Your Commercial real estate capital gains calculator images are ready. Commercial real estate capital gains calculator are a topic that is being searched for and liked by netizens today. You can Get the Commercial real estate capital gains calculator files here. Download all free photos and vectors.

If you’re looking for commercial real estate capital gains calculator pictures information related to the commercial real estate capital gains calculator keyword, you have come to the ideal blog. Our site frequently gives you hints for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Commercial Real Estate Capital Gains Calculator. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high income earners. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form. The depreciation recapture value is the amount of depreciation taken multiplied by a 25 rate.

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin From propertycashin.com

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin From propertycashin.com

This capital gains tax calculator estimates your real estate capital gains tax plus analyzes a 1031 like-kind exchange versus a taxable sale for benefit. How much are total capital gains taxes when selling real estate in NYC. Subtract your adjusted basis from your selling price to determine your total capital gain. 2021 Capital Gains Tax Calculator Use this tool to estimate capital gains taxes you may owe after selling an investment property. Capital Gains Tax on Sale of Property. First deduct the Capital Gains tax-free allowance from your taxable gain.

A commercial real estate owner is permitted to depreciate a commercial building over time to lessen taxable income.

This calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset investment property or otherwise. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. Subtract your adjusted basis from your selling price to determine your total capital gain. But if the building is sold and the sales price is higher than the depreciated value the increase is treated as a capital gain. Capital gains tax is calculated by taking the selling price of your property and subtracting the price you originally purchased it for and associated expenses like legal fees stamp duty agent fees etc. First deduct the Capital Gains tax-free allowance from your taxable gain.

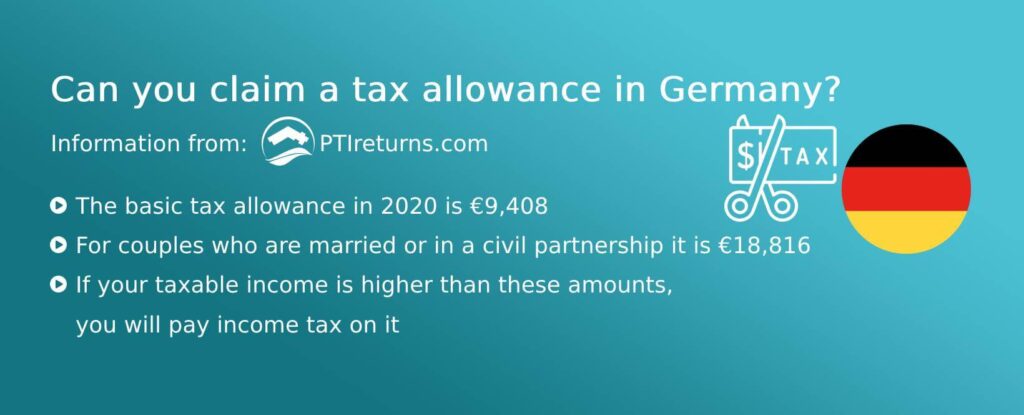

Source: ptireturns.com

Source: ptireturns.com

With real estate it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. 25 x 250000 62500 To get the full tax picture and impact of depreciation recapture lets continue to the total capital gains tax due. The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high income earners. With real estate it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. In this example subtract 900000.

Source: propertycashin.com

Source: propertycashin.com

The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. The depreciation recapture value is the amount of depreciation taken multiplied by a 25 rate. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form. It may not account for specific scenarios that could affect your tax liability. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation.

Source: wikihow.com

Source: wikihow.com

Capital gains are your net profit when selling something you own. NIIT income thresholds are 200k for single filers 125k for married. For the 2020 to 2021 tax. The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high income earners. The remaining amount is your capital gain.

25 x 250000 62500 To get the full tax picture and impact of depreciation recapture lets continue to the total capital gains tax due. Subtract your adjusted basis from your selling price to determine your total capital gain. But if the building is sold and the sales price is higher than the depreciated value the increase is treated as a capital gain. A Special Real Estate Exemption for Capital Gains Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria. For the 2020 to 2021 tax.

