Your Commercial real estate debt funds list images are available in this site. Commercial real estate debt funds list are a topic that is being searched for and liked by netizens now. You can Get the Commercial real estate debt funds list files here. Get all free photos.

If you’re searching for commercial real estate debt funds list pictures information linked to the commercial real estate debt funds list keyword, you have pay a visit to the ideal site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Commercial Real Estate Debt Funds List. Real Estate Debt Fundraising Debt funds played a very minor role in the private real estate industry prior to the fi nancial crisis with the majority of the aggregate capital raised by real estate funds accounted for by those focused solely on equity Fig. However the private real estate debt market opened up considerably to alternative. Real Estate Debt Fund Strategien. Relevante Bestimmungen von BVV2.

Methods To Carry Out A Vacancy Risk Assessment In Cre Investments Investing Commercial Property Real Estate Career From pinterest.com

Methods To Carry Out A Vacancy Risk Assessment In Cre Investments Investing Commercial Property Real Estate Career From pinterest.com

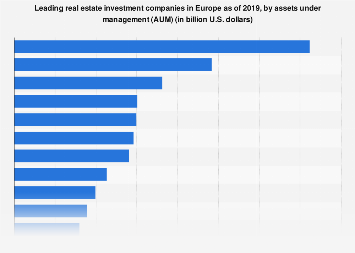

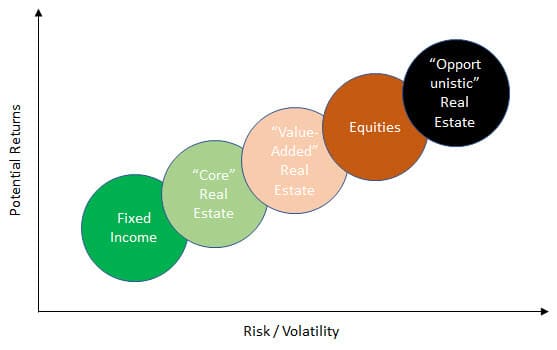

Real Estate Debt Fundraising Debt funds played a very minor role in the private real estate industry prior to the fi nancial crisis with the majority of the aggregate capital raised by real estate funds accounted for by those focused solely on equity Fig. North American-based managers in. Corporate bonds are represented by the ICE BofAML US. REDFs have shorter terms than typical private equity and infrastructure funds and their investment period is shorter. Real estate private debt funds are pools of private equity-backed capital that have mandates or targets to originate senior and mezzanine real estate collateralized loans for qualified borrowers. The largest funds in the market globally are managed by Cerberus Capital Management LP TCI Real Estate Partners Bridge Investment Group Torchlight Investors LLC and Walton Street Capital LLC.

The profit is in the interest rate on the loan as well as points on the loan and other fees.

High yield bonds are represented by the ICE BofAML US. Real Estate Debt Fund Strategien. Credit across commercial real estate markets in its home market with SKr66 billion 745 million. Real estate debt funds rose to prominence in the wake of the 2008 crash. Corporate bonds are represented by the ICE BofAML US. Municipal bonds are represented by the SP Municipal Bond High Yield Index.

Source: statista.com

Source: statista.com

High yield bonds are represented by the ICE BofAML US. In addition there is usually an ability to recycle funds. Debt investors are attracted to a steady source of income which payout a higher yield than other fixed income. During 2009 2010 while banks remained paralyzed and failed to provide any sort of debt liquidity private lenders began to emerge to fill a market void. Compiled by our colleagues in the PERE research analytics team the list is based on the capital raised for debt issuance funds between 2014 and 2018.

Source: pinterest.com

Source: pinterest.com

Credit across commercial real estate markets in its home market with SKr66 billion 745 million. 6 days ago REAL ESTATE DEBT FUNDS Between 2003 and 2010 IMPACT created four direct commercial real estate funds to channel capital to address intractable problems facing communities in need of access to quality healthcare childcare and community facilities. Research by commercial real estate specialist Cushman Wakefield also found that total investment in UK commercial property fell by 18 percent between 2017 and 2018 to. According to Preqin an institutional research firm institutional private debt funds. And a familiar name occupies the number one spot Blackstone.

