Your Chicago real estate transactions cook county images are available. Chicago real estate transactions cook county are a topic that is being searched for and liked by netizens now. You can Find and Download the Chicago real estate transactions cook county files here. Download all royalty-free images.

If you’re looking for chicago real estate transactions cook county pictures information related to the chicago real estate transactions cook county topic, you have come to the right site. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

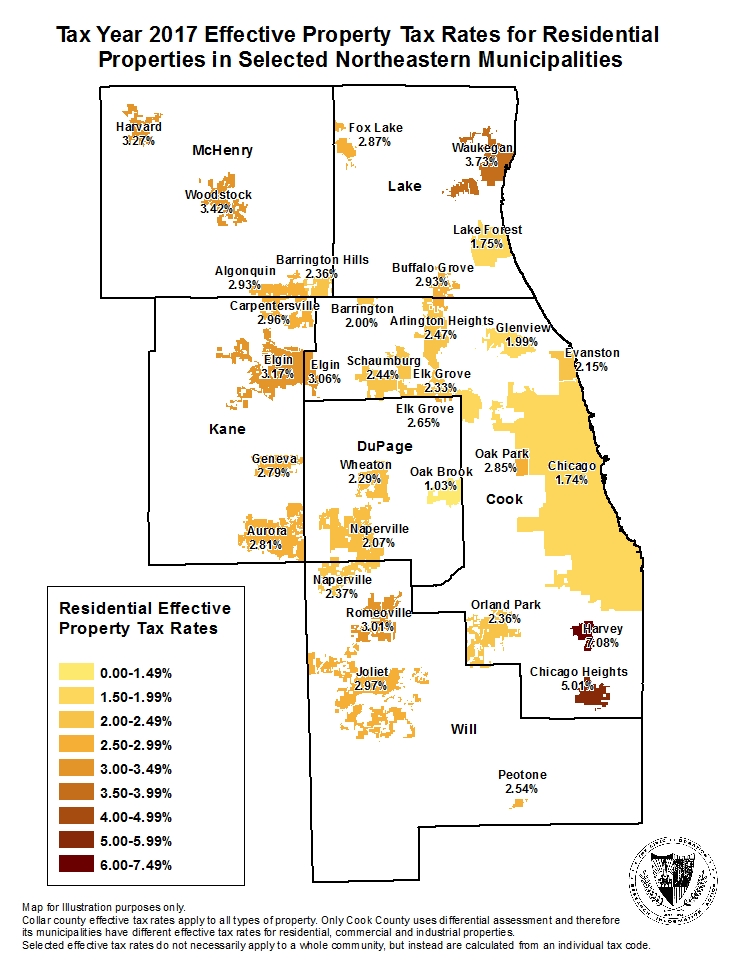

