Your Cherokee county real estate taxes images are ready. Cherokee county real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Cherokee county real estate taxes files here. Get all free images.

If you’re searching for cherokee county real estate taxes images information related to the cherokee county real estate taxes keyword, you have visit the right site. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

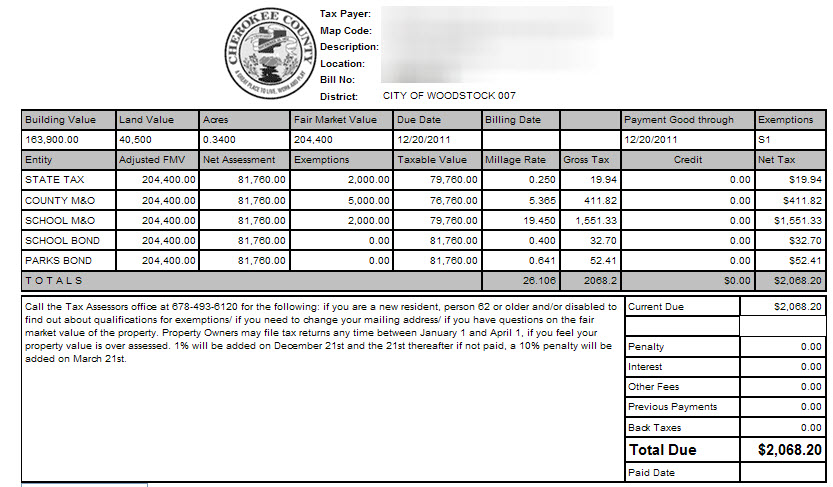

Cherokee County Real Estate Taxes. Fair market value 300000 Assessed value 40 X 300000 120000 Millage rate 32198 Property tax 120000 X 321981000 3508. No warranties expressed or implied are provided for the data herein its use. Cherokee County collects on average 052 of a propertys assessed fair market value as property tax. The District appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP.

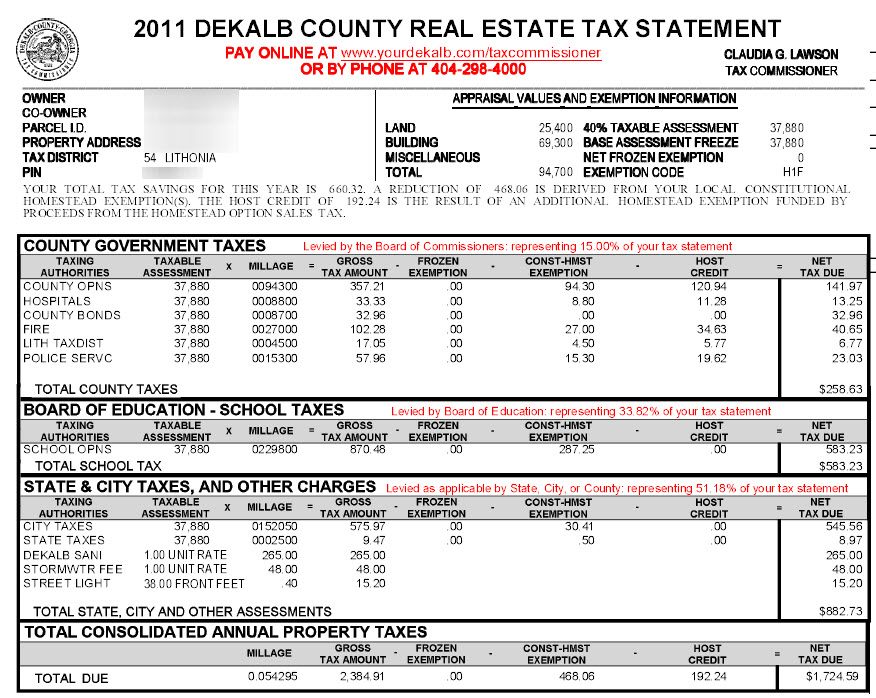

Index Of Images Property Taxes Cherokee County From homeatlanta.com

Index Of Images Property Taxes Cherokee County From homeatlanta.com

We continue to ask you to. Box 1267 Gaffney SC 29342 Phone. Publication of Delinquent Real Estate Taxes. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Kansas is ranked 1904th of the 3143 counties in the United States in order of the median amount of property taxes collected. Any errors or omissions should be reported for investigation.

