Your City of richmond real estate tax due dates images are available. City of richmond real estate tax due dates are a topic that is being searched for and liked by netizens today. You can Download the City of richmond real estate tax due dates files here. Download all free vectors.

If you’re looking for city of richmond real estate tax due dates pictures information connected with to the city of richmond real estate tax due dates topic, you have pay a visit to the right site. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

City Of Richmond Real Estate Tax Due Dates. 3 Road Richmond BC. 2007-299-261 was adopted by City Council for more details regarding business personal property taxes in 2009Real Estate Taxes Are Due In Two Equal Payments. Richmond County currently performs a General Reassessment of all parcels of land including improvements every four4 to five 5 years. Offered by City of Richmond Virginia.

New Listing Alert Team Member Grantgoodagent Does It Again With This Offering Located In The Quickly Changing City Of Rich Home Buying New Homes Homeowner From fi.pinterest.com

New Listing Alert Team Member Grantgoodagent Does It Again With This Offering Located In The Quickly Changing City Of Rich Home Buying New Homes Homeowner From fi.pinterest.com

Business License Renewals and First Installment Payment Due. Real-Estate-USInfo disclaims any and all representations warranties or guarantees of any kind. All late payments accrue interest. Richmond City Assessor Mission Statement It is the mission of the Richmond Real Estate Assessors Office to annually make equitable assessments at market value through teamwork while encouraging citizen participation in the process. Annual Tax notices are sent to property owners in the last week of May. To produce an assessment roll in accordance with state statutes and to provide accurate information to the public all in a courteous efficient and.

Real estate taxes are due on January 14 th and June 14 th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day.

Real estate taxes are due on January 14 th and June 14 th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day. Business Personal Property Machinery Tools Tax Return Filing Deadline. If you do not receive a bill it is your responsibility to investigate whether you have a liability to the Town. Offered by City of Richmond Virginia. Property Taxes are due once a year in Richmond on the first business day of July. Taxes are payable on November 10th 1st half and May 10th 2nd half.

Source: richmondmagazine.com

Source: richmondmagazine.com

Assessments Pursuant to the Code of Virginia all real estate assessments are valued at 100 of Fair Market Value based on recent property sales throughout the County. Richmond City Assessor Mission Statement It is the mission of the Richmond Real Estate Assessors Office to annually make equitable assessments at market value through teamwork while encouraging citizen participation in the process. To produce an assessment roll in accordance with state statutes and to provide accurate information to the public all in a courteous efficient and. Real Estate Tax Payment Due First Half. Payments can be made through the mail the tax commissioners website and at the Municipal Building.

Source: pinterest.com

Source: pinterest.com

Real estate taxes are due in two equal payments on January 14 2020 and June 14 2020. Please note that failure to receive a tax bill does not negate the requirement to pay the tax. Friday July 2 2021 Richmond residents will have. Billing is on annual basis and payments are due on December 5 th of each year. Real estate taxes are due on January 14 th and June 14 th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day.

Source: fi.pinterest.com

Source: fi.pinterest.com

Business License Renewals and First Installment Payment Due. The City of Richmonds fiscal year is July 1 through June 30. Late payment penalty of 10 is applied on December 6 th. Value of Real Estate Personal Property and Machinery Tools Established. 2007-299-261 was adopted by City Council for more details regarding business personal property taxes in 2009Real Estate Taxes Are Due In Two Equal Payments.

Source: ci.richmond.va.us

Source: ci.richmond.va.us

Richmond City Assessor Mission Statement It is the mission of the Richmond Real Estate Assessors Office to annually make equitable assessments at market value through teamwork while encouraging citizen participation in the process. Residents are invited to attend the annual budget hearings in April and May of each year. City Offering Tax Amnesty for Real Estate and Personal Property Taxes Due in June 2020 Allowing Payment without Penalty or Interest by August 14 2020 In light of the impact the COVID-19 pandemic has had on those who live and work in the city of Richmond the City is also offering Tax Amnesty on penalties and interest applied to Real Estate and Tangible Personal Property Taxes. Taxes are payable on November 10th 1st half and May 10th 2nd half. Pay Real Estate Tax.

Source: pinterest.com

Source: pinterest.com

How to read your Property Tax Bill See bill example to know How to Read Your Property Tax Bill. Bills paid after November 15th will incur interest charges immediately thereafter each month and a one-time penalty of 10 on December the 20th. 1000am Monday September 27 2021. Tax bills are mailed in the month of July. Tax bills which are usually mailed in mid-September will retain their same due date of November 15th.

Source: rva.gov

Source: rva.gov

The effective date of the. Value of Real Estate Personal Property and Machinery Tools Established. The effective date of the. City Offering Tax Amnesty for Real Estate and Personal Property Taxes Due in June 2020 Allowing Payment without Penalty or Interest by August 14 2020 In light of the impact the COVID-19 pandemic has had on those who live and work in the city of Richmond the City is also offering Tax Amnesty on penalties and interest applied to Real Estate and Tangible Personal Property Taxes. Real estate taxes are due in two equal payments on January 14 2020 and June 14 2020.

