Your Cbre uk real estate market outlook 2019 images are available. Cbre uk real estate market outlook 2019 are a topic that is being searched for and liked by netizens today. You can Find and Download the Cbre uk real estate market outlook 2019 files here. Find and Download all royalty-free images.

If you’re searching for cbre uk real estate market outlook 2019 pictures information linked to the cbre uk real estate market outlook 2019 interest, you have come to the ideal blog. Our website always gives you hints for downloading the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

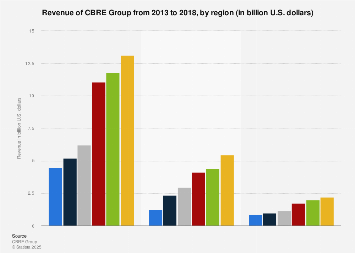

Cbre Uk Real Estate Market Outlook 2019. Real Estate Market Outlook a thoughtful analysis of market conditions across 18 different cities in this region. The CBRE United Kingdom Real Estate Market Outlook 2019 provides insight on the key trends our experts think will affect the UK property industry over the next 12 months. Cross-border investmentalthough from different sources than before as Chinese property companies are substantially reducing outbound. United Kingdom Alternatives Sector Market Outlook 2019.

I1f6thgsrknspm From

I1f6thgsrknspm From

The era of overall yield compression is over and prime yields will be flat for most of 2019. The UKs two national lockdowns mean that the UK economy will now not recover to pre-pandemic size until at least mid-2022. The CBRE United Kingdom Real Estate Market Outlook 2019 provides insight on the key trends our experts think will affect the UK property industry over the next 12 months. Cross-border investmentalthough from different sources than before as Chinese property companies are substantially reducing outbound. Rising home sales prices will continue to curtail renters ability to move into homeownership. Rising home sales prices will continue to curtail renters ability to move into homeownership.

Cross-border investmentalthough from different sources than before as Chinese property companies are substantially reducing outbound.

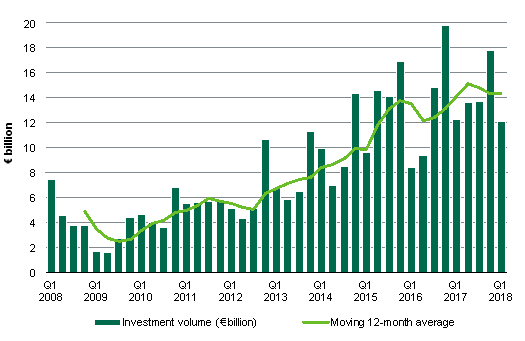

Spanishs economy will continue to grow in 2019 outpacing most other European countries as the expansion phase that the economic cycle entered in 2013 further extends. This report is the most comprehensive sector-by-sector outlook in the. Rising home sales prices will continue to curtail renters ability to move into homeownership. In this report we look at how economic political and technological forces will affect property markets in 2019 and beyond. United Kingdom Alternatives Sector Market Outlook 2019. This report is the most comprehensive sector-by-sector outlook in the industry from flexible office space to e-commerce and from data centres to build-to-rent.

Source: cbre.de

Source: cbre.de

The limited availability of assets for sale will also act as a brake on the further growth in investment volume with many investible properties having been acquired by long term buyers over the past few years. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. Spain Real Estate Market Outlook 2019. Spanishs economy will continue to grow in 2019 outpacing most other European countries as the expansion phase that the economic cycle entered in 2013 further extends. Rising home sales prices will continue to curtail renters ability to move into homeownership.

Source: statista.com

Source: statista.com

The CBRE United Kingdom Real Estate Market Outlook 2019 provides insight on the key trends our experts think will affect the UK property industry over the next 12 months. In this special Alternatives edition of the UK Real Estate Outlook we look at how economic political financial and technological trends might affect the Alternatives property markets. Rising home sales prices will continue to curtail renters ability to move into homeownership. Cross-border investmentalthough from different sources than before as Chinese property companies are substantially reducing outbound. A combination of low interest rates low inflation powerful fiscal stimulus and the resolution of Brexit uncertainty will support recovery.

