Your City of chicago real estate transfer tax images are available. City of chicago real estate transfer tax are a topic that is being searched for and liked by netizens today. You can Download the City of chicago real estate transfer tax files here. Find and Download all free vectors.

If you’re searching for city of chicago real estate transfer tax pictures information related to the city of chicago real estate transfer tax topic, you have pay a visit to the ideal blog. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

City Of Chicago Real Estate Transfer Tax. This is a tax imposed when titled real estate property is transferred within the city of Chicago. For more information on the citys real property transfer taxes there is some useful information available here. Real Estate Transfer Tax in Chicago. Section 3-33-060O of the Municipal Code includes a refund provision for the CTA portion of the Real Property Transfer Tax for transfers valued at 25000000 or less to transferees who are age 65 years or older and will occupy the property as the principal dwelling place for at.

What Is A Real Estate Transfer Tax The Civic Federation From civicfed.org

What Is A Real Estate Transfer Tax The Civic Federation From civicfed.org

7501000 for city portion 3001000 for CTA portion a supplemental tax. Who Pays The Property Transfer Tax In Chicago IL. Transfer tax rates are frequently charged per each monetary unit of sale price. Real Estate Transfer Tax in Chicago. There are City of Chicago Transfer Taxes Cook County Transfer Taxes and State of Illinois Transfer Taxes. Effective 112016 in accordance with URPO Ruling 5 all Real Property Transfer Tax declarations must be filed online at httpsmytaxillinoisgovMyDec.

By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged.

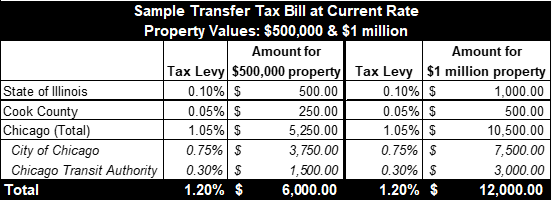

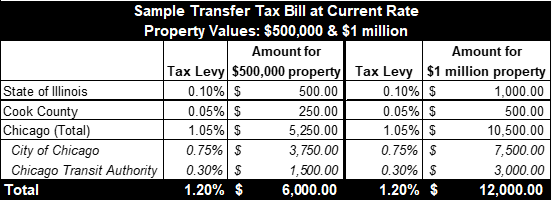

Transfer stamps is split between the seller and buyer but not equally. NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov. Chicago Illinois Code of Ordinances Sec. The purpose of this Ruling 6 is to discuss. 13 L 050291 theKTCPHorizon Cases reviewed and analyzed the Chicago Real Property Transfer Tax Ordinance the Ordinance to determine whether one who purchases a loan and mortgage through an assignment of mortgage acquires a beneficial interest in real property such that the parties are subject to transfer taxes on the assignment and. In Chicago for example the transfer tax rate is 525 375 standard portion and 150 Chicago Transit Authority portion.

Source: pinterest.com

Source: pinterest.com

In the real property then it must pay tax on any consideration paid for the excess. City of Chicago Transfer Tax. There are City of Chicago Transfer Taxes Cook County Transfer Taxes and State of Illinois Transfer Taxes. The buyers portion of the tax is called the City Portion and the sellers portion is begrudgingly referred to as the CTA portion. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property.

Source: in.pinterest.com

Source: in.pinterest.com

The seller is responsible for the state 100 per 1000 and county transfer taxes 050 per 1000. Chicago Heights 41000 City Hall Seller Cicero 101000 Town Hall Seller Country Club Hills 51000 City Hall Seller Countryside 50 flat fee City Hall Either Des Plaines 21000 City Hall Seller Dolton 10 per property Village Hall Seller East Hazel Crest 25 flat fee City Hall Buyer. Below is a table table that. Chicago Real Estate Transfer Tax. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property.

Source: pinterest.com

Source: pinterest.com

Following taxes will be assessed on a transfer of real estate in the city of Chicago. Section 3-33-060O of the Municipal Code includes a refund provision for the CTA portion of the Real Property Transfer Tax for transfers valued at 25000000 or less to transferees who are age 65 years or older and will occupy the property as the principal dwelling place for at. 2 days ago The municipal real estate transfer tax can vary and in some cases be much higher than the state and county real estate transfer tax. Transfer between a subsidiary corporation and its parent or between subsidiary corporations of common parent pursuant to a plan of merger or consolidation or pursuant to an agreement providing for the sale of substantially all. The purpose of this Ruling 6 is to discuss.

Source: pinterest.com

Source: pinterest.com

13 L 050291 theKTCPHorizon Cases reviewed and analyzed the Chicago Real Property Transfer Tax Ordinance the Ordinance to determine whether one who purchases a loan and mortgage through an assignment of mortgage acquires a beneficial interest in real property such that the parties are subject to transfer taxes on the assignment and. Typically buyers pay 7501000 and sellers pay 3001000. Property taxes are calculated as follows. Transfer between a subsidiary corporation and its parent or between subsidiary corporations of common parent pursuant to a plan of merger or consolidation or pursuant to an agreement providing for the sale of substantially all. TheState of Illinois the County and the local municipality ie.

Source: illinoislawreview.org

Source: illinoislawreview.org

Typically buyers pay 7501000 and sellers pay 3001000. In the City of Chicago they are also responsible for 300 per 1000 of the city transfer tax. TheState of Illinois the County and the local municipality ie. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property. Horizon Group XXI LLC Case No.

