Your Commercial real estate appreciation historical images are available. Commercial real estate appreciation historical are a topic that is being searched for and liked by netizens today. You can Get the Commercial real estate appreciation historical files here. Download all royalty-free photos and vectors.

If you’re searching for commercial real estate appreciation historical pictures information related to the commercial real estate appreciation historical interest, you have come to the ideal blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

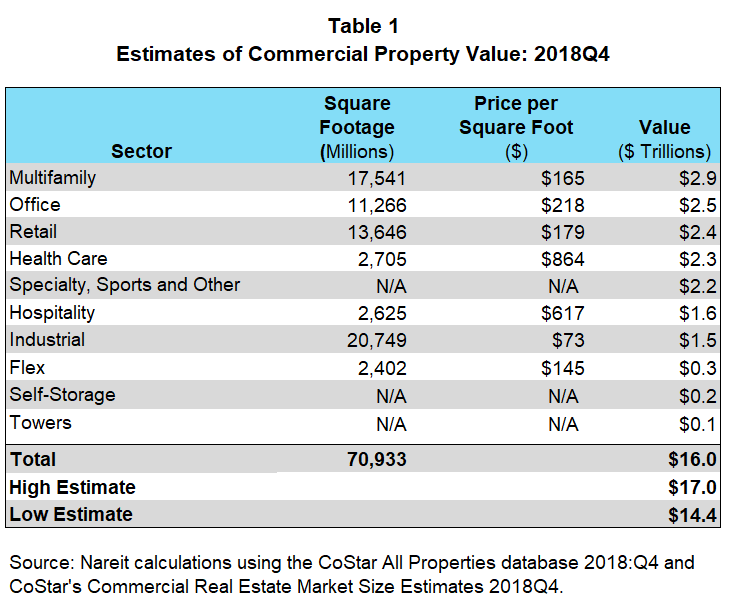

Commercial Real Estate Appreciation Historical. Appreciation beyond inflationat least since the late 1970s. CRE properties rose 78 in 2019. Even in the face of historical appreciation the Los Angeles housing market looks poised to benefit savvy investors for years to come. Dollars worth of commercial real estate were built in the United States.

In New Mexico for example in 1940 the median home price was only 6800. Current Los Angeles real estate market trends are directly correlated to the introduction of COVID-19. Real Estate Bay Realty Brokerage 220 Duncan Mill Road Suite 209 Toronto ON M3B 3J5 Phone. Meanwhile real estate investment trusts REITS tied with an average annual return of 105. A 235k home becomes worth 570k at 3 appreciation after 30 years but it becomes worth a whopping 762k at 4 appreciation. Meanwhile real estate prices tend to outpace inflation but not by much.

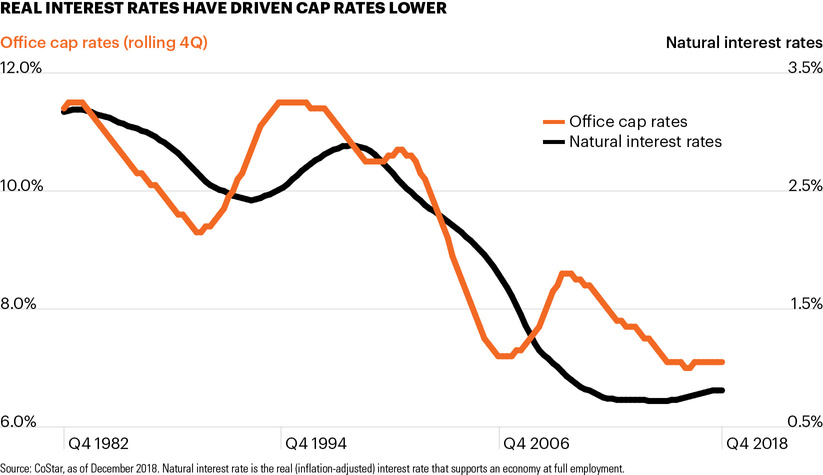

This rent growth trans lated into higher sales prices and valuations for commercial real estate.

