Your Capital gains tax rate real estate 2013 images are ready in this website. Capital gains tax rate real estate 2013 are a topic that is being searched for and liked by netizens today. You can Get the Capital gains tax rate real estate 2013 files here. Find and Download all royalty-free photos and vectors.

If you’re looking for capital gains tax rate real estate 2013 images information related to the capital gains tax rate real estate 2013 keyword, you have visit the right site. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

Capital Gains Tax Rate Real Estate 2013. If you sold both the property along with the land it sits on you must determine. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. However note that these tax rates only apply if youve owned your property for more than one year. State long-term capital gains taxes Investors also need to consider state capital gains taxes.

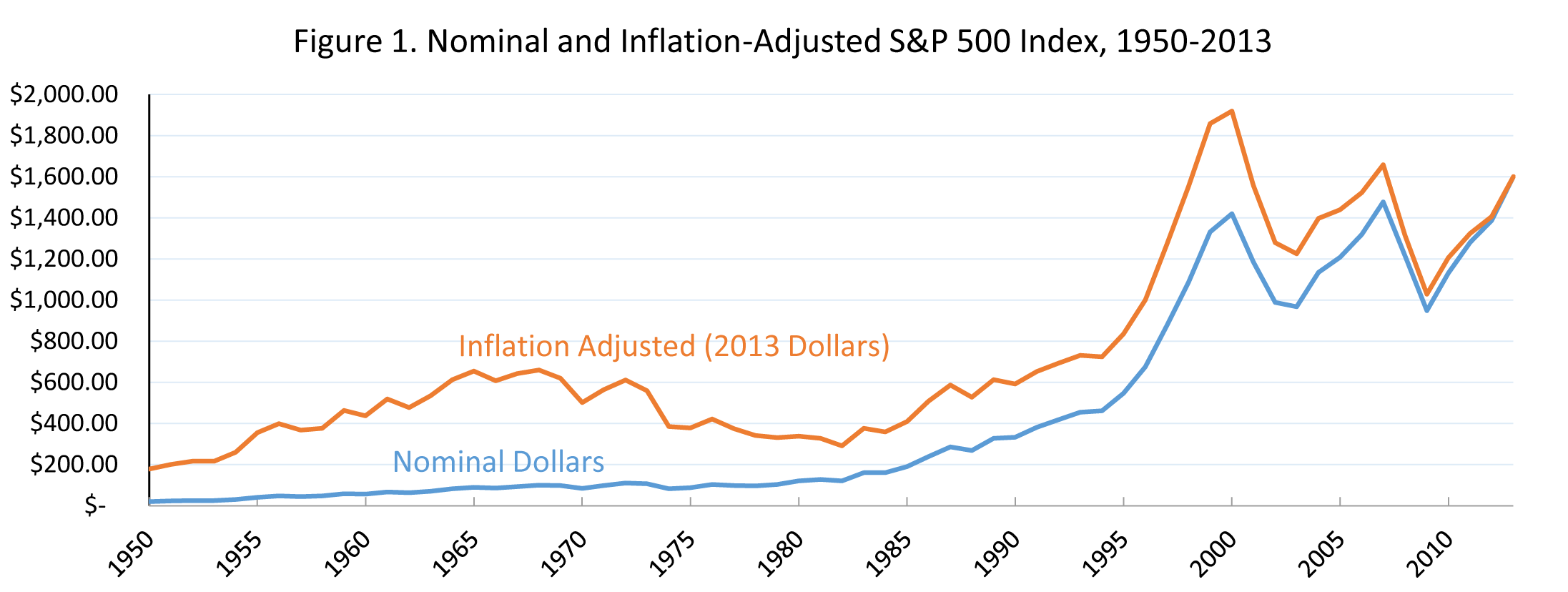

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation From taxfoundation.org

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation From taxfoundation.org

Effective January 1 2013 the top capital gain tax rate has been permanently increased to 20 for married couples filing jointly with incomes exceeding 450000 400000 taxable income for single filers. It may be possible to amend the trust to permit the inclusion of capital gains in DNI or the trustee may simply be able to exercise his or her discretion. State long-term capital gains taxes Investors also need to consider state capital gains taxes. Therefore the top federal tax rate on long-term capital gains is 238. State and local taxes often apply to capital gains. How the trust handles the capital gains makes a big difference in the familys tax.

