Your Carried interest real estate example images are available in this site. Carried interest real estate example are a topic that is being searched for and liked by netizens today. You can Find and Download the Carried interest real estate example files here. Download all free photos and vectors.

If you’re searching for carried interest real estate example images information linked to the carried interest real estate example keyword, you have pay a visit to the right site. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

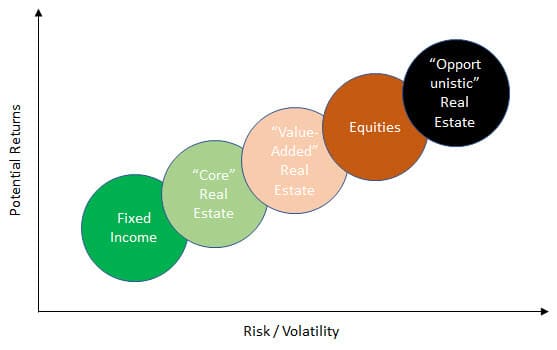

Carried Interest Real Estate Example. A common practice among real estate partnerships however is to permit the general partner to receive some of the profits through a carried interest even when the general partner has contributed little or no capital to the enterprise. This process shall be repeated until the time these profits reach a cumulative IRR of 10. Videos you watch may be added to the TVs watch history and. Carried interest is a common theme in many real estate partnerships.

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep From wallstreetprep.com

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep From wallstreetprep.com

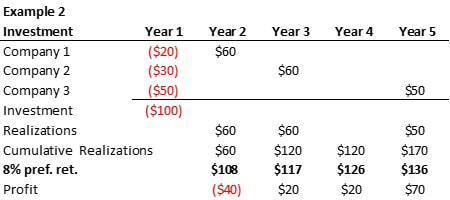

A carried interest is first and foremost an interest in the partnership. For example for certain US. Notable examples of private equity funds that charge carried interest include Carlyle. Because it is a long-term riskbased investment it is not paid contemporaneously nor is it guaranteed. Carried Interest Example. As an example assume the GP and the limited partner LP invest in a limited partnership the Fund.

Videos you watch may be added to the TVs watch history and.

Because carried interest is considered a return on investment it is taxed at a. This process shall be repeated until the time these profits reach a cumulative IRR of 10. Bs gain is long-term capital gain. Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers. Gain is allocated from sale. A carried interest is first and foremost an interest in the partnership.

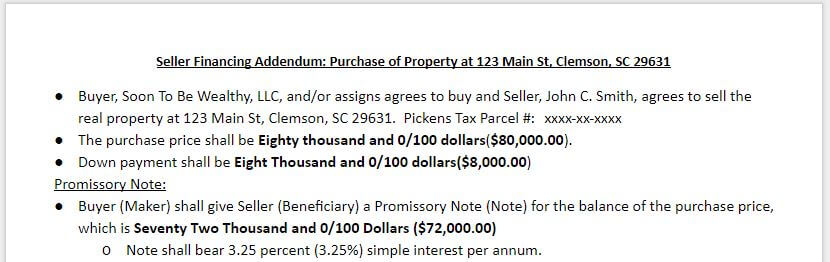

Source: coachcarson.com

Source: coachcarson.com

As an example assume the GP and the limited partner LP invest in a limited partnership the Fund. This process shall be repeated until the time these profits reach a cumulative IRR of 10. Examples Explained of Carried Interest - Reviewed Ross Blankenship. Notable examples of private equity funds that charge carried interest include Carlyle. Carried interest is a common theme in many real estate partnerships.

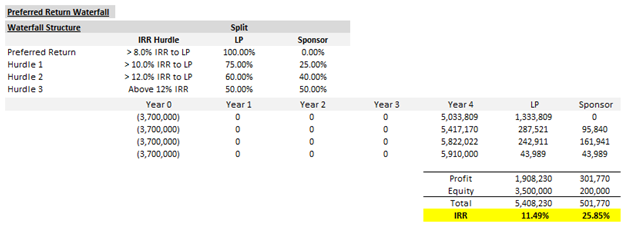

Source: boardwalkwealth.com

Source: boardwalkwealth.com

This process shall be repeated until the time these profits reach a cumulative IRR of 10. Gain is allocated from sale. Notable examples of private equity funds that charge carried interest include Carlyle. Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers. Examples Explained of Carried Interest - Reviewed Ross Blankenship.

