Your Commercial real estate bubble 2017 images are ready in this website. Commercial real estate bubble 2017 are a topic that is being searched for and liked by netizens today. You can Find and Download the Commercial real estate bubble 2017 files here. Find and Download all royalty-free vectors.

If you’re looking for commercial real estate bubble 2017 pictures information connected with to the commercial real estate bubble 2017 keyword, you have come to the ideal blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Commercial Real Estate Bubble 2017. Commercial real estate such as office and apartment towers in trophy cities in the US and Europe has been among the favorite items on the long and eclectic shopping lists of Chinese companies. It seems premature to say that there is a bubble forming in commercial real estate. At the forefront are the vast immensely indebted opaquely structured conglomerates HNA Dalian Wanda Anbang Insurance and Fosun International. The delinquency rate for commercial mortgages that have been packaged into bonds is forecast to climb by as much as 24 percentage points to 575 percent in 2017 reversing several years of.

U S Commercial Real Estate Valuation Trends From naic.org

U S Commercial Real Estate Valuation Trends From naic.org

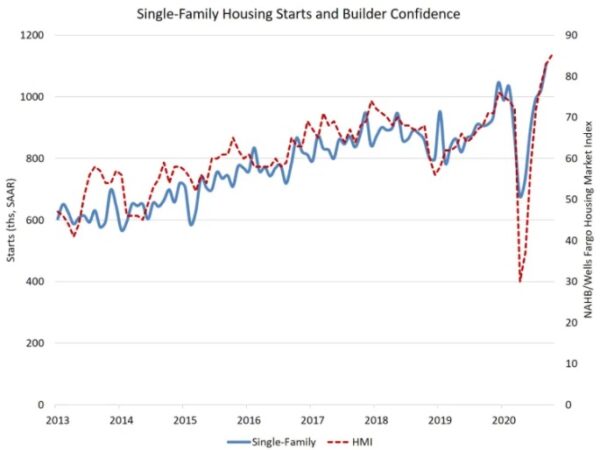

The commercial real estate bubble holds important lessons for understanding the residential real estate bubble. Heres a look at five commercial real estate. At the forefront are the vast immensely indebted opaquely structured conglomerates HNA Dalian Wanda Anbang Insurance and Fosun International. More than half of Americans surveyed in 2017 also said they were worried that the real estate market is. Commercial real estate such as office and apartment towers in trophy cities in the US and Europe has been among the favorite items on the long and eclectic shopping lists of Chinese companies. I want to get into real estate but that has me a little shaken.

The delinquency rate for commercial mortgages that have been packaged into bonds is forecast to climb by as much as 24 percentage points to 575 percent in 2017 reversing several years of.

CRE is an 11 trillion bubble when commercial mortgage-based securities CMBS are included. CRE is an 11 trillion bubble when commercial mortgage-based securities CMBS are included. July 24 2017 EIRNSRising default rates are shaking the commercial real estate CRE part of the US. The delinquency rate for commercial mortgages that have been packaged into bonds is forecast to climb by as much as 24 percentage points to 575 percent in 2017 reversing several years of. Commercial real estate prices in the US after a seven-year boom peaked last year. Global economic and political uncertainties.

Source: naic.org

Source: naic.org

According to UBS retailers have closed more than 15000 stores since 2017 and will close an incredible 75000 more stores by 2026. CRE is an 11 trillion bubble when commercial mortgage-based securities CMBS are included. Green Streets Commercial Property Price Index in July 2017 was below where it had been in June 2016. Fed Frets about Commercial Real Estate Bubble its 2 Trillion in Loans Mostly at Smaller Banks by Wolf Richter Feb 15 2017 35 Comments Fear of waiting too long or of having already waited too long. More than half of Americans surveyed in 2017 also said they were worried that the real estate market is.