Source: naic.org

Source: naic.org

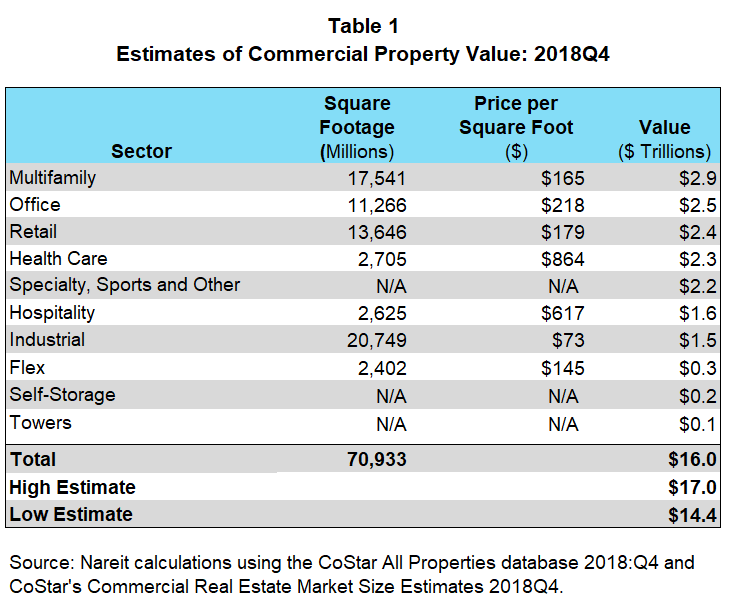

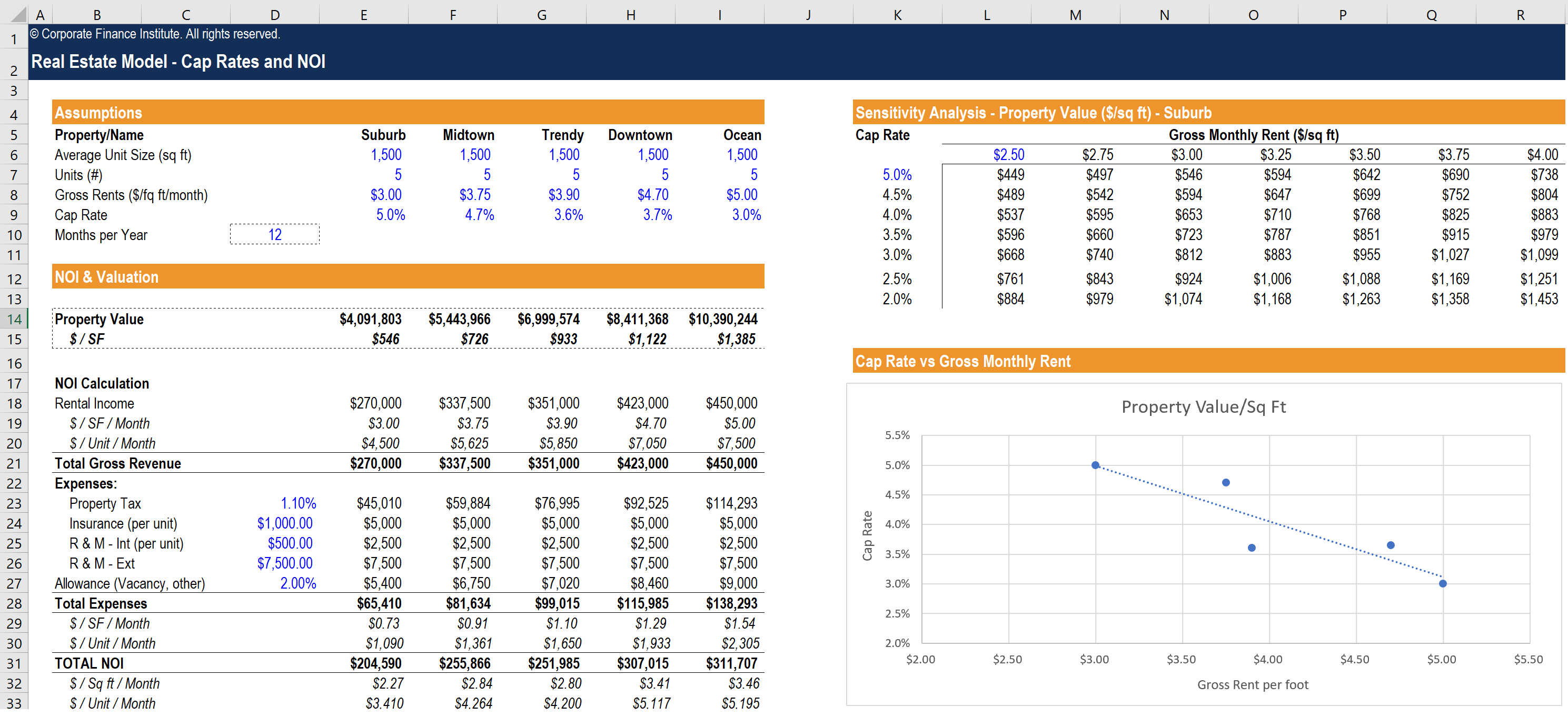

Commercial real estate debt is represented by the Giliberto-Levy Commercial Mortgage Performance Index. Accompanying PEREs first special report on debt funds is our inaugural top 50 ranking of global private real estate debt fund managers RED 50 for short. This funding is used for commercial real estate projects that range from shopping centers to multi-family buildings. The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said. The liquidity requirements called Basel III impacted.

Source: pinterest.com

Source: pinterest.com

During 2009 2010 while banks remained paralyzed and failed to provide any sort of debt liquidity private lenders began to emerge to fill a market void. 27 Zeilen Commercial Real Estate Debt Fund LP. Real Estate Debt Fund Strategien. AllianceBernstein Commercial Real Estate Debt Fund III. Übersicht von Rendite und Risiko der untersuchten Anlagen.

Source: br.pinterest.com

Source: br.pinterest.com

Relevante Bestimmungen von BVV2. Most are structured to execute a specific loan strategy or investment goal. The profit is in the interest rate on the loan as well as points on the loan and other fees. With real estate debt investments investors act as lenders to property owners developers or real estate companies sponsoring deals. How Commercial Real Estate Debt Financing Works.

Source: naic.org

Source: naic.org

The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said. High yield bonds are represented by the ICE BofAML US. With real estate debt investments investors act as lenders to property owners developers or real estate companies sponsoring deals. Research by commercial real estate specialist Cushman Wakefield also found that total investment in UK commercial property fell by 18 percent between 2017 and 2018 to. Two of the funds focused on expanding healthcare facilities one on developing new.

Source: realcrowd.com

Source: realcrowd.com

Corporate bonds are represented by the ICE BofAML US. Debt investors function much like a bank by lending money to real estate developers. Credit across commercial real estate markets in its home market with SKr66 billion 745 million. Debt investors are attracted to a steady source of income which payout a higher yield than other fixed income. Real estate debt funds help connect borrowers often developers with short-term capital for commercial real estate projects like multifamily buildings shopping centers construction loans and many other property types.

Source: reit.com