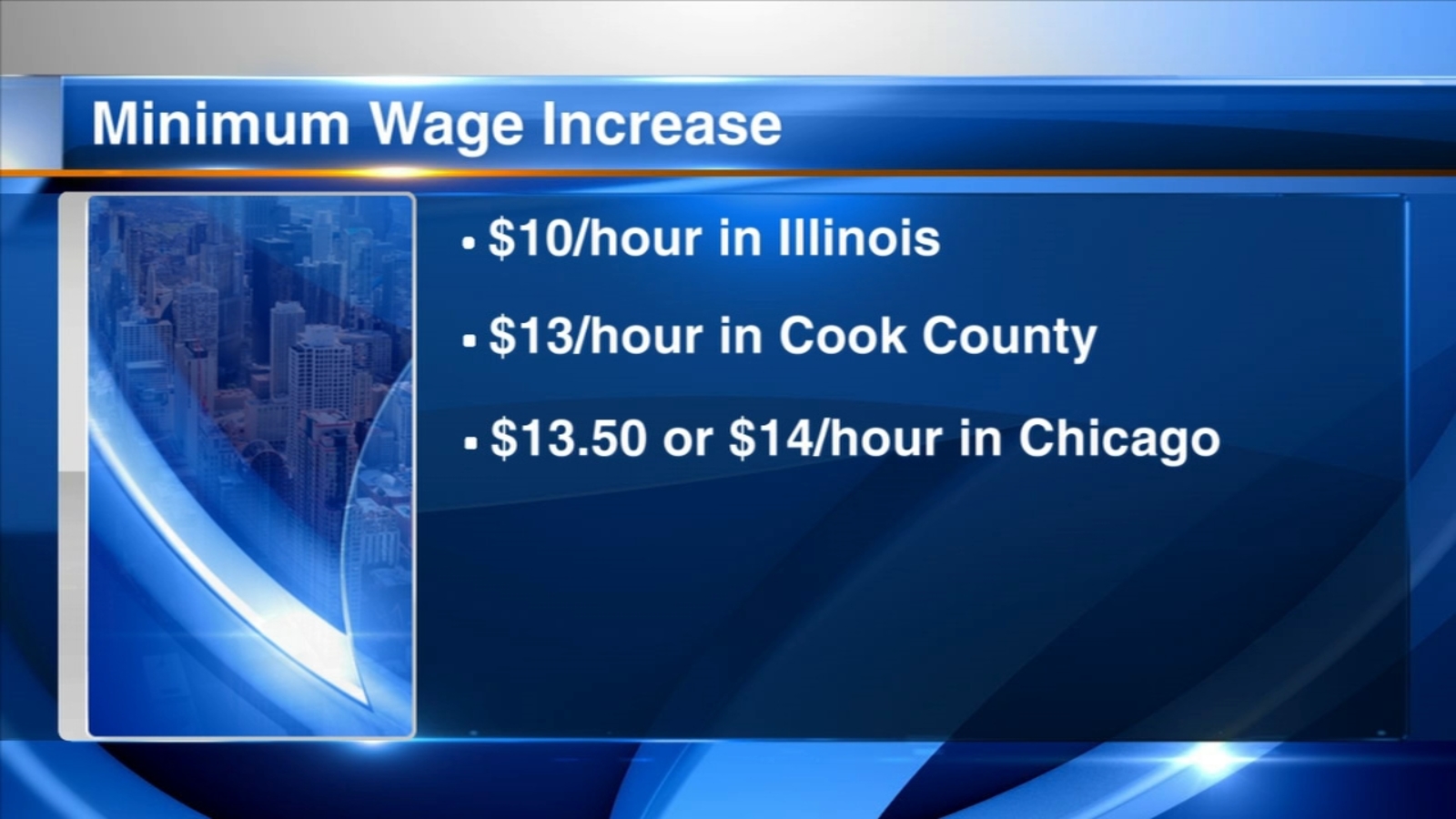

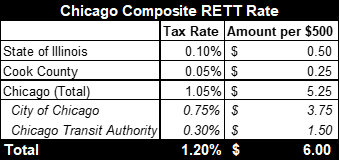

Chicago Real Estate Transactions Cook County. Thankfully this tax is much less than the Chicago transfer and it only applies to sellers. Cook County Transfer Tax. Everyone has their hand out Like the Cook County transfer tax the state of Illinois property transfer tax also only applies to sellers. Great for discovering comps sales history photos and more.

Chicago S Housing Market Is Finally Balancing Chicago Magazine From chicagomag.com

Chicago S Housing Market Is Finally Balancing Chicago Magazine From chicagomag.com