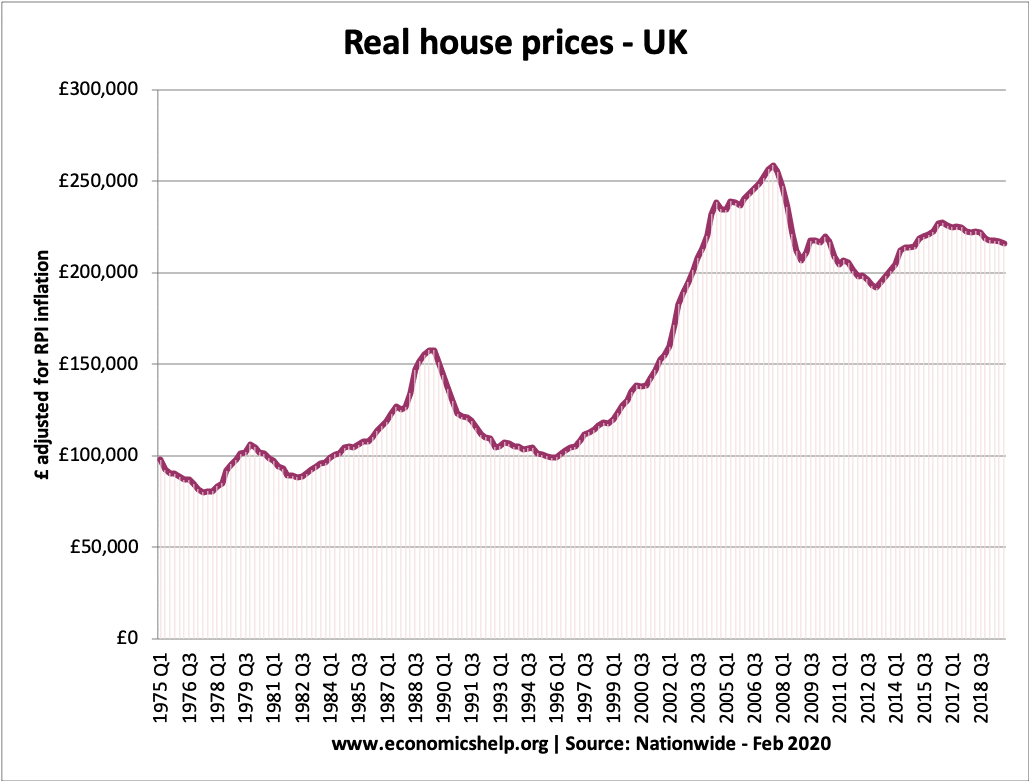

Source: economicshelp.org

Source: economicshelp.org

The commercial real estate bubble holds important lessons for understand-ing the residential real estate bubble. In 2017 debt funds and mortgage REITs lending to the CRE sector increased 42 compared with the. Insurance industrys CRE exposure consisted of 415 billion in directly owned properties and 396 billion in mortgage loans for total exposure of 4374 billion as of YE2015 see Table 2. So I was browsing YouTube and I found some guy spouting off his doomsday theory about how we are in a real estate bubble and its gonna pop in 2017 all his facts seemed pretty legit but its kinda worrying I guess. 11 Trillion Commercial Real Estate Bubble Quaking.

Source: gordcollins.com

Source: gordcollins.com

So I was browsing YouTube and I found some guy spouting off his doomsday theory about how we are in a real estate bubble and its gonna pop in 2017 all his facts seemed pretty legit but its kinda worrying I guess. The ongoing retail apocalypse is another trend that will help cause the US. Housing prices may be appreciating at a seemingly unsustainable rate once again in some markets around the country but Christopher Thornberg believes the nations economic fundamentals will continue to be much more sound in 2017 than when the market began to implode back in 2005. Theres no housing bubble. It seems premature to say that there is a bubble forming in commercial real estate.

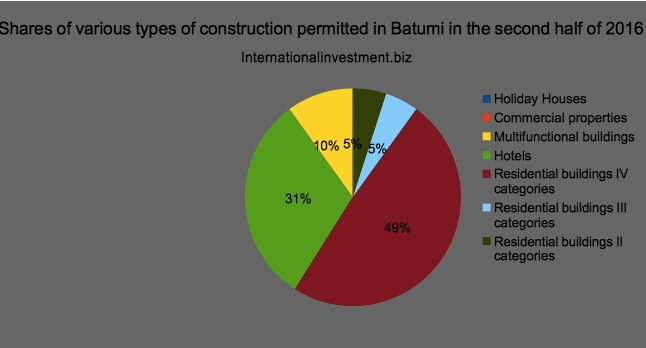

Source: internationalinvestment.biz

Source: internationalinvestment.biz

Mortgage loan exposure excludes 317 billion classified as. According to UBS retailers have closed more than 15000 stores since 2017 and will close an incredible 75000 more stores by 2026. Commercial real estate bubble to burst. Private equity firms keep raising substantial war chests to acquire. So I was browsing YouTube and I found some guy spouting off his doomsday theory about how we are in a real estate bubble and its gonna pop in 2017 all his facts seemed pretty legit but its kinda worrying I guess.

