Your Commercial real estate analysis and investments answers images are ready. Commercial real estate analysis and investments answers are a topic that is being searched for and liked by netizens now. You can Get the Commercial real estate analysis and investments answers files here. Get all free vectors.

If you’re looking for commercial real estate analysis and investments answers images information linked to the commercial real estate analysis and investments answers keyword, you have pay a visit to the right blog. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

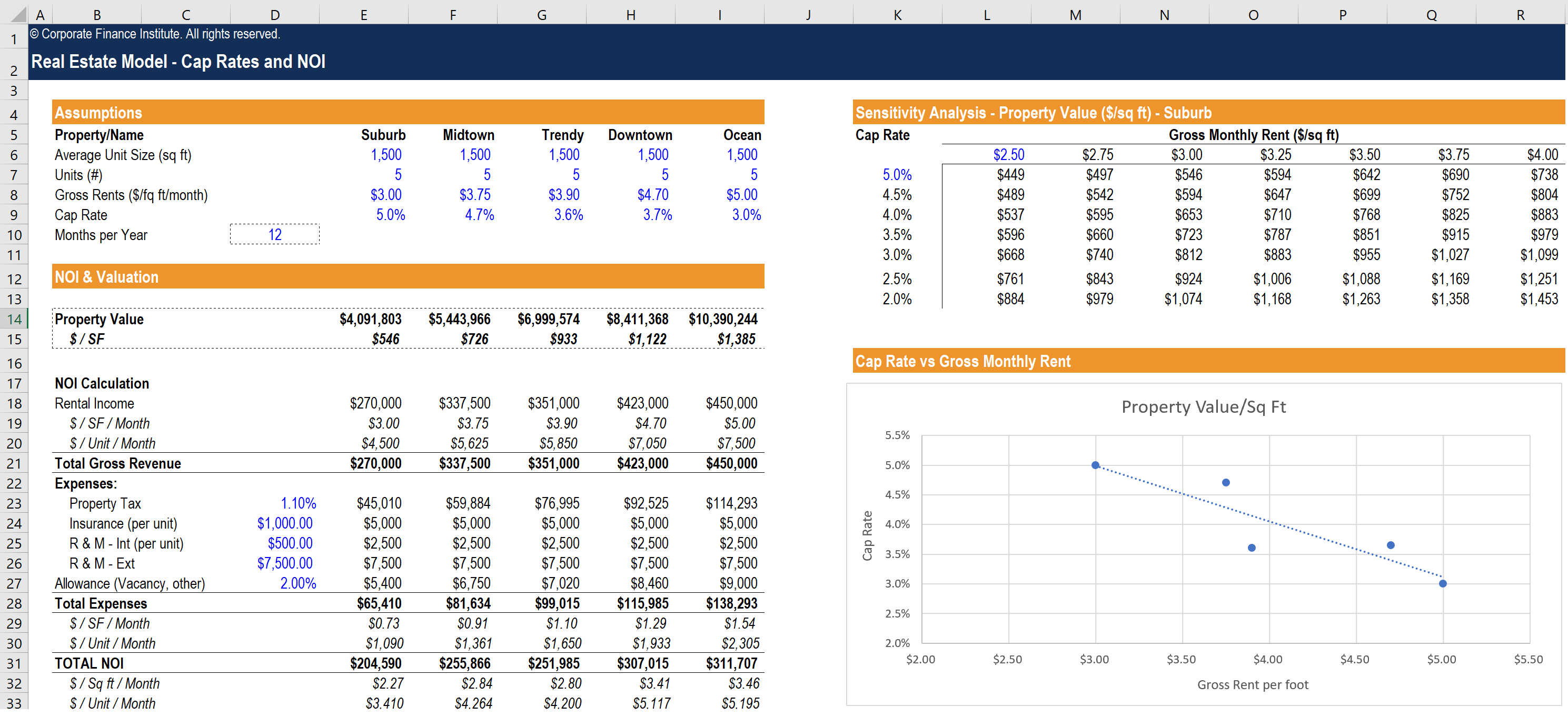

Commercial Real Estate Analysis And Investments Answers. Scott Person Associate Acquisitions Editor. If you increase the NOI by 2 a year 1350 your NOI would be 14850 giving you a COC of 9. The answer is 10-88 or NOI would have to grow by 25. Unlike static PDF Commercial Real Estate Analysis And Investments with CD-ROM 2nd Edition solution manuals or printed answer keys our experts show you how to solve each problem step-by-step.

