Your Commercial real estate cap rate trends images are available. Commercial real estate cap rate trends are a topic that is being searched for and liked by netizens now. You can Download the Commercial real estate cap rate trends files here. Get all royalty-free images.

If you’re searching for commercial real estate cap rate trends images information related to the commercial real estate cap rate trends keyword, you have come to the right blog. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Commercial Real Estate Cap Rate Trends. In the third quarter CoStar a commercial real estate database MOB rates averaged a slight decline with average asking net rates of 2230 per square foot PSF. The average cap rate trend is higher for CRE excluding multi-family in suburban areas and gradually lower as the population and market size increases. The cap rate is expressed as a percentage usually somewhere between 3 and 20. Highest Multifamily Cap Rate.

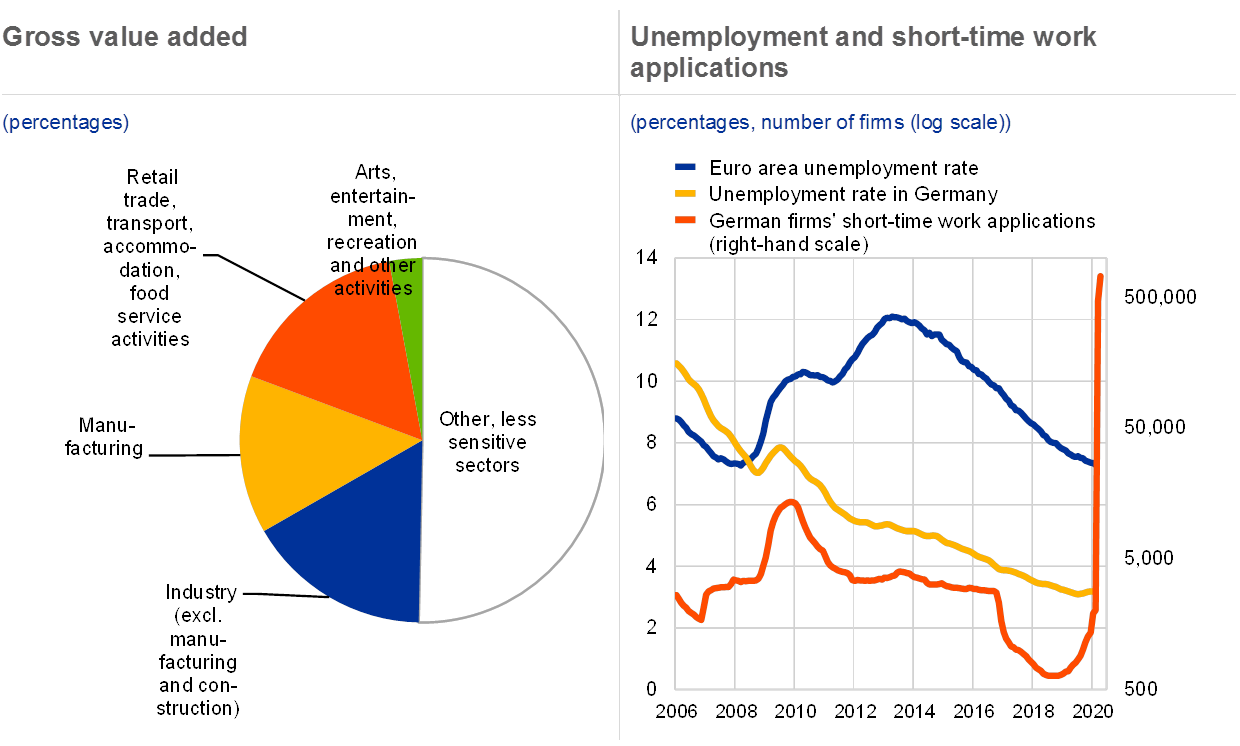

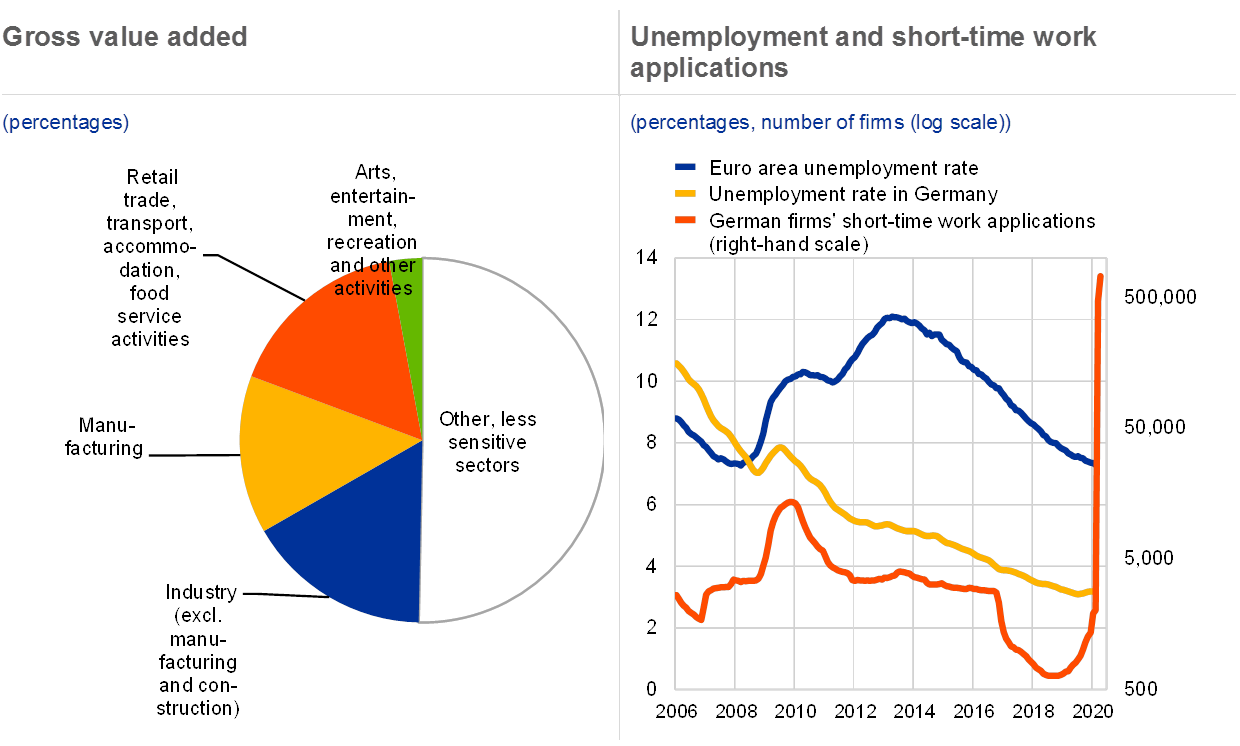

Financial Stability Review May 2020 From ecb.europa.eu

Financial Stability Review May 2020 From ecb.europa.eu

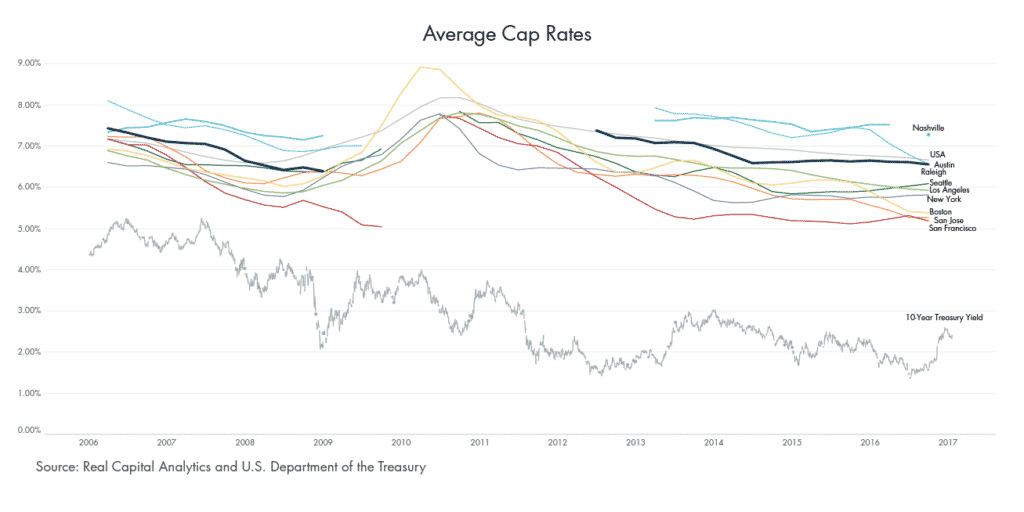

ProspectNows property databases contain a wealth of information useful for calculating cap rates for commercial real estate. Revista a medical property research platform showed average asking net rates around 2140SF at the same time. Comparatively weve returned to a landscape where monetary policy is the ultimate influencer of cap rates. 31 In July 78 of US domestic banks tightened lending standards for CRE loans. Excel files are easy to download and. Cap rates generally have an inverse relationship to the property value.

