Your City of richmond real estate tax rate images are ready. City of richmond real estate tax rate are a topic that is being searched for and liked by netizens today. You can Download the City of richmond real estate tax rate files here. Find and Download all free photos and vectors.

If you’re looking for city of richmond real estate tax rate pictures information connected with to the city of richmond real estate tax rate keyword, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

City Of Richmond Real Estate Tax Rate. In order to participate in the 2021 program for real estate property owners must pay their outstanding real estate taxes by March 31 2021 or enter a payment plan with 25 down and a duration of no more than 6 months. Richmonds low taxation is a result of the ongoing commitment by City Council and City Administration to focus on fiscal responsibility allowing them to effectively manage expenditures while still providing high quality services to a growing population. City of Richmond Maintenance Operations 05254100 Value. The interest rate is set by the Province pursuant to section 11 3 of the Taxation Rural Area Act.

Richmond Va Public Works From ci.richmond.va.us

Richmond Va Public Works From ci.richmond.va.us

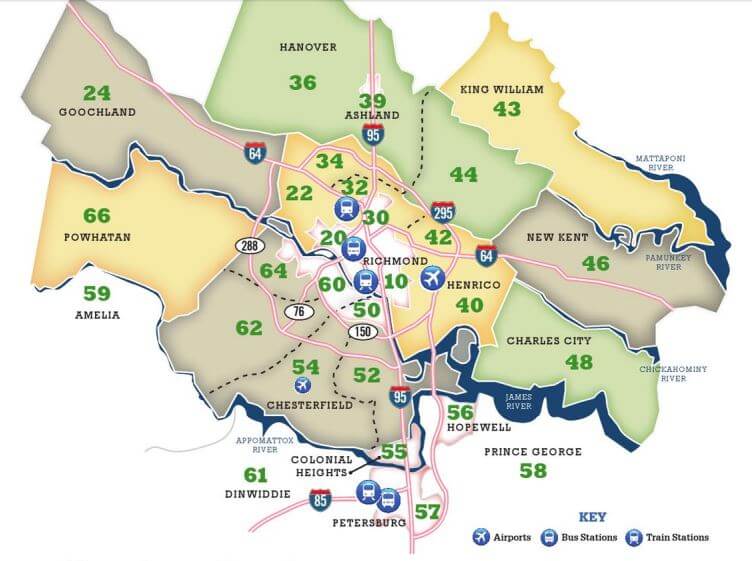

Real Property residential and commercial and Personal Property. Property values are determined by the City Assessor and the Department of Finance issues the tax bills based on the valuation information provided by the Assessors Office. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at. Property Tax Ad Valorem - 2019 Tax Year. 2007-299-261 was adopted by City Council for more details regarding business personal property taxes in 2009Real Estate Taxes Are Due In Two Equal Payments. In order to participate in the 2021 program for real estate property owners must pay their outstanding real estate taxes by March 31 2021 or enter a payment plan with 25 down and a duration of no more than 6 months.