The assessed value is 40 of the fair market value.

Cherokee County Appraisal District is responsible for appraising all real and business personal property within Cherokee County. For technical problems related to this website please contact the Cherokee County IT Department. No warranties expressed or implied are provided for the data herein its use. Tax payments made by 1200 midnight on January 31st of a given year for the current years taxes will be posted as ON TIME payments without penalty or interest unless the account in question is part of an ongoing delinquent tax suit where attorney fee penalties may have already attached. In neighboring Cherokee County senior tax breaks including Woodstock GA there is also an exemption at age 62. Cherokee County collects on average 112 of a propertys assessed fair market value as property tax.

Source: homeatlanta.com

Source: homeatlanta.com

Thank you for the honor and privilege to serve as your Revenue Commissioner. 864 487-2548 Auditors Office. In neighboring Cherokee County senior tax breaks including Woodstock GA there is also an exemption at age 62. Back to Tax Commissioners Office. The average yearly property tax paid by Cherokee County residents amounts to about 17 of their yearly income.

Source: realtor.com

Source: realtor.com

Tax bills are prepared in the name of the owner of record as of January 1st of each taxable year. Tax lien fee of 2250 on bills less than 10000 or 3250 on bills more than 10000 There is also a 5 penalty every 120 days to max out at 20 figured on the remaining balance still due. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. For technical problems related to this website please contact the Cherokee County IT Department. 864 487-2548 Auditors Office.

Source: realtor.com

Source: realtor.com

Thank you for the honor and privilege to serve as your Revenue Commissioner. Publication of Delinquent Real Estate Taxes. Yearly median tax in Cherokee County The median property tax in Cherokee County Oklahoma is 505 per year for a home worth the median value of 97100. Treasurers Office 110 Railroad Avenue Suite 110 Gaffney SC 29340 PO. Box 1267 Gaffney SC 29342 Phone.

Source: homeatlanta.com

Source: homeatlanta.com

Cherokee County GA - Real Estate Search The Tax Assessors Office has reopened to the public with distancing traffic-flow and sanitizing protocols in place. Treasurers Office 110 Railroad Avenue Suite 110 Gaffney SC 29340 PO. At 90 days delinquent a FiFa. Not all payments are able to be made online at this time. 864 487-2548 Auditors Office.

If you have any questions about the data displayed on this website please contact the Cherokee County Appraisal Office at 828-835-3296. The County Treasurer is responsible for tax billing collection of county property tax on real estate and personal property and distributions to all County entities city school districts townships etc for. The District also collects taxes for jurisdictions within Cherokee County. The assessed value is 40 of the fair market value. If you have general questions please contact Eddie Allen at the Cherokee County Tax Administrators Office.

The County Treasurer is responsible for tax billing collection of county property tax on real estate and personal property and distributions to all County entities city school districts townships etc for. 864 487-2548 Auditors Office. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. If you have any questions about the data displayed on this website please contact the Cherokee County Appraisal Office at 828-835-3296. Any errors or omissions should be reported for investigation.

Source: realtor.com

Source: realtor.com

North Carolina General Statutes requires real estate to be assessed at 100 of its market value. Publication of Delinquent Real Estate Taxes. Box 1267 Gaffney SC 29342 Phone. Not all payments are able to be made online at this time. This tax saving is different from county to county.

