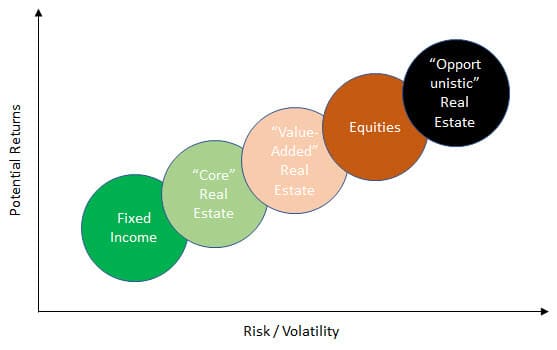

The strategy specializes in debt-driven opportunities across the Real Estate groups six areas of investment focus commercial real. A mix of equity and debt investments has the best potential for balancing risk and reward in a real estate portfolio. Commercial mortgage loans are typically illiquid and do not have an active secondary market. 26 2021 at 215 pm. Apollo Commercial Real Estate Finance Inc. Examples of commercial real estate include office and retail space industrial facilities apartment buildings and multi-family homes among other things.

Commercial Real Estate Debt Fund Three Most Common Debt Financing Loans.

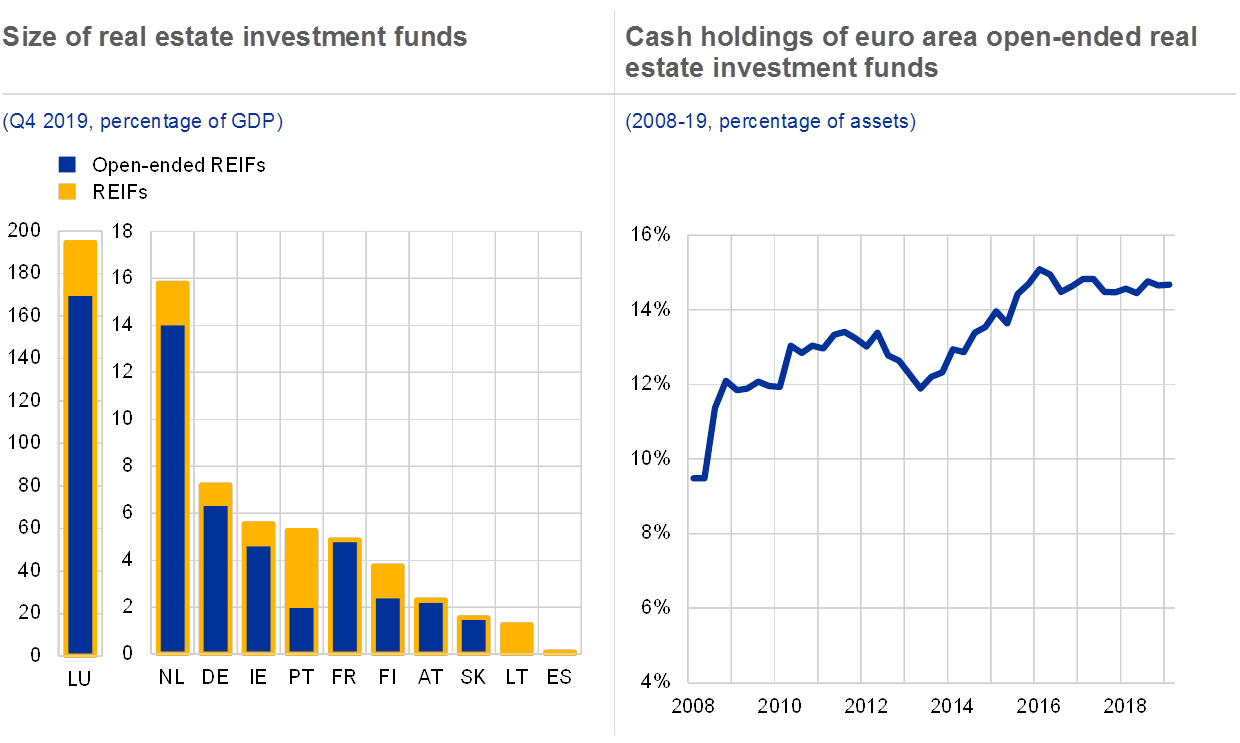

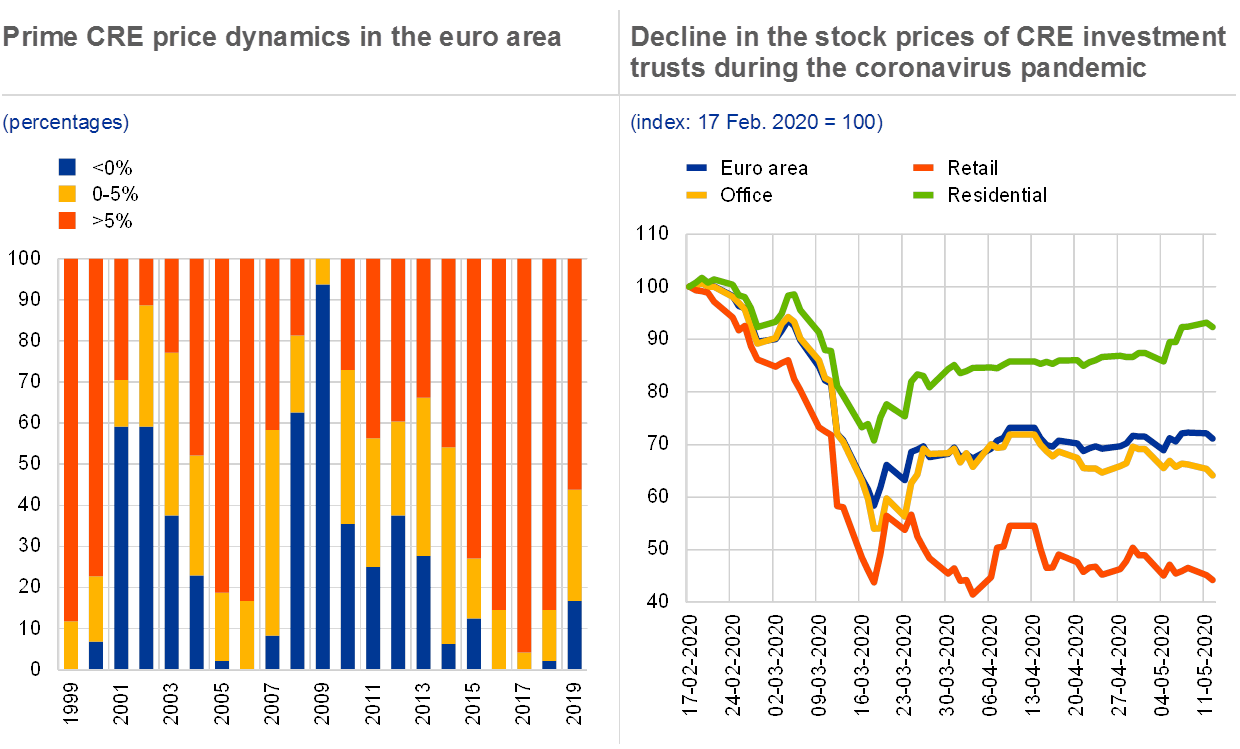

While both types of insurer invest mainly in private markets life insurers tend to do so in the form of debt such as commercial real estate CRE loans or residential mortgages while non-life insurers prefer direct real estate investments. Is a real estate investment trust that primarily originates and invests in senior mortgages mezzanine loans and other commercial real estate-related debt investments collateralized by properties throughout the United States and Europe. Investors should consider key risks of investing in commercial real estate debt. That leaves 20 that need to be covered with equity cash on hand. Often the bank will lend up to 75 of the property and. Real Estate Debt Funds occupy an important place in the commercial real estate finance markets.

Source: naic.org

Source: naic.org

What is Commercial Real Estate CRE Debt Traditional investment advice states that as you approach retirement your overall investment mix should weigh toward wealth preservation and risk mitigation. The loan is secured by the property itself. 5 Keys to Making Decisions in Commercial Real. Commercial real estate is any property you buy for investment purposes. 27 2021 at 924 am.