Source: wowa.ca

Source: wowa.ca

Capital gains are your net profit when selling something you own. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. Subtract 100000 from 1 million to get a 900000 adjusted basis. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. Adjusted gross proceeds from the sale of a qualified capital asset say 200000 minus the adjusted original purchase price of that property say 150000 equals a 50000 capital gains amount.

Source: relakhs.com

Source: relakhs.com

This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. Access capital gains tax calculators 1031 identificationclosing Deadline calculators commercial real estate analysis spreadsheets and more. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. This calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset investment property or otherwise. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale.

Source: pinterest.com

Source: pinterest.com

The resulting number is your capital gain. The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high income earners. Your gains are not from residential property. Capital gains taxes come into play when you sell your property at a profit or gain. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level.

Source: relakhs.com

Source: relakhs.com

This formula applies to both short- and long-term capital gains. How much are total capital gains taxes when selling real estate in NYC. First deduct the Capital Gains tax-free allowance from your taxable gain. A Special Real Estate Exemption for Capital Gains Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria. Capital gains tax is calculated by taking the selling price of your property and subtracting the price you originally purchased it for and associated expenses like legal fees stamp duty agent fees etc.

Source: bankbazaar.com

Source: bankbazaar.com

If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form. This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. It may not account for specific scenarios that could affect your tax liability. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. Basic Capital Gains Calculation A simple capital gains calculation looks like this.

Source: apnaplan.com

Source: apnaplan.com

The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. And 2 you have not sold or exchanged another home during the two years preceding the sale. This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. Your gains are not from residential property. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form.

Source: madanca.com

Source: madanca.com

A Special Real Estate Exemption for Capital Gains Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria. The remaining amount is your capital gain. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings. 25 x 250000 62500 To get the full tax picture and impact of depreciation recapture lets continue to the total capital gains tax due. This formula applies to both short- and long-term capital gains.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

NIIT income thresholds are 200k for single filers 125k for married. This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. Basic Capital Gains Calculation A simple capital gains calculation looks like this. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings. Subtract your adjusted basis from your selling price to determine your total capital gain.

Source: propertycashin.com

Source: propertycashin.com

A commercial real estate owner is permitted to depreciate a commercial building over time to lessen taxable income. First deduct the Capital Gains tax-free allowance from your taxable gain. Long-term Federal capital gains tax rates vary from 0 to 20 based on income levels. And 2 you have not sold or exchanged another home during the two years preceding the sale. It may not account for specific scenarios that could affect your tax liability.

Source: relakhs.com

Source: relakhs.com

A Special Real Estate Exemption for Capital Gains Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria. For the 2020 to 2021 tax. A commercial real estate owner is permitted to depreciate a commercial building over time to lessen taxable income. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. Your gains are not from residential property.

Source: propertycashin.com

Source: propertycashin.com

How much are total capital gains taxes when selling real estate in NYC. Access capital gains tax calculators 1031 identificationclosing Deadline calculators commercial real estate analysis spreadsheets and more. We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real estate and others. A commercial real estate owner is permitted to depreciate a commercial building over time to lessen taxable income. Subtract your adjusted basis from your selling price to determine your total capital gain.

Source: forbes.com

Source: forbes.com

APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real estate and others. This calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset investment property or otherwise. Subtract 100000 from 1 million to get a 900000 adjusted basis. Access capital gains tax calculators 1031 identificationclosing Deadline calculators commercial real estate analysis spreadsheets and more.

Source: forbes.com

Source: forbes.com

The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high income earners. In this example subtract 900000. How to Calculate Capital Gains Taxes on Real Estate In order to accurately calculate capital gains taxes on real estate first subtract the cost basis or original purchase price of the house from the net proceeds or net profits of the sale. It may not account for specific scenarios that could affect your tax liability. Access capital gains tax calculators 1031 identificationclosing Deadline calculators commercial real estate analysis spreadsheets and more.

Source: hrblock.com

Source: hrblock.com

Capital gains are your net profit when selling something you own. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. NIIT income thresholds are 200k for single filers 125k for married. The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high income earners. Subtract 100000 from 1 million to get a 900000 adjusted basis.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate capital gains calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.