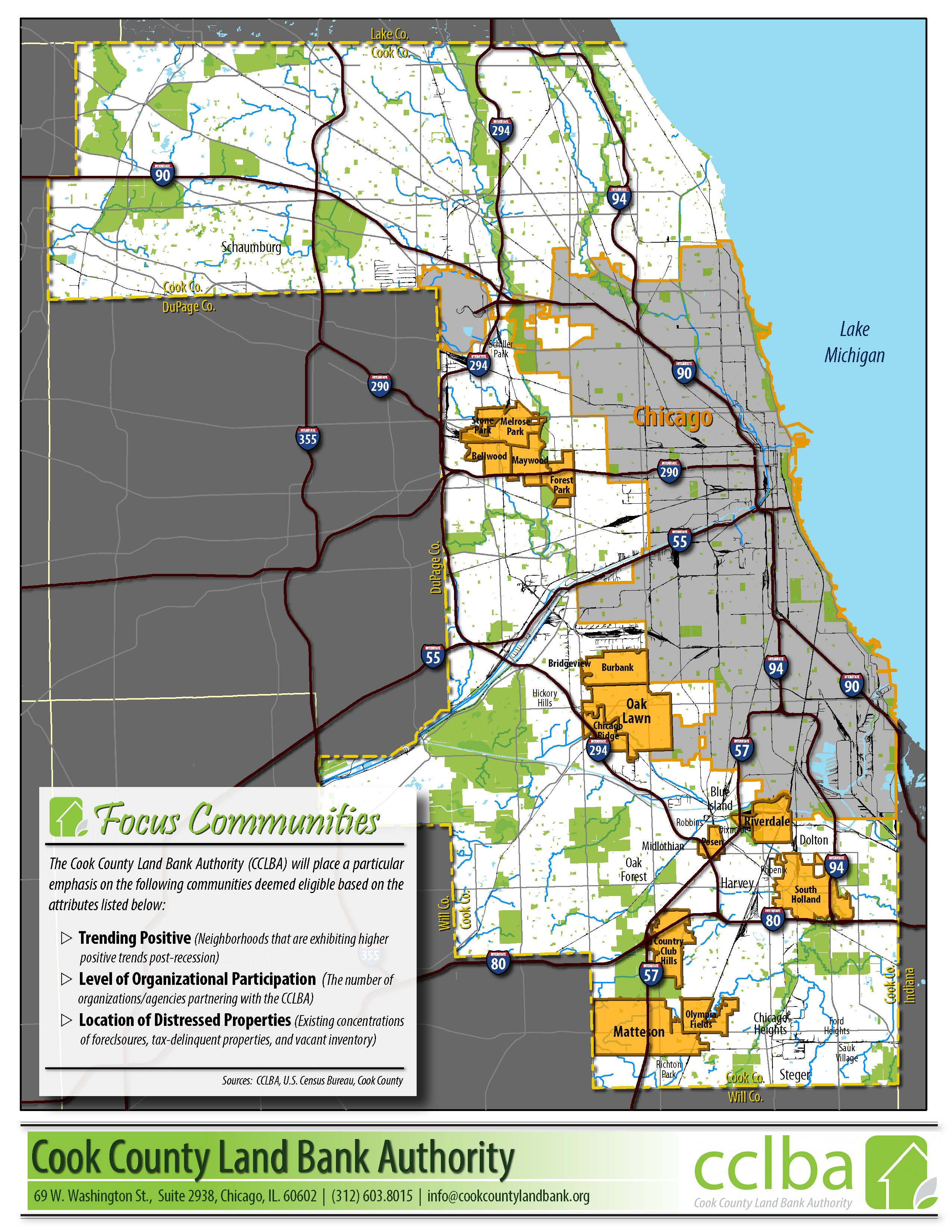

Chicago is in Cook County and Cook County also has its own tax that applies to the majority of real estate sales. The buyer pays the taxes that will accrue after he or she takes title to the property. Illinois Property Transfer Tax. Below is the latest report of the Chicago Housing Market. Property transactions are subject to a Real Estate Transfer Tax known as stamp duty in other places. Cook County Treasurers Office - Chicago Illinois.

When its paid Cook County takes a note and sends the data on to the Illinois Department of Revenue IDOR which updates a public.

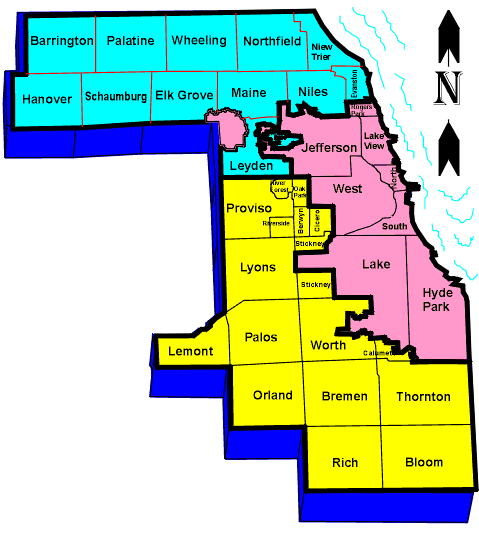

Cook County IL Recent Home Sales. Property transactions are subject to a Real Estate Transfer Tax known as stamp duty in other places. Fritz Kaegi Cook County Assessor. Local Township Assessors CCAO Office Locations Cook County Government Offices. As the testimonials we have been honored to receive indicate our clients needs and goals come first. In order to facilitate this exchange real estate taxes must be.

Source: chicagorealtor.com

Source: chicagorealtor.com

Cook County Treasurers Office - Chicago Illinois. As the testimonials we have been honored to receive indicate our clients needs and goals come first. Fritz Kaegi Cook County Assessor. IMPORTANT DOCUMENT RECORDING INFORMATION. The Cook County Clerks Recordings Division accurately records stores and maintains land records and other official documents.