Source: naic.org

Source: naic.org

How Debt Investments Work When investing in real estate debt instruments the investor is acting as a lender to the property owner or the deal sponsor. Often the bank will lend up to 75 of the property and. In most cases if you have renters youre probably in the commercial real estate business. Investors should consider key risks of investing in commercial real estate debt. Commercial Real Estate.

Source: ecb.europa.eu

Source: ecb.europa.eu

The Real Estate Debt strategy seeks to achieve attractive risk-adjusted returns and produce current income by investing in real estate-related debt that is not anticipated to result in control of the underlying asset. Examples of commercial real estate include office and retail space industrial facilities apartment buildings and multi-family homes among other things. Roughly 430 billion in commercial and multifamily real estate debt matures in 2021 forcing lenders and borrowers to come to terms about what buildings are worth in. Investors should consider key risks of investing in commercial real estate debt. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Source: investopedia.com

Source: investopedia.com

Gaining real estate exposure via public markets only plays a minor role. Commercial Real Estate. Investors should consider key risks of investing in commercial real estate debt. That leaves 20 that need to be covered with equity cash on hand. Going into Debt to Invest in Commercial Real Estate Benefits You can use borrowed capital to invest in commercial real estate.

Source: sharplaunch.com

Source: sharplaunch.com

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. This is especially true for investments in mortgage-backed securities which have almost disappeared. In a conventional real estate transaction an investor can usually cover the senior debt for up to max 80 of a propertys value. This YouTube Channel is 1 for commercial real estate investing worldwide and the lessons you can learn for free from these videos are priceless. Commercial Real Estate Debt Fund Three Most Common Debt Financing Loans.

Source: preqin.com

Source: preqin.com

Going into Debt to Invest in Commercial Real Estate Benefits You can use borrowed capital to invest in commercial real estate. The Real Estate Debt strategy seeks to achieve attractive risk-adjusted returns and produce current income by investing in real estate-related debt that is not anticipated to result in control of the underlying asset. Commercial Real Estate Debt Fund Three Most Common Debt Financing Loans. While both types of insurer invest mainly in private markets life insurers tend to do so in the form of debt such as commercial real estate CRE loans or residential mortgages while non-life insurers prefer direct real estate investments. That leaves 20 that need to be covered with equity cash on hand.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

While both types of insurer invest mainly in private markets life insurers tend to do so in the form of debt such as commercial real estate CRE loans or residential mortgages while non-life insurers prefer direct real estate investments. You produce wealth by. Investors pile into risky commercial real estate debt even as Fed warns of trouble Last Updated. While both types of insurer invest mainly in private markets life insurers tend to do so in the form of debt such as commercial real estate CRE loans or residential mortgages while non-life insurers prefer direct real estate investments. There is no assurance that commercial real estate.

Source: we-heart.com

Source: we-heart.com

High-return investments tend to capture the bulk of media attention as risk and outperformance make for a more dramatic narrative. Often the bank will lend up to 75 of the property and. The strategy specializes in debt-driven opportunities across the Real Estate groups six areas of investment focus commercial real. Commercial mortgage loans are typically illiquid and do not have an active secondary market. What is Commercial Real Estate CRE Debt Traditional investment advice states that as you approach retirement your overall investment mix should weigh toward wealth preservation and risk mitigation.

Source: de.pinterest.com

Source: de.pinterest.com

Going into Debt to Invest in Commercial Real Estate Benefits You can use borrowed capital to invest in commercial real estate. This is especially true for investments in mortgage-backed securities which have almost disappeared. Commercial real estate debt investing can generate returns on a risk-adjusted basis that compare favorably against expected equity returns but with debt risk characteristics and benefits. Often the bank will lend up to 75 of the property and. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Source: realcrowd.com

Source: realcrowd.com

Apollo Commercial Real Estate Finance Inc. Investors pile into risky commercial real estate debt even as Fed warns of trouble Last Updated. Is a real estate investment trust that primarily originates and invests in senior mortgages mezzanine loans and other commercial real estate-related debt investments collateralized by properties throughout the United States and Europe. Commercial Real Estate. That leaves 20 that need to be covered with equity cash on hand.