Source: statista.com

Source: statista.com

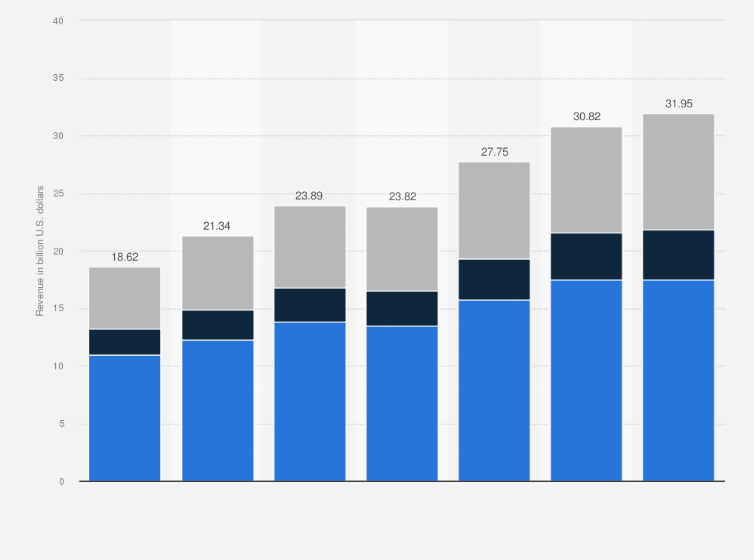

Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. CBRE Ireland hosts an annual Outlook event that focuses on the trends and predictions for each sector of the Irish commercial property market for the year ahead. Real estate has never been more expensive than it is right now which means the information in this report has never been more important. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. The era of overall yield compression is over and prime yields will be flat for most of 2019.

Source: cbre.de

Source: cbre.de

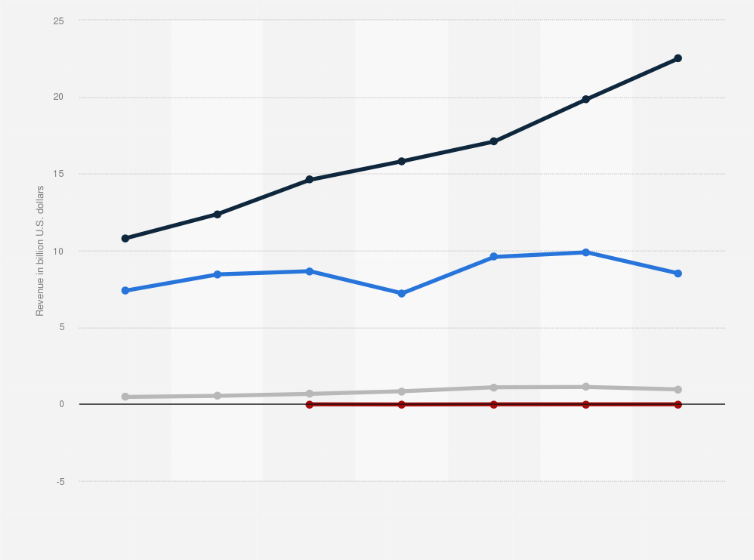

UK Real Estate Market Outlook 2019. We forecast an average total return of 51 per annum in 2019 and 27 for 2020 most of which will be driven by income return. The limited availability of assets for sale will also act as a brake on the further growth in investment volume with many investible properties having been acquired by long term buyers over the past few years. Rising home sales prices will continue to curtail renters ability to move into homeownership. Cross-border investmentalthough from different sources than before as Chinese property companies are substantially reducing outbound.

Source: twitter.com

Source: twitter.com

Global real estate advisor CBRE has today published its 2019 UK Real Estate Market Outlook report which foresees a turbulent political scene driven by Brexit uncertainty causing hesitation and delay for property markets businesses and consumers alike. Global real estate advisor CBRE has today published its 2019 UK Real Estate Market Outlook report which foresees a turbulent political scene driven by Brexit uncertainty causing hesitation and delay for property markets businesses and consumers alike. WELCOME TO THE CBRE UK MARKET OUTLOOK FOR 2018 Its crunch time for Brexit and the UK economy faces challenges in the form of full employment higher inflation and lower consumer spending. Rising home sales prices will continue to curtail renters ability to move into homeownership. Delivered by our Head of Research Marie Hunt regarded as one of the industrys most authoritative property economic researchers media commentators our annual outlook presentation.

Source: redribbon.co

Source: redribbon.co

The limited availability of assets for sale will also act as a brake on the further growth in investment volume with many investible properties having been acquired by long term buyers over the past few years. CBRE Ireland hosts an annual Outlook event that focuses on the trends and predictions for each sector of the Irish commercial property market for the year ahead. A combination of low interest rates low inflation powerful fiscal stimulus and the resolution of Brexit uncertainty will support recovery. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. Spanishs economy will continue to grow in 2019 outpacing most other European countries as the expansion phase that the economic cycle entered in 2013 further extends.

Source: news.cbre.de

Source: news.cbre.de

Global real estate advisor CBRE has today published its 2019 UK Real Estate Market Outlook report which foresees a turbulent political scene driven by Brexit uncertainty causing hesitation and delay for property markets businesses and consumers alike. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. Spain Real Estate Market Outlook 2019. Rising home sales prices will continue to curtail renters ability to move into homeownership. Embedded in this website you will find more than 100.

Source: statista.com

Source: statista.com

In de Real Estate Outlook publicaties en updates geven we een overzicht van de stand van zaken in de vastgoedinvesteringsmarkt. In de Real Estate Outlook publicaties en updates geven we een overzicht van de stand van zaken in de vastgoedinvesteringsmarkt. Real Estate Market Outlook a thoughtful analysis of market conditions across 18 different cities in this region. With substantial dry powder targeting real estate investors will continue to diversify into secondary markets in search of yield. Delivered by our Head of Research Marie Hunt regarded as one of the industrys most authoritative property economic researchers media commentators our annual outlook presentation.