Your capital gains tax rate can range from 0 15 or 20 depending on your income and tax status.

Capital Gains Tax Rate for 2013 and 2014. Across the US states levy an average 51 tax on long-term capital gains according to The Tax. You see it pays to hold onto any item – real. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. Therefore the top federal tax rate on long-term capital gains is 238. Capital Gains Tax Rate for 2013 and 2014.

Source: pinterest.com

Source: pinterest.com

State long-term capital gains taxes Investors also need to consider state capital gains taxes. They are generally lower than short-term capital gains tax rates. Capital Gains Tax Rate for 2013 and 2014. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. The tax rate on capital gains from securities held in such an account is 10 after a 3-year holding period and 0 after the accounts maximum 5 years period is expired.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

The 6 health insurance tax on capital gains. If this amount is within the basic Income Tax band youll pay 10 on your gains or 18 on residential property. The 6 health insurance tax on capital gains. Understanding Capital Gains Tax on a Real Estate Investment Property Real estate properties generate income for investors but taxes play a factor in returns. In that case the long-term capital gains tax rates would be applicable.

Source: in.pinterest.com

Source: in.pinterest.com

Youll pay 20 or 28 on residential property on any amount above the basic. However note that these tax rates only apply if youve owned your property for more than one year. Individual belongings are taxed at different rates determined by what they are and the situation. However which bracket you. This tax is known as the net investment income tax.

Source: japanpropertycentral.com

Source: japanpropertycentral.com

However which bracket you. The tax rate on capital gains from securities held in such an account is 10 after a 3-year holding period and 0 after the accounts maximum 5 years period is expired. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. Individual belongings are taxed at different rates determined by what they are and the situation. What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No.

Source: forbes.com

Source: forbes.com

Capital gains ordinarily are held by the trust and taxed at the trust level BIG tax. The capital gains deduction limit on gains arising from dispositions of QSBCS and QFFP in 2015 is 406800 12 of a LCGE of 813600. But really any property you own is subject to capital gains tax if you sell it for more than the. Your long-term capital gain because of your income would fall in the 15 bracket. Therefore the top federal tax rate on long-term capital gains is 238.

Source: krugman.blogs.nytimes.com

Source: krugman.blogs.nytimes.com

58 Increase for Top Earners What you need to know as the deadline draws near. If you sold both the property along with the land it sits on you must determine. In that case the long-term capital gains tax rates would be applicable. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form. You see it pays to hold onto any item – real.

Source: pinterest.com

Source: pinterest.com

Download Excel Federal Capital Gains Tax Rates 1988-2013Download Federal Capital Gains Tax Rates 1988-2011Download Federal Capital Gains Tax Rates 1988-2011. You see it pays to hold onto any item – real. Individual belongings are taxed at different rates determined by what they are and the situation. For Real Properties Six percent 6. What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No.

Source: pinterest.com

Source: pinterest.com

The 6 health insurance tax on capital gains. They are generally lower than short-term capital gains tax rates. Download Excel Federal Capital Gains Tax Rates 1988-2013Download Federal Capital Gains Tax Rates 1988-2011Download Federal Capital Gains Tax Rates 1988-2011. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. State long-term capital gains taxes Investors also need to consider state capital gains taxes.

Source: taxfoundation.org

Source: taxfoundation.org

Your long-term capital gain because of your income would fall in the 15 bracket. However note that these tax rates only apply if youve owned your property for more than one year. Capital Gains Tax Rate for 2013 and 2014. State and local taxes often apply to capital gains. In that case the long-term capital gains tax rates would be applicable.

Source: taxfoundation.org

Source: taxfoundation.org

Your long-term capital gain because of your income would fall in the 15 bracket. However which bracket you. From 1 August 2013 residents also were obligated to pay an additional 6 of health insurance tax EHO on their capital gain. The 6 health insurance tax on capital gains. For Real Properties Six percent 6.