Source: civicfed.org

Source: civicfed.org

The recording webpages can be found at the link below. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Cook County Treasurers Office - Chicago Illinois. The recording webpages can be found at the link below. Browse data on the 278786 recent real estate transactions in Cook County IL.

Source: housingstudies.org

Source: housingstudies.org

Fritz Kaegi Cook County Assessor. A 60-year-old 1½-story house on Prospect Avenue sold for 575000 on Sept. ALL DOCUMENTS must be recorded at the Clerks downtown offices at 118 N. In a typical real estate transaction the seller pays whatever real estate taxes accrued while he or she was the owner of the property. 525 per 50000 of the transfer price or fraction thereof of the real property or the beneficial interest in real property.

Source: cawleychicago.com

Source: cawleychicago.com

Public records show 3064 square feet of living space and a 2010 tax bill of 10987. Everyone has their hand out Like the Cook County transfer tax the state of Illinois property transfer tax also only applies to sellers. We help home buyers and sellers with real estate closings in Chicago Cook County DuPage County and Lake County Illinois. In a typical real estate transaction the seller pays whatever real estate taxes accrued while he or she was the owner of the property. Fritz Kaegi Cook County Assessor.

Source: abc7chicago.com

Source: abc7chicago.com

We help home buyers and sellers with real estate closings in Chicago Cook County DuPage County and Lake County Illinois. In general The Buyer is responsible for 375 and the Seller is responsible for 150. Great for discovering comps sales history photos and more. They are maintained by various government offices in Cook County Illinois State and at the Federal level. The recording webpages can be found at the link below.

Source: chicagoagentmagazine.com

Source: chicagoagentmagazine.com

Lets start with the bad news Its twice as much as the Cook County. In general The Buyer is responsible for 375 and the Seller is responsible for 150. Local Township Assessors CCAO Office Locations Cook County Government Offices. A blog by lawyers about real estate closings in Chicago and the Chicagoland area. Great for discovering comps sales history photos and more.

Source: chicagorealtor.com

Source: chicagorealtor.com

Cook County Property Records are real estate documents that contain information related to real property in Cook County Illinois. IMPORTANT DOCUMENT RECORDING INFORMATION. Oppose Cook Countys Proposed RTLO November 12 2020. MARIA PAPPAS COOK COUNTY TREASURER. The State of Illinois and each county gets a cut of the RETT as well as Chicago and the Chicago Transit Authority for transactions that take place here.

