Your Colorado real estate transfer tax images are ready in this website. Colorado real estate transfer tax are a topic that is being searched for and liked by netizens now. You can Download the Colorado real estate transfer tax files here. Find and Download all royalty-free photos.

If you’re looking for colorado real estate transfer tax pictures information connected with to the colorado real estate transfer tax keyword, you have pay a visit to the right site. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Colorado Real Estate Transfer Tax. 52 рядків Transfer taxes are calculated based on the sale price of your home and can. Additionally the uses of the transfer tax fee were expanded to include the improvement of land. Filter By Time All Past 24 hours Past Week Past Month. In a state of Colorado the fee is no more than 2 of the purchase price.

Free Colorado Revocable Living Trust Form Pdf Word Eforms From eforms.com

Free Colorado Revocable Living Trust Form Pdf Word Eforms From eforms.com

Additionally the uses of the transfer tax fee were expanded to include the improvement of land. All transactions for real property within the Town of Breckenridge in which no transfer tax is due must have a related exemption application. A real estate transfer tax is a tax thats charged when the title of a property is transferred from one owner to another. In the USA total transfer taxes can range between very small for example 01 in Colorado to relatively large 4 in the city of Pittsburgh. The tax imposed by this Chapter on the transfer of real property. A majority of states and the District of Columbia provide for this tax but 13 states do not.

What are real estate transfer taxes.

Transfer Taxes the fee associated with the transfer of the title of the property from one to another and is used by the town Private Transfer Fees generally associated with a propertybuilding and are established by the property association Home buyers can apply for an exemption up to 160000 US. Aspen CO Districts for Real Estate Transfer Tax RETT The City of Aspen Real Estate Transfer Tax RETT of approximately 15 is due upon the closing of a property within the City of Aspen. Closing entity withholds that one-time fee at the time of the closing and remits it to the Colorado Department of Revenue. Real estate instrument recording fee. Submitting to the registered electors of the state of Colorado an amendment to the Colorado constitution concerning the imposition of a real estate transfer tax of one-tenth of one percent of the value of real property transferred in the state that will be used to finance affordable housing and in connection therewith allowing the revenues from the tax to be collected and spent. A real estate transfer tax is a tax thats charged when the title of a property is transferred from one owner to another.

Source: deeds.com

Source: deeds.com

Real estate transfer taxes are taxes imposed on the transfer of title of real property. Depending on where you are you could be liable for transfer tax at the state. Real estate transfer tax is a tax that may be imposed by states counties or municipalities on the privilege of transferring real property within the jurisdiction. To report the purchase of real estate to the county re-corder. How much is the transfer tax.

Source: nl.pinterest.com

Source: nl.pinterest.com

How much is the transfer tax. Real estate instrument recording fee. What are real estate transfer taxes. This ordinance is no longer applicable due to passage of the TABOR Amendment which does not allow the town to raise the 1 tax under the Colorado Constitution. 52 рядків Transfer taxes are calculated based on the sale price of your home and can.

Source: corealestateattorneys.com

Source: corealestateattorneys.com

To report the purchase of real estate to the county re-corder. Real Estate Transfer by County. How much is the transfer tax. Any lease of real property with a term or initial term and all renewal terms. Closing entity withholds that one-time fee at the time of the closing and remits it to the Colorado Department of Revenue.

Source: arizonareport.com

Source: arizonareport.com

Real estate transfer taxes are taxes imposed on the transfer of title of real property. How much is the transfer tax. All transactions for real property within the Town of Breckenridge in which no transfer tax is due must have a related exemption application. REAL ESTATE TRANSFER TAX. Submitting to the registered electors of the state of Colorado an amendment to the Colorado constitution concerning the imposition of a real estate transfer tax of one-tenth of one percent of the value of real property transferred in the state that will be used to finance affordable housing and in connection therewith allowing the revenues from the tax to be collected and spent.

