Your Capital gains tax on commercial real estate 2017 images are available. Capital gains tax on commercial real estate 2017 are a topic that is being searched for and liked by netizens now. You can Download the Capital gains tax on commercial real estate 2017 files here. Get all free vectors.

If you’re searching for capital gains tax on commercial real estate 2017 pictures information linked to the capital gains tax on commercial real estate 2017 keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Capital Gains Tax On Commercial Real Estate 2017. The capital gains deduction limit on gains arising from dispositions of QSBCS and QFFP in 2015 is 406800 12 of a LCGE of 813600. Capital gains from the sale of real estate are included in the taxable income of the entity and are taxed at the applicable CIT rate. The term sale includes pacto de retro sale. But the formula must be adjusted by an accountant to comply with current tax codes.

Reit Investments Tax Implications In India Reit Real Estate Investment Trust Investing From in.pinterest.com

Reit Investments Tax Implications In India Reit Real Estate Investment Trust Investing From in.pinterest.com

The tax on capital gains shall be levied in excess of Rs. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale. The full impacts of the GOP tax bill will take time to be felt but commercial real estate investors look like major beneficiaries. Sales Price Initial Purchase Price Capital Gain. Capital gains tax is owed when you sell a non-inventory asset at a higher price than you paid resulting in a realized profit. However IRC Section 1031 provides an exception that allows you to defer the tax on the gain if you reinvest the proceeds in similar property.

Not commercial real estate or residential rental property.

The capital gains deduction limit on gains arising from dispositions of QSBCS in 2016 is 412088 12 of a LCGE of 824176. This guide will break down how real estate capital gains tax works different nuances to. Capital gains from the sale of real estate are included in the taxable income of the entity and are taxed at the applicable CIT rate. Apart from federal income tax the capital gains calculator also computes the state tax on capital gains. New deductions for pass-through entities benefit. The capital gains tax rate in Ontario for the highest income bracket is 2676.

Source: pinterest.com

Source: pinterest.com

The sale of real estate by individuals is subject to personal income tax at 15. Not commercial real estate or residential rental property. No capital gains tax is incurred on inventory assets. To be precise theres no exemption pe se from capital gains taxation on commercial real estate. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction.

Source: in.pinterest.com

Source: in.pinterest.com

To be precise theres no exemption pe se from capital gains taxation on commercial real estate. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Sales Price Initial Purchase Price Capital Gain. The sale of real estate by individuals is subject to personal income tax at 15. Generally you will pay capital gains tax whenever you sell investment or business property.

Source: pinterest.com

Source: pinterest.com

1706 shall be filed in triplicate copies by the SellerTransferor who are natural or juridical whether resident or non-resident including Estates and Trusts who sell exchange or dispose of a real property located in the Philippines classified as capital asset as defined under Sec. The tax on the capital gain is paid by the. The term sale includes pacto de retro sale. Capital gains tax on real estate is something you definitely want to be familiar with if you own any real estate whether its your home or another type of investment property. Currently the tax rate is 15.

Source: pinterest.com

Source: pinterest.com

To be precise theres no exemption pe se from capital gains taxation on commercial real estate. To be precise theres no exemption pe se from capital gains taxation on commercial real estate. The formula is simple in concept. Capital gains tax might result from selling your home stocks bonds commodities mutual funds a business and other similar capital assets. The rates of CGT change depending on who owns the asset.

Source: pinterest.com

Source: pinterest.com

What Is Capital Gains Tax. But the formula must be adjusted by an accountant to comply with current tax codes. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. The sale of real estate by individuals is subject to personal income tax at 15. Long-term capital gains tax rates are based on your income.

Source: pinterest.com

Source: pinterest.com

Currently the tax rate is 15. But the formula must be adjusted by an accountant to comply with current tax codes. This is especially true if you recently sold or plan to sell your property which is when capital gains tax goes into effect. The rates of CGT change depending on who owns the asset. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10.