New Sunpal 2x Solar Real Estate Light By Silicon Solar Solar Solutions Sign Lighting Silicon Solar From pinterest.com

New Sunpal 2x Solar Real Estate Light By Silicon Solar Solar Solutions Sign Lighting Silicon Solar From pinterest.com

N2 - The well-known and respected authorship team of Geltner and Miller bring you a new edition of what has become the undisputed and authoritative resource on commercial real estate investment. AU - Eichholtz PMA. AU - Clayton J. Real estate institutional investors face a challenging environment. The two major types of return measures are a periodic returns and b multiperiod returns. Also referred to as the real estate usage market or rental market.

Describe a typical work week for a real estate analyst.

Provide a text on commercial real estate analysis and investments with an emphasis on economics both urban and financial. ANSWERS TO STUDY QUESTIONS Chapter 9 91. Commercial Real Estate Chapter Exam Instructions. Prepared commercial real estate analysts should know exactly the type of tasks they will support before starting the job. View Notes - Chapter 13 Answers – Oddpdf from REAL EST 410 at University of Wisconsin. For graduate students Geltner Massachusetts Institute of Technology et al.

Source: in.pinterest.com

Source: in.pinterest.com

The commercial real estate market has lagged behind other financial sectors in fully embracing data analytics capabilities. DCF McGrath Chapter 10 101-3 3. The answer is 10-88 or NOI would have to grow by 25. Miller Jim Clayton Piet Eichholtz VPEditorial Director. NOI is the operating revenue minus the operating expenses.

Source: pinterest.com

Source: pinterest.com

The answer is 10-88 or NOI would have to grow by 25. SES LECTURES READINGS RECITATIONS. Commercial Real Estate Answers to End of Chapter Questions- Ch 17- Mortgage Calculation and Amortization. Unlike static PDF Commercial Real Estate Analysis And Investments with CD-ROM 2nd Edition solution manuals or printed answer keys our experts show you how to solve each problem step-by-step. No need to wait for office hours or assignments to be graded to find out where you took a wrong turn.

Source: fi.pinterest.com

Source: fi.pinterest.com

ANSWERS TO STUDY QUESTIONS Chapter 9 91. If you increase the NOI by 2 a year 1350 your NOI would be 14850 giving you a COC of 9. Commercial Real Estate Answers to End of Chapter Questions- Ch 14- Discounted Cash Flow Analysis. Commercial Real Estate Answers to End of Chapter Questions- Ch 17- Mortgage Calculation and Amortization. The Commercial Real Estate Analysis and Investment online short course from the MIT School of Architecture and Planning SAP draws on real-world examples of real estate investment and development projects with a focus on unique tools terms and theories that have been pioneered and developed by the Faculty Director David Geltner.

Source: pinterest.com

Source: pinterest.com

T1 - Commercial real estate analysis and investments. Commercial Real Estate Chapter Exam Instructions. Learn why now may be an opportune time to change that. Real estate institutional investors face a challenging environment. View Notes - Chapter 13 Answers – Oddpdf from REAL EST 410 at University of Wisconsin.

Source: pinterest.com

Source: pinterest.com

44 von 5 Sternen. This edition has been updated to include more examples and topics such as real estate development projects after-tax valuation own vs. PDF On Jan 1 2007 DM Geltner and others published Commercial Real Estate Analysis and Investments Find read and cite all the research you need on ResearchGate. Describe a typical work week for a real estate analyst. DCF cont and NPV.

Source: pinterest.com

Source: pinterest.com

Analyzing a Commercial Real Estate Investment By reducing the asking price to 735000 or by 2 a COC of 9 can be achieved. DCF McGrath Chapter 10 101-3 3. No need to wait for office hours or assignments to be graded to find out where you took a wrong turn. Scott Person Associate Acquisitions Editor. Prepared commercial real estate analysts should know exactly the type of tasks they will support before starting the job.

Source: pinterest.com

Source: pinterest.com

SES LECTURES READINGS RECITATIONS. Commercial Real Estate Chapter Exam Instructions. The two major types of return measures are a periodic returns and b multiperiod returns. Several factors appear to be limiting growth and profitability for real estate institutional investors. Course introduction Geltner Chapters 1 2 and skim parts.