Source: ec.europa.eu

Source: ec.europa.eu

So capital gains tax is a fee you pay when you sell an asset that has increased in value since you purchased it. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. Capital Gains Tax on Sale of Property. The long-term capital gains tax rate has three brackets 0 percent 15 percent and 20 percent. The capital gains deduction limit on gains arising from dispositions of QSBCS in 2016 is 412088 12 of a LCGE of 824176.

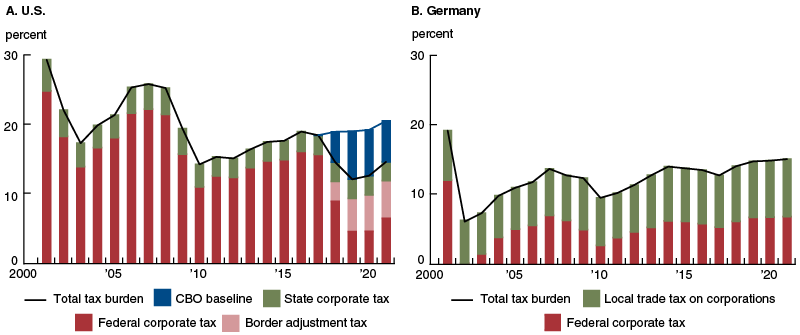

Source: chicagofed.org

Source: chicagofed.org

Depending on how the trust is written and which state the trust is located state laws apply it may be possible to include capital gains in DNI. Capital Gains Tax on Sale of Property. So capital gains tax is a fee you pay when you sell an asset that has increased in value since you purchased it. They are generally lower than short-term capital gains tax rates. You see it pays to hold onto any item – real.

Source: pinterest.com

Source: pinterest.com

Capital Gains Tax Rate for 2013 and 2014. Download Excel Federal Capital Gains Tax Rates 1988-2013Download Federal Capital Gains Tax Rates 1988-2011Download Federal Capital Gains Tax Rates 1988-2011. If you sold both the property along with the land it sits on you must determine. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax.

Source: hackyourwealth.com

Source: hackyourwealth.com

Depending on how the trust is written and which state the trust is located state laws apply it may be possible to include capital gains in DNI. Effective January 1 2013 the top capital gain tax rate has been permanently increased to 20 for married couples filing jointly with incomes exceeding 450000 400000 taxable income for single filers. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. The tax rate on capital gains from securities held in such an account is 10 after a 3-year holding period and 0 after the accounts maximum 5 years period is expired. The long-term capital gains tax rate has three brackets 0 percent 15 percent and 20 percent.

Source: pinterest.com

Source: pinterest.com

Across the US states levy an average 51 tax on long-term capital gains according to The Tax. From 1 August 2013 residents also were obligated to pay an additional 6 of health insurance tax EHO on their capital gain. In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate. For Real Properties Six percent 6. What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No.

Source: diypropertyinvestment.com

Source: diypropertyinvestment.com

The capital gains deduction limit on gains arising from dispositions of QSBCS in 2016 is 412088 12 of a LCGE of 824176. In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate. Across the US states levy an average 51 tax on long-term capital gains according to The Tax. Effective January 1 2013 the top capital gain tax rate has been permanently increased to 20 for married couples filing jointly with incomes exceeding 450000 400000 taxable income for single filers. From 1 August 2013 residents also were obligated to pay an additional 6 of health insurance tax EHO on their capital gain.

Source: ptireturns.com

Source: ptireturns.com

Capital Gains Tax on Sale of Property. Download Excel Federal Capital Gains Tax Rates 1988-2013Download Federal Capital Gains Tax Rates 1988-2011Download Federal Capital Gains Tax Rates 1988-2011. So youd pay 15000 on the 100000 gain saving you 7000. Your capital gains tax rate can range from 0 15 or 20 depending on your income and tax status. For Real Properties Six percent 6.

Source: in.pinterest.com

Source: in.pinterest.com

The 6 health insurance tax on capital gains. 58 Increase for Top Earners What you need to know as the deadline draws near. Individual belongings are taxed at different rates determined by what they are and the situation. Across the US states levy an average 51 tax on long-term capital gains according to The Tax. The long-term capital gains tax rate has three brackets 0 percent 15 percent and 20 percent.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital gains tax rate real estate 2013 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.