Source: wallstreetprep.com

Source: wallstreetprep.com

Example of Carried Interest The typical carried interest amount is 20 for private equity and hedge funds. A holds a profits interest and B a capital interest. If playback doesnt begin shortly try restarting your device. Videos you watch may be added to the TVs watch history and. Carried Interest Example.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Carried Interest Example. When a PE Fund realizes the profits then these profits shall be first allocated to the limited partner that is Investors. Gain is allocated from sale. Because it is a long-term riskbased investment it is not paid contemporaneously nor is it guaranteed. Carried interest is a common theme in many real estate partnerships.

Source: wallstreetprep.com

Source: wallstreetprep.com

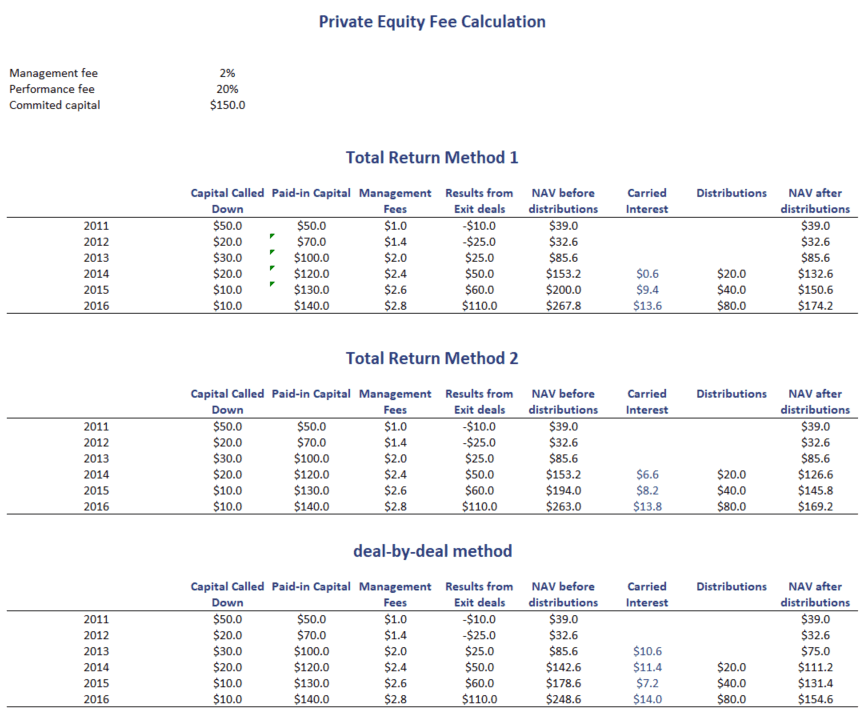

Assuming a Private equity fund is having a carried interest of 20 for the fund manager and a hurdle rate of 10. For example for certain US. A common practice among real estate partnerships however is to permit the general partner to receive some of the profits through a carried interest even when the general partner has contributed little or no capital to the enterprise. Examples Explained of Carried Interest - Reviewed Ross Blankenship. Assuming a Private equity fund is having a carried interest of 20 for the fund manager and a hurdle rate of 10.

Source: relakhs.com

Source: relakhs.com

The LP invests 100 the GP invests 0 and the partnership agreement says that the LP will receive its capital commitment back plus 10 the preferred return. Manager receives a 20 carried interest and is therefore allocated 10 million of this gain. Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers. It can be thought of as a tool to incentive the managing partner also referred to as the general partner or sponsor as it will typically earmark a disproportionate amount of investment returns to the manager if the investment is successful. Gain is allocated from sale.

