Your Chesterfield county real estate tax rate images are available in this site. Chesterfield county real estate tax rate are a topic that is being searched for and liked by netizens today. You can Get the Chesterfield county real estate tax rate files here. Get all free vectors.

If you’re looking for chesterfield county real estate tax rate images information linked to the chesterfield county real estate tax rate keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Chesterfield County Real Estate Tax Rate. Please note that these assessment records are not the official assessment records of Chesterfield County. In order to obtain a valid decal for your license plate taxes must be paid. Written documents deeds wills etc relating to the ownership of real estate filed in the Clerks Office of the Circuit Court of Chesterfield County are received and processed daily by the Assessors Office. The new effective rate for data center equipment will be 024 per 100 of assessed value.

The Deal Of The Day Real Estate Search Bathroom Dimensions Manchester From pinterest.com

The Deal Of The Day Real Estate Search Bathroom Dimensions Manchester From pinterest.com

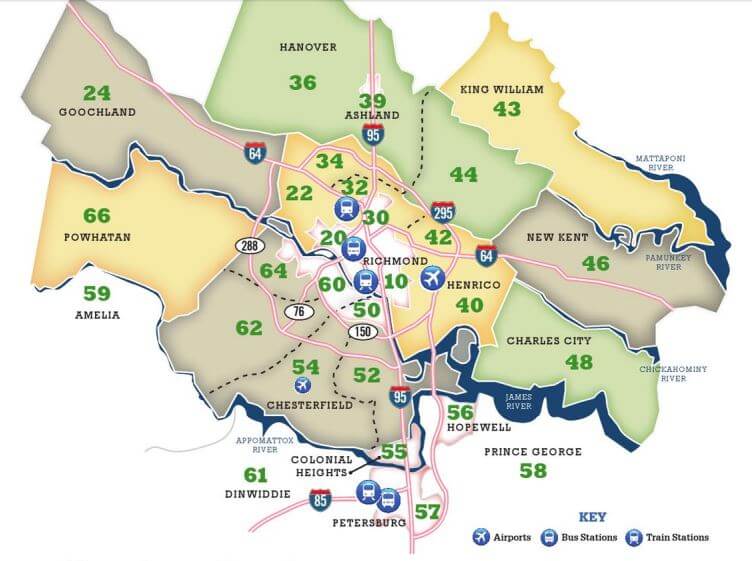

While the Office of the Real Estate. Chesterfield County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. The real estate tax rate is established each year after two separate public hearings have been held by the County Board of Supervisors - one hearing on the tax rate and one hearing on the budget. In order to obtain a valid decal for your license plate taxes must be paid. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax.

Sales Tax Rates within the City of Chesterfield.

That new rate will. The median property tax on a 23560000 house is 195548 in Chesterfield County. The Auditors office bills all personal property taxes in Chesterfield County. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. Personal Property Tax and First. How do I know if my property assessment has changed.

Source: mrwilliamsburg.com

Source: mrwilliamsburg.com

Personal Property Tax and First. Will home maintenance increase the assessment. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. In order to obtain a valid decal for your license plate taxes must be paid. Official records are located in the Office of the Real Estate Assessor.

Source: pinterest.com

Source: pinterest.com

12 Zeilen First Quarter State Estimated Income Tax Due. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. Written documents deeds wills etc relating to the ownership of real estate filed in the Clerks Office of the Circuit Court of Chesterfield County are received and processed daily by the Assessors Office. The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083. The Auditors office bills all personal property taxes in Chesterfield County.

Source: pelletiergroup.com

Source: pelletiergroup.com

Please note that these assessment records are not the official assessment records of Chesterfield County. The median property tax on a 23560000 house is 174344 in Virginia. How do I know if my property assessment has changed. The median property tax on a 23560000 house is 195548 in Chesterfield County. Office Equipment Furniture used in a business.