Source: whitecase.com

Source: whitecase.com

The Real Estate Debt strategy seeks to achieve attractive risk-adjusted returns and produce current income by investing in real estate-related debt that is not anticipated to result in control of the underlying asset. While both types of insurer invest mainly in private markets life insurers tend to do so in the form of debt such as commercial real estate CRE loans or residential mortgages while non-life insurers prefer direct real estate investments. Commercial mortgage loans are typically illiquid and do not have an active secondary market. Global real estate debt funds dry powder the amount of capital raised but not invested has piled up to 61 billion as of March 2019 from a low of 12 billion as of December 2012. The loan is secured by the property itself.

Source: realcrowd.com

Source: realcrowd.com

High-return investments tend to capture the bulk of media attention as risk and outperformance make for a more dramatic narrative. How Debt Investments Work When investing in real estate debt instruments the investor is acting as a lender to the property owner or the deal sponsor. Real Estate Debt Funds occupy an important place in the commercial real estate finance markets. Commercial real estate debt investing can generate returns on a risk-adjusted basis that compare favorably against expected equity returns but with debt risk characteristics and benefits. The three most common types of debt financing loans offer different incentives.

Source: ecb.europa.eu

Source: ecb.europa.eu

In a conventional real estate transaction an investor can usually cover the senior debt for up to max 80 of a propertys value. How to invest in. Examples of commercial real estate include office and retail space industrial facilities apartment buildings and multi-family homes among other things. A mix of equity and debt investments has the best potential for balancing risk and reward in a real estate portfolio. Commercial real estate is any property you buy for investment purposes.

Source: statista.com

Source: statista.com

In addition while commercial loans are typically secured by a first-priority mortgage on commercial real estate properties they are still subject to the risk of default by the borrower. Global real estate debt funds dry powder the amount of capital raised but not invested has piled up to 61 billion as of March 2019 from a low of 12 billion as of December 2012. How Debt Investments Work When investing in real estate debt instruments the investor is acting as a lender to the property owner or the deal sponsor. How to invest in. The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said.

Source: we-heart.com

Source: we-heart.com

Commercial mortgage loans are typically illiquid and do not have an active secondary market. Your money is at work because you are leveraging the banks money to buy the property. Gaining real estate exposure via public markets only plays a minor role. 5 Keys to Making Decisions in Commercial Real. Is a real estate investment trust that primarily originates and invests in senior mortgages mezzanine loans and other commercial real estate-related debt investments collateralized by properties throughout the United States and Europe.

Source: reit.com

Source: reit.com

In most cases if you have renters youre probably in the commercial real estate business. There is no assurance that commercial real estate. High-return investments tend to capture the bulk of media attention as risk and outperformance make for a more dramatic narrative. The loan is secured by the property itself. The strategy specializes in debt-driven opportunities across the Real Estate groups six areas of investment focus commercial real.

Source: whitecase.com

Source: whitecase.com

From cryptocurrencies to pre-IPO startups to. The Real Estate Debt strategy seeks to achieve attractive risk-adjusted returns and produce current income by investing in real estate-related debt that is not anticipated to result in control of the underlying asset. 5 Keys to Making Decisions in Commercial Real. Commercial Real Estate. Often the bank will lend up to 75 of the property and.

Source: pinterest.com

Source: pinterest.com

Commercial real estate debt investing can generate returns on a risk-adjusted basis that compare favorably against expected equity returns but with debt risk characteristics and benefits. The loan is secured by the property itself. In addition while commercial loans are typically secured by a first-priority mortgage on commercial real estate properties they are still subject to the risk of default by the borrower. Investors pile into risky commercial real estate debt even as Fed warns of trouble Last Updated. Going into Debt to Invest in Commercial Real Estate Benefits You can use borrowed capital to invest in commercial real estate.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate debt investment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.