Carried interest is a common theme in many real estate partnerships. Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers. In a typical real estate transaction it is in fact only on sale that the carried interest produces capital gain. Here GP is an acronym for general partner. A common practice among real estate partnerships however is to permit the general partner to receive some of the profits through a carried interest even when the general partner has contributed little or no capital to the enterprise.

Source: crowdstreet.com

Source: crowdstreet.com

Assuming a Private equity fund is having a carried interest of 20 for the fund manager and a hurdle rate of 10. In a typical real estate transaction it is in fact only on sale that the carried interest produces capital gain. 1061 the excess of the. Example of Carried Interest The typical carried interest amount is 20 for private equity and hedge funds. As an example assume the GP and the limited partner LP invest in a limited partnership the Fund.

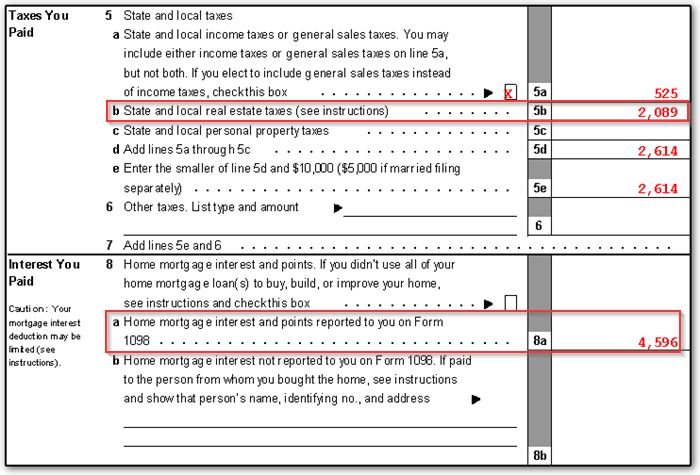

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

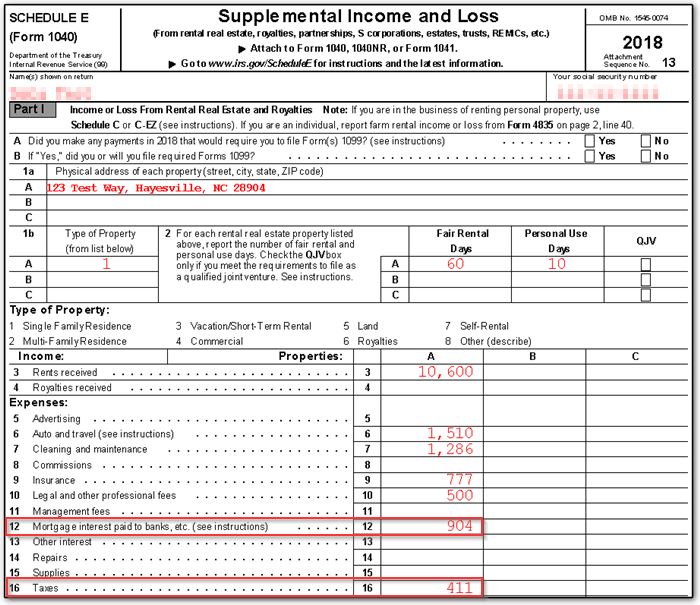

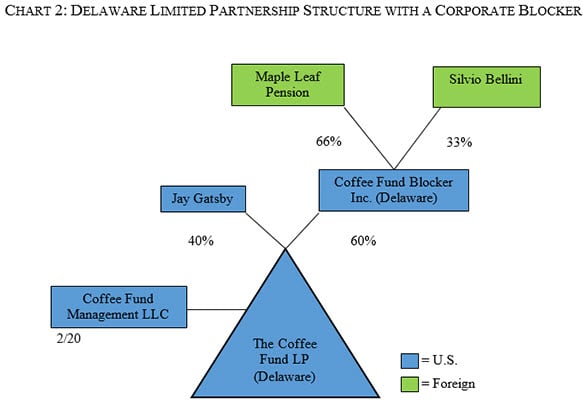

Properties a real estate investment trust REIT may convert the character of income earned at the property level eg Unrelated Business Taxable Income UBTI Effectively Connected Income ECI commercial activity to more beneficial dividend income without any entity-level tax so long as all income is distributed on an annual basis. Its amount and timing depends on the success of the partnership venture. Real estate developers often include the concept of a promote in their operating or partnership agreements providing them a greater return than. Examples Explained of Carried Interest - Reviewed Ross Blankenship. For a numerical example lets say that.