Source: citywatchla.com

Source: citywatchla.com

Commercial real estate such as office and apartment towers in trophy cities in the US and Europe has been among the favorite items on the long and eclectic shopping lists of Chinese companies. The following five trends will play a significant role in commercial real estate in 2017. Unlike the residential market there is almost no government involvement in commercial real estate. So I was browsing YouTube and I found some guy spouting off his doomsday theory about how we are in a real estate bubble and its gonna pop in 2017 all his facts seemed pretty legit but its kinda worrying I guess. The commercial real estate bubble holds important lessons for understanding the residential real estate bubble.

Source: propertyology.com.au

Source: propertyology.com.au

This week Deloitte predicted the volume of commercial real estate transactions will jump 13 percent in the next 18 months. In 2017 debt funds and mortgage REITs lending to the CRE sector increased 42 compared with the. At the forefront are the vast immensely indebted opaquely structured conglomerates HNA Dalian Wanda Anbang Insurance and Fosun International. The delinquency rate for commercial mortgages that have been packaged into bonds is forecast to climb by as much as 24 percentage points to 575 percent in 2017 reversing several years of. Fed Frets about Commercial Real Estate Bubble its 2 Trillion in Loans Mostly at Smaller Banks by Wolf Richter Feb 15 2017 35 Comments Fear of waiting too long or of having already waited too long.

At the forefront are the vast immensely indebted opaquely structured conglomerates HNA Dalian Wanda Anbang Insurance and Fosun International. Fed Frets about Commercial Real Estate Bubble its 2 Trillion in Loans Mostly at Smaller Banks by Wolf Richter Feb 15 2017 35 Comments Fear of waiting too long or of having already waited too long. Warnings about a commercial real estate price bubble have been increasingly common this year. The delinquency rate for commercial mortgages that have been packaged into bonds is forecast to climb by as much as 24 percentage points to 575 percent in 2017 reversing several years of. Commercial real estate bubble to burst.

Source: economicshelp.org

Source: economicshelp.org

Commercial real estate bubble to burst. Unlike the residential market there is almost no government involvement in commercial real estate. The existence of the parallel commercial real estate bubble presents a strong challenge to explanations of the residential bubble that focus on government. This week Deloitte predicted the volume of commercial real estate transactions will jump 13 percent in the next 18 months. Unlike the residential market there is almost no government involvement in commercial real estate.

Source: naic.org

Source: naic.org

Commercial real estate such as office and apartment towers in trophy cities in the US and Europe has been among the favorite items on the long and eclectic shopping lists of Chinese companies. For example the average price of a new home has increased from 259800 in 2009 to 386100 in 2017 according to figures from the US Census Bureau. The ongoing retail apocalypse is another trend that will help cause the US. CRE is an 11 trillion bubble when commercial mortgage-based securities CMBS are included. Heres a look at five commercial real estate.

Source: pinterest.com

Source: pinterest.com

Largely because interest rates are still low spreads remain high despite cap rates in gateway markets. The commercial real estate bubble holds important lessons for understand-ing the residential real estate bubble. The following five trends will play a significant role in commercial real estate in 2017. Unlike the residential market there is almost no government involvement in commercial real estate. The existence of the parallel commercial real estate bubble presents a.

Source: pinterest.com

Source: pinterest.com

July 24 2017 EIRNSRising default rates are shaking the commercial real estate CRE part of the US. Largely because interest rates are still low spreads remain high despite cap rates in gateway markets. For example the average price of a new home has increased from 259800 in 2009 to 386100 in 2017 according to figures from the US Census Bureau. Unlike the residential market there is almost no government involvement in commercial real estate. In 2017 debt funds and mortgage REITs lending to the CRE sector increased 42 compared with the.

Source: naic.org

Source: naic.org

Commercial real estate bubble to burst. The ongoing retail apocalypse is another trend that will help cause the US. Private equity firms keep raising substantial war chests to acquire. For example the average price of a new home has increased from 259800 in 2009 to 386100 in 2017 according to figures from the US Census Bureau. In 2017 debt funds and mortgage REITs lending to the CRE sector increased 42 compared with the.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

Fed Frets about Commercial Real Estate Bubble its 2 Trillion in Loans Mostly at Smaller Banks by Wolf Richter Feb 15 2017 35 Comments Fear of waiting too long or of having already waited too long. At the forefront are the vast immensely indebted opaquely structured conglomerates HNA Dalian Wanda Anbang Insurance and Fosun International. The existence of the parallel commercial real estate bubble presents a strong challenge to explanations of the residential bubble that focus on government. The ongoing retail apocalypse is another trend that will help cause the US. July 24 2017 EIRNSRising default rates are shaking the commercial real estate CRE part of the US.

