Your Capital gains tax alberta real estate images are available. Capital gains tax alberta real estate are a topic that is being searched for and liked by netizens today. You can Get the Capital gains tax alberta real estate files here. Get all royalty-free images.

If you’re searching for capital gains tax alberta real estate pictures information related to the capital gains tax alberta real estate interest, you have visit the right blog. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Capital Gains Tax Alberta Real Estate. Subtract that from the sale price and you get the capital gains. The capital gains tax is the same for everyone in Canada. The downside however is that you probably have a capital gain. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made.

What Is Capital Gains Tax And When Are You Exempt Thestreet From thestreet.com

What Is Capital Gains Tax And When Are You Exempt Thestreet From thestreet.com

Depending on how you earn your money you can pay as much as 48 in income tax in Alberta and would need to earn 192 just to net you a dollar after the income taxes have been paid. I thought the correct numbers were that you were taxed on 50 of the profit and the tax on the 50 would be 19 or the Alberta Marginal Tax rate. Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. The capital gains deduction limit on gains arising from dispositions of QSBCS in 2017 is 417858 12 of a LCGE of 835716. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. Credit Card Nerd Math.

You will have a capital gain of 395000 400000 less 5000 of which half will be taxable.

Alberta tax rates for 2019 are the following. For instance if you earn 80000 taxable income in Ontario and you sold a capital property. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made. However note that these tax rates only apply if youve owned your property for more than one year. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2021.

Source: sterlingedmonton.com

Source: sterlingedmonton.com

This total is now your new personal income amount and therefore you will be taxed on your capital gains according to the tax bracket that you are in. Any resulting capital gains are 50 taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. However your daughters cost will be 5000 and if she sells to a third party at a later date for 400000 tax will apply on the same gain hence double taxation. 10 on the portion of your taxable income that is 131220 or less. If you sell your home for more than what you paid for it thats good news.

Source: pinterest.com

Source: pinterest.com

When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. Subtract that from the sale price and you get the capital gains. So if you have sold or are selling a house what does this mean for you. Exactly how much capital gains tax will an Albertan expect to pay if they sell an investment property. Depending on how you earn your money you can pay as much as 48 in income tax in Alberta and would need to earn 192 just to net you a dollar after the income taxes have been paid.

Source: damore-law.com

Source: damore-law.com

10 on the portion of your taxable income that is 131220 or less. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. Any resulting capital gains are 50 taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. On a capital gain of 50000 for instance only half of that or 25000. So for example if you buy a stock at 100 and it earns 50 in value when you sell it.

Source: moneysense.ca

Source: moneysense.ca

Exactly how much capital gains tax will an Albertan expect to pay if they sell an investment property. You will have a capital gain of 395000 400000 less 5000 of which half will be taxable. Currently the tax rate is 15. Even giving an example would be great to give the readers an idea of what to expect for taxes on say a net gain of. The capital gains tax is the same for everyone in Canada.

Source: loanscanada.ca

Source: loanscanada.ca

In Canada 50 of the value of any capital gains is taxable. This total is now your new personal income amount and therefore you will be taxed on your capital gains according to the tax bracket that you are in. The most taxed earnings will be derived from labour followed by capital gains or dividends depending on your marginal tax bracket. The capital gains deduction limit on gains arising from dispositions of QSBCS in 2017 is 417858 12 of a LCGE of 835716. I thought the correct numbers were that you were taxed on 50 of the profit and the tax on the 50 would be 19 or the Alberta Marginal Tax rate.

