Your Charleston county real estate tax assessment images are available. Charleston county real estate tax assessment are a topic that is being searched for and liked by netizens today. You can Find and Download the Charleston county real estate tax assessment files here. Download all royalty-free images.

If you’re looking for charleston county real estate tax assessment pictures information related to the charleston county real estate tax assessment topic, you have visit the right site. Our site always gives you hints for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

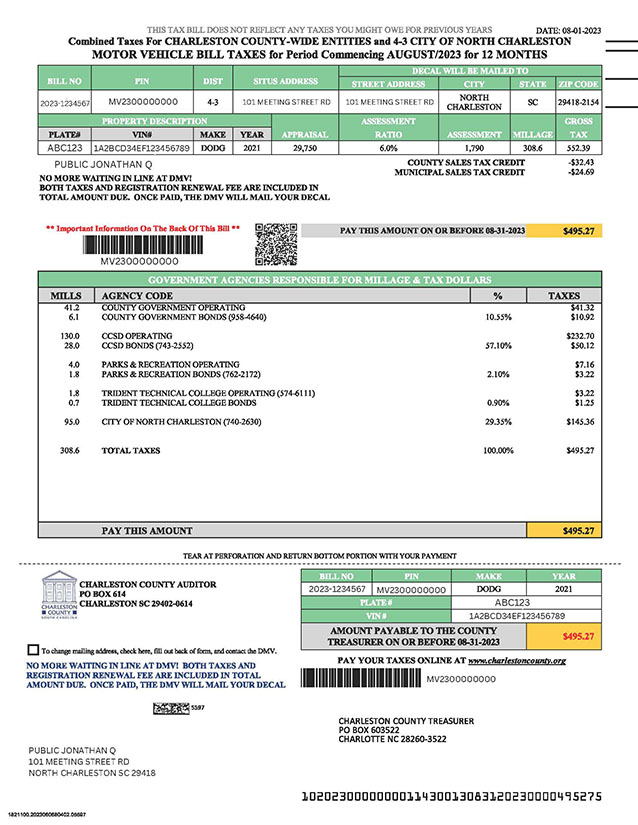

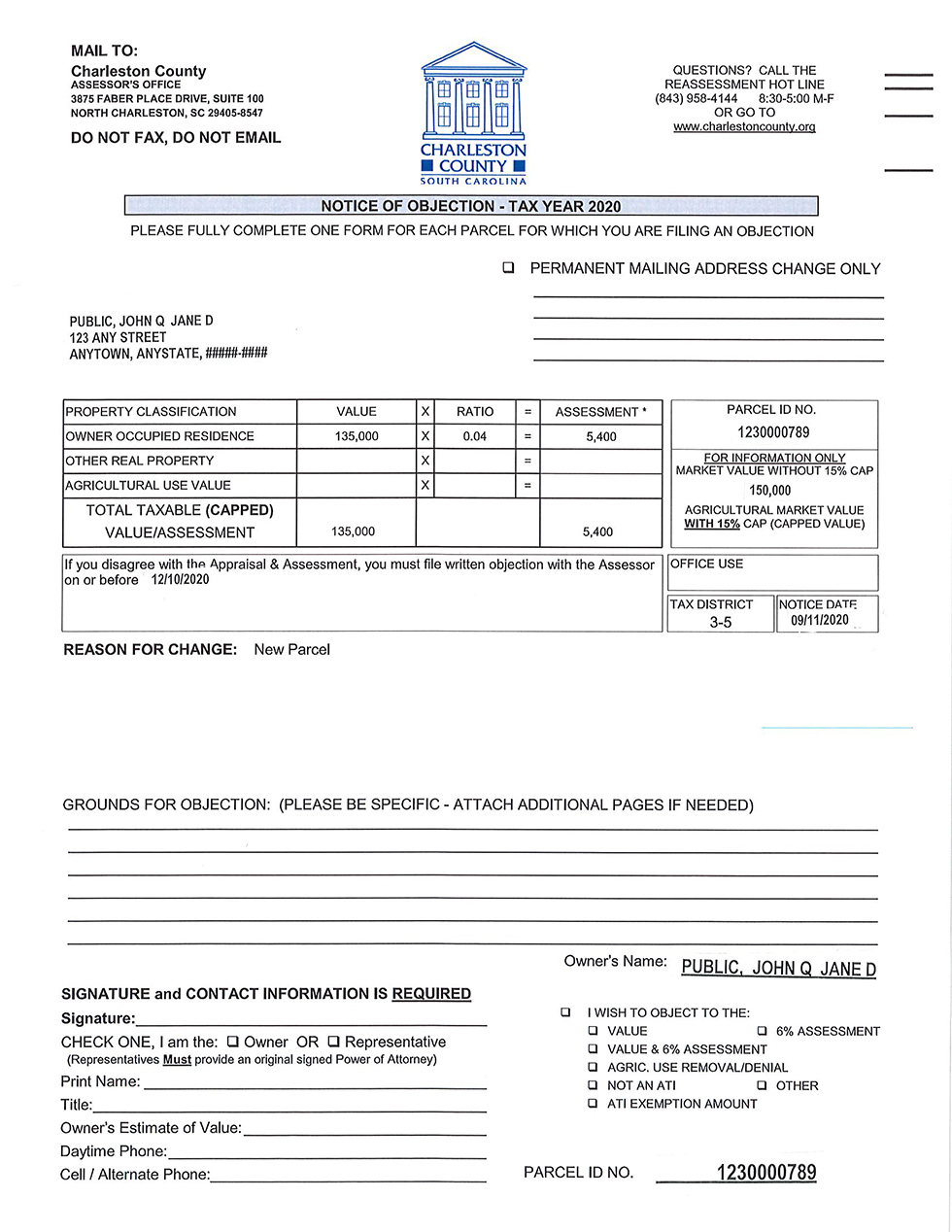

Charleston County Real Estate Tax Assessment. The current assessment ratios for the state of South Carolina are as follows. When searching with PIN do not enter dashes or spaces ex. Request My Watercraft Tax Bill. Owner-occupied properties are exempt from specific taxes bringing their tax rate to 4 percent.

Treasurer S Office From charlestoncounty.org

Treasurer S Office From charlestoncounty.org

When searching with PIN do not enter dashes or spaces ex. The current assessment ratios for the state of South Carolina are as follows. Law Enforcement Public Safety. They are maintained by various government offices in Charleston County South. In-depth Charleston County SC Property Tax Information. Call the Auditors Office at 843 958-4200.

Figure out how to figure out property taxes for real estate in Charleston county SC.

In doing this we will invariably gain useful information that will enable us to make informed decisions. Real Property Record Search. Pay Taxes. In doing this we will invariably gain useful information that will enable us to make informed decisions. The current assessment ratios for the state of South Carolina are as follows. CARS BOATS BUSINESS PERSONAL PROPERTY QUESTIONS.

Source: pinterest.com

Source: pinterest.com

In-depth Charleston County SC Property Tax Information. Figure out how to figure out property taxes for real estate in Charleston county SC. The median property tax in Charleston County South Carolina is 1205 per year for a home worth the median value of 242100. Out of State Tag Reporting. Citizens with mortgage company questions should call the County Treasurer at 843 958-4360.