Meanwhile real estate investment trusts REITS tied with an average annual return of 105. Meanwhile real estate investment trusts REITS tied with an average annual return of 105. In commercial real estate rent demand is elastic. CRE properties rose 78 in 2019. Another reason to know the rate is that you might not want to be tied to your home for 30 years. The 5000000 building would become worth 9030000.

Source: pinterest.com

Source: pinterest.com

Thus in the above examples a 1000000 building would become worth 1806000 over 20 years at 3 annual appreciation. In New Mexico for example in 1940 the median home price was only 6800. In proformas most people assume an annual appreciation rate of 2-3. Currently there is limited international experience in constructing representative real estate price indices as real estate markets are heterogeneous both within and across countries and illiquid. Prior to 2007 historical housing price data seemed to indicate that real estate prices could continue to rise indefinitely.

Source: pinterest.com

Source: pinterest.com

In New Mexico for example in 1940 the median home price was only 6800. Another reason to know the rate is that you might not want to be tied to your home for 30 years. Commercial real estate CRE properties have exhibited impressive price appreciation as the longest economic expansion in US. 416-800-1055 infolistingca Listingca on Twitter RealEstateBayca on Facebook. Most commercial real estate will appreciate over time provided the property is maintained and the surrounding area does not decline.

Source: berkadia.com

Source: berkadia.com

At the same time real estate in Portland appreciated 1013 February 2012 to January 2021 the median home value in the United States went from 161000 to 266104 an increase of 652. SAN FRANCISCO-Most property sectors achieved annual price increases not seen since the beginning of this bull market in the 1990s says a report from Global Real Analytics publisher of. On the other hand a real estate investor can also consider forced real estate appreciation. Another reason to know the rate is that you might not want to be tied to your home for 30 years. Most commercial real estate will appreciate over time provided the property is maintained and the surrounding area does not decline.

Source: sior.com

Source: sior.com

Residential and diversified real estate investments do a bit better averaging 105. For a better idea of how the Portland real estate market has performed in recent history its best to place it in context with the US. In 2019 some 8525 billion US. Prior to 2007 historical housing price data seemed to indicate that real estate prices could continue to rise indefinitely. Dollars worth of commercial real estate were built in the United States.

Meanwhile real estate investment trusts REITS tied with an average annual return of 105. Most commercial real estate will appreciate over time provided the property is maintained and the surrounding area does not decline. At the same time real estate in Portland appreciated 1013 February 2012 to January 2021 the median home value in the United States went from 161000 to 266104 an increase of 652. CRE properties rose 78 in 2019. This series covers commercial real estate price indices.

Source: fsinvestments.com

Source: fsinvestments.com

In fact with few exceptions the average sale price of homes sold in. CRE properties rose 78 in 2019. Dollars worth of commercial real estate were built in the United States. 416-800-1055 infolistingca Listingca on Twitter RealEstateBayca on Facebook. A Retrospective Look At A Historic Cycle In Commercial Real Estate September 7 2018 In the period just prior to 2008 the commercial real estate sector was riding a wave of unbridled optimism.

Source: reit.com

Source: reit.com

This kind of natural real estate appreciation is a great and not to mention effortless way of making money in real estate and getting a good return on investment when you decide to sell the investment property. One percentage point makes quite a difference. This rent growth trans lated into higher sales prices and valuations for commercial real estate. In fact with few exceptions the average sale price of homes sold in. Currently there is limited international experience in constructing representative real estate price indices as real estate markets are heterogeneous both within and across countries and illiquid.

A Retrospective Look At A Historic Cycle In Commercial Real Estate September 7 2018 In the period just prior to 2008 the commercial real estate sector was riding a wave of unbridled optimism. Similarly several authors have noted that commercial property rents tend to be stationary in real dollars eg Wheaton and Torto 1994. Dollars worth of commercial real estate were built in the United States. Real estate appreciation is a simple concept. Meanwhile real estate prices tend to outpace inflation but not by much.

Over the last year Dallas appreciation. Currently there is limited international experience in constructing representative real estate price indices as real estate markets are heterogeneous both within and across countries and illiquid. At the same time real estate in Portland appreciated 1013 February 2012 to January 2021 the median home value in the United States went from 161000 to 266104 an increase of 652. In 2019 some 8525 billion US. To commercial real estate appreciation was rent growth.

