Your Cobb county real estate tax records images are ready. Cobb county real estate tax records are a topic that is being searched for and liked by netizens today. You can Get the Cobb county real estate tax records files here. Get all free images.

If you’re looking for cobb county real estate tax records pictures information related to the cobb county real estate tax records interest, you have come to the ideal site. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Cobb County Real Estate Tax Records. The Marietta Daily Journal is the official organ of Cobb County. These records can include Cobb County property tax assessments and assessment challenges appraisals and income taxes. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. PT-61s are available online.

Cobb County Ga Hallock Law Llc Property Tax Appeals From hallocklaw.com

Cobb County Ga Hallock Law Llc Property Tax Appeals From hallocklaw.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Each sale is advertised in the official organ of the county as prescribed by law according to a period defined by general law. HOA fees are common within condos and some single-family home neighborhoods. Recording all Cobb County real estate deeds plats condominium floor plans UCC filings general execution docket and lien filings Military Discharge trade names and partnerships. Real Estate Division 10 East Park Square Building C Marietta GA 30090 770 528-1360. The time of sale is set forth by state law accordingly the Sheriffs Sale is conducted on the 1st Tuesday of the month.

They are maintained by various government offices in Cobb County Georgia State and at the Federal.

The Marietta Daily Journal is the official organ of Cobb County. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Each sale is advertised in the official organ of the county as prescribed by law according to a period defined by general law. SEE Detailed property tax report for 1832 Beckford Oaks Pl Cobb County GA. Cobb Countys Tax Assessor has a new website up and running.

Source: cobbassessor.org

Source: cobbassessor.org

The time of sale is set forth by state law accordingly the Sheriffs Sale is conducted on the 1st Tuesday of the month. The Cobb County Sheriffs Office conducts a public sale of property according to the general laws of this state. Cobb County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cobb County Georgia. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Cobb County Tax Appraisers office. Of note mobile home and heavy duty taxes are collected not only for the county the.

Source: houselogic.com

Source: houselogic.com

All revenue tax collected is distributed to the Cobb County Finance Department and the Cobb County Board of Education on a weekly basis. It includes powerful new search tools to give taxpayers access to information about real estate sales values and maps. Working together to strengthen our communities. Forms must be completed online printed and submitted with deed at the time of recording. The time of sale is set forth by state law accordingly the Sheriffs Sale is conducted on the 1st Tuesday of the month.

Source: homeatlanta.com

Source: homeatlanta.com

Read More Members Learn more about the benefits of being a members of the Cobb Association of REALTORS. Cobb County does not retain any portion of the fees. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. Below is a pie chart showing the average percentage of revenue collected among our taxing authorities for real and personal property taxes. Cobb County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cobb County Georgia.

Source: allongeorgia.com

Source: allongeorgia.com

Our Property Tax Division bills collects and distributes ad valorem property taxes for real property personal property boats planes business property etc heavy duty equipment mobile homes and public utilities. Certain types of Tax Records are available to the general public while some Tax Records are only available. PT-61s are available online. Cobb County does not retain any portion of the fees. Cobb County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Cobb County Georgia.

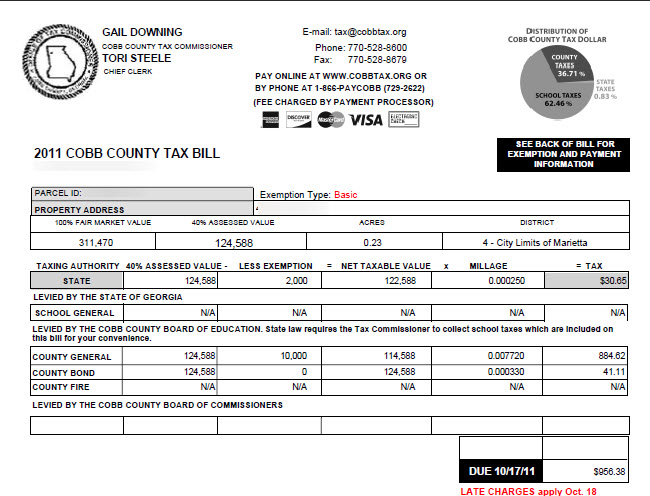

Source: cobbtax.org

Source: cobbtax.org

Read More Members Learn more about the benefits of being a members of the Cobb Association of REALTORS. The State of Georgia does not have a statewide property tax. Working together to strengthen our communities. For your convenience we also provide computers in our front lobby for filling out the PT-61 forms. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: cobbcounty.org

Source: cobbcounty.org

The median property tax on a 21100000 house is 166690 in Cobb County. The median property tax on. The time of sale is set forth by state law accordingly the Sheriffs Sale is conducted on the 1st Tuesday of the month. It includes powerful new search tools to give taxpayers access to information about real estate sales values and maps. See sample report.