Although hotels office buildings and retail real estate can provide high yields in suburban areas these properties are also more susceptible to.

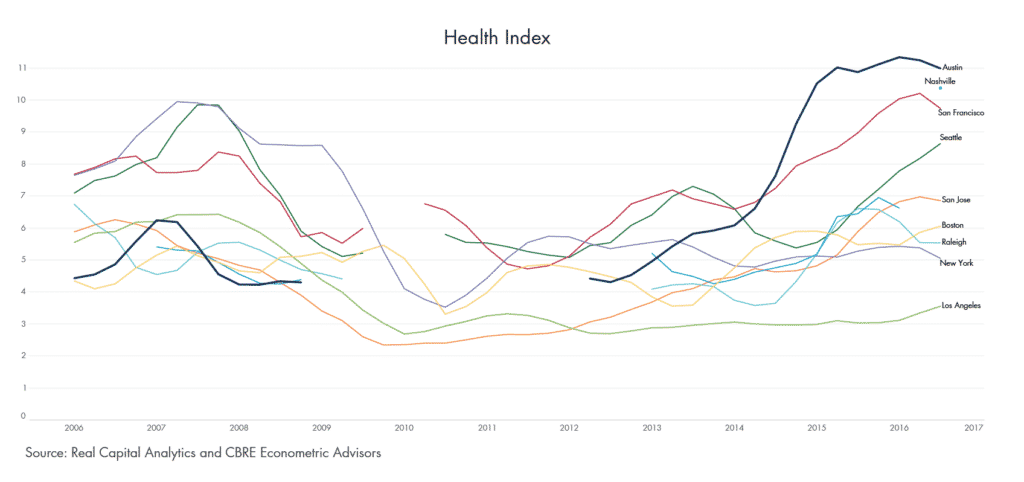

Using the Cap Rate Approach. Revista a medical property research platform showed average asking net rates around 2140SF at the same time. Detroit real estate market 2143. Generally most commercial investment grade properties trade somewhere in the 4 12 Cap Rate range. At the peak of the CRE price cycle cap rates averaged a low of 645 in 2007 and reached an average high of 82 in 2009. ProspectNows property databases contain a wealth of information useful for calculating cap rates for commercial real estate.

Source: ecb.europa.eu

Source: ecb.europa.eu

Consider that in the cap rate approach the NOI is assumed to be stable and. Average transaction-based cap rates for all property types fell to 63 at YE2016 from 64 in YE2015 and 74 in YE2010 per RCA data. Using the Cap Rate Approach. Foreclosure Cap Rates by City Range. Highest Foreclosure Cap Rate.