Source: sior.com

Source: sior.com

SAN FRANCISCO-Most property sectors achieved annual price increases not seen since the beginning of this bull market in the 1990s says a report from Global Real Analytics publisher of. If you are a home buyer or real estate investor Dallas definitely has a track record of being one of the best long term real estate investments in America through the last ten years. Real Estate Bay Realty Brokerage 220 Duncan Mill Road Suite 209 Toronto ON M3B 3J5 Phone. Residential and diversified real estate investments do a bit better averaging 105. 416-800-1055 infolistingca Listingca on Twitter RealEstateBayca on Facebook.

Source: pinterest.com

Source: pinterest.com

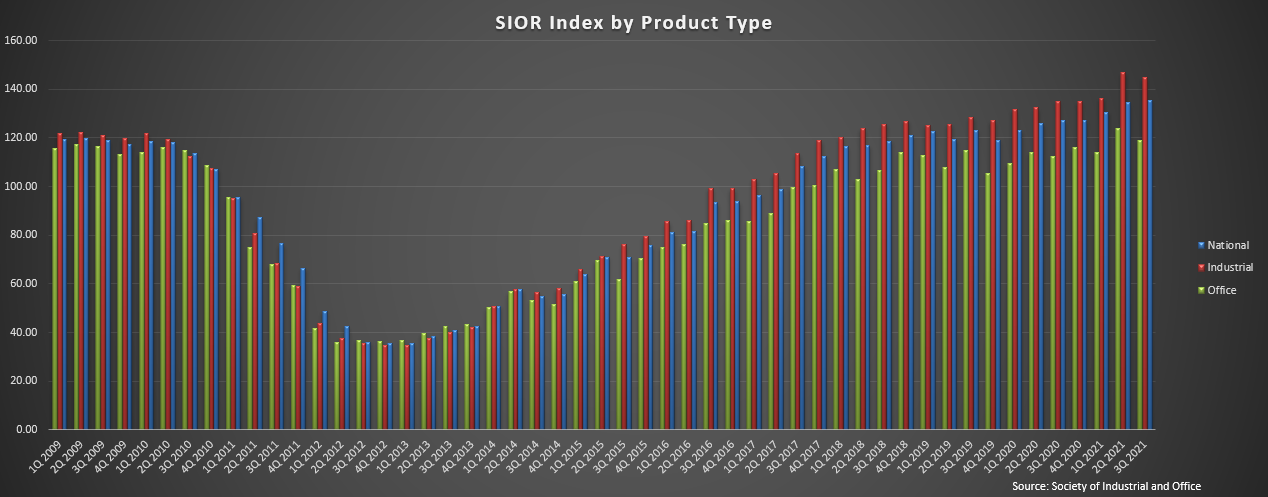

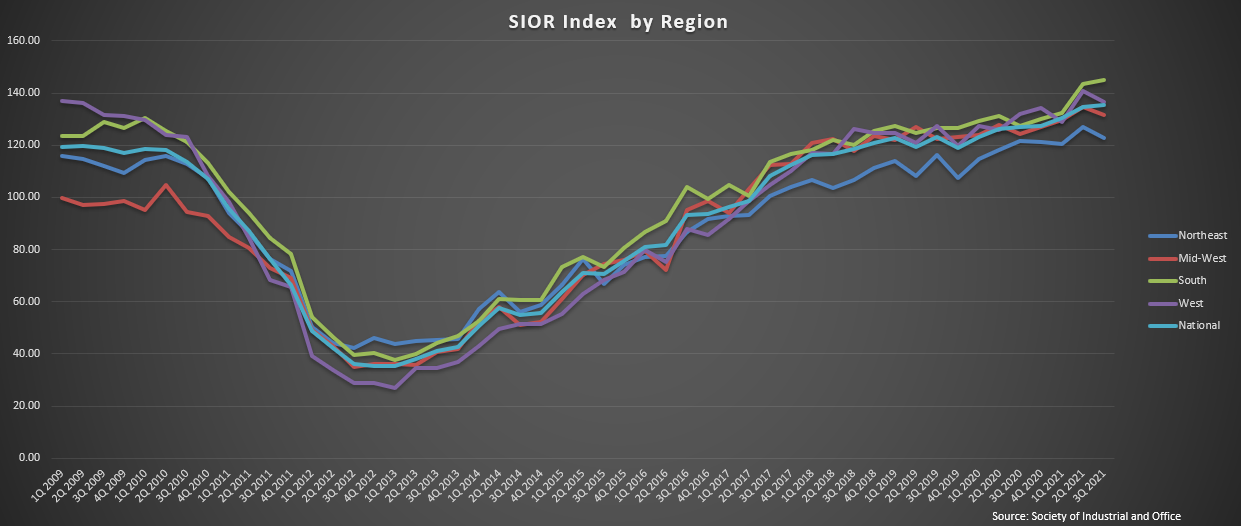

Features that differentiate this index are its timeliness its emphasis on average institutional quality properties and its ability to capture changes in the aggregate value of the commercial property. Even in the face of historical appreciation the Los Angeles housing market looks poised to benefit savvy investors for years to come. In commercial real estate rent demand is elastic. Meanwhile real estate prices tend to outpace inflation but not by much. This weeks chart highlights price changes for major property types in commercial real estate.

Source: rba.gov.au

Source: rba.gov.au

Commercial real estate CRE properties have exhibited impressive price appreciation as the longest economic expansion in US. At the same time real estate in Portland appreciated 1013 February 2012 to January 2021 the median home value in the United States went from 161000 to 266104 an increase of 652. This series covers commercial real estate price indices. A 235k home becomes worth 570k at 3 appreciation after 30 years but it becomes worth a whopping 762k at 4 appreciation. Meanwhile real estate investment trusts REITS tied with an average annual return of 105.

One percentage point makes quite a difference. In this study we contribute to the evidence on commercial property by examining 100 years of commercial. Residential and diversified real estate investments do a bit better averaging 105. Most commercial real estate will appreciate over time provided the property is maintained and the surrounding area does not decline. Appraisers use rent or income to determine what is known as the income approach to value.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

In fact with few exceptions the average sale price of homes sold in. For a better idea of how the Portland real estate market has performed in recent history its best to place it in context with the US. Currently there is limited international experience in constructing representative real estate price indices as real estate markets are heterogeneous both within and across countries and illiquid. Over the last year Dallas appreciation. Appreciation beyond inflationat least since the late 1970s.

