Your Capital gains tax rate real estate 2019 images are available in this site. Capital gains tax rate real estate 2019 are a topic that is being searched for and liked by netizens today. You can Download the Capital gains tax rate real estate 2019 files here. Get all royalty-free photos.

If you’re searching for capital gains tax rate real estate 2019 images information linked to the capital gains tax rate real estate 2019 interest, you have come to the right site. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

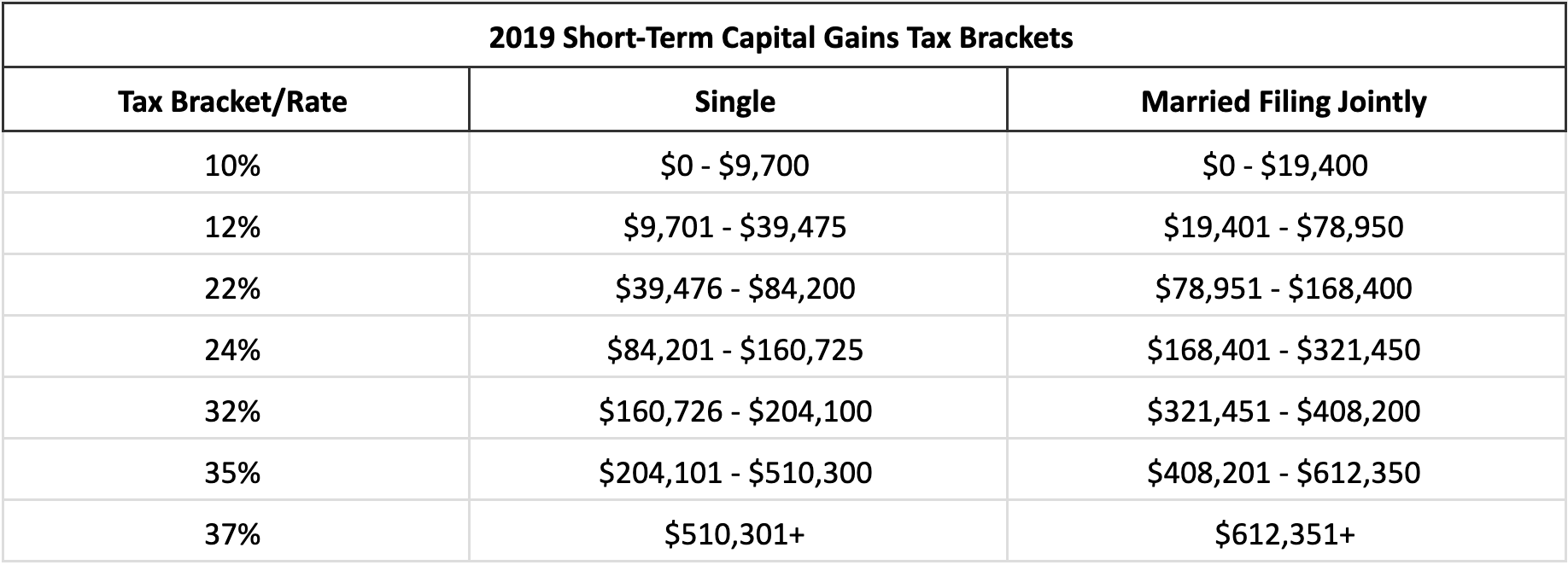

Capital Gains Tax Rate Real Estate 2019. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. The rate of tax is 5 of the net gain. Theyre taxed at lower rates than short-term capital gains. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit.

How To Calculate Capital Gains Tax H R Block From hrblock.com

How To Calculate Capital Gains Tax H R Block From hrblock.com

For Shares of Stocks Not Traded in the Stock Exchange. The Capital Gain is not subject to further taxation after payment of the 5 rate of tax. The following Capital Gains Tax rates apply. Anything above these limits and you fall into the 20 tax bracket which is the highest capital gains tax bracket. What Are Capital Assets. In our example you would have to include 1325 2650 x 50 in your income.

16 What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No.

WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. How Much is Capital Gains Tax on the Sale of a Home. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. When selling your primary home you can make up to 250000 in profit or double that if you are married and you wont owe anything for capital gains. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. The sale price minus your ACB is the capital gain that youll need to pay tax on.

Source: relakhs.com

Source: relakhs.com

For Shares of Stocks Not Traded in the Stock Exchange. The amount of tax youll pay depends on. Anything above these limits and you fall into the 20 tax bracket which is the highest capital gains tax bracket. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit.

Source: hackyourwealth.com

Source: hackyourwealth.com

The rate of tax is 5 of the net gain. Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of 1000000. Net Gain is Sales Proceeds minus the Acquisition and Incidental cost CGT is on gains arising from sale of property. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax.

