Your Colorado real estate withholding tax images are available. Colorado real estate withholding tax are a topic that is being searched for and liked by netizens today. You can Get the Colorado real estate withholding tax files here. Download all free photos.

If you’re looking for colorado real estate withholding tax pictures information connected with to the colorado real estate withholding tax interest, you have come to the ideal site. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

Colorado Real Estate Withholding Tax. The Colorado Department of Revenue requires withholding from sale proceeds anytime the seller is a nonresident and the sales price is greater than 100000. Prior Year Real Estate Withholding Forms. This is also on the low end compared to the whopper California. Why is this complicated.

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning Home Buying Process Real Estate Buying First Home From pinterest.com

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning Home Buying Process Real Estate Buying First Home From pinterest.com

This is for the entire state of Colorado including metro and rural areas. Colorados price appreciation Over the last 5 years Colorado has appreciated 56 source FHA. 3 days ago and trusts are subject to Colorado income tax withholding on the sales of Colorado real estate in excess of 100000. The Colorado withholding statute can be found at CRS. Colorado 2 Real Estate Withholding Tax. The federal state and local capital gains tax is combined to make one large sum and that sum in Colorado is 2963 percent.

The Colorado Department of Revenue requires withholding from sale proceeds anytime the seller is a nonresident and the sales price is greater than 100000.

Real Property Interest Transfers DR 1079 is required when remitting Colorado tax withheld. In general sales of Colorado real property valued at more than 100000 and made by non-residents of Colorado are subject to a withholding tax in anticipation of any Colorado income tax that could be due on the gain of the sale. Colorado 2 Real Estate Withholding Tax. Prior Year Real Estate Withholding Forms. The money they collect needs to be enough money to motivate the seller to file a Colorado tax return. The tax is withheld at.

Source: in.pinterest.com

Source: in.pinterest.com

DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. On the DR 1079 form use the name and Social Security numberColorado account number of the taxpayers who will claim the withholding tax on the Colorado income tax return. In general sales of Colorado real property valued at more than 100000 and made by non-residents of Colorado are subject to a withholding tax in anticipation of any Colorado income tax that could be due on the gain of the sale. Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on the sale of real estate in excess of 100000. More specifically the withholding tax will be the lesser of either 2 of.

Source: br.pinterest.com

Source: br.pinterest.com

Do not use the name and account number of the real estate company. Colorado 2 Real Estate Withholding Tax. Prior Year Real Estate Withholding Forms. The Colorado Department of Revenue requires withholding from sale proceeds anytime the seller is a nonresident and the sales price is greater than 100000. Any sale that shows a non-Colorado address.

Source: fool.com

Source: fool.com

Do not use the name and account number of the real estate company. The sale of Colorado real estate by nonresidents with some exceptions is subject to a withholding tax in the anticipation of Colorado income tax that will be due from the gain of the sale. Colorado state law requires the settlement agent of your real estate closing to withhold 2 of the sales price if you are moving out of state and not buying another primary residence. The federal state and local capital gains tax is combined to make one large sum and that sum in Colorado is 2963 percent. 2 withholding can be a significant amount of money and Colorado knows it.

Source: sandersustax.com

Source: sandersustax.com

3 days ago and trusts are subject to Colorado income tax withholding on the sales of Colorado real estate in excess of 100000. DR 1079 - Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers. If you dont live in Colorado and sell your Colorado property the company handling the closing is required to collect 2 of the sales price for the state of Colorado. This is for the entire state of Colorado including metro and rural areas. Do not use the name and account number of the real estate company.

Source: upnest.com

Source: upnest.com

The procedure is very similar to the FIRPTA withholding tax which is also a prepayment on any federal income tax which may be due. Withholding is required regardless of whether the Colorado-source income is. The money they collect needs to be enough money to motivate the seller to file a Colorado tax return. Colorados price appreciation Over the last 5 years Colorado has appreciated 56 source FHA. The withholding tax when imposed is the lesser of two percent of the sales price rounded to the nearest dollar or the net proceeds from the sale.

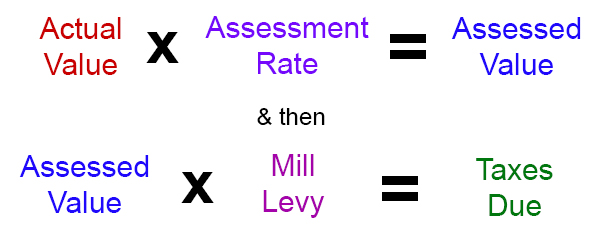

Source: bouldercounty.org

Source: bouldercounty.org

Any sale that shows a non-Colorado address. This applies to properties in Breckenridge Keystone Frisco Silverthorne Dillon and Copper Mou. 3 days ago and trusts are subject to Colorado income tax withholding on the sales of Colorado real estate in excess of 100000. Real Property Interest Transfers DR 1079 is required when remitting Colorado tax withheld. This is also on the low end compared to the whopper California.

Source: sellmyhousetosmith.com

Source: sellmyhousetosmith.com

Well to get around the amendment lawmakers later came up with a statewide documentary fee of 001 thats paid by the buyer on any property. Colorados price appreciation Over the last 5 years Colorado has appreciated 56 source FHA. This applies to properties in Breckenridge Keystone Frisco Silverthorne Dillon and Copper Mou. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. The Colorado withholding statute can be found at CRS.