Source: cookcountylandbank.org

Source: cookcountylandbank.org

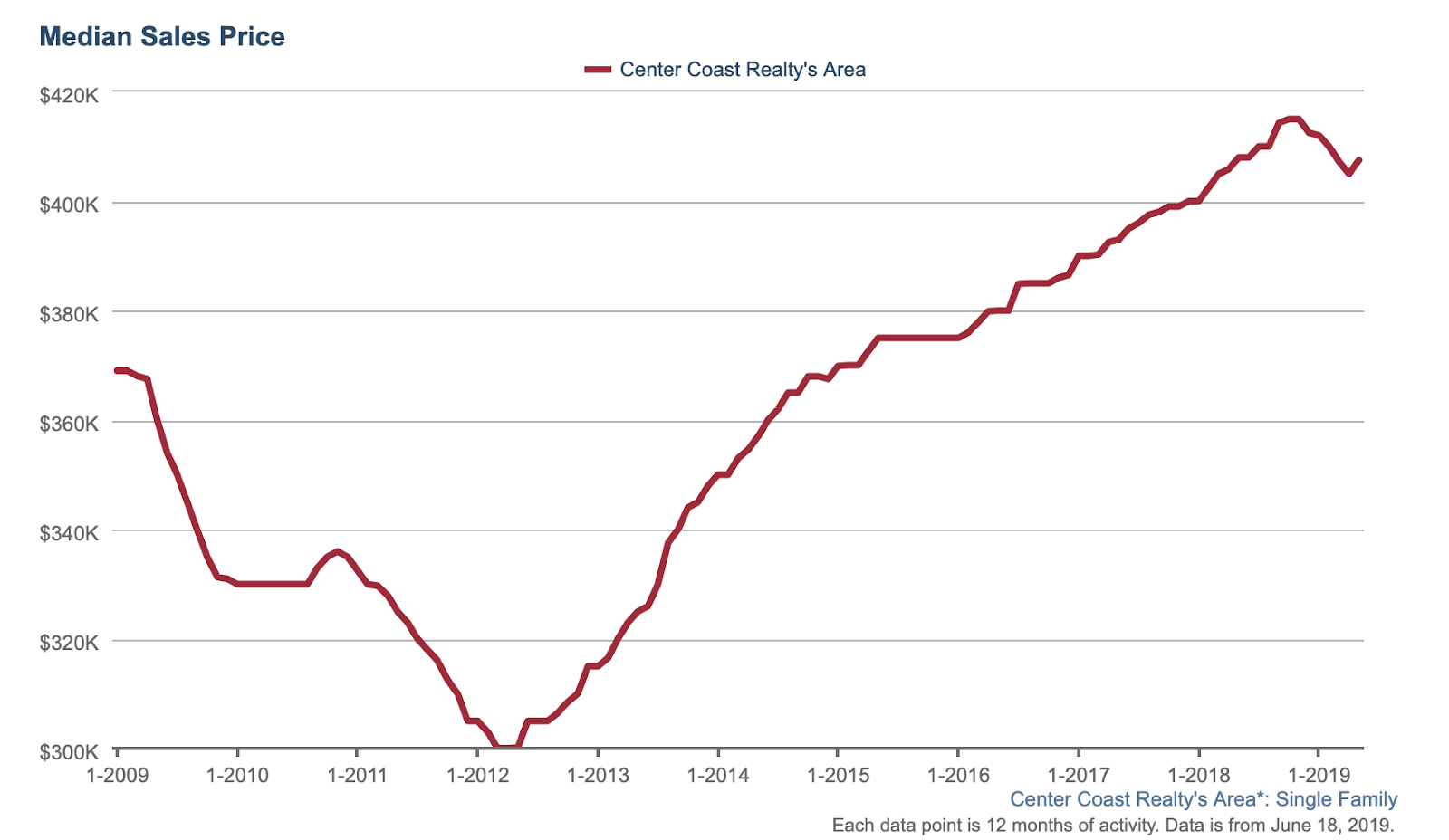

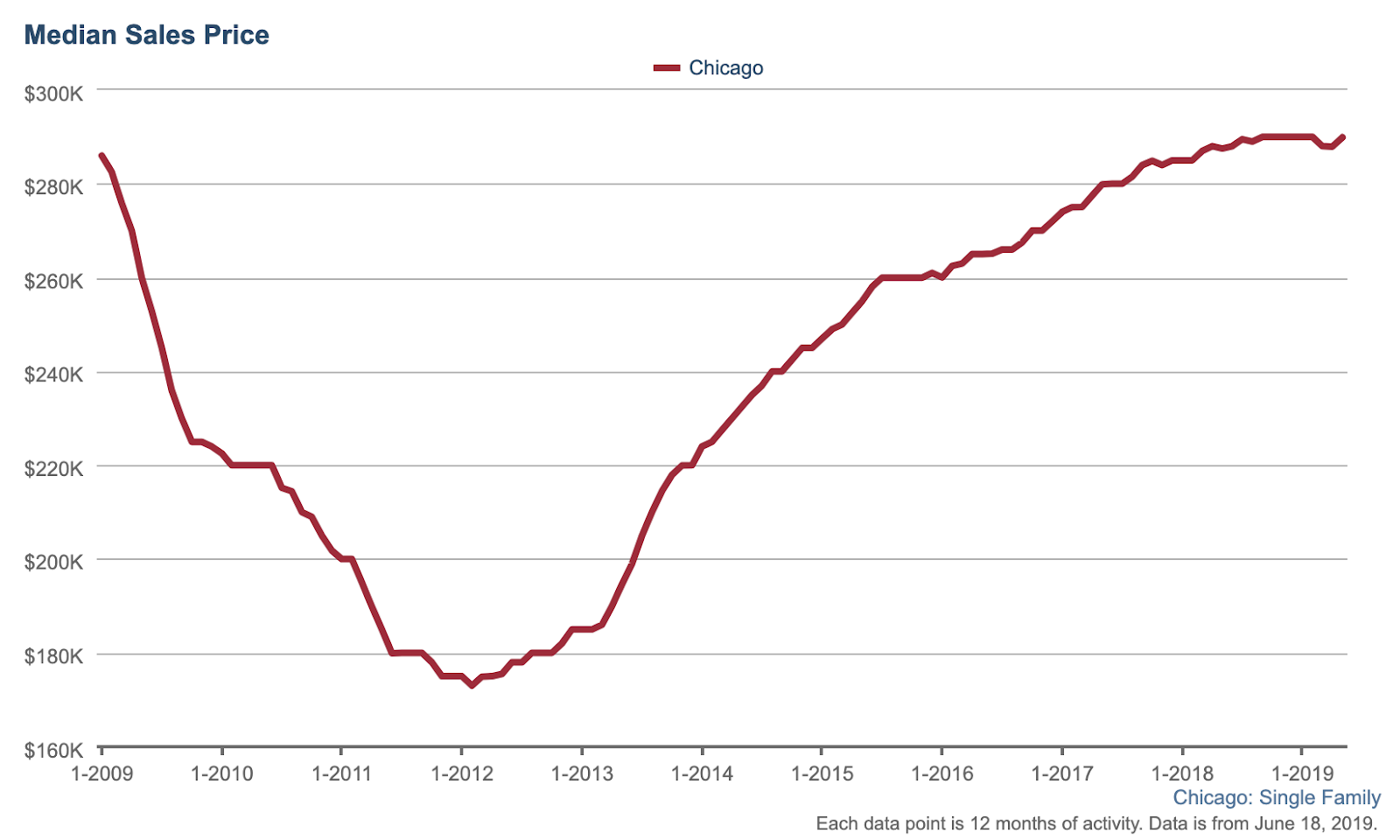

Cook County IL Recent Home Sales. The Cook County Clerks Recordings Division accurately records stores and maintains land records and other official documents. A 60-year-old 1½-story house on Prospect Avenue sold for 575000 on Sept. Everyone has their hand out Like the Cook County transfer tax the state of Illinois property transfer tax also only applies to sellers. Below is the latest report of the Chicago Housing Market.

