Your Capital gains tax rate 2020 real estate images are ready. Capital gains tax rate 2020 real estate are a topic that is being searched for and liked by netizens now. You can Get the Capital gains tax rate 2020 real estate files here. Find and Download all free photos.

If you’re looking for capital gains tax rate 2020 real estate pictures information connected with to the capital gains tax rate 2020 real estate topic, you have come to the right blog. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

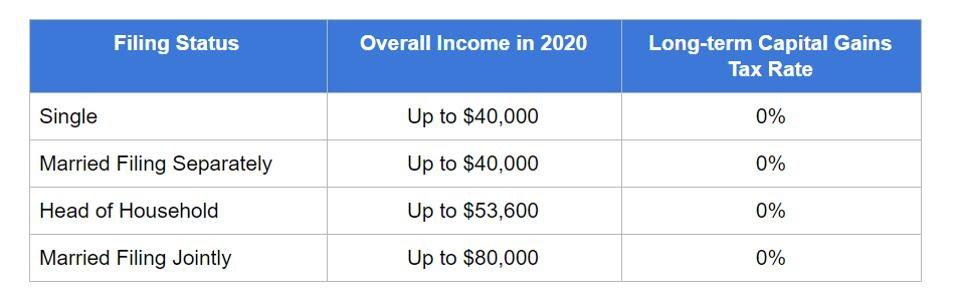

Capital Gains Tax Rate 2020 Real Estate. The tax rate would increase to 15 percent for total income between 40401 and 445850 and 20 percent for income above 445850. The rates are much less onerous. For heads of household this is between 52751 and 461700. Anything above these limits and you fall into the 20 tax bracket which is the highest capital gains tax bracket.

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin From propertycashin.com

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin From propertycashin.com

So naturally people have started to what capital gains tax rates are and how to avoid them. When selling your primary home you can make up to 250000 in profit or double that if you are married and you wont owe anything for capital gains. The Government of Canada allows you to offset your capital gains with your capital losses for up to three years post claiming capital gains. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Many people qualify for a 0 tax rate. Simply put California taxes all capital gains as regular income.

10 12 22 24 32 35 and 37.

February 23 2020 by Prashant Thakur. Anything above these limits and you fall into the 20 tax bracket which is the highest capital gains tax bracket. So naturally people have started to what capital gains tax rates are and how to avoid them. 10 12 22 24 32 35 and 37. The Government of Canada allows you to offset your capital gains with your capital losses for up to three years post claiming capital gains. Its also worth noting that if youre on the cusp of one of the.

Source: quarryhilladvisors.com

Source: quarryhilladvisors.com

Currently the tax rate is 15. Short-term investments held for one year or less are taxed at your ordinary income tax rate. What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No. The Government of Canada allows you to offset your capital gains with your capital losses for up to three years post claiming capital gains. Many people qualify for a 0 tax rate.

Source: forbes.com

Source: forbes.com

In 2019 it was 50. The capital gains tax is the same for everyone in Canada. The Government of Canada allows you to offset your capital gains with your capital losses for up to three years post claiming capital gains. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. The rates are much less onerous.

Source: forbes.com

Source: forbes.com

So naturally people have started to what capital gains tax rates are and how to avoid them. The Government of Canada allows you to offset your capital gains with your capital losses for up to three years post claiming capital gains. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. For dispositions of qualified farm or fishing property QFFP in 2016 to 2020 the LCGE is 1000000. This means youll pay 30 in.

Source: itep.org

Source: itep.org

How long you own a rental property and your taxable income will determine your capital gains tax rate. Do keep in mind that your state may charge its own capital gains tax. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. The calculator based on your input calculates both short term capital gains as well as long term capital gains tax.

Source: businessinsider.com

Source: businessinsider.com

Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. Short-term investments held for one year or less are taxed at your ordinary income tax rate. Long-term capital gains tax rates typically apply if you owned the asset for more than a year. For single folks you can benefit from the 0 capital gains rate if you have an income below 40000 in 2020. February 23 2020 by Prashant Thakur.

2020 long-term capital gains tax rates Long-term capital gains are taxed at a rate of 0 15 or 20 depending on the taxpayers income. Lets break it down. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. The capital gains tax is the same for everyone in Canada. Tax rates for short-term gains in 2020 are.

Source: forbes.com

Source: forbes.com

The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. Simply put California taxes all capital gains as regular income. Short-term investments held for one year or less are taxed at your ordinary income tax rate. The calculator based on your input calculates both short term capital gains as well as long term capital gains tax.

Source: relakhs.com

Source: relakhs.com

For dispositions of qualified farm or fishing property QFFP in 2016 to 2020 the LCGE is 1000000. How Much is Capital Gains Tax on the Sale of a Home. Currently the tax rate is 15. In 2019 it was 50. For heads of household this is between 52751 and 461700.

Source: propertycashin.com

Source: propertycashin.com

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. How Are Capital Gains Calculated. A recent proposal may dramatically increase the capital gain tax. Many people qualify for a 0 tax rate. Lets break it down.

Source: realtor.com

Source: realtor.com

A recent proposal may dramatically increase the capital gain tax. In 2019 it was 50. What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No. For single folks you can benefit from the 0 capital gains rate if you have an income below 40000 in 2020. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020.

Source: propertycashin.com

Source: propertycashin.com

Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit. Short-term investments held for one year or less are taxed at your ordinary income tax rate. For single folks you can benefit from the 0 capital gains rate if you have an income below 40000 in 2020. Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of 1000000.

Source: thestreet.com

Source: thestreet.com

If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. The Government of Canada allows you to offset your capital gains with your capital losses for up to three years post claiming capital gains. Do keep in mind that your state may charge its own capital gains tax. Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Short-term investments held for one year or less are taxed at your ordinary income tax rate.

Source: propertycashin.com

Source: propertycashin.com

Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of 1000000. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. Currently the tax rate is 15. This means your capital gains taxes will run. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000.

Source: propertycashin.com

Source: propertycashin.com

Most single people will fall into the 15 capital gains rate. Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Which rate your capital. It does not recognize the distinction between short-term and long-term capital gains. In 2019 it was 50.

Source: hackyourwealth.com

Source: hackyourwealth.com

If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. Short-term investments held for one year or less are taxed at your ordinary income tax rate. Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of 1000000. Simply put California taxes all capital gains as regular income. Lets break it down.

Source: creamcityhomebuyers.com

Source: creamcityhomebuyers.com

Simply put California taxes all capital gains as regular income. 2020 long-term capital gains tax rates Long-term capital gains are taxed at a rate of 0 15 or 20 depending on the taxpayers income. Tax rates for short-term gains in 2020 are. The capital gains tax is the same for everyone in Canada. Currently the tax rate is 15.

Source: itep.org

Source: itep.org

Anything above these limits and you fall into the 20 tax bracket which is the highest capital gains tax bracket. This means youll pay 30 in. In 2019 it was 50. If you file taxes jointly with your partner the long-term capital. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

Source: relakhs.com

Source: relakhs.com

This means youll pay 30 in. Short-term investments held for one year or less are taxed at your ordinary income tax rate. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. It does not recognize the distinction between short-term and long-term capital gains. In 2019 it was 50.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title capital gains tax rate 2020 real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.