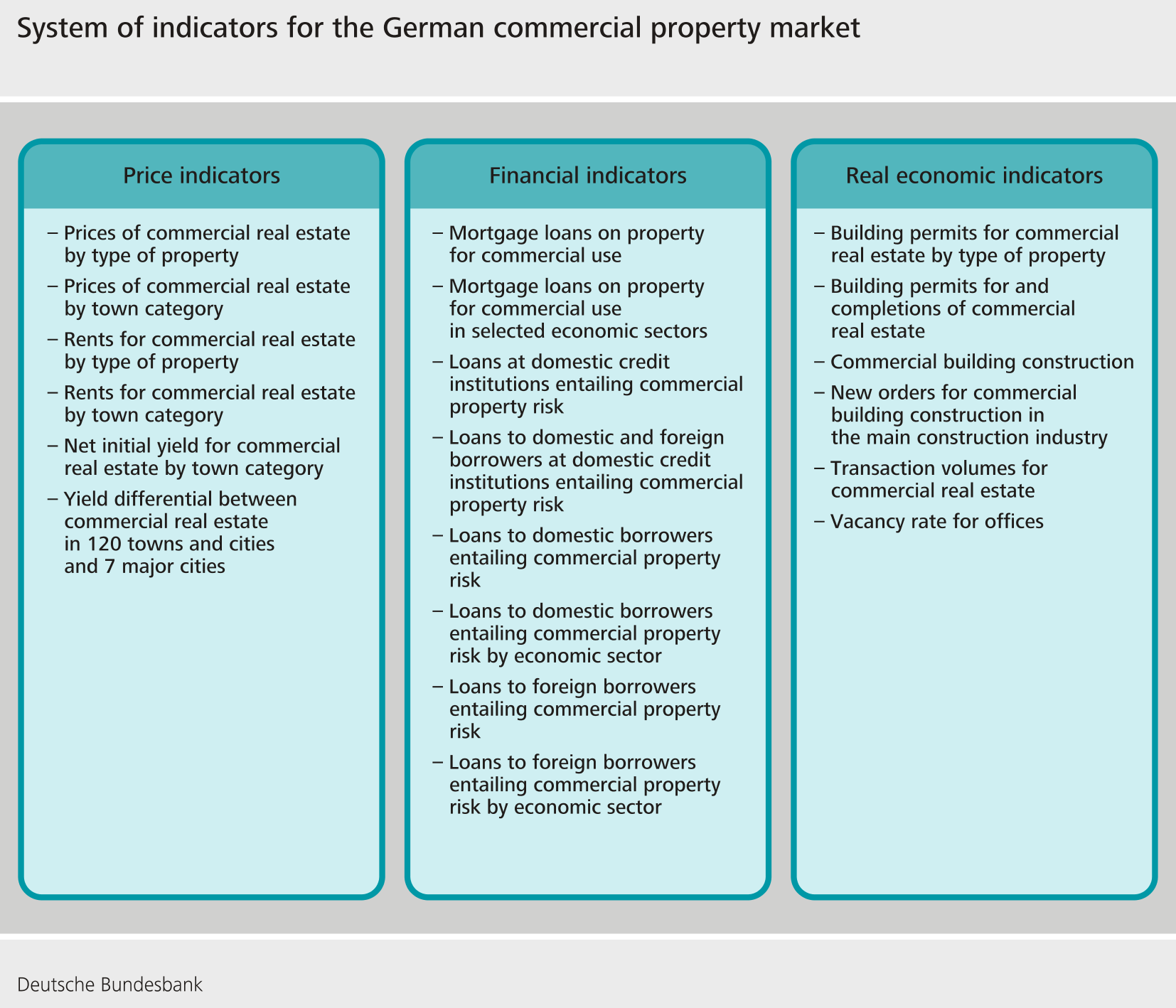

Source: bundesbank.de

Source: bundesbank.de

This kind of natural real estate appreciation is a great and not to mention effortless way of making money in real estate and getting a good return on investment when you decide to sell the investment property. Appraisers use rent or income to determine what is known as the income approach to value. Dallas real estate appreciated 7741 over the last ten years which is an average annual home appreciation rate of 590 putting Dallas in the top 10 nationally for real estate appreciation. It refers to how the value of an investment property increases with time. The 5000000 building would become worth 9030000.

Source: pinterest.com

Source: pinterest.com

To commercial real estate appreciation was rent growth. This weeks chart highlights price changes for major property types in commercial real estate. National CRE property prices have increased 246 and 465 over the past three and five years. Similarly several authors have noted that commercial property rents tend to be stationary in real dollars eg Wheaton and Torto 1994. Real Estate Bay Realty Brokerage 220 Duncan Mill Road Suite 209 Toronto ON M3B 3J5 Phone.

Source: pinterest.com

Source: pinterest.com

In 2000 at 108100 it was still below the national median but the percentage increase in appreciation over those six. Real Estate Bay Realty Brokerage 220 Duncan Mill Road Suite 209 Toronto ON M3B 3J5 Phone. Most commercial real estate will appreciate over time provided the property is maintained and the surrounding area does not decline. The 5000000 building would become worth 9030000. Real estate appreciation is a simple concept.

Source: pinterest.com

Source: pinterest.com

Another reason to know the rate is that you might not want to be tied to your home for 30 years. Meanwhile real estate prices tend to outpace inflation but not by much. Thus in the above examples a 1000000 building would become worth 1806000 over 20 years at 3 annual appreciation. SAN FRANCISCO-Most property sectors achieved annual price increases not seen since the beginning of this bull market in the 1990s says a report from Global Real Analytics publisher of. Dallas real estate appreciated 7741 over the last ten years which is an average annual home appreciation rate of 590 putting Dallas in the top 10 nationally for real estate appreciation.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate appreciation historical by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.