Source:

Source:

The County Treasurer is responsible for tax billing collection of county property tax on real estate and personal property and distributions to all County entities city school districts townships etc for. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. However this material may be slightly dated which would have an impact on its accuracy. Please follow these links to pay the following. If you have any questions about the data displayed on this website please contact the Cherokee County Appraisal Office at 828-835-3296.

Source: homeatlanta.com

Source: homeatlanta.com

No warranties expressed or implied are provided for the data herein its use. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. If you have general questions please contact Eddie Allen at the Cherokee County Tax Administrators Office. Treasurers Office 110 Railroad Avenue Suite 110 Gaffney SC 29340 PO. Back to Tax Commissioners Office.

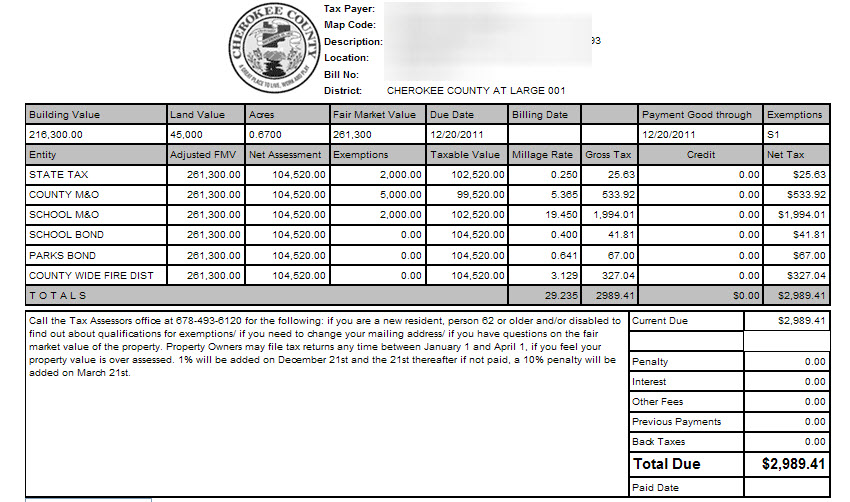

Source: cherokeega.com

Source: cherokeega.com

Tax lien fee of 2250 on bills less than 10000 or 3250 on bills more than 10000 There is also a 5 penalty every 120 days to max out at 20 figured on the remaining balance still due. This website allows you the flexibility to pay your taxes research Cherokee Countys tax records and links you to our state-of-the art mapping site. Yearly median tax in Cherokee County The median property tax in Cherokee County Oklahoma is 505 per year for a home worth the median value of 97100. Back to Tax Commissioners Office. The exemption is for up to 32062500 and then is a graduated portion.

Source: cherokeega.com

Source: cherokeega.com

Any errors or omissions should be reported for investigation. Any errors or omissions should be reported for investigation. Fair market value 300000 Assessed value 40 X 300000 120000 Millage rate 32198 Property tax 120000 X 321981000 3508. The average yearly property tax paid by Cherokee County residents amounts to about 17 of their yearly income. For technical problems related to this website please contact the Cherokee County IT Department.

Source: patch.com

Source: patch.com

For technical problems related to this website please contact the Cherokee County IT Department. Treasurers Office 110 Railroad Avenue Suite 110 Gaffney SC 29340 PO. Thank you for the honor and privilege to serve as your Revenue Commissioner. At 90 days delinquent a FiFa. If you have general questions please contact Eddie Allen at the Cherokee County Tax Administrators Office.

Box 1267 Gaffney SC 29342 Phone. Transfer of ownership during the year does not relieve the seller of tax liability. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. No warranties expressed or implied are provided for the data herein its use.

Source: ajc.com

Source: ajc.com

In Cherokee March 1 is the deadline for applying. Prior to current year delinquent taxes being put in the delinquent records of the Cherokee County Treasurer they are published in the official county newspaper as designated by the Board of County Commissioners for three consecutive weeks in August in accordance with the provisions of KSA. The District appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. This website allows you the flexibility to pay your taxes research Cherokee Countys tax records and links you to our state-of-the art mapping site. Back to Tax Commissioners Office.