Source: ar.pinterest.com

Source: ar.pinterest.com

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Offered by City of Richmond Virginia. Real-Estate-USInfo disclaims any and all representations warranties or guarantees of any kind. What is the due date of real estate taxes in the City of Richmond. How to read your Property Tax Bill See bill example to know How to Read Your Property Tax Bill.

Source: ci.richmond.va.us

Source: ci.richmond.va.us

Real Estate taxes are assessed as of January 1 st of each year. Billing is on annual basis and payments are due on December 5 th of each year. Real estate taxes are due on January 14 th and June 14 th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day. 3 Road Richmond BC. Time Date.

Source: richmondmagazine.com

Source: richmondmagazine.com

Real Estate Taxes are billed once a year with a December 5 th due date. Tax bills are mailed in the month of July. Real-Estate-USInfo disclaims any and all representations warranties or guarantees of any kind. Real Estate Taxes are billed once a year with a December 5 th due date. Richmond City Assessor Mission Statement It is the mission of the Richmond Real Estate Assessors Office to annually make equitable assessments at market value through teamwork while encouraging citizen participation in the process.

Source: richmondmagazine.com

Source: richmondmagazine.com

Late payment penalty of 10 is applied on December 6 th. Time Date. City of Richmond Council Chambers 6911 No. 1000am Monday September 27 2021. Friday July 2 2021 Richmond residents will have.

Source: richmondbizsense.com

Source: richmondbizsense.com

Business License Renewals and First Installment Payment Due. City Offering Tax Amnesty for Real Estate and Personal Property Taxes Due in June 2020 Allowing Payment without Penalty or Interest by August 14 2020 In light of the impact the COVID-19 pandemic has had on those who live and work in the city of Richmond the City is also offering Tax Amnesty on penalties and interest applied to Real Estate and Tangible Personal Property Taxes. 1000am Monday September 27 2021. Time Date. Offered by City of Richmond Virginia.

Source: richmond.com

Source: richmond.com

What is the due date of real estate taxes in the City of Richmond. All late payments accrue interest. Value of Real Estate Personal Property and Machinery Tools Established. 1000am Monday September 27 2021. Business License Renewals and First Installment Payment Due.

Source: pinterest.com

Source: pinterest.com

Real estate taxes are due on January 14 th and June 14 th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day. Tax bills are mailed in the month of July. How to read your Property Tax Bill See bill example to know How to Read Your Property Tax Bill. If you do not receive a bill it is your responsibility to investigate whether you have a liability to the Town. Taxes are payable on November 10th 1st half and May 10th 2nd half.

Source: pinterest.com

Source: pinterest.com

Real Estate taxes are assessed as of January 1 st of each year. Billing is on annual basis and payments are due on December 5 th of each year. Real estate taxes are due in two equal payments on January 14 2020 and June 14 2020. Disabled Veterans or their surviving spouses who believe they may be eligible for the real estate tax exemption effective January 1 2011 as a result of an amendment to the Virginia Constitution and subsequent legislation enacted by the Virginia General Assembly should contact the City Assessors Office at 804 646-7500 to obtain further information. 3 Road Richmond BC.

Source: pinterest.com

Source: pinterest.com

Property Taxes are due once a year in Richmond on the first business day of July. Bills paid after November 15th will incur interest charges immediately thereafter each month and a one-time penalty of 10 on December the 20th. Tax bills are mailed in the month of July. The November payment is for July 1st through December 31st and the May payment is for January 1st through June 30th. What is the due date of real estate taxes in the City of Richmond.

Source: learn.roofstock.com

Source: learn.roofstock.com

1000am Monday September 27 2021. Assessments Pursuant to the Code of Virginia all real estate assessments are valued at 100 of Fair Market Value based on recent property sales throughout the County. All late payments accrue interest. If you do not receive your tax notice by mid June please contact the Tax department at 604-276-4145. Property Taxes are due once a year in Richmond on the first business day of July.

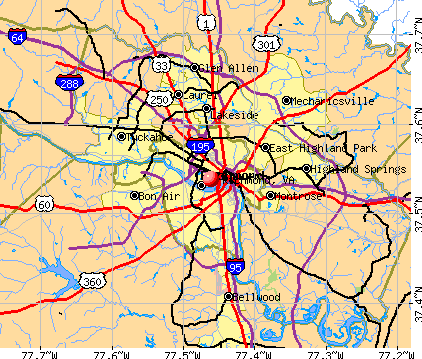

Source: city-data.com

Source: city-data.com

Business License Renewals and First Installment Payment Due. 1000am Monday September 27 2021. The budget is also available to the public upon request. Value of Real Estate Personal Property and Machinery Tools Established. The City of Richmonds fiscal year is July 1 through June 30.

Source: pinterest.com

Source: pinterest.com

City of Richmond Council Chambers 6911 No. 2007-299-261 was adopted by City Council for more details regarding business personal property taxes in 2009Real Estate Taxes Are Due In Two Equal Payments. Late payment penalty of 10 is applied on December 6 th. How to read your Property Tax Bill See bill example to know How to Read Your Property Tax Bill. Tax bills are mailed in the month of July.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title city of richmond real estate tax due dates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.