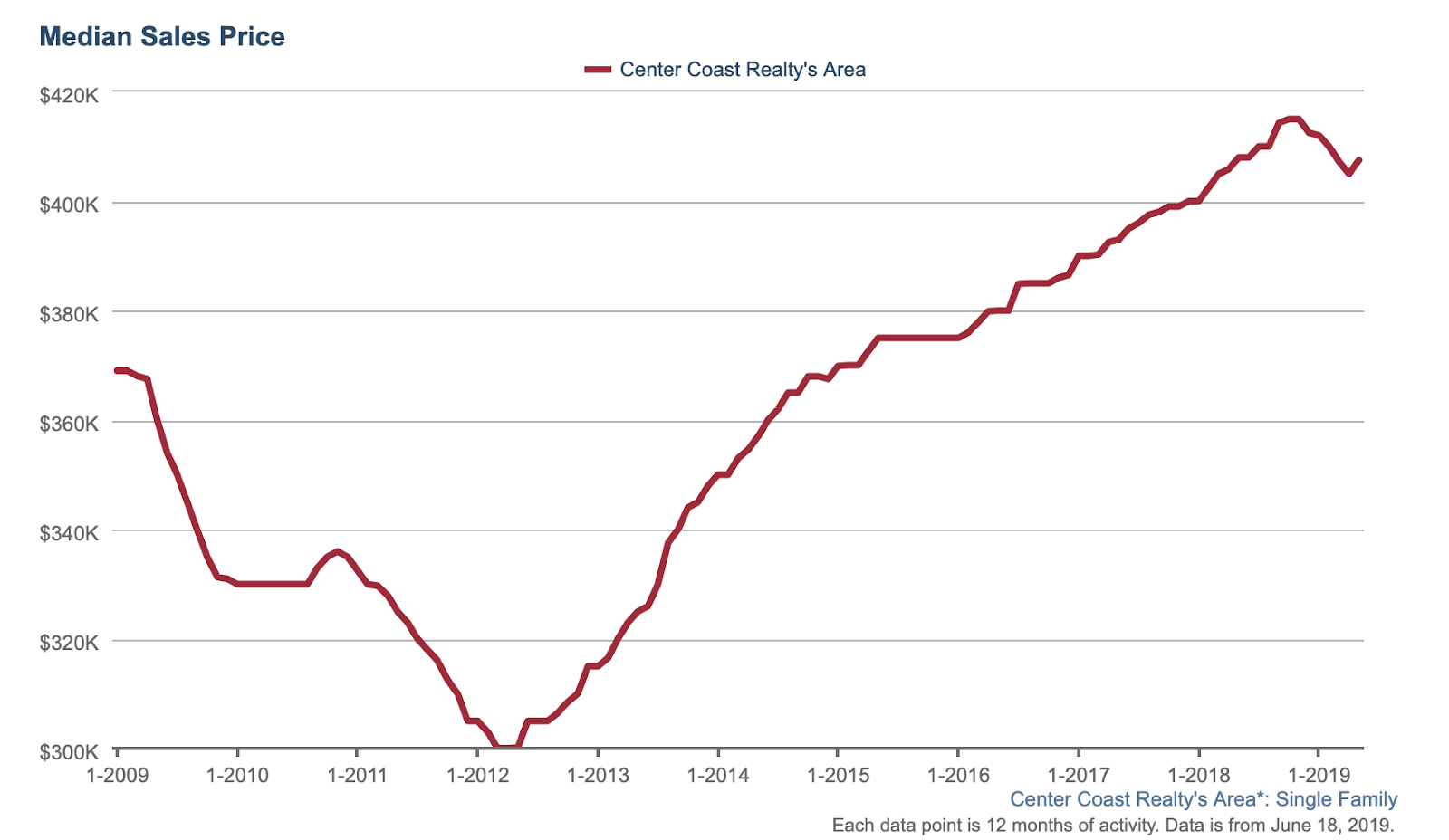

The report compares the Chicago metro and the citys housing metrics from Feb 2021 with Feb 2020. MARIA PAPPAS COOK COUNTY TREASURER. Great for discovering comps sales history photos and more. Thank you for taking the time to voice your opposition to Cook Countys proposed RTLOThe vote on this proposal has been delayed 30 days and conversations among the impacted groups will continue to make the proposal more balanced. In order to facilitate this exchange real estate taxes must be.

Source: abc7chicago.com

Source: abc7chicago.com

Public records show 3064 square feet of living space and a 2010 tax bill of 10987. Chicago is in Cook County and Cook County also has its own tax that applies to the majority of real estate sales. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Cook County Transfer Tax. When its paid Cook County takes a note and sends the data on to the Illinois Department of Revenue IDOR which updates a public.

