Your City of boston real estate tax bill images are ready. City of boston real estate tax bill are a topic that is being searched for and liked by netizens today. You can Get the City of boston real estate tax bill files here. Download all free photos.

If you’re looking for city of boston real estate tax bill pictures information related to the city of boston real estate tax bill keyword, you have pay a visit to the right blog. Our site always gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

City Of Boston Real Estate Tax Bill. Otherwise the unpaid taxes. For current fiscal year payments call. All Time 42 New Post Past 24 Hours Past Week Past month. You can get another copy of your real estate tax bill by filling out the Assessing contact form or calling the Taxpayer Referral and Assistance Center at 617-635-4287.

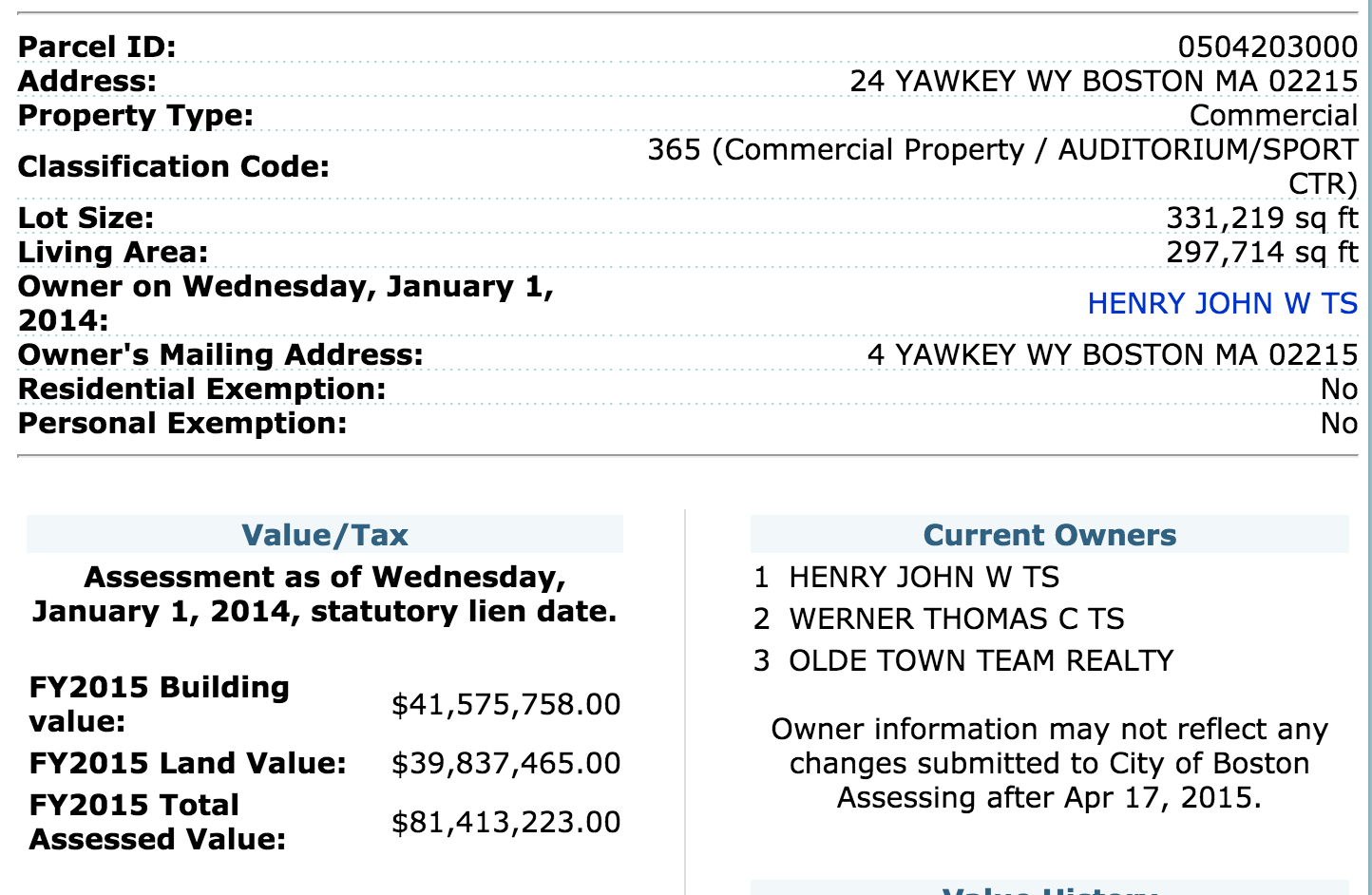

The City of Boston Assessor is responsible for appraising real estate and assessing a property tax on properties located in City of Boston Massachusetts. 2455 FY2021 Gross Tax. For current fiscal year payments call. Find Tax Records including. Boston Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Boston Massachusetts. Your property tax bill.