Source: twitter.com

Source: twitter.com

United Kingdom Alternatives Sector Market Outlook 2019. Embedded in this website you will find more than 100. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. United Kingdom Alternatives Sector Market Outlook 2019. Real estate has never been more expensive than it is right now which means the information in this report has never been more important.

Source: twitter.com

Source: twitter.com

Real estate has never been more expensive than it is right now which means the information in this report has never been more important. WELCOME TO THE CBRE UK MARKET OUTLOOK FOR 2018 Its crunch time for Brexit and the UK economy faces challenges in the form of full employment higher inflation and lower consumer spending. Rising home sales prices will continue to curtail renters ability to move into homeownership. Spain Real Estate Market Outlook 2019. Real Estate Outlook 2021.

Source: internews.biz

Source: internews.biz

Rising home sales prices will continue to curtail renters ability to move into homeownership. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. Gebaseerd op actuele data transacties en trends. WELCOME TO THE CBRE UK MARKET OUTLOOK FOR 2018 Its crunch time for Brexit and the UK economy faces challenges in the form of full employment higher inflation and lower consumer spending. Rising home sales prices will continue to curtail renters ability to move into homeownership.

Source: statista.com

Source: statista.com

Rising home sales prices will continue to curtail renters ability to move into homeownership. WELCOME TO THE CBRE UK MARKET OUTLOOK FOR 2018 Its crunch time for Brexit and the UK economy faces challenges in the form of full employment higher inflation and lower consumer spending. The era of overall yield compression is over and prime yields will be flat for most of 2019. Cross-border investmentalthough from different sources than before as Chinese property companies are substantially reducing outbound. The limited availability of assets for sale will also act as a brake on the further growth in investment volume with many investible properties having been acquired by long term buyers over the past few years.

Source: cbre.de

Source: cbre.de

Gebaseerd op actuele data transacties en trends. Rising home sales prices will continue to curtail renters ability to move into homeownership. We forecast an average total return of 51 per annum in 2019 and 27 for 2020 most of which will be driven by income return. We expect a consumer-driven recovery with retail sales already having recovered quite strongly. Welcome to the CBRE 2019 Southeast US.

Source: cbre.de

Source: cbre.de

This report is the most comprehensive sector-by-sector outlook in the industry from flexible office space to e-commerce and from data centres to build-to-rent. A combination of low interest rates low inflation powerful fiscal stimulus and the resolution of Brexit uncertainty will support recovery. With substantial dry powder targeting real estate investors will continue to diversify into secondary markets in search of yield. We forecast an average total return of 51 per annum in 2019 and 27 for 2020 most of which will be driven by income return. In this report we look at how economic political and technological forces will affect property markets in 2018 and beyond.

Source: news.cbre.de

Source: news.cbre.de

The limited availability of assets for sale will also act as a brake on the further growth in investment volume with many investible properties having been acquired by long term buyers over the past few years. The UKs two national lockdowns mean that the UK economy will now not recover to pre-pandemic size until at least mid-2022. Gebaseerd op actuele data transacties en trends. The CBRE United Kingdom Real Estate Market Outlook 2019 provides insight on the key trends our experts think will affect the UK property industry over the next 12 months. We forecast an average total return of 51 per annum in 2019 and 27 for 2020 most of which will be driven by income return.

Source: twitter.com

Source: twitter.com

The CBRE United Kingdom Real Estate Market Outlook 2019 provides insight on the key trends our experts think will affect the UK property industry over the next 12 months. In this special Alternatives edition of the UK Real Estate Outlook we look at how economic political financial and technological trends might affect the Alternatives property markets. Delivered by our Head of Research Marie Hunt regarded as one of the industrys most authoritative property economic researchers media commentators our annual outlook presentation. This report is the most comprehensive sector-by-sector outlook in the industry from flexible office space to e-commerce and from data centres to build-to-rent. The era of overall yield compression is over and prime yields will be flat for most of 2019.

Source: nordicsrealestate.com

Source: nordicsrealestate.com

We forecast an average total return of 51 per annum in 2019 and 27 for 2020 most of which will be driven by income return. Delivered by our Head of Research Marie Hunt regarded as one of the industrys most authoritative property economic researchers media commentators our annual outlook presentation. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. In this report we look at how economic political and technological forces will affect property markets in 2019 and beyond.

Source:

Source:

We expect a consumer-driven recovery with retail sales already having recovered quite strongly. Real Estate Outlook 2021. Investment activity in 2019 will come close to peak volumes achieved in recent years with the forecast exceeding US150 billion for the year. In this report we look at how economic political and technological forces will affect property markets in 2018 and beyond. Rising home sales prices will continue to curtail renters ability to move into homeownership.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cbre uk real estate market outlook 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.