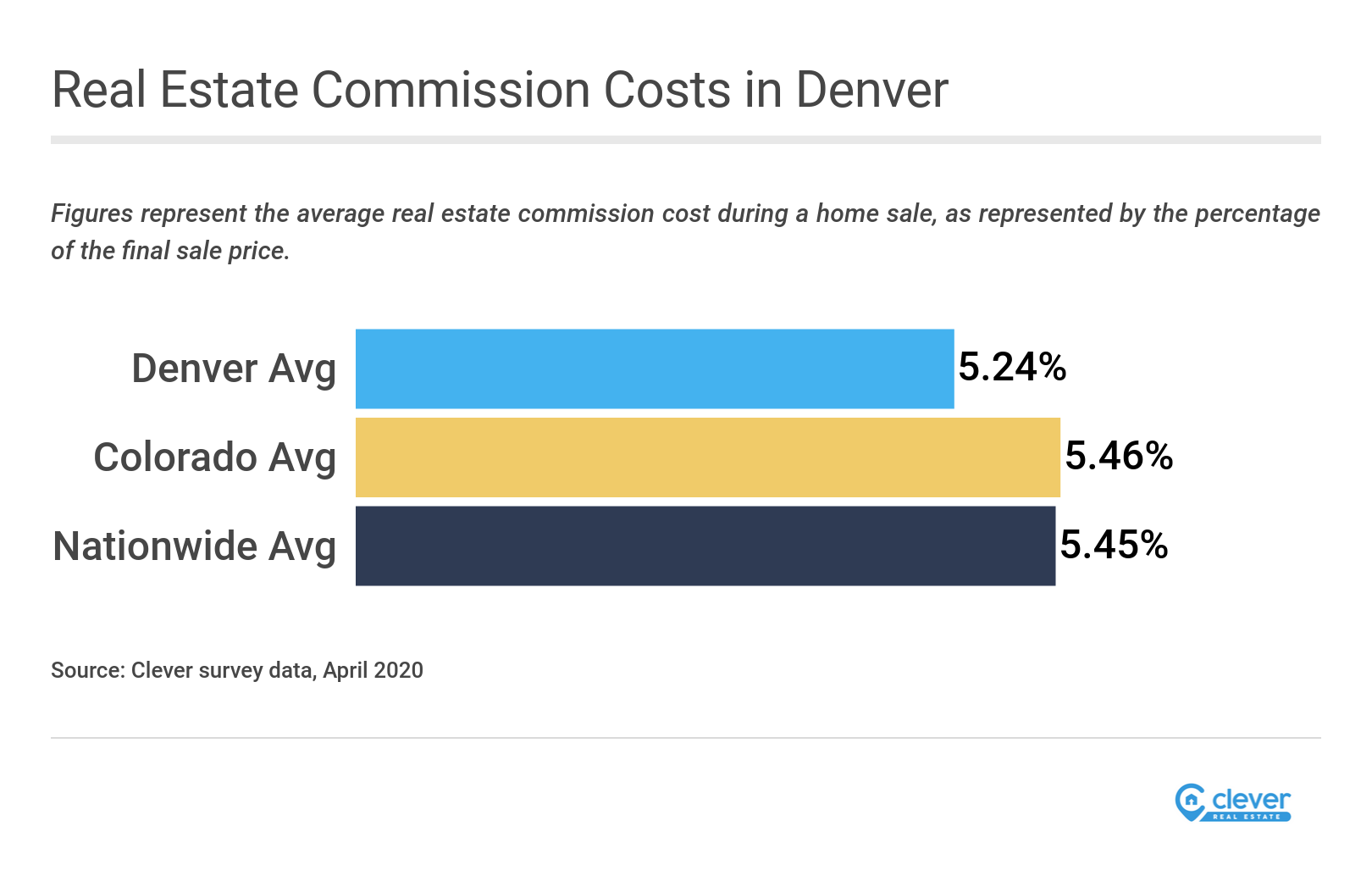

Source: listwithclever.com

Source: listwithclever.com

Controlling-interest transfers typically require a tax return to be filed with the appropriate jurisdiction to report the change in control and remit the tax. Popular Searched Yamasa co ltd real estate Patrick real estate ephrata wa Zillow houses for sale in deltona fl Elicense lookup real estate ohio Real estate market history chart Recently Searched Colorado real estate transfer tax Real estate university courses Mit real estate innovation lab. Controlling-interest transfers typically require a tax return to be filed with the appropriate jurisdiction to report the change in control and remit the tax. Submitting to the registered electors of the state of Colorado an amendment to the Colorado constitution concerning the imposition of a real estate transfer tax of one-tenth of one percent of the value of real property transferred in the state that will be used to finance affordable housing and in connection therewith allowing the revenues from the tax to be collected and spent. To report the purchase of real estate to the county re-corder.

Source:

Source:

Real estate transfer taxes are taxes imposed on the transfer of title of real property. To report the purchase of real estate to the county re-corder. Submitting to the registered electors of the state of Colorado an amendment to the Colorado constitution concerning the imposition of a real estate transfer tax of one-tenth of one percent of the value of real property transferred in the state that will be used to finance the provision of affordable housing and in connection therewith allowing the revenues from the tax to be collected and spent notwithstanding. Council established a cap of 1 on RETT unless voted on by town residents. Against the county tax.

Source: listwithclever.com

Source: listwithclever.com

Transfer Taxes the fee associated with the transfer of the title of the property from one to another and is used by the town Private Transfer Fees generally associated with a propertybuilding and are established by the property association Home buyers can apply for an exemption up to 160000 US. The tax is about 15 of the closing price payable by the buyer. Aspen CO Districts for Real Estate Transfer Tax RETT The City of Aspen Real Estate Transfer Tax RETT of approximately 15 is due upon the closing of a property within the City of Aspen. What are real estate transfer taxes. The tax imposed by this Chapter on the transfer of real property.

Source: pinterest.com

Source: pinterest.com

Transfer Taxes the fee associated with the transfer of the title of the property from one to another and is used by the town Private Transfer Fees generally associated with a propertybuilding and are established by the property association Home buyers can apply for an exemption up to 160000 US. Submitting to the registered electors of the state of Colorado an amendment to the Colorado constitution concerning the imposition of a real estate transfer tax of one-tenth of one percent of the value of real property transferred in the state that will be used to finance the provision of affordable housing and in connection therewith allowing the revenues from the tax to be collected and spent notwithstanding. Real estate transfer tax is a tax that may be imposed by states counties or municipalities on the privilege of transferring real property within the jurisdiction. Real estate transfer taxes are taxes imposed on the transfer of title of real property. Any lease of real property with a term or initial term and all renewal terms.