Source: reit.com

Credit across commercial real estate markets in its home market with SKr66 billion 745 million. The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said. AMP Capital has extensive experience managing unlisted real estate portfolios and offers a range of pooled funds and bespoke solutions to give global investors access to quality commercial real estate equity and debt strategies in Australia New Zealand and the United States via PCCP. However the private real estate debt market opened up considerably to alternative. During 2009 2010 while banks remained paralyzed and failed to provide any sort of debt liquidity private lenders began to emerge to fill a market void.

Source: sharplaunch.com

Source: sharplaunch.com

Accompanying PEREs first special report on debt funds is our inaugural top 50 ranking of global private real estate debt fund managers RED 50 for short. Real estate debt funds help connect borrowers often developers with short-term capital for commercial real estate projects like multifamily buildings shopping centers construction loans and many other property types. Real Estate Debt Fundraising Debt funds played a very minor role in the private real estate industry prior to the fi nancial crisis with the majority of the aggregate capital raised by real estate funds accounted for by those focused solely on equity Fig. This funding is used for commercial real estate projects that range from shopping centers to multi-family buildings. PIMCO raises almost 700m for commercial real estate debt vehicle The asset management behemoth rounded up 697 million for its PIMCO Commercial Real Estate Debt Fund.

Source: pinterest.com

Source: pinterest.com

The fund will focus primarily on high-yield lending on commercial real estate through new loan originations and purchases of legacy loans and securities. With real estate debt investments investors act as lenders to property owners developers or real estate companies sponsoring deals. 6 days ago REAL ESTATE DEBT FUNDS Between 2003 and 2010 IMPACT created four direct commercial real estate funds to channel capital to address intractable problems facing communities in need of access to quality healthcare childcare and community facilities. Fundraising figures from Real Estate Capitals sister title PERE show that 2018 was the worst year for private real estate capital raising in the last seven with total capital raised down from 127 billion in 2017 to just 104 billion last year. This funding is used for commercial real estate projects that range from shopping centers to multi-family buildings.