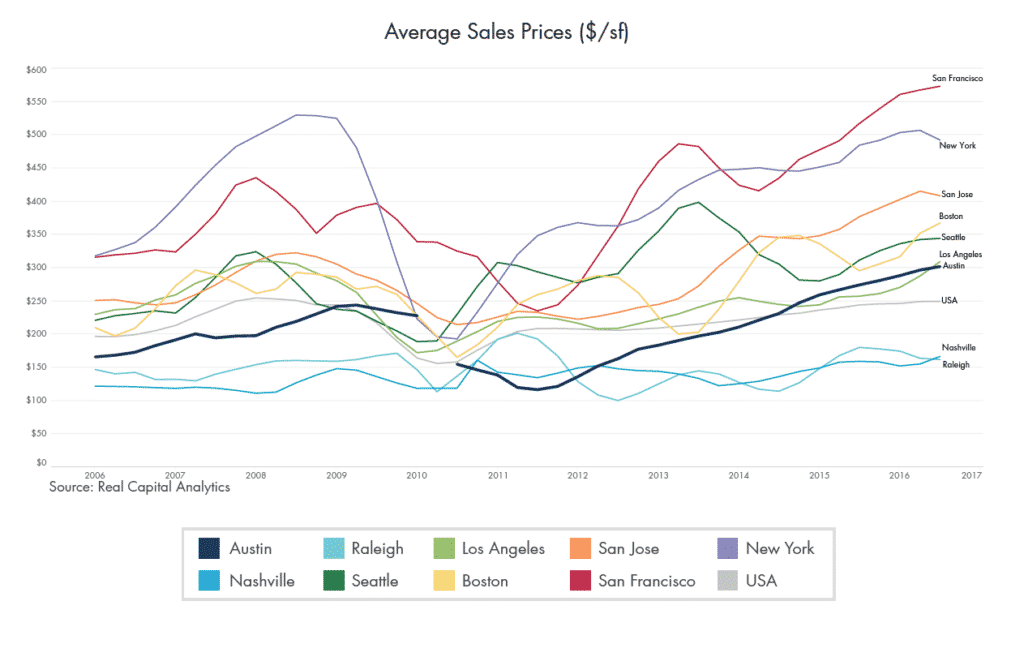

Source: pinterest.com

Source: pinterest.com

Cap rates should be broadly stable with slight compression for multifamily assets and slight increases for the other major sectors for an average spread of about 260 bps over 10-year Treasury yields next year. Its a straightforward way to figure out how many times earnings a property is being offered for. RaleighDurham Orlando and Nashvillerounding out the top five. In turn lenders were all too happy to lend capriciously to CRE investors during this cycle a trend that drove property values up and cap rates down. Revista a medical property research platform showed average asking net rates around 2140SF at the same time.

Generally most commercial investment grade properties trade somewhere in the 4 12 Cap Rate range. Detroit real estate market 2143. In turn lenders were all too happy to lend capriciously to CRE investors during this cycle a trend that drove property values up and cap rates down. From 008 to 2143. Highest Multifamily Cap Rate.

Source: pinterest.com

Source: pinterest.com

According to the Emerging Trends in Real Estate Report 2019 produced by PwC and ULI the top market in the US in 2019 is. At the peak of the CRE price cycle cap rates averaged a low of 645 in 2007 and reached an average high of 82 in 2009. Comparatively weve returned to a landscape where monetary policy is the ultimate influencer of cap rates. Generally most commercial investment grade properties trade somewhere in the 4 12 Cap Rate range. To calculate the present value of a property using the cap rate approach we simply take the buildings next year Net Operating Income and divide it by the appropriate cap rate.

Source: statista.com

Source: statista.com

I am optimistic about the future despite being 10 years. From 008 to 2143. Generally most commercial investment grade properties trade somewhere in the 4 12 Cap Rate range. Cap rates should be broadly stable with slight compression for multifamily assets and slight increases for the other major sectors for an average spread of about 260 bps over 10-year Treasury yields next year. It is also one of the most well-known approaches and will come up in most commercial real estate interviews.

Source: pinterest.com

Source: pinterest.com

Cap rates generally have an inverse relationship to the property value. It also provides convenient access to popular macroeconomic data sets covering population employment consumption housing GDP inflation and interest rates. Foreclosure Cap Rates by City Range. Using the Cap Rate Approach. Detroit real estate market 2143.

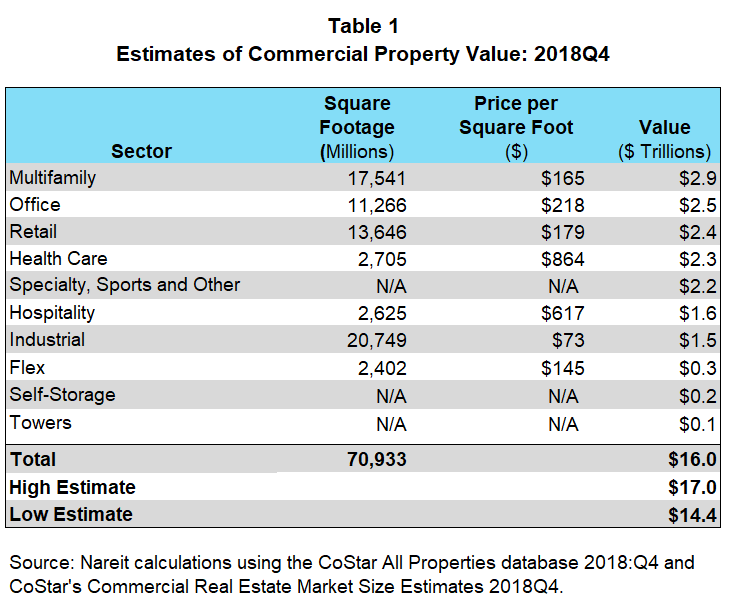

Source: reit.com

Source: reit.com

Highest Multifamily Cap Rate. Revista a medical property research platform showed average asking net rates around 2140SF at the same time. Cap rates generally have an inverse relationship to the property value. It is also one of the most well-known approaches and will come up in most commercial real estate interviews. Tucson real estate market 008.

ProspectNows property databases contain a wealth of information useful for calculating cap rates for commercial real estate. Using the Cap Rate Approach. Second on the list is New York-Brooklyn followed by. The cap rate is expressed as a percentage usually somewhere between 3 and 20. Foreclosure Cap Rates by City Range.