Source: pinterest.com

Source: pinterest.com

Ok if youre selling a home youve lived in for two of the past five years you can exempt up to 250000 in capital gains from taxation and 500000 if youre married. Currently the tax rate is 15. Long-term capital gains taxes apply to profits from selling something youve held for a year or more. Not commercial real estate or residential rental property. Corporate income tax is applied to the accounting profit after adjustments for tax purposes.

Source: es.pinterest.com

Source: es.pinterest.com

But the formula must be adjusted by an accountant to comply with current tax codes. Capital gains from the sale of real estate are included in the taxable income of the entity and are taxed at the applicable CIT rate. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. The three long-term capital gains tax rates of. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale.

Source: pinterest.com

Source: pinterest.com

The Capital Gains Tax rate you use depends on the total amount of your taxable income so work that out first. Capital gains tax on real estate is something you definitely want to be familiar with if you own any real estate whether its your home or another type of investment property. Not commercial real estate or residential rental property. For instance if you earn 80000 taxable income in Ontario and you sold a capital property. The Capital Gains Tax Return BIR Form No.

Source: br.pinterest.com

Source: br.pinterest.com

But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. For instance if you earn 80000 taxable income in Ontario and you sold a capital property. A 30 per cent CGT rate is applied to any net capital gains for company owned assets unless the company is a base rate entity where a lower rate of 275 per cent is available. Capital gains from the sale of real estate are included in the taxable income of the entity and are taxed at the applicable CIT rate. Generally you will pay capital gains tax whenever you sell investment or business property.