Source: pinterest.com

Source: pinterest.com

That new rate will. That new rate will. The new effective rate for data center equipment will be 024 per 100 of assessed value. What is the effective date of annual assessments. Office Equipment Furniture used in a business.

Source:

Source:

Personal Property Tax and First. 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. Chesterfield County Va Real Estate Tax Rate. 8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. How does fire damage storm damage demolition etc affect a.

Source: br.pinterest.com

Source: br.pinterest.com

Written documents deeds wills etc relating to the ownership of real estate filed in the Clerks Office of the Circuit Court of Chesterfield County are received and processed daily by the Assessors Office. Taxes are based on the value of the. Written documents deeds wills etc relating to the ownership of real estate filed in the Clerks Office of the Circuit Court of Chesterfield County are received and processed daily by the Assessors Office. The median property tax on a 23560000 house is 195548 in Chesterfield County. Individual real estate records.

Source: pinterest.com

Source: pinterest.com

The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Personal property which is taxable includes. What is the effective date of annual assessments. The new effective rate for data center equipment will be 024 per 100 of assessed value. How are real estate taxes calculated.

Source: realtor.com

Source: realtor.com

The real estate tax rate is established each year after two separate public hearings have been held by the County Board of Supervisors - one hearing on the tax rate and one hearing on the budget. How are real estate taxes calculated. The Department of Real Estate Assessments operates in accordance with the Code of Virginia Title 581 Taxation and the Charter and Code of Chesterfield County. The Auditors office bills all personal property taxes in Chesterfield County. 8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value.

The Department of Real Estate Assessments operates in accordance with the Code of Virginia Title 581 Taxation and the Charter and Code of Chesterfield County. The median property tax on a 23560000 house is 195548 in Chesterfield County. 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. Currently data centers pay an effective business property tax rate of 180 per 100 of assessed value for equipment put into service during the first year of operation. While the Office of the Real Estate.

Source: pinterest.com

Source: pinterest.com

22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. The real estate tax rate is established each year after two separate public hearings have been held by the County Board of Supervisors - one hearing on the tax rate and one hearing on the budget.

Source: pinterest.com

Source: pinterest.com

12 Zeilen First Quarter State Estimated Income Tax Due. The median property tax on a 23560000 house is 195548 in Chesterfield County. Chesterfield County Va Real Estate Tax Rate. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax. That effective rate is reduced every year for the following five years by a decreasing assessment ratio schedule.

Source: realtor.com

Source: realtor.com

Chesterfield County Va Real Estate Tax Rate. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax. The median property tax on a 23560000 house is 195548 in Chesterfield County. Personal Property Tax and First. While the Office of the Real Estate.

Source: realtor.com

Source: realtor.com

That effective rate is reduced every year for the following five years by a decreasing assessment ratio schedule. The Department of Real Estate Assessments operates in accordance with the Code of Virginia Title 581 Taxation and the Charter and Code of Chesterfield County. Under Virginia State Law these real estate assessment records are public information. 8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. Boats trailers and airplanes are not prorated.

Source:

Source:

Sales Tax Rates within the City of Chesterfield. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Vehicle taxes are due the month your tag expires. For example if the tax rate is 095 per 100. What is the effective date of annual assessments.

Source: pinterest.com

Source: pinterest.com

The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. While the Office of the Real Estate. Sales Tax Rates within the City of Chesterfield. 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. 8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value.

Source:

Source:

What is the effective date of annual assessments. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Under Virginia State Law these real estate assessment records are public information. What is the effective date of annual assessments. Who establishes the tax rate.

Source:

Source:

8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. Please note that these assessment records are not the official assessment records of Chesterfield County. Individual real estate records. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. The median property tax on a 23560000 house is 195548 in Chesterfield County.

Source: richmondhouselistings.com

Source: richmondhouselistings.com

8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. How do I know if my property assessment has changed. Personal property which is taxable includes. Real estate taxes are calculated by multiplying the propertys assessed value by the current tax rate. About the Commission of.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title chesterfield county real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.