Source: pinterest.com

Source: pinterest.com

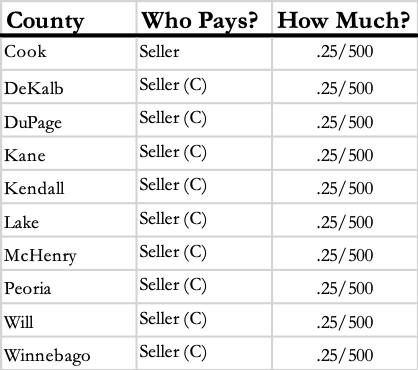

State county and city taxes. The City of Chicago. In the City of Chicago they are also responsible for 300 per 1000 of the city transfer tax. Chicago Heights 41000 City Hall Seller Cicero 101000 Town Hall Seller Country Club Hills 51000 City Hall Seller Countryside 50 flat fee City Hall Either Des Plaines 21000 City Hall Seller Dolton 10 per property Village Hall Seller East Hazel Crest 25 flat fee City Hall Buyer. In addition counties may apply an additional tax of 025 per 500.

Source: illinoislawreview.org

Source: illinoislawreview.org

In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. 13 L 050291 theKTCPHorizon Cases reviewed and analyzed the Chicago Real Property Transfer Tax Ordinance the Ordinance to determine whether one who purchases a loan and mortgage through an assignment of mortgage acquires a beneficial interest in real property such that the parties are subject to transfer taxes on the assignment and. Who Pays The Property Transfer Tax In Chicago IL. Your declaration will advance through the approval stages of the recording process. Real estate sales in Chicago incur three levels of transfer tax.

Source: listwithclever.com

Source: listwithclever.com

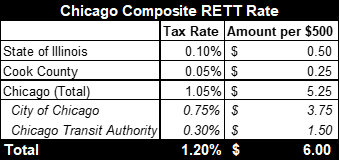

The current composite rate for a real estate transfer in Chicago is 12 or 6 per every 500 of the property value. There are very few exceptions non-profits etc. The buyers portion of the tax is called the City Portion and the sellers portion is begrudgingly referred to as the CTA portion. Chicago currently has a law called the Real Estate Transfer Tax RETT. 2 days ago The municipal real estate transfer tax can vary and in some cases be much higher than the state and county real estate transfer tax.

Source: in.pinterest.com

Source: in.pinterest.com

NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov. There are very few exceptions non-profits etc. Chicago Real Estate Transfer Tax. Transfer tax rates are frequently charged per each monetary unit of sale price. Benefits of online filing are.

Source: ryanhardychicago.com

Source: ryanhardychicago.com

There are City of Chicago Transfer Taxes Cook County Transfer Taxes and State of Illinois Transfer Taxes. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged. The state of Illinois has a transfer tax that is typically paid by sellers at a rate of 050 per 500 or 500 per 100000 of property value. Chicago Illinois Code of Ordinances Sec. The tax applies to almost every real estate sale in the city.

Source: in.pinterest.com

Source: in.pinterest.com

Effective 112016 in accordance with URPO Ruling 5 all Real Property Transfer Tax declarations must be filed online at httpsmytaxillinoisgovMyDec. Who Pays The Property Transfer Tax In Chicago IL. In Chicago for example the transfer tax rate is 525 375 standard portion and 150 Chicago Transit Authority portion. City of Chicago. NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov.

Source: civicfed.org

Source: civicfed.org

There are 3 taxes paid upon the transfer of real estate. Transfer price is net amount after subtracting the deductions for non-real property items. Chicago currently has a law called the Real Estate Transfer Tax RETT. Chicago Real Estate Transfer Tax. There are 3 taxes paid upon the transfer of real estate.

Source: pinterest.com

Source: pinterest.com

50 per 500 imposed on. Real Estate Transfer Tax in Chicago. 2 days ago The municipal real estate transfer tax can vary and in some cases be much higher than the state and county real estate transfer tax. State county and city taxes. Chicago Real Estate Transfer Tax.

Source: pinterest.com

Source: pinterest.com

7501000 for city portion 3001000 for CTA portion a supplemental tax. NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov. The state of Illinois has a transfer tax that is typically paid by sellers at a rate of 050 per 500 or 500 per 100000 of property value. City of Chicago Transfer Tax. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property.

Source: civicfed.org

Source: civicfed.org

Transfer price is net amount after subtracting the deductions for non-real property items. There are City of Chicago Transfer Taxes Cook County Transfer Taxes and State of Illinois Transfer Taxes. Chicago Illinois Code of Ordinances Sec. Following taxes will be assessed on a transfer of real estate in the city of Chicago. Chicago currently has a law called the Real Estate Transfer Tax RETT.

Source: realpropertyalliance.org

Source: realpropertyalliance.org

Your declaration will advance through the approval stages of the recording process. 375 per 500 imposed on BUYER 150 per 500 imposed on SELLER Cook County Real Estate Transfer Tax. Typically buyers pay 7501000 and sellers pay 3001000. As of late 2019 Mayor Lightfoot is calling for an increase in the transfer tax. Transfer stamps is split between the seller and buyer but not equally.

Source: pinterest.com

Source: pinterest.com

Chicago imposes two separate taxes of 075 or 375 and 03 or 150. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property. Benefits of online filing are. For more information on the citys real property transfer taxes there is some useful information available here. Chicago currently has a law called the Real Estate Transfer Tax RETT.

Source: listwithclever.com

Source: listwithclever.com

25 per 500 imposed on SELLER no change State of Illinois Real Estate Transfer Tax. 50 per 500 imposed on. City of Chicago Transfer Tax. The purpose of this Ruling 6 is to discuss. Chicago Heights 41000 City Hall Seller Cicero 101000 Town Hall Seller Country Club Hills 51000 City Hall Seller Countryside 50 flat fee City Hall Either Des Plaines 21000 City Hall Seller Dolton 10 per property Village Hall Seller East Hazel Crest 25 flat fee City Hall Buyer.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title city of chicago real estate transfer tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.