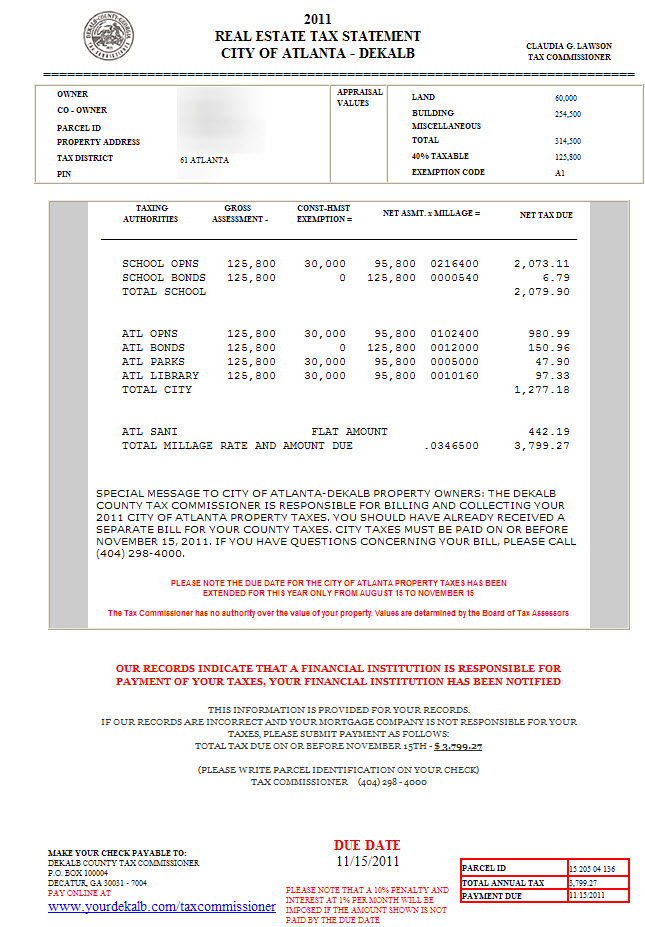

Source: homeatlanta.com

Source: homeatlanta.com

The Cherokee - SC Tax Office makes every effort to produce and publish the most accurate information possible. Treasurers Office 110 Railroad Avenue Suite 110 Gaffney SC 29340 PO. The District appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. Fair market value 300000 Assessed value 40 X 300000 120000 Millage rate 32198 Property tax 120000 X 321981000 3508. 864 487-2548 Auditors Office.

Source: cherokeega.com

Source: cherokeega.com

864 487-2548 Auditors Office. Box 1267 Gaffney SC 29342 Phone. We continue to ask you to. The exemption is for up to 32062500 and then is a graduated portion. However this material may be slightly dated which would have an impact on its accuracy.

Source: homeatlanta.com

Source: homeatlanta.com

Kansas is ranked 1904th of the 3143 counties in the United States in order of the median amount of property taxes collected. Multiply that by the millage rate and divide by 1000. Cherokee County collects on average 052 of a propertys assessed fair market value as property tax. Tax payments made by 1200 midnight on January 31st of a given year for the current years taxes will be posted as ON TIME payments without penalty or interest unless the account in question is part of an ongoing delinquent tax suit where attorney fee penalties may have already attached. Cherokee County collects on average 112 of a propertys assessed fair market value as property tax.

Source: zillow.com

Source: zillow.com

Publication of Delinquent Real Estate Taxes. In neighboring Cherokee County senior tax breaks including Woodstock GA there is also an exemption at age 62. Tax lien fee of 2250 on bills less than 10000 or 3250 on bills more than 10000 There is also a 5 penalty every 120 days to max out at 20 figured on the remaining balance still due. Tax bills are prepared in the name of the owner of record as of January 1st of each taxable year. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cherokee county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.