Source: allenlatta.com

Source: allenlatta.com

Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers. If playback doesnt begin shortly try restarting your device. Carried interest is generally tied to a specified rate of return known as a hurdle rate. Because carried interest is considered a return on investment it is taxed at a. A carried interest is first and foremost an interest in the partnership.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

1 the hurdle rate is 7 2 PE Fund total committed capital is 100M 3 the only capital drawn down is 50M at time 0 to keep things simple 4 There is only a distribution in year 4 year 1 - 3 has no distributions at all. An example of a profit sharing arrangement similar to a carried interest is a developers promote in a real estate development project. Manager receives a 20 carried interest and is therefore allocated 10 million of this gain. Carried interest is a common theme in many real estate partnerships. In a typical real estate transaction it is in fact only on sale that the carried interest produces capital gain.

Source: asimplemodel.com

Source: asimplemodel.com

For a numerical example lets say that. As an example assume the GP and the limited partner LP invest in a limited partnership the Fund. 1 the hurdle rate is 7 2 PE Fund total committed capital is 100M 3 the only capital drawn down is 50M at time 0 to keep things simple 4 There is only a distribution in year 4 year 1 - 3 has no distributions at all. An example of a profit sharing arrangement similar to a carried interest is a developers promote in a real estate development project. Before carried interest kicks in for year 4 the amount needed to be returned to LPs is.

Source: venable.com

Source: venable.com

Carried interest is a rule in the tax code that lets the managers of some types of private investment fundshedge private equity venture capital real estate and other types of vehiclespay a. Partnership AB with rental real estate property Property purchased on 712016. Videos you watch may be added to the TVs watch history and. The general partners profits interest is carried with the property until it is sold. This process shall be repeated until the time these profits reach a cumulative IRR of 10.

Source: breakingdownfinance.com

Source: breakingdownfinance.com

Examples Explained of Carried Interest - Reviewed Ross Blankenship. Regardless of paper profits that might exist. For example for certain US. A common practice among real estate partnerships however is to permit the general partner to receive some of the profits through a carried interest even when the general partner has contributed little or no capital to the enterprise. Property sold on 12312017.

Source: famcap.com

Source: famcap.com

Notable examples of private equity funds that charge carried interest include Carlyle. Gain is allocated from sale. Regardless of paper profits that might exist. The LP invests 100 the GP invests 0 and the partnership agreement says that the LP will receive its capital commitment back plus 10 the preferred return. Before carried interest kicks in for year 4 the amount needed to be returned to LPs is.

Source: wallstreetprep.com

Source: wallstreetprep.com

Regardless of paper profits that might exist. Regardless of paper profits that might exist. Example of Carried Interest The typical carried interest amount is 20 for private equity and hedge funds. Assuming a Private equity fund is having a carried interest of 20 for the fund manager and a hurdle rate of 10. Because carried interest is considered a return on investment it is taxed at a.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Before carried interest kicks in for year 4 the amount needed to be returned to LPs is. Carried Interest Example. Notable examples of private equity funds that charge carried interest include Carlyle. Because carried interest is considered a return on investment it is taxed at a. If for example the funds target return is 12 and it only earns 8 the general partner might earn no.

Source: jobsearchdigest.com

Source: jobsearchdigest.com

As an example assume the GP and the limited partner LP invest in a limited partnership the Fund. Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers. It can be thought of as a tool to incentive the managing partner also referred to as the general partner or sponsor as it will typically earmark a disproportionate amount of investment returns to the manager if the investment is successful. This 10 shall be calculated on the capital amounts that have been contributed by the. Property sold on 12312017.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title carried interest real estate example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.