Source: nycasas.com

Source: nycasas.com

When selling a home or condo in Summit County Colorado out of state sellers are subject to the 2 withholding tax. The withholding tax if required will be the smaller of two percent 2 of the sales price rounded to the nearest dollar or the net proceeds from the sale. More specifically the withholding tax will be the lesser of either 2 of. The procedure is very similar to the FIRPTA withholding tax which is also a prepayment on any federal income tax which may be due. The Colorado withholding statute can be found at CRS.

Source: crested-butte-real-estate.com

Source: crested-butte-real-estate.com

Since 1991 Colorado has appreciated 380. Pass-through entities must withhold an d remit Colorado income tax for any nonresident member who neither completes Form DR 0107 nor is included in a composite return. The withholding tax is made in anticipation of the Colorado income tax that will be due on the gain from the sale quoting from the instructions on the form. The IRS has reinstated Form 1099-NEC Nonemployee Compensation effective for tax year 2020 and forward. The money they collect needs to be enough money to motivate the seller to file a Colorado tax return.

Source: pinterest.com

Source: pinterest.com

DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. The tax is withheld at. This applies to non-residents. Beginning January 15 2021 you can submit Form 1099-NEC to the Colorado Department of Revenue via email. Any sale that shows a non-Colorado address.

Source: jmco.com

Source: jmco.com

This applies to properties in Breckenridge Keystone Frisco Silverthorne Dillon and Copper Mou. 2 withholding can be a significant amount of money and Colorado knows it. Colorado state law requires the settlement agent of your real estate closing to withhold 2 of the sales price if you are moving out of state and not buying another primary residence. The withholding tax is made in anticipation of the Colorado income tax that will be due on the gain from the sale quoting from the instructions on the form. Colorado 2 Real Estate Withholding Tax.

Source: goldgreece.com

Source: goldgreece.com

Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on the sale of real estate in excess of 100000. The form must be filed within 30 days of the date of closing. The law doesnt just apply to out-of-state individuals it also applies to corporations that do not maintain a permanent place of business in Colorado as well as estates and trusts outside of Colorado. Real estate transfer taxes are an especially tricky issue in Colorado as the state passed a constitutional amendment in 1992 freezing all real estate transfer taxes and prohibiting any new transfer taxes being imposed. On the DR 1079 form use the name and Social Security numberColorado account number of the taxpayers who will claim the withholding tax on the Colorado income tax return.

Source: pinterest.com

Source: pinterest.com

Why is this complicated. Do not use the name and account number of the real estate company. Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on the sale of real estate in excess of 100000. This is for the entire state of Colorado including metro and rural areas. Beginning January 15 2021 you can submit Form 1099-NEC to the Colorado Department of Revenue via email.

Source: pinterest.com

Source: pinterest.com

Real estate transfer taxes are an especially tricky issue in Colorado as the state passed a constitutional amendment in 1992 freezing all real estate transfer taxes and prohibiting any new transfer taxes being imposed. The withholding tax if required will be the smaller of two percent 2 of the sales price rounded to the nearest dollar or the net proceeds from the sale. If you dont live in Colorado and sell your Colorado property the company handling the closing is required to collect 2 of the sales price for the state of Colorado. Colorados price appreciation Over the last 5 years Colorado has appreciated 56 source FHA. The sale of Colorado real estate by nonresidents with some exceptions is subject to a withholding tax in the anticipation of Colorado income tax that will be due from the gain of the sale.

Source: pinterest.com

Source: pinterest.com

More specifically the withholding tax will be the lesser of either 2 of. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. Since 1991 Colorado has appreciated 380. The IRS has reinstated Form 1099-NEC Nonemployee Compensation effective for tax year 2020 and forward. Beginning January 15 2021 you can submit Form 1099-NEC to the Colorado Department of Revenue via email.

Source: fool.com

Source: fool.com

Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on the sale of real estate in excess of 100000. 2 withholding can be a significant amount of money and Colorado knows it. COLORADO CONVEYANCE OF REAL PROPERTY All sales of real property in the State of Colorado over 10000000 may be subject to a withholding tax in anticipation of Colorado income tax that will be due on gain from the sale. On the DR 1079 form use the name and Social Security numberColorado account number of the taxpayers who will claim the withholding tax on the Colorado income tax return. Colorados price appreciation Over the last 5 years Colorado has appreciated 56 source FHA.

Source: listwithclever.com

Source: listwithclever.com

More specifically the withholding tax will be the lesser of either 2 of. COLORADO CONVEYANCE OF REAL PROPERTY All sales of real property in the State of Colorado over 10000000 may be subject to a withholding tax in anticipation of Colorado income tax that will be due on gain from the sale. The procedure is very similar to the FIRPTA withholding tax which is also a prepayment on any federal income tax which may be due. DR 1079 - Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers. Do not use the name and account number of the real estate company.

Source: pinterest.com

Source: pinterest.com

Pass-through entities must withhold an d remit Colorado income tax for any nonresident member who neither completes Form DR 0107 nor is included in a composite return. This is for the entire state of Colorado including metro and rural areas. 3 days ago and trusts are subject to Colorado income tax withholding on the sales of Colorado real estate in excess of 100000. COLORADO CONVEYANCE OF REAL PROPERTY All sales of real property in the State of Colorado over 10000000 may be subject to a withholding tax in anticipation of Colorado income tax that will be due on gain from the sale. The sale of Colorado real estate by nonresidents with some exceptions is subject to a withholding tax in the anticipation of Colorado income tax that will be due from the gain of the sale.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title colorado real estate withholding tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.