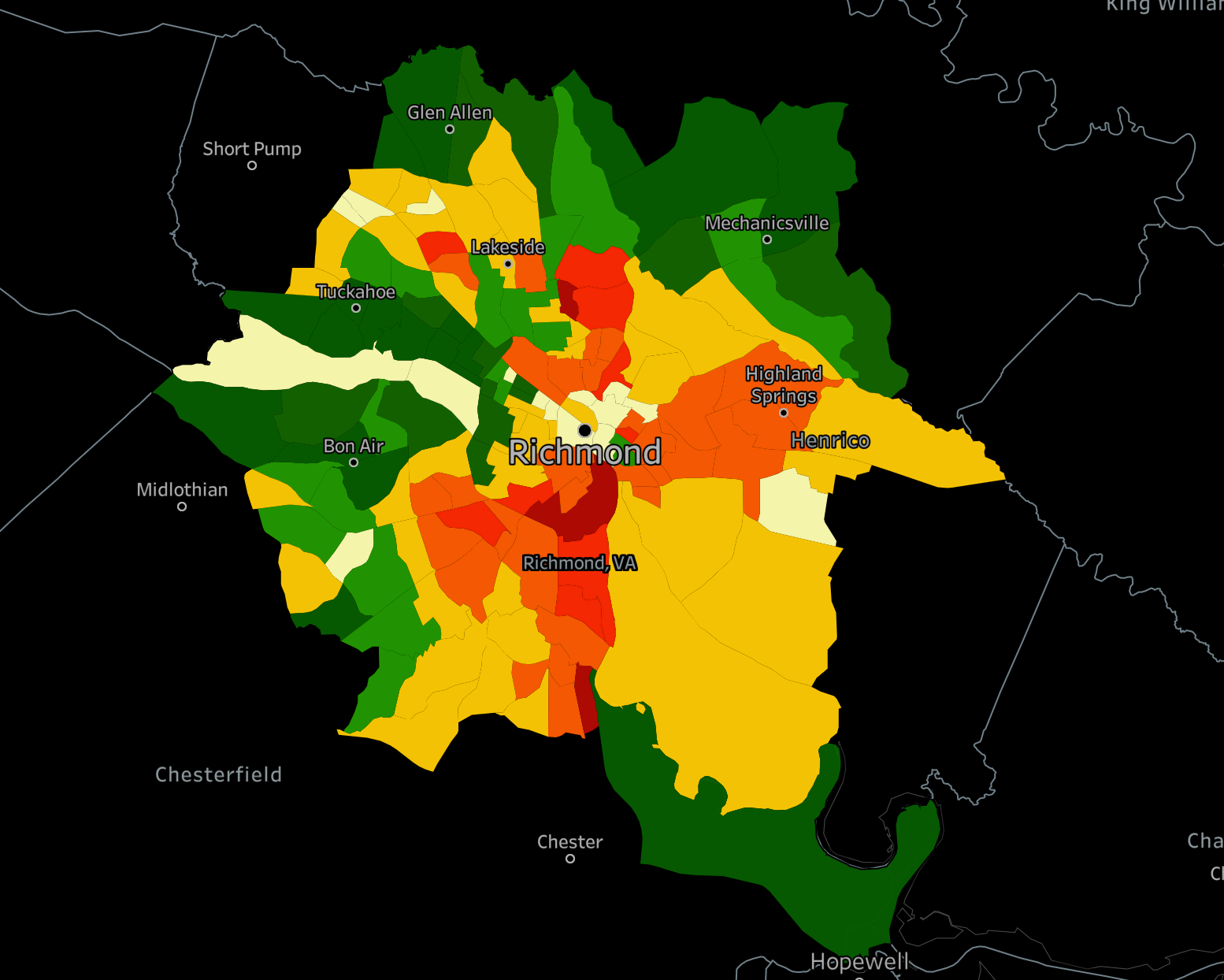

Homes that were constructed before 1980 make up 33 of Richmonds real estate market and many homes are older properties in the City of Richmond.

To produce an assessment roll in accordance with state statutes and to provide accurate information to the public all in a courteous efficient and. Property Tax Ad Valorem - 2019 Tax Year. Richmond City Hall. Real estate taxes are due on January 14th and June 14th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day. 2007-299-261 was adopted by City Council for more details regarding business personal property taxes in 2009Real Estate Taxes Are Due In Two Equal Payments. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

Source: pinterest.com

Source: pinterest.com

The city of Richmond is authorized by state law to levy taxes on real property in the city of Richmond. 604-276-4000 2020 City of Richmond. 107 Zeilen Richmonds real estate tax rate is 120 per 100 of assessed value. Richmond City Assessor Mission Statement It is the mission of the Richmond Real Estate Assessors Office to annually make equitable assessments at market value through teamwork while encouraging citizen participation in the process. Metro Vancouver 604-432-6200.

Source: pinterest.com

Source: pinterest.com

City of Richmond Maintenance Operations 05254100 Value. 7 days ago Shall the Ordinance amending the City of Richmonds Municipal Code changing the Real Estate Documentary Transfer Tax so the tax rate for properties below 1 million does not increase the rate for properties between 1 million to 3 million increases from 7 to 125. Schedule one time or periodic automatic payments with Flex-Pay. Richmond property tax is based on the assessed value of your home. 815 am to 500 pm Monday to Friday.

Source: pinterest.com

Source: pinterest.com

The rate for properties between 3 million to 10 million increases from 7 to 25. And the rate for properties. 2007-299-261 was adopted by City Council for more details regarding business personal property taxes in 2009Real Estate Taxes Are Due In Two Equal Payments. The city of Richmond is authorized by state law to levy taxes on real property in the city of Richmond. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxesinclude creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay.

Source: fi.pinterest.com

Source: fi.pinterest.com

107 Zeilen Richmonds real estate tax rate is 120 per 100 of assessed value. The interest rate is set by the Province pursuant to section 11 3 of the Taxation Rural Area Act. In order to participate in the 2021 program for real estate property owners must pay their outstanding real estate taxes by March 31 2021 or enter a payment plan with 25 down and a duration of no more than 6 months. Disabled Veteransor their surviving spouseswho believe they. The real estate tax rate is 120 per 100 of the properties assessed value.

Source: pinterest.com

Source: pinterest.com

4 1000 of assessment value over 4M Between 3M to 4M Over 4M New Additional School Tax for Qualifying Residential Properties. City of Richmond Maintenance Operations 05254100 Value. Property Tax Ad Valorem - 2019 Tax Year. 604-276-4000 2020 City of Richmond. Disabled Veteransor their surviving spouseswho believe they.

Source: wowa.ca

Source: wowa.ca

Disabled Veteransor their surviving spouseswho believe they. Richmonds low taxation is a result of the ongoing commitment by City Council and City Administration to focus on fiscal responsibility allowing them to effectively manage expenditures while still providing high quality services to a growing population. Property Tax Ad Valorem - 2019 Tax Year. The City of Richmonds 2020 residential rate is 180065 per 1000 of assessed property value. These agencies provide their required tax rates and the City collects the taxes on their behalf.