Source: blog.graana.com

Source: blog.graana.com

In our example you would have to include 1325 2650 x 50 in your income. It is a final tax ie. Net Gain is Sales Proceeds minus the Acquisition and Incidental cost CGT is on gains arising from sale of property. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. The rate of tax is 5 of the net gain.

Source: litrg.org.uk

Source: litrg.org.uk

The following Capital Gains Tax rates apply. Capital gains tax is usually charged as a percentage of the profit earned from selling your assets based on your countrys tax laws and prevailing rates. Apart from federal income tax the capital gains calculator also computes the state tax on capital gains. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. A capital asset is defined as property of any kind that is not easily sold in the regular course of a businesss operations non-inventory and is generally owned for its role in contributing to the businesss ability to generate profit.

Source: itep.org

Source: itep.org

Adjusted Cost Base ACB. For Real Properties Six percent 6 B. Do keep in mind that your state may charge its own capital gains tax. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. In our example you would have to include 1325 2650 x 50 in your income.

Source: canr.msu.edu

Source: canr.msu.edu

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40000 and 441500 married filing jointly earning between 80001 and 486600 or head of household. Do keep in mind that your state may charge its own capital gains tax. Long-term capital gains are gains on assets you hold for more than one year. Net Gain is Sales Proceeds minus the Acquisition and Incidental cost CGT is on gains arising from sale of property. A capital asset is defined as property of any kind that is not easily sold in the regular course of a businesss operations non-inventory and is generally owned for its role in contributing to the businesss ability to generate profit.

Source: hrblock.com

Source: hrblock.com

The rate of tax is 5 of the net gain. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. For dispositions of qualified farm or fishing property QFFP in 2016 to 2020 the LCGE is 1000000. For Shares of Stocks Not Traded in the Stock Exchange. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more on how to.

Source: pinterest.com

Source: pinterest.com

It is a final tax ie. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. A capital asset is defined as property of any kind that is not easily sold in the regular course of a businesss operations non-inventory and is generally owned for its role in contributing to the businesss ability to generate profit. In Canada 50 of the value of any capital gains is taxable. The Capital Gain is not subject to further taxation after payment of the 5 rate of tax.

Source: financialcontrol.in

Source: financialcontrol.in

What Are Capital Assets. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40000 and 441500 married filing jointly earning between 80001 and 486600 or head of household. For Real Properties Six percent 6 B. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit. Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of 1000000.

Source: apnaplan.com

Source: apnaplan.com

Long-term capital gains are gains on assets you hold for more than one year. 16 What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No. Theyre taxed at lower rates than short-term capital gains. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more on how to. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit.

Source: relakhs.com

Source: relakhs.com

The rate of tax is 5 of the net gain. A capital asset is defined as property of any kind that is not easily sold in the regular course of a businesss operations non-inventory and is generally owned for its role in contributing to the businesss ability to generate profit. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. This means youll pay 30 in Capital Gains. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10.

Source: diypropertyinvestment.com

Source: diypropertyinvestment.com

Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of 1000000. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. 3 Zeilen The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain. Thats why some very rich Americans dont. Adjusted Cost Base ACB.

Source: zameen.com

Source: zameen.com

In our example you would have to include 1325 2650 x 50 in your income. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more on how to. The sale price minus your ACB is the capital gain that youll need to pay tax on. Apart from federal income tax the capital gains calculator also computes the state tax on capital gains. For dispositions of qualified farm or fishing property QFFP in 2016 to 2020 the LCGE is 1000000.

Source: blog.graana.com

Source: blog.graana.com

This means youll pay 30 in Capital Gains. The sale price minus your ACB is the capital gain that youll need to pay tax on. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit. Do keep in mind that your state may charge its own capital gains tax.

Source: relakhs.com

Source: relakhs.com

Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more on how to. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. Theres also the 38 net investment income tax but this is reserved for taxpayers on higher incomes. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit.

Source: relakhs.com

Source: relakhs.com

Do keep in mind that your state may charge its own capital gains tax. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. Long-term capital gains are gains on assets you hold for more than one year. 10 and 20 tax rates for individuals not including residential property and carried interest 18 and 28 tax rates for individuals for residential. Adjusted Cost Base ACB.

Source: expertsforexpats.com

Source: expertsforexpats.com

Net Gain is Sales Proceeds minus the Acquisition and Incidental cost CGT is on gains arising from sale of property. 3 Zeilen The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain. Capital gains tax is usually charged as a percentage of the profit earned from selling your assets based on your countrys tax laws and prevailing rates. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. Net Gain is Sales Proceeds minus the Acquisition and Incidental cost CGT is on gains arising from sale of property.

Source: businesstoday.in

Source: businesstoday.in

In Canada 50 of the value of any capital gains is taxable. 4 Zeilen If you sell the property now for net proceeds of 350000 youll owe long-term capital gains. 3 Zeilen The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more on how to. The Capital Gain is not subject to further taxation after payment of the 5 rate of tax.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital gains tax rate real estate 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.