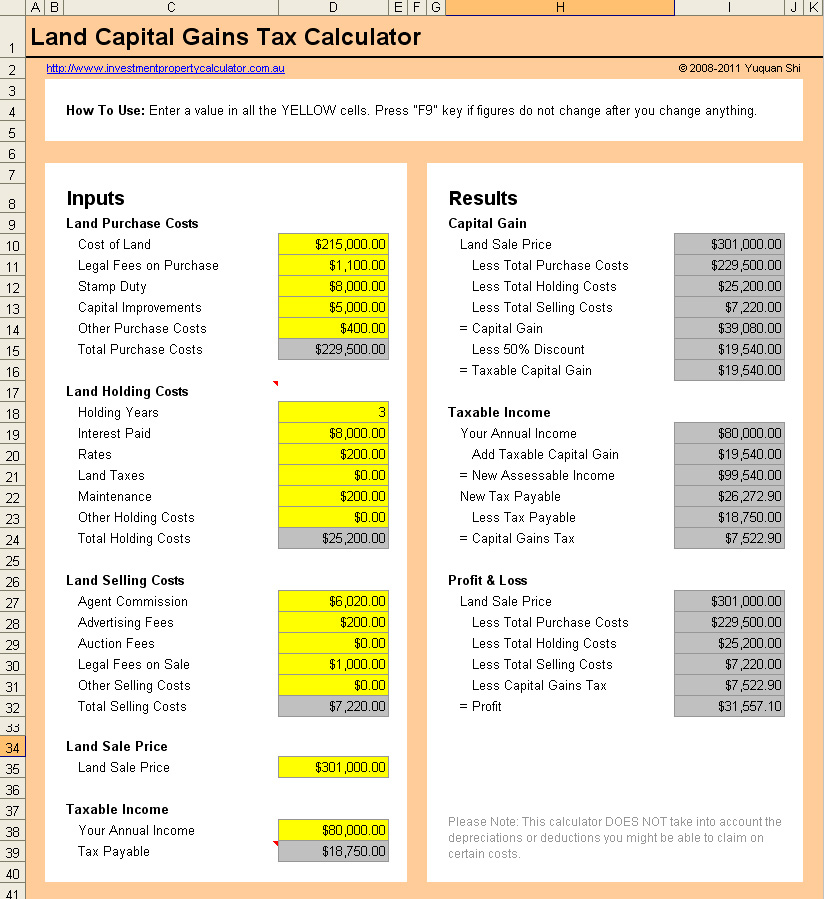

Source: investmentpropertycalculator.com.au

Source: investmentpropertycalculator.com.au

Single filers with incomes more than 441500 will get hit with a 20 long-term. When selling a commercial property capital gains are taxable. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. The total capital gains is.

Source: thestreet.com

Source: thestreet.com

Exactly how much capital gains tax will an Albertan expect to pay if they sell an investment property. The amount of tax youll pay depends on. So if you have sold or are selling a house what does this mean for you. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made.

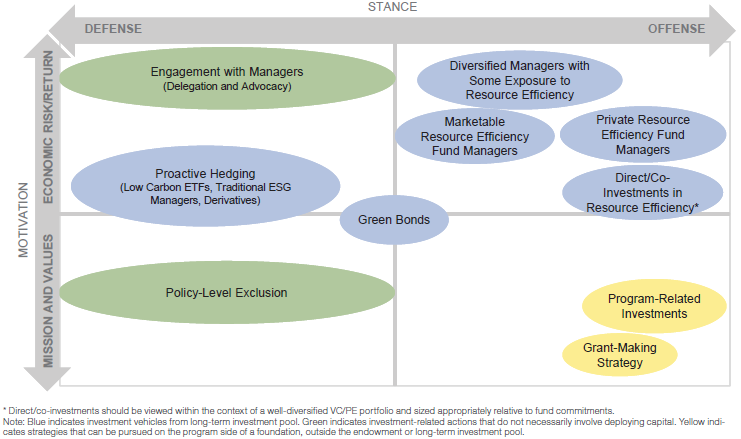

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made. So for example if you buy a stock at 100 and it earns 50 in value when you sell it. 250000 100000 150000 total capital gains Since your property is in Canada 50 of the total capital gains profit is subject to tax. This total is now your new personal income amount and therefore you will be taxed on your capital gains according to the tax bracket that you are in. The Canadian Annual Capital Gains Tax Calculator is updated for the 202122 tax year.

Source: madanca.com

Source: madanca.com

The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. The capital gains tax rate in Ontario for the highest income bracket is 2676. When selling secondary residences capital gains are taxable. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. Exactly how much capital gains tax will an Albertan expect to pay if they sell an investment property.

Source: blog.investyadnya.in

Source: blog.investyadnya.in

The capital gains tax is the same for everyone in Canada. The capital gains deduction limit on gains arising from dispositions of QSBCS in 2017 is 417858 12 of a LCGE of 835716. And you may have to pay. The amount of tax youll pay depends on. In 2019 it was 50.

Source: wowa.ca

Source: wowa.ca

Only half 50 of the capital gain on any given sale is taxed all at your marginal tax rate which varies by province. The capital gains tax is the same for everyone in Canada. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. Subtract that from the sale price and you get the capital gains.

This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. On a capital gain of 50000 for instance only half of that or 25000. Even giving an example would be great to give the readers an idea of what to expect for taxes on say a net gain of. The most taxed earnings will be derived from labour followed by capital gains or dividends depending on your marginal tax bracket. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made.

Any resulting capital gains are 50 taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. 250000 100000 150000 total capital gains Since your property is in Canada 50 of the total capital gains profit is subject to tax. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income.

Source: sterlingedmonton.com

Source: sterlingedmonton.com

The Canadian Annual Capital Gains Tax Calculator is updated for the 202122 tax year. In 2019 it was 50. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. The amount of tax youll pay depends on. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made.

Source: boxas.com.au

Source: boxas.com.au

250000 100000 150000 total capital gains Since your property is in Canada 50 of the total capital gains profit is subject to tax. The capital gains tax is the same for everyone in Canada. Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. The total capital gains is. Exactly how much capital gains tax will an Albertan expect to pay if they sell an investment property.

Source: duotax.com.au

Source: duotax.com.au

In 2019 it was 50. Alberta tax rates for 2019 are the following. Subtract that from the sale price and you get the capital gains. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction.

When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. Only half 50 of the capital gain on any given sale is taxed all at your marginal tax rate which varies by province. 10 on the portion of your taxable income that is 131220 or less.

The capital gains tax rate in Ontario for the highest income bracket is 2676. And you may have to pay. The sale price minus your ACB is the capital gain that youll need to pay tax on. The Canadian Annual Capital Gains Tax Calculator is updated for the 202122 tax year. Currently the tax rate is 15.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title capital gains tax alberta real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.