Source: naic.org

Source: naic.org

The existence of the parallel commercial real estate bubble presents a strong challenge to explanations of the residential bubble that focus on government. Commercial real estate such as office and apartment towers in trophy cities in the US and Europe has been among the favorite items on the long and eclectic shopping lists of Chinese companies. This week Deloitte predicted the volume of commercial real estate transactions will jump 13 percent in the next 18 months. At the forefront are the vast immensely indebted opaquely structured conglomerates HNA Dalian Wanda Anbang Insurance and Fosun International. In 2017 debt funds and mortgage REITs lending to the CRE sector increased 42 compared with the.

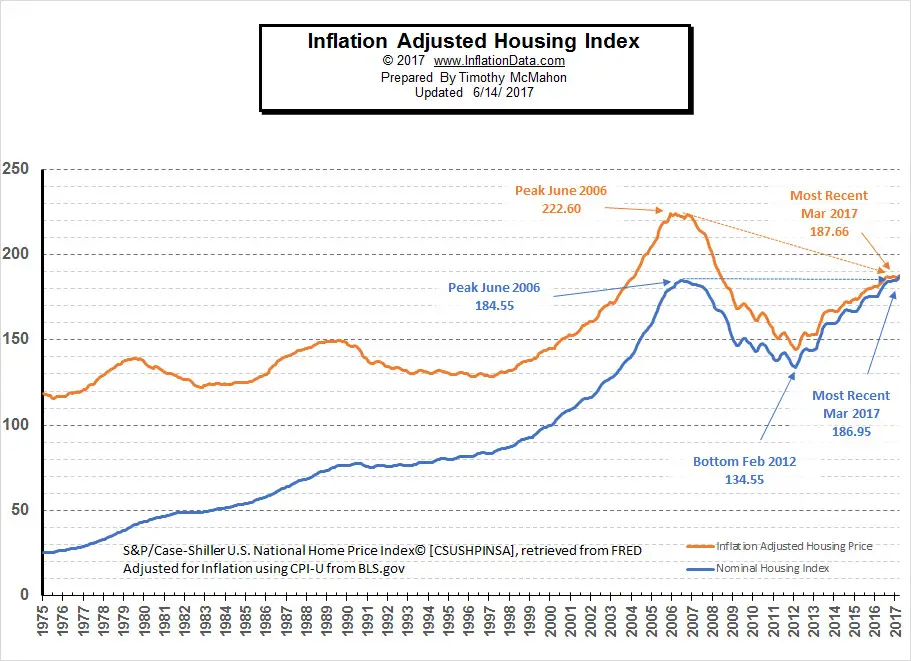

Source: inflationdata.com

Source: inflationdata.com

In 2017 debt funds and mortgage REITs lending to the CRE sector increased 42 compared with the. According to UBS retailers have closed more than 15000 stores since 2017 and will close an incredible 75000 more stores by 2026. Private equity firms keep raising substantial war chests to acquire. This marks the first year-over-year decline albeit a small one. Commercial Real Estate Investments As defined for the purposes of this report the US.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

More than half of Americans surveyed in 2017 also said they were worried that the real estate market is. A survey of 400 people in the real estate business by PricewaterhouseCoopers PwC and the Urban Land Institute ULI showed a drop in positive sentiment to 69 from 84 six months ago. Housing prices may be appreciating at a seemingly unsustainable rate once again in some markets around the country but Christopher Thornberg believes the nations economic fundamentals will continue to be much more sound in 2017 than when the market began to implode back in 2005. This year held some surprises that could have an impact on commercial real estate and the economy as a whole in 2017. Commercial real estate bubble to burst.

Source: pinterest.com

Source: pinterest.com

Mortgage loan exposure excludes 317 billion classified as. Mortgage loan exposure excludes 317 billion classified as. Green Streets Commercial Property Price Index in July 2017 was below where it had been in June 2016. Largely because interest rates are still low spreads remain high despite cap rates in gateway markets. Heres a look at five commercial real estate.

Source: nestseekers.com

Source: nestseekers.com

The delinquency rate for commercial mortgages that have been packaged into bonds is forecast to climb by as much as 24 percentage points to 575 percent in 2017 reversing several years of. At the forefront are the vast immensely indebted opaquely structured conglomerates HNA Dalian Wanda Anbang Insurance and Fosun International. The existence of the parallel commercial real estate bubble presents a. Commercial real estate bubble to burst. The commercial real estate bubble holds important lessons for understand-ing the residential real estate bubble.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate bubble 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.