Source: gresb.com

Source: gresb.com

6 days ago REAL ESTATE DEBT FUNDS Between 2003 and 2010 IMPACT created four direct commercial real estate funds to channel capital to address intractable problems facing communities in need of access to quality healthcare childcare and community facilities. Real Estate Debt Fundraising Debt funds played a very minor role in the private real estate industry prior to the fi nancial crisis with the majority of the aggregate capital raised by real estate funds accounted for by those focused solely on equity Fig. This funding is used for commercial real estate projects that range from shopping centers to multi-family buildings. The firm also targets distressed senior real estate credit. Research by commercial real estate specialist Cushman Wakefield also found that total investment in UK commercial property fell by 18 percent between 2017 and 2018 to.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Fundraising figures from Real Estate Capitals sister title PERE show that 2018 was the worst year for private real estate capital raising in the last seven with total capital raised down from 127 billion in 2017 to just 104 billion last year. High yield bonds are represented by the ICE BofAML US. Debt investors function much like a bank by lending money to real estate developers. This funding is used for commercial real estate projects that range from shopping centers to multi-family buildings. The loan is secured by the property and investors earn a fixed return based on the loans interest rate and the amount theyve invested.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

A private real estate lending fund raises capital from accredited investors and lends it out to borrowers. However the private real estate debt market opened up considerably to alternative. 27 Zeilen Commercial Real Estate Debt Fund LP. Real estate debt is an attractive investment for several reasons. Most are structured to execute a specific loan strategy or investment goal.

Source: pinterest.com

Source: pinterest.com

And a familiar name occupies the number one spot Blackstone. A private real estate lending fund raises capital from accredited investors and lends it out to borrowers. North American-based managers in. AMP Capital has extensive experience managing unlisted real estate portfolios and offers a range of pooled funds and bespoke solutions to give global investors access to quality commercial real estate equity and debt strategies in Australia New Zealand and the United States via PCCP. Private real estate debt funds were born for the most part out of the aftermath of the financial crisis.

Source: insuranceaum.com

Source: insuranceaum.com

27 Zeilen Commercial Real Estate Debt Fund LP. Loans are represented by the Credit Suisse Leveraged Loan Index. In addition there is usually an ability to recycle funds. PIMCO raises almost 700m for commercial real estate debt vehicle The asset management behemoth rounded up 697 million for its PIMCO Commercial Real Estate Debt Fund. The profit is in the interest rate on the loan as well as points on the loan and other fees.

Source: pinterest.com

Source: pinterest.com

Real Estate Debt Fund Strategien. Credit across commercial real estate markets in its home market with SKr66 billion 745 million. During 2009 2010 while banks remained paralyzed and failed to provide any sort of debt liquidity private lenders began to emerge to fill a market void. Global real estate debt funds dry powder the amount of capital raised but not invested has piled up to 61 billion as of March 2019 from a low of 12 billion as of December 2012. The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said.

Source: pinterest.com

Source: pinterest.com

Debt investors are attracted to a steady source of income which payout a higher yield than other fixed income. Real estate debt funds connect borrowers which more usual than naught are developers to short-term funding capital. How Commercial Real Estate Debt Financing Works. PIMCO raises almost 700m for commercial real estate debt vehicle The asset management behemoth rounded up 697 million for its PIMCO Commercial Real Estate Debt Fund. Real estate debt is an attractive investment for several reasons.

Source: insuranceaum.com

Source: insuranceaum.com

Real estate debt funds connect borrowers which more usual than naught are developers to short-term funding capital. The largest funds in the market globally are managed by Cerberus Capital Management LP TCI Real Estate Partners Bridge Investment Group Torchlight Investors LLC and Walton Street Capital LLC. Most are structured to execute a specific loan strategy or investment goal. Relevante Bestimmungen von BVV2. AMP Capital has extensive experience managing unlisted real estate portfolios and offers a range of pooled funds and bespoke solutions to give global investors access to quality commercial real estate equity and debt strategies in Australia New Zealand and the United States via PCCP.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate debt funds list by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.