Owner-occupied properties are exempt from specific taxes bringing their tax rate to 4 percent. Real Property Bill Search. Other Real Estate 6 percent fair market value. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Here are some search tips.

Source: pinterest.com

Source: pinterest.com

Charleston County Property Records are real estate documents that contain information related to real property in Charleston County South Carolina. Apr 29 2021 Search by one of the following. Real Property Record Search. Pay Taxes. Out of State Tag Reporting.

1230000123 NOT 123-00-00-123 The less information entered the broader the search results will be. If you are certified totally and permanently disabled or blind you may qualify for the Homestead. If youre purchasing real property in Mt Pleasant Isle of Palms Folly Beach Downtown James Johns Sullivans Kiawah Seabrook or Daniel Islands calculator table to calculate real estate taxes for primary. There are no residency requirements. As such here is some insightful information about Charleston Countys Quadrennial Reassessment Program from one of the smartest.

1230000123 NOT 123-00-00-123 The less information entered the broader the search results will be. Charleston County Property Records are real estate documents that contain information related to real property in Charleston County South Carolina. Charleston County Tax Estimator Example at 1000000 for Secondary residence at 6 Based on a Residence located in Downtown Charleston. The median property tax in Charleston County South Carolina is 1205 per year for a home worth the median value of 242100. The Charleston County Treasurers Office ensures that copies of Charleston County real property tax bills have been sent to mortgage companies.

Source: pinterest.com

Source: pinterest.com

Call the Auditors Office at 843 958-4200. The current assessment ratios for the state of South Carolina are as follows. Owner-occupied properties are exempt from specific taxes bringing their tax rate to 4 percent. Whos In Jail Inmate Search Charleston Countys Crime Map. Request My Watercraft Tax Bill.