The abatement program can save you up to 253847 max exemption from last year on your annual tax assessment.

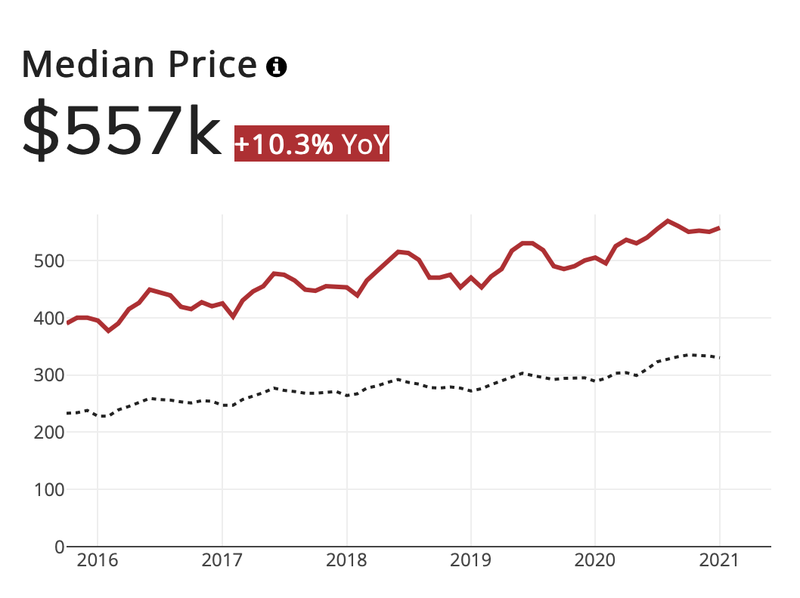

Boston real estate tax gets closer to becoming reality. Your quarterly tax bills are due on these dates. Boston property tax records. Our work in the Collecting Division involves collecting property taxes and all other monies due to the City while serving taxpayers in a professional courteous manner. Checking the City of Boston property tax due date. Downtown Boston values are higher with a median value.

City of Boston Real Estate PO. The abatement program can save you up to 253847 max exemption from last year on your annual tax assessment. Tax Records include property tax assessments property appraisals and income tax records. Where should I mail my real estate tax bill payment. We prepare and file tax takings and tax certification liens issue municipal lien certificates and prepare petitions for foreclosures with the Law Department.

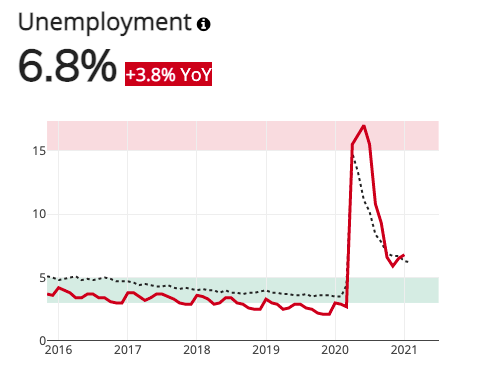

Assessments and tax rates appear on your 3rd quarter tax bill Mail your tax payments to. Boston extending property tax bill deadline to June 1 amid the spread of COVID-19. All Time 42 New Post Past 24 Hours Past Week Past month. Mail your tax payments to. Professional real estate business and legal entities access and draw upon Boston property parcel data to support and enhance their specific business operations.

Source: fool.com

Source: fool.com

The citys total taxable property value hit an all-time high of 164 billion in fiscal 2019 a spike of more than 72 billion or 78 in just the last five years. Professional real estate. You can contact the City of Boston Assessor for. Downtown Boston values are higher with a median value. The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property.

General Laws Chapter 59 Section 29. The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property. For current fi scal year payments call the Taxpayer Referral Assistance Center TRAC at 617 635-4287 or access tax. City Of Boston Real Estate Values. Where do I obtain tax payment information.

Source: fool.com

Source: fool.com

You can get another copy of your real estate tax bill by filling out the Assessing contact form or calling the Taxpayer Referral and Assistance Center at 617-635-4287. Boston City Councilor Lydia. 000 FY2021 Net Tax. City of Boston Real Estate PO Box 55808 Boston MA 02205-5808 For prior fiscal year tax balances and payments contact the Collectors office at 617 635-4131 or 617 635-4132. Councilors on Wednesday passed a bill that would allow the city to impose a tax of up to 2 percent on real estate sales of more than 2 million.