Source: pinterest.com

Source: pinterest.com

Property Tax Ad Valorem - 2019 Tax Year. The interest rate is set by the Province pursuant to section 11 3 of the Taxation Rural Area Act. Metro Vancouver 604-432-6200. 7 days ago Shall the Ordinance amending the City of Richmonds Municipal Code changing the Real Estate Documentary Transfer Tax so the tax rate for properties below 1 million does not increase the rate for properties between 1 million to 3 million increases from 7 to 125. 2 1000 of assessment value between 3M to 4M Tier 2.

Source: de.pinterest.com

Source: de.pinterest.com

Real Property residential and commercial and Personal Property. Property Tax Ad Valorem - 2019 Tax Year. 4 1000 of assessment value over 4M Between 3M to 4M Over 4M New Additional School Tax for Qualifying Residential Properties. The rate for properties between 3 million to 10 million increases from 7 to 25. Greater Vancouver Transportation Authority TransLink 604-953-3333.

Source: pinterest.com

Source: pinterest.com

Richmond City Assessor Mission Statement It is the mission of the Richmond Real Estate Assessors Office to annually make equitable assessments at market value through teamwork while encouraging citizen participation in the process. To produce an assessment roll in accordance with state statutes and to provide accurate information to the public all in a courteous efficient and. What is considered real property. Real Property residential and commercial and Personal Property. The current interest rate is 545 and will be adjusted quarterly in line with interest trends.

Source: pinterest.com

Source: pinterest.com

Schedule one time or periodic automatic payments with Flex-Pay. Richmond City Assessor Mission Statement It is the mission of the Richmond Real Estate Assessors Office to annually make equitable assessments at market value through teamwork while encouraging citizen participation in the process. Schedule one time or periodic automatic payments with Flex-Pay. City of Richmond Debt Service 01745100 Value Total Property Tax Rate 06999100 Value. Every year the BC Assessment conducts an evaluation.

Source: ro.pinterest.com

Source: ro.pinterest.com

The City of Richmonds 2020 residential rate is 180065 per 1000 of assessed property value. What is considered real property. City of Richmond Debt Service 01745100 Value Total Property Tax Rate 06999100 Value. 2 1000 of assessment value between 3M to 4M Tier 2. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxesinclude creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay.

Source: pinterest.com

Source: pinterest.com

7 days ago Shall the Ordinance amending the City of Richmonds Municipal Code changing the Real Estate Documentary Transfer Tax so the tax rate for properties below 1 million does not increase the rate for properties between 1 million to 3 million increases from 7 to 125. City of Richmond Maintenance Operations 05254100 Value. Richmond City Hall. Metro Vancouver 604-432-6200. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

Source: ci.richmond.va.us

Source: ci.richmond.va.us

The interest rate is set by the Province pursuant to section 11 3 of the Taxation Rural Area Act. 7 days ago Shall the Ordinance amending the City of Richmonds Municipal Code changing the Real Estate Documentary Transfer Tax so the tax rate for properties below 1 million does not increase the rate for properties between 1 million to 3 million increases from 7 to 125. What is the due date of real estate taxes in the City of Richmond. Richmond property tax rates are the fourth lowest property tax rates in BC for municipalities with a population greater than 10K. 4 1000 of assessment value over 4M Between 3M to 4M Over 4M New Additional School Tax for Qualifying Residential Properties.

Source: richmond.com

Source: richmond.com

Property Tax Ad Valorem - 2019 Tax Year. 815 am to 500 pm Monday to Friday. What is considered real property. 2 1000 of assessment value between 3M to 4M Tier 2. 2007-299-261 was adopted by City Council for more details regarding business personal property taxes in 2009Real Estate Taxes Are Due In Two Equal Payments.

Source: ar.pinterest.com

Source: ar.pinterest.com

The interest rate is set by the Province pursuant to section 11 3 of the Taxation Rural Area Act. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at. Tax Rate 2038 - 100 assessment. City of Richmond Maintenance Operations 05254100 Value. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxesinclude creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay.

Source: learn.roofstock.com

Source: learn.roofstock.com

The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median. Richmond property tax is based on the assessed value of your home. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxesinclude creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. Real estate taxes are due on January 14th and June 14th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day. The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median.

Source: pinterest.com

Source: pinterest.com

7 days ago Shall the Ordinance amending the City of Richmonds Municipal Code changing the Real Estate Documentary Transfer Tax so the tax rate for properties below 1 million does not increase the rate for properties between 1 million to 3 million increases from 7 to 125. Richmond property tax is based on the assessed value of your home. Richmonds low taxation is a result of the ongoing commitment by City Council and City Administration to focus on fiscal responsibility allowing them to effectively manage expenditures while still providing high quality services to a growing population. The current interest rate is 545 and will be adjusted quarterly in line with interest trends. Property Tax Ad Valorem - 2019 Tax Year.

Source: mrwilliamsburg.com

Source: mrwilliamsburg.com

Homes that were constructed before 1980 make up 33 of Richmonds real estate market and many homes are older properties in the City of Richmond. Every year the BC Assessment conducts an evaluation. The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxesinclude creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. The real estate tax rate is 120 per 100 of the properties assessed value.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title city of richmond real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.