Source: deeds.com

Source: deeds.com

Real estate instrument recording fee. What are real estate transfer taxes. In Colorado we have a real estate transfer tax fee. Additionally the uses of the transfer tax fee were expanded to include the improvement of land. The state statutes may or may not stipulate who buyer or seller is responsible for paying the tax.

Source: yourcoloradospringshouse.com

Source: yourcoloradospringshouse.com

REAL ESTATE TRANSFER TAX. Depending on where you are you could be liable for transfer tax at the state. Against the county tax. Additionally the uses of the transfer tax fee were expanded to include the improvement of land. Council established a cap of 1 on RETT unless voted on by town residents.

Source: listwithclever.com

Source: listwithclever.com

A real estate transfer tax is a tax thats charged when the title of a property is transferred from one owner to another. REAL ESTATE TRANSFER TAX. In a state of Colorado the fee is no more than 2 of the purchase price. Real estate transfer taxes are taxes imposed on the transfer of title of real property. All transactions for real property within the Town of Breckenridge in which no transfer tax is due must have a related exemption application.

To report the purchase of real estate to the county re-corder. REAL ESTATE TRANSFER TAX. Transfer Taxes the fee associated with the transfer of the title of the property from one to another and is used by the town Private Transfer Fees generally associated with a propertybuilding and are established by the property association Home buyers can apply for an exemption up to 160000 US. Against the county tax. Lets break down Colorados real estate transfer taxes and answer some of the most frequently asked questions about the Centennial States real estate tax policy.

The Town of Breckenridge Real Estate Transfer Tax RETT is a tax imposed on all transfers of property located within the Town of Breckenridge unless specifically exempted by the Breckenridge Town Code. Exemptions for Real Estate Transfer Tax RETT are given based upon certain criteria which can be found in the Town of Avon Municipal Code Chapter 312060. In most cases it is an ad valorem tax that is based on the value of the property transferred. Real estate transfer taxes are taxes imposed on the transfer of title of real property. The tax imposed by this Chapter on the transfer of real property.

Source: eforms.com

Source: eforms.com

In the USA total transfer taxes can range between very small for example 01 in Colorado to relatively large 4 in the city of Pittsburgh. The tax is about 15 of the closing price payable by the buyer. In the USA total transfer taxes can range between very small for example 01 in Colorado to relatively large 4 in the city of Pittsburgh. To report the purchase of real estate to the county re-corder. The Town of Breckenridge Real Estate Transfer Tax RETT is a tax imposed on all transfers of property located within the Town of Breckenridge unless specifically exempted by the Breckenridge Town Code.

Source: wpgov.com

Source: wpgov.com

In the USA total transfer taxes can range between very small for example 01 in Colorado to relatively large 4 in the city of Pittsburgh. In most cases it is an ad valorem tax that is based on the value of the property transferred. In the USA total transfer taxes can range between very small for example 01 in Colorado to relatively large 4 in the city of Pittsburgh. The tax imposed by this Chapter on the transfer of real property. 52 рядків Transfer taxes are calculated based on the sale price of your home and can.

Source: ltgc.com

Source: ltgc.com

Colorado 2 Withholding on Real Estate Transactions for Nonresidents. All transactions for real property within the Town of Breckenridge in which no transfer tax is due must have a related exemption application. Real estate transfer tax is a tax that may be imposed by states counties or municipalities on the privilege of transferring real property within the jurisdiction. Aspen CO Districts for Real Estate Transfer Tax RETT The City of Aspen Real Estate Transfer Tax RETT of approximately 15 is due upon the closing of a property within the City of Aspen. What are real estate transfer taxes.

Source: store.nolo.com

Source: store.nolo.com

The state statutes may or may not stipulate who buyer or seller is responsible for paying the tax. Popular Searched Yamasa co ltd real estate Patrick real estate ephrata wa Zillow houses for sale in deltona fl Elicense lookup real estate ohio Real estate market history chart Recently Searched Colorado real estate transfer tax Real estate university courses Mit real estate innovation lab. In Colorado we have a real estate transfer tax fee. A real estate transfer tax is a tax thats charged when the title of a property is transferred from one owner to another. In our Summit County real estate market where many of our buyers and sellers are not residents of the state of Colorado this comes up quite a lot.

Source: upnest.com

Source: upnest.com

Colorado 2 Withholding on Real Estate Transactions for Nonresidents. Depending on where you are you could be liable for transfer tax at the state. 52 рядків Transfer taxes are calculated based on the sale price of your home and can. Exemptions for Real Estate Transfer Tax RETT are given based upon certain criteria which can be found in the Town of Avon Municipal Code Chapter 312060. This ordinance is no longer applicable due to passage of the TABOR Amendment which does not allow the town to raise the 1 tax under the Colorado Constitution.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title colorado real estate transfer tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.