Source: pinterest.com

Source: pinterest.com

You can get another copy of your real estate tax bill by filling out the Assessing contact form or calling the Taxpayer Referral and Assistance Center at 617-635-4287. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request. Mail your tax payments to. Councilors on Wednesday passed a bill that would allow the city to impose a tax of up to 2 percent on real estate sales of more than 2 million. 44688 - Residential Exemption.

Source: pinterest.com

Source: pinterest.com

Professional real estate business and legal entities access and draw upon Boston property parcel data to support and enhance their specific business operations. City of Boston Real Estate PO. You can contact the City of Boston Assessor for. City Of Boston Real Estate Values. 000 FY2021 Net Tax.

Source: fool.com

Source: fool.com

City of Boston Massachusetts - Assessors Office. All taxable personal property owned held or leased should be listed Mass. Popular Searched Real estate ocho rios jamaica Old houses for sale to be moved Zungoli campania italy real estate Victoria mutual houses for sale Texas real estate principles 1 final exam Recently Searched Boston real estate tax bill Georgia real estate reciprocity states Real estate in yakima wa. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request. Our work in the Collecting Division involves collecting property taxes and all other monies due to the City while serving taxpayers in a professional courteous manner.

Source: in.pinterest.com

Source: in.pinterest.com

For current fiscal year payments call. Box 55808 Boston MA 02205-5808. 6 days ago. Filter By Time All Past 24 hours Past Week Past Month. The median home value in the North End is 717800 according to Zillow translating to an annual property tax bill of 7565.

Source: ar.pinterest.com

Source: ar.pinterest.com

Box 55808 Boston MA 02205-5808. Houses 5 days ago Councilors on Wednesday passed a bill that would allow the city to impose a tax of up to 2 percent on real estate sales of more than 2 million. Box 55808 Boston MA 02205-5808. Mail your tax payments to. Find Tax Records including.

Source: pinterest.com

Source: pinterest.com

City of Boston Real Estate PO. For current fiscal year payments call. The abatement program can save you up to 253847 max exemption from last year on your annual tax assessment. FY2021 Tax Rates per thousand. If you live in Boston or nearly any part of Massachusetts you may qualify for the residential property tax exemption.

Source: br.pinterest.com

Source: br.pinterest.com

000 FY2021 Net Tax. We prepare and file tax takings and tax certification liens issue municipal lien certificates and prepare petitions for foreclosures with the Law Department. For current fi scal year payments call the Taxpayer Referral Assistance Center TRAC at 617 635-4287 or access tax. If you live in Boston or nearly any part of Massachusetts you may qualify for the residential property tax exemption. Assessments and tax rates appear on your 3rd quarter tax bill Mail your tax payments to.

Source: pinterest.com

Source: pinterest.com

All businesses in the City of Boston that have not filed a personal. If you live in Boston or nearly any part of Massachusetts you may qualify for the residential property tax exemption. We mail all tax bills and collect both current and delinquent taxes. Checking the City of Boston property tax due date. The center will either mail you the copy of your tax bill or you can pick it up at their office.

The city of Boston is extending the due date for property tax bills amid the ongoing coronavirus. General Laws Chapter 59 Section 29. Mail your tax payments to. If you live in Boston or nearly any part of Massachusetts you may qualify for the residential property tax exemption. Boston extending property tax bill deadline to June 1 amid the spread of COVID-19.

Source: golocalprov.com

Source: golocalprov.com

The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property. So if you own the property you need to make sure that the property taxes are paid. Your property tax bill. 6 days ago. City of Boston Massachusetts - Assessors Office.

Source: in.pinterest.com

Source: in.pinterest.com

For current fiscal year payments call. Assessed taxes on real estate stay with the property not the name on the tax bill. Professional real estate business and legal entities access and draw upon Boston property parcel data to support and enhance their specific business operations. 000 - Personal Exemption. The abatement program can save you up to 253847 max exemption from last year on your annual tax assessment.

Source: pinterest.com

Source: pinterest.com

FY2021 Tax Rates per thousand. We prepare and file tax takings and tax certification liens issue municipal lien certificates and prepare petitions for foreclosures with the Law Department. Houses 5 days ago Councilors on Wednesday passed a bill that would allow the city to impose a tax of up to 2 percent on real estate sales of more than 2 million. Mail your tax payments to. Make sure you have your ward and parcel number.

Source: pinterest.com

Source: pinterest.com

Filter By Time All Past 24 hours Past Week Past Month. City Of Boston Real Estate Values. All businesses in the City of Boston that have not filed a personal. So if you own the property you need to make sure that the property taxes are paid. Make sure you have your ward and parcel number.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title city of boston real estate tax bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.