Source: charlestoninsideout.net

Source: charlestoninsideout.net

The Charleston County Treasurers Office ensures that copies of Charleston County real property tax bills have been sent to mortgage companies. Pay Taxes. What property tax exemptions are available for the disabled. Request My Vehicle Tax Bill. Enter your search criteria name address street PIN etc in the Search boxes below.

Source: charlestoncounty.org

Source: charlestoncounty.org

Whos In Jail Inmate Search Charleston Countys Crime Map. Citizens with mortgage company questions should call the County Treasurer at 843 958-4360. Out of State Tag Reporting. Personal Property some motor vehicles watercraft aircraft business personal property 105 percent fair market. The Charleston County Treasurers Office ensures that copies of Charleston County real property tax bills have been sent to mortgage companies.

Source: charlestoncounty.org

Source: charlestoncounty.org

Apr 29 2021 Search by one of the following. List of Online Services provided by Charleston County Government. 1230000123 NOT 123-00-00-123 The less information entered the broader the search results will be. When searching with PIN do not enter dashes or spaces ex. Whos In Jail Inmate Search Charleston Countys Crime Map.

Source: charlestoncounty.org

Source: charlestoncounty.org

Enter your search criteria name address street PIN etc in the Search boxes below. What property tax exemptions are available for the disabled. You can search specifically by owner name PIN street address mailing address or a. Here are some search tips. Owner-occupied properties are exempt from specific taxes bringing their tax rate to 4 percent.

Source: pinterest.com

Source: pinterest.com

The current assessment ratios for the state of South Carolina are as follows. The median property tax also known as real estate tax in Charleston County is 120500 per year based on a median home value of 24210000 and a median effective property tax. If you owned a tract of real property in Charleston County on January 1 of the current tax year and it was used to raise harvest or store crops feed breed or manage livestock or to produce plants trees fowl or animals useful to man you may qualify for a special assessment that will reduce your taxes. In doing this we will invariably gain useful information that will enable us to make informed decisions. Law Enforcement Public Safety.

Source: charlestoncounty.org

Source: charlestoncounty.org

Request My Watercraft Tax Bill. Primary Residences 4 percent fair market value. The current assessment ratios for the state of South Carolina are as follows. Out of State Tag Reporting. Pay Taxes.

In real estate as in life we should never be afraid to ask for help especially when those issues relate to one of the most valuable assets we own our home. Figure out how to figure out property taxes for real estate in Charleston county SC. 5006 Wetland Crossing Drive North Charleston SC 29418. The Charleston County Treasurers Office ensures that copies of Charleston County real property tax bills have been sent to mortgage companies. For example entering Green will yield results either where a name or part of.

Source: charlestoncounty.org

Source: charlestoncounty.org

You can search specifically by owner name PIN street address mailing address or a. If youre purchasing real property in Mt Pleasant Isle of Palms Folly Beach Downtown James Johns Sullivans Kiawah Seabrook or Daniel Islands calculator table to calculate real estate taxes for primary. Charleston County Tax Estimator Example at 1000000 for Secondary residence at 6 Based on a Residence located in Downtown Charleston. Charleston County collects on average 05 of a propertys assessed fair market value as property tax. Request My Vehicle Tax Bill.

Source: fi.pinterest.com

Source: fi.pinterest.com

The median property tax in Charleston County South Carolina is 1205 per year for a home worth the median value of 242100. Real Property Record Search. Property Tax Account Inquiry. Here are some search tips. Law Enforcement Public Safety.

Source: pinterest.com

Source: pinterest.com

Those tax shifts used to be dramatic so dramatic that after Charleston Countys 2005 reassessment South Carolinas property tax system was overhauled by. Out of State Tag Reporting. The median property tax also known as real estate tax in Charleston County is 120500 per year based on a median home value of 24210000 and a median effective property tax. The median property tax in Charleston County South Carolina is 1205 per year for a home worth the median value of 242100. Charleston County Property Records are real estate documents that contain information related to real property in Charleston County South Carolina.

Source: pinterest.com

Source: pinterest.com

Pay Taxes. The current assessment ratios for the state of South Carolina are as follows. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the. Enter your search criteria name address street PIN etc in the Search boxes below. Charleston County Tax Estimator Example at 1000000 for Secondary residence at 6 Based on a Residence located in Downtown Charleston.

Source: pinterest.com

Source: pinterest.com

An application must be filed with the. The median property tax in Charleston County South Carolina is 1205 per year for a home worth the median value of 242100. What property tax exemptions are available for the disabled. Up to the first 50000 of your homes appraised value. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title charleston county real estate tax assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.