Source: realtymogul.com

Source: realtymogul.com

From 008 to 2143. It also provides convenient access to popular macroeconomic data sets covering population employment consumption housing GDP inflation and interest rates. The average cap rate trend is higher for CRE excluding multi-family in suburban areas and gradually lower as the population and market size increases. If youre looking for a real estate tool to inform your investment decisions ProspectNow has been in the. Lowest Foreclosure Cap Rate.

Source: preqin.com

Source: preqin.com

Detroit real estate market 2143. In Q2 of 2020 mortgage interest rates for 15-year rates slipped to 27 from 387 in Q1 of 2019 30-year fixed-rate dipped to 323 from 437 in Q1 of 2019 and 5-year ARM dropped to 319 from 387 in Q1 of 2019. Detroit real estate market 2143. 31 In July 78 of US domestic banks tightened lending standards for CRE loans. Generally most commercial investment grade properties trade somewhere in the 4 12 Cap Rate range.

Source: aquilacommercial.com

Source: aquilacommercial.com

It is also one of the most well-known approaches and will come up in most commercial real estate interviews. Average cap rates continued to fall ending the quarter at 65 percenta 4 basis-point drop from mid-year and 9 basis points down from this time last year. Detroit real estate market 2143. In 2016 industrial cap rates were the highest of the major property types averaging 53 percent. To calculate the present value of a property using the cap rate approach we simply take the buildings next year Net Operating Income and divide it by the appropriate cap rate.

Source: ecb.europa.eu

Source: ecb.europa.eu

One of the most important metrics an investor looks at when analyzing the acquisition of a piece of commercial real estate is the CAP rate. With the obvious concerns cap rates increased slightly in March and April resulting in lower values. Average transaction-based cap rates for all property types fell to 63 at YE2016 from 64 in YE2015 and 74 in YE2010 per RCA data. Foreclosed Homes for Sale in 2020. Lowest Foreclosure Cap Rate.

Source: forbes.com

Source: forbes.com

Lowest Multifamily Cap Rate. RaleighDurham Orlando and Nashvillerounding out the top five. Tucson real estate market 008. I am optimistic about the future despite being 10 years. The commercial mortgage-backed securities delinquency rate remained above 9 in August after reaching an all-time high of 103 in June largely driven by hotels at 23 and retail at 15.

Source: 2ndkitchen.com

Source: 2ndkitchen.com

ProspectNows property databases contain a wealth of information useful for calculating cap rates for commercial real estate. Second on the list is New York-Brooklyn followed by. To calculate the present value of a property using the cap rate approach we simply take the buildings next year Net Operating Income and divide it by the appropriate cap rate. The cap rate is expressed as a percentage usually somewhere between 3 and 20. Honolulu real estate market 007.

Source: aquilacommercial.com

Source: aquilacommercial.com

One of the most important metrics an investor looks at when analyzing the acquisition of a piece of commercial real estate is the CAP rate. In 2016 industrial cap rates were the highest of the major property types averaging 53 percent. RaleighDurham Orlando and Nashvillerounding out the top five. Its a straightforward way to figure out how many times earnings a property is being offered for. Capitalization rate Cap Rate The value of a CRE property is determined based on the yield or discount rate otherwise known as cap rate.

Source: realtymogul.com

Source: realtymogul.com

Lowest Multifamily Cap Rate. With the obvious concerns cap rates increased slightly in March and April resulting in lower values. Capitalization rate Cap Rate The value of a CRE property is determined based on the yield or discount rate otherwise known as cap rate. Cap rates generally have an inverse relationship to the property value. RaleighDurham Orlando and Nashvillerounding out the top five.

Source: aquilacommercial.com

Source: aquilacommercial.com

Detroit real estate market 2143. Although hotels office buildings and retail real estate can provide high yields in suburban areas these properties are also more susceptible to. 31 In July 78 of US domestic banks tightened lending standards for CRE loans. Lowest Foreclosure Cap Rate. I expect 2019 to be another great year for commercial real estate.

Highest Multifamily Cap Rate. Whether you are researching market comps or looking for your next commercial real estate investment youll find reliable data on the ProspectNow platform. One of those factors was Wall Street investors snatching up commercial mortgage-backed securities faster than banks could package them. Honolulu real estate market 007. In Q2 of 2020 mortgage interest rates for 15-year rates slipped to 27 from 387 in Q1 of 2019 30-year fixed-rate dipped to 323 from 437 in Q1 of 2019 and 5-year ARM dropped to 319 from 387 in Q1 of 2019.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial real estate cap rate trends by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.