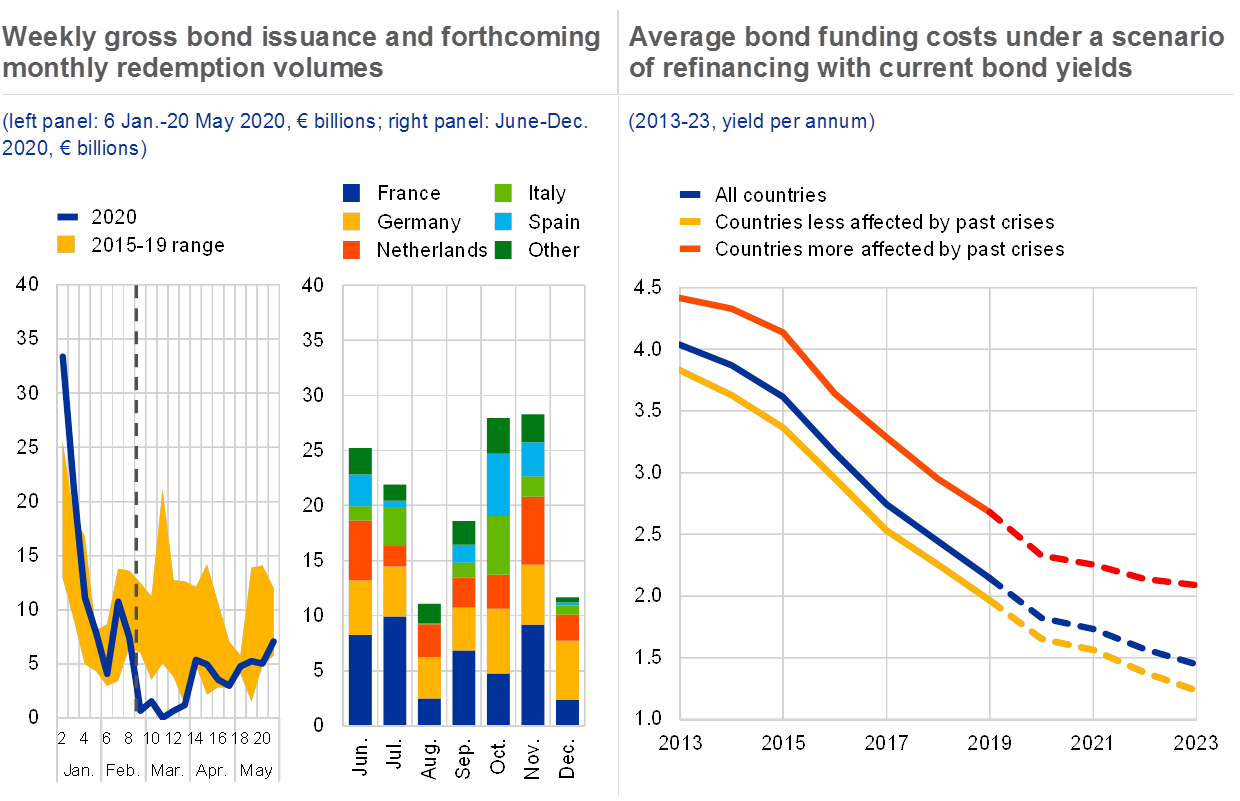

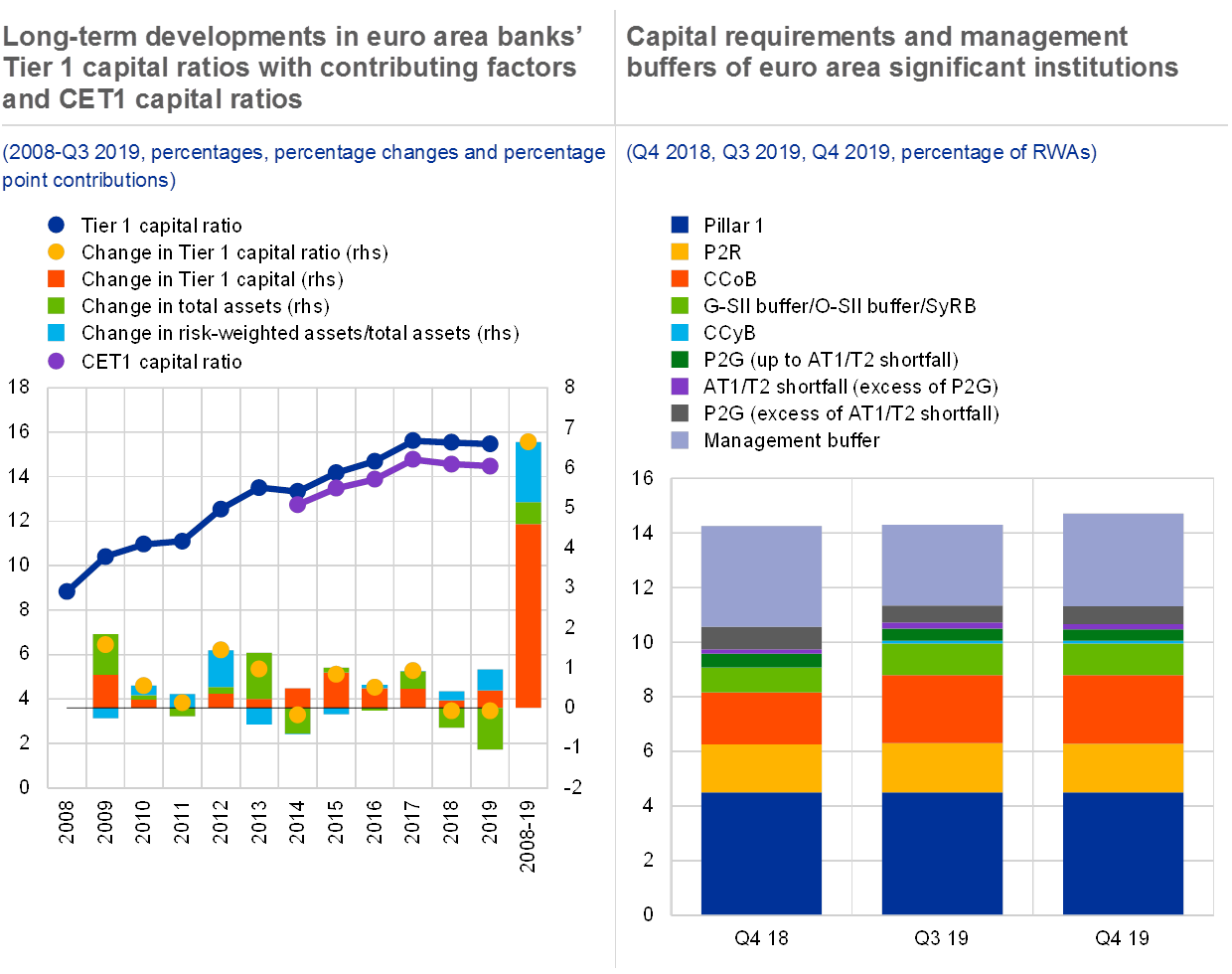

Source: ecb.europa.eu

Source: ecb.europa.eu

Generally you will pay capital gains tax whenever you sell investment or business property. The formula is simple in concept. New deductions for pass-through entities benefit. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. Not commercial real estate or residential rental property.

Source: in.pinterest.com

Source: in.pinterest.com

The formula is simple in concept. Capital gains from the sale of real estate are included in the taxable income of the entity and are taxed at the applicable CIT rate. Capital gains tax might result from selling your home stocks bonds commodities mutual funds a business and other similar capital assets. The term sale includes pacto de retro sale. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction.

Source: pinterest.com

Source: pinterest.com

This means youll pay 30 in Capital Gains Tax. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. 10 and 20 tax. Generally you will pay capital gains tax whenever you sell investment or business property.

Source: in.pinterest.com

Source: in.pinterest.com

Generally you will pay capital gains tax whenever you sell investment or business property. Not commercial real estate or residential rental property. A 30 per cent CGT rate is applied to any net capital gains for company owned assets unless the company is a base rate entity where a lower rate of 275 per cent is available. Currently the tax rate is 15. This means youll pay 30 in Capital Gains Tax.

Source: ecb.europa.eu

Source: ecb.europa.eu

Ok if youre selling a home youve lived in for two of the past five years you can exempt up to 250000 in capital gains from taxation and 500000 if youre married. What Is Capital Gains Tax. The tax on the capital gain is paid by the. Capital gains tax is owed when you sell a non-inventory asset at a higher price than you paid resulting in a realized profit. 1706 shall be filed in triplicate copies by the SellerTransferor who are natural or juridical whether resident or non-resident including Estates and Trusts who sell exchange or dispose of a real property located in the Philippines classified as capital asset as defined under Sec.