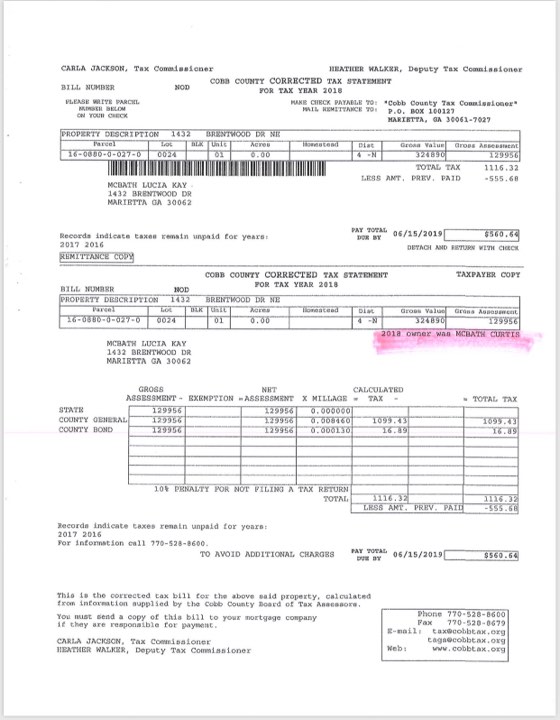

Source: pinterest.com

Source: pinterest.com

HOA fees are common within condos and some single-family home neighborhoods. Cobb County does not retain any portion of the fees. For your convenience we also provide computers in our front lobby for filling out the PT-61 forms. Personal Property Cobb County Board of Tax Assessors. In addition this division also processes homestead exemptions and conducts tax sales.

Source: ar.pinterest.com

Source: ar.pinterest.com

Certain types of Tax Records are available to the general public while some Tax Records are only available. All revenue tax collected is distributed to the Cobb County Finance Department and the Cobb County Board of Education on a weekly basis. The State of Georgia does not have a statewide property tax. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Source: cobbcounty.org

Source: cobbcounty.org

The median property tax on a 21100000 house is 166690 in Cobb County. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. There may be additional penalties interest or fees amounts that are not reflected. Of note mobile home and heavy duty taxes are collected not only for the county the. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: pinterest.com

Source: pinterest.com

Read More Members Learn more about the benefits of being a members of the Cobb Association of REALTORS. All revenue tax collected is distributed to the Cobb County Finance Department and the Cobb County Board of Education on a weekly basis. Please contact us directly at 770-528-8623 if you have delinquent payoff amounts. The time of sale is set forth by state law accordingly the Sheriffs Sale is conducted on the 1st Tuesday of the month. Of note mobile home and heavy duty taxes are collected not only for the county the.

Source: hallocklaw.com

Source: hallocklaw.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The mission of the Cobb County Board of Assessors is to produce an annual tax digest that conforms to the requirements of Georgia Law and the rules and regulations of the Georgia Department of Revenue. All revenue tax collected is distributed to the Cobb County Finance Department and the Cobb County Board of Education on a weekly basis. Cobb County does not retain any portion of the fees. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month.

Source: cobbcounty.org

Source: cobbcounty.org

Cobb County does not retain any portion of the fees. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Consumers REALTORS ensure the best experience when buying selling your home. The Real Estate Department provides a variety of services to the public including. These records can include Cobb County property tax assessments and assessment challenges appraisals and income taxes.

Source: cobbcounty.org

Source: cobbcounty.org

Its Who We R. The Marietta Daily Journal is the official organ of Cobb County. Quit Claim Deeds require a PT-61 and payment of transfer tax at the time of recording unless exempt. There may be additional penalties interest or fees amounts that are not reflected. The mission of the Cobb County Board of Assessors is to produce an annual tax digest that conforms to the requirements of Georgia Law and the rules and regulations of the Georgia Department of Revenue.

Source: cobbcounty.org

Source: cobbcounty.org

Cobb County Property Records are real estate documents that contain information related to real property in Cobb County Georgia. PT-61s are available online. Working together to strengthen our communities. Of note mobile home and heavy duty taxes are collected not only for the county the. The Real Estate Department provides a variety of services to the public including.

Source: in.pinterest.com

Source: in.pinterest.com

Please contact us directly at 770-528-8623 if you have delinquent payoff amounts. Real Estate Division 10 East Park Square Building C Marietta GA 30090 770 528-1360. The Real Estate Department provides a variety of services to the public including. The time of sale is set forth by state law accordingly the Sheriffs Sale is conducted on the 1st Tuesday of the month. If you think your homes assessment is too high or are just curious about home sales in your part of Cobb County.

Source: in.pinterest.com

Source: in.pinterest.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Cobb Countys Tax Assessor has a new website up and running. Working together to strengthen our communities. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Below is a pie chart showing the average percentage of revenue collected among our taxing authorities for real and personal property taxes.

Source: cobbcounty.org

Source: cobbcounty.org

SEE Detailed property tax report for 1832 Beckford Oaks Pl Cobb County GA. Cobb County does not retain any portion of the fees. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Cobb County Tax Appraisers office. In addition this division also processes homestead exemptions and conducts tax sales. Our Property Tax Division bills collects and distributes ad valorem property taxes for real property personal property boats planes business property etc heavy duty equipment mobile homes and public utilities.

Source: cobbcounty.org

Source: cobbcounty.org

A Marshals Sale is conducted on the 1st Monday of the month. See sample report. If you think your homes assessment is too high or are just curious about home sales in your part of Cobb County. Working together to strengthen our communities. Read More Members Learn more about the benefits of being a members of the Cobb Association of REALTORS.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cobb county real estate tax records by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.