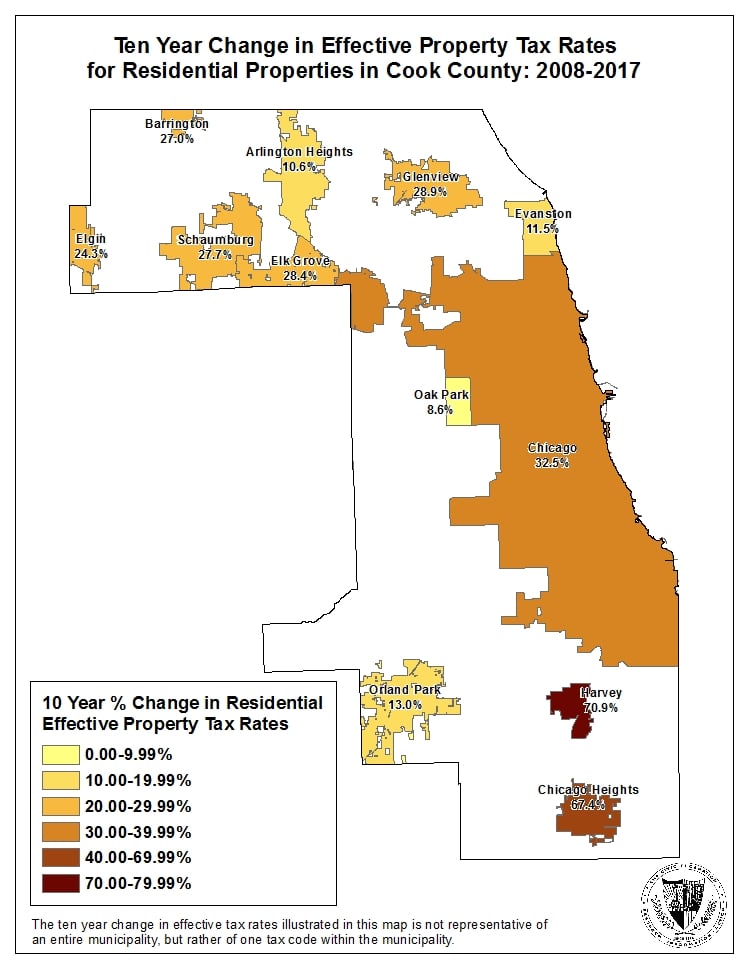

Source: civicfed.org

Source: civicfed.org

Browse data on the 278786 recent real estate transactions in Cook County IL. To tell us about your situation and learn more about our services and commitment level schedule a free consultation today by calling 312-815-6637. The State of Illinois and each county gets a cut of the RETT as well as Chicago and the Chicago Transit Authority for transactions that take place here. When its paid Cook County takes a note and sends the data on to the Illinois Department of Revenue IDOR which updates a public. Cook County Transfer Tax.

Source: chicagomag.com

Source: chicagomag.com

A 60-year-old 1½-story house on Prospect Avenue sold for 575000 on Sept. This supplemental tax shall be referred to as the CTA portion of the Chicago Real Property Transfer Tax and the 375 tax shall be referred to as the City portion Tax Rate. Effective Monday December 7 the Cook County Clerks Office has assumed all operations and duties of the Cook County Recorder of Deeds Office and that office no longer exists. Cook County Transfer Tax. A 60-year-old 1½-story house on Prospect Avenue sold for 575000 on Sept.

Source: therealdeal.com

Source: therealdeal.com

Below is the latest report of the Chicago Housing Market. As the testimonials we have been honored to receive indicate our clients needs and goals come first. Oppose Cook Countys Proposed RTLO November 12 2020. Property transactions are subject to a Real Estate Transfer Tax known as stamp duty in other places. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Source: chicagomag.com

Source: chicagomag.com

Thank you for taking the time to voice your opposition to Cook Countys proposed RTLOThe vote on this proposal has been delayed 30 days and conversations among the impacted groups will continue to make the proposal more balanced. Great for discovering comps sales history photos and more. Everyone has their hand out Like the Cook County transfer tax the state of Illinois property transfer tax also only applies to sellers. The buyer pays the taxes that will accrue after he or she takes title to the property. A 60-year-old 1½-story house on Prospect Avenue sold for 575000 on Sept.

Source: railapc.com

Source: railapc.com

The buyer pays the taxes that will accrue after he or she takes title to the property. The real estate transactions for Cook and Du Page Counties return today to Your Place with data compiled from the recorder of deeds offices by REIC the Real Estate Connection in. In a typical real estate transaction the seller pays whatever real estate taxes accrued while he or she was the owner of the property. Thank you for taking the time to voice your opposition to Cook Countys proposed RTLOThe vote on this proposal has been delayed 30 days and conversations among the impacted groups will continue to make the proposal more balanced. Effective Monday December 7 the Cook County Clerks Office has assumed all operations and duties of the Cook County Recorder of Deeds Office and that office no longer exists.

Source: civicfed.org

Source: civicfed.org

Chicago is in Cook County and Cook County also has its own tax that applies to the majority of real estate sales. Browse data on the 278786 recent real estate transactions in Cook County IL. The State of Illinois and each county gets a cut of the RETT as well as Chicago and the Chicago Transit Authority for transactions that take place here. They are maintained by various government offices in Cook County Illinois State and at the Federal level. As the testimonials we have been honored to receive indicate our clients needs and goals come first.

Source: gilmartinlegal.com

Source: gilmartinlegal.com

RedaCiprianMagnone LLC 8501 W. Chicago is in Cook County and Cook County also has its own tax that applies to the majority of real estate sales. Fritz Kaegi Cook County Assessor. The real estate transactions for Cook and Du Page Counties return today to Your Place with data compiled from the recorder of deeds offices by REIC the Real Estate Connection in. In general The Buyer is responsible for 375 and the Seller is responsible for 150.

Source: gilmartinlegal.com

Source: gilmartinlegal.com

Cook County IL Recent Home Sales. 525 per 50000 of the transfer price or fraction thereof of the real property or the beneficial interest in real property. Chicago is in Cook County and Cook County also has its own tax that applies to the majority of real estate sales. Local Township Assessors CCAO Office Locations Cook County Government Offices. As the testimonials we have been honored to receive indicate our clients needs and goals come first.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title chicago real estate transactions cook county by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.