Source: in.pinterest.com

Source: in.pinterest.com

Also referred to as the real estate usage market or rental market. Real estate space and asset markets. The Commercial Real Estate Analysis and Investment online short course from the MIT School of Architecture and Planning SAP draws on real-world examples of real estate investment and development projects with a focus on unique tools terms and theories that have been pioneered and developed by the Faculty Director David Geltner. Choose your answers to the questions and click Next to see the next set of questions. Faced with higher risks and competition.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

DCF cont and NPV. His most recent book Commercial Real Estate Analysis and Investment with David Geltner at MIT is in its third edition and is the worlds leading graduate-level real estate textbook. AU - Clayton J. DCF cont and NPV. If you increase the NOI by 2 a year 1350 your NOI would be 14850 giving you a COC of 9.

Source: researchgate.net

Source: researchgate.net

Describe a typical work week for a real estate analyst. DCF cont and NPV. The Commercial Real Estate Analysis and Investment online short course from the MIT School of Architecture and Planning SAP draws on real-world examples of real estate investment and development projects with a focus on unique tools terms and theories that have been pioneered and developed by the Faculty Director David Geltner. On completion of this course youll be armed with. Scott Person Associate Acquisitions Editor.

Source: pinterest.com

Source: pinterest.com

Prepared commercial real estate analysts should know exactly the type of tasks they will support before starting the job. Commercial Real Estate Analysis and Investment 18572 Words 75 Pages. Describe a typical work week for a real estate analyst. You can check your reasoning as you tackle a problem using our interactive solutions viewer. Commercial Real Estate Chapter Exam Instructions.

Source: wallstreetprep.com

Source: wallstreetprep.com

Streamlined and completely updated with. He has lectured around the world including France Singapore Thailand New Zealand and Russia. Individuals households and firms that want. Commercial Real Estate Analysis and Investments 3e ANSWERS TO STUDY QUESTIONS Chapter 13 131. Course introduction Geltner Chapters 1 2 and skim parts.

Source: pinterest.com

Source: pinterest.com

Apart from extraordi- nary capital improvement expenditures or partial sales proceeds the NOI represents the net cash flow spun off by the property. Learn why now may be an opportune time to change that. Also referred to as the real estate usage market or rental market. A data-driven finance-focused approach to real estate investment with a program that focuses solely on commercial real estate opportunities for profit and growth. Faced with higher risks and competition.

Source: pinterest.com

Source: pinterest.com

DCF McGrath Chapter 10 101-3 3. Apart from extraordi- nary capital improvement expenditures or partial sales proceeds the NOI represents the net cash flow spun off by the property. Commercial Real Estate Answers to End of Chapter Questions- Ch 30- Effective Rent Spreadsheet. If you increase the NOI by 2 a year 1350 your NOI would be 14850 giving you a COC of 9. ANSWERS TO STUDY QUESTIONS Chapter 11 111.

Source: pinterest.com

Source: pinterest.com

Several factors appear to be limiting growth and profitability for real estate institutional investors. The Commercial Real Estate Analysis and Investment online short course from the MIT School of Architecture and Planning SAP draws on real-world examples of real estate investment and development projects with a focus on unique tools terms and theories that have been pioneered and developed by the Faculty Director David Geltner. Learn why now may be an opportune time to change that. A data-driven finance-focused approach to real estate investment with a program that focuses solely on commercial real estate opportunities for profit and growth. Also referred to as the real estate usage market or rental market.

Source: pinterest.com

Source: pinterest.com

Commercial Real Estate Answers to End of Chapter Questions- Ch 14- Discounted Cash Flow Analysis. The multiperiod return gives a single inherently multiperiod. This cash flow is distributed first to any debt holders mortgage payments second to the government for income tax obliga-tions and third to. He has lectured around the world including France Singapore Thailand New Zealand and Russia. If you increase the NOI by 2 a year 1350 your NOI would be 14850 giving you a COC of 9.

Source: id.pinterest.com

Source: id.pinterest.com

The answer is 10-88 or NOI would have to grow by 25. This cash flow is distributed first to any debt holders mortgage payments second to the government for income tax obliga-tions and third to. T1 - Commercial real estate analysis and investments. For graduate students Geltner Massachusetts Institute of Technology et al. Choose your answers to the questions and click Next to see the next set of questions.

Source: researchgate.net

Source: researchgate.net

Band Mortgage Equity Capitalization or Atkerson format Ellwood This is the. For graduate students Geltner Massachusetts Institute of Technology et al. Mark Linton Content Project Manager. Commercial Real Estate Analysis and Investments Second Edition David M. Periodic returns measure what the investment grows to within each single period of time assuming that all cash flow or asset valuation occurs only at the beginning and end of the period of time.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial real estate analysis and investments answers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.