Source: pinterest.com

Source: pinterest.com

10 and 20 tax. The formula is simple in concept. The three long-term capital gains tax rates of. Not commercial real estate or residential rental property. The capital gains deduction limit on gains arising from dispositions of QSBCS and QFFP in 2015 is 406800 12 of a LCGE of 813600.

Source: pinterest.com

Source: pinterest.com

The capital gains tax rate in Ontario for the highest income bracket is 2676. A 30 per cent CGT rate is applied to any net capital gains for company owned assets unless the company is a base rate entity where a lower rate of 275 per cent is available. The Capital Gains Tax rate you use depends on the total amount of your taxable income so work that out first. Currently the tax rate is 15. Ok if youre selling a home youve lived in for two of the past five years you can exempt up to 250000 in capital gains from taxation and 500000 if youre married.

Source: pinterest.com

Source: pinterest.com

The full impacts of the GOP tax bill will take time to be felt but commercial real estate investors look like major beneficiaries. As per Section 112A long-term capital gains arising from transfer of an equity share or a unit of an equity oriented fund or a unit of a business trust shall be taxed at 10 without indexation of such capital gains. Per the IRS Tax Rate Chart below Joint filers with 75000 in short-term capital gains fall into the 12 rate bracket rather than a 0 tax rate shown in the next section for long-term capital gains. The formula is simple in concept. Capital gains from the sale of real estate are included in the taxable income of the entity and are taxed at the applicable CIT rate.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title capital gains tax on commercial real estate 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.