Your Capital gains holding period real estate images are ready in this website. Capital gains holding period real estate are a topic that is being searched for and liked by netizens now. You can Download the Capital gains holding period real estate files here. Find and Download all royalty-free photos.

If you’re searching for capital gains holding period real estate pictures information related to the capital gains holding period real estate topic, you have visit the ideal blog. Our website frequently gives you hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Capital Gains Holding Period Real Estate. The time period to keep in mind is one year. Most carried interests likely fall within this definition. And once you sell the property you get the benefits of indexation concession rate of 20 per cent and tax saving instrument by investing in another property or capital gains bond. If the capital gain property is held for more than 12 months gain or loss is long-term according to IRC Sec.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments From moneycrashers.com

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments From moneycrashers.com

Capital gains are your net profit when selling something you own. The holding period for the gains from real estate investment to be considered as STCG is less than 2 years. The capital gains deduction limit on gains arising from dispositions of qualified farm property qualified fishing property or QSBCS after March 18 2007 and before 2014 is 375000 12 of a LCGE of 750000. It would be a long-term gain if it were held for longer than a year. The resulting number is your capital gain. The Holding Period for Gift Property The recipient of the gift also receives the donors holding period in the property for determining whether a gain is long-term or short-term.

Capital gains taxes come into play when you sell your property at a profit or gain.

Equities and real estate obviously are considered long term capital gains since their holding period is generally over 3 years or more. For stock the holding period. According to IRS Publication 544 holding period is generally speaking the length of time a capital asset is owned. Short Term Capital Gains from Real Estate Investment Real estate investment pertains to properties such as land residential house flat etc. The Holding Period for Gift Property The recipient of the gift also receives the donors holding period in the property for determining whether a gain is long-term or short-term. If you are an investor looking at long-term capital gains associated with tax benefits you will have to hold the property for atleast two years.

Source: relakhs.com

Source: relakhs.com

The way capital gains are taxed depends on how long the asset was owned for. It would be a long-term gain if it were held for longer than a year. The time period to keep in mind is one year. Held More Than One Year but Less Than Five Years The Internal Revenue Service considers assets held longer than one year to be long-term investments. Another important element to employ capital gain rates.

Source: relakhs.com

Source: relakhs.com

If you hold property for a year or less short-term capital gain or loss rules apply. Long-term gains on most assets are taxed at lower rates than are short-term gains or ordinary income. If you are an investor looking at long-term capital gains associated with tax benefits you will have to hold the property for atleast two years. The Holding Period for Gift Property The recipient of the gift also receives the donors holding period in the property for determining whether a gain is long-term or short-term. If you hold property for a year or less short-term capital gain or loss rules apply.

Source: finance.zacks.com

Source: finance.zacks.com

Long-term capital gains give a property seller the benefits of indexation concession rate of 20 and an avenue to save tax by investing in another residential house or capital gains bonds. Equities and real estate obviously are considered long term capital gains since their holding period is generally over 3 years or more. Held More Than One Year but Less Than Five Years The Internal Revenue Service considers assets held longer than one year to be long-term investments. If the capital gain property is held for more than 12 months gain or loss is long-term according to IRC Sec. Begins the day after you buy the shares or the day after the trade date.

Source: investopedia.com

Source: investopedia.com

Short Term Capital Gains from Real Estate Investment Real estate investment pertains to properties such as land residential house flat etc. Most carried interests likely fall within this definition. If you hold property for more than a year long-term capital gain or loss rules apply. The time period to keep in mind is one year. Short Term Capital Gains from Real Estate Investment Real estate investment pertains to properties such as land residential house flat etc.

Capital gains are your net profit when selling something you own. The capital gains deduction limit on gains arising from dispositions of QSBCS and QFFP in 2014 is 400000 12 of a LCGE of 800000. The capital gains deduction limit on gains arising from dispositions of qualified farm property qualified fishing property or QSBCS after March 18 2007 and before 2014 is 375000 12 of a LCGE of 750000. Short-Term Capital Gains The tax rate on capital gains depends on how long you hold your property before you sell it. Capital gains taxes come into play when you sell your property at a profit or gain.

Source: investopedia.com

Source: investopedia.com

So the holding period is calculated from the date of registration in his name to date of Sale. Most carried interests likely fall within this definition. Begins the day after you buy the shares or the day after the trade date. Short Term Capital Gains from Real Estate Investment Real estate investment pertains to properties such as land residential house flat etc. If you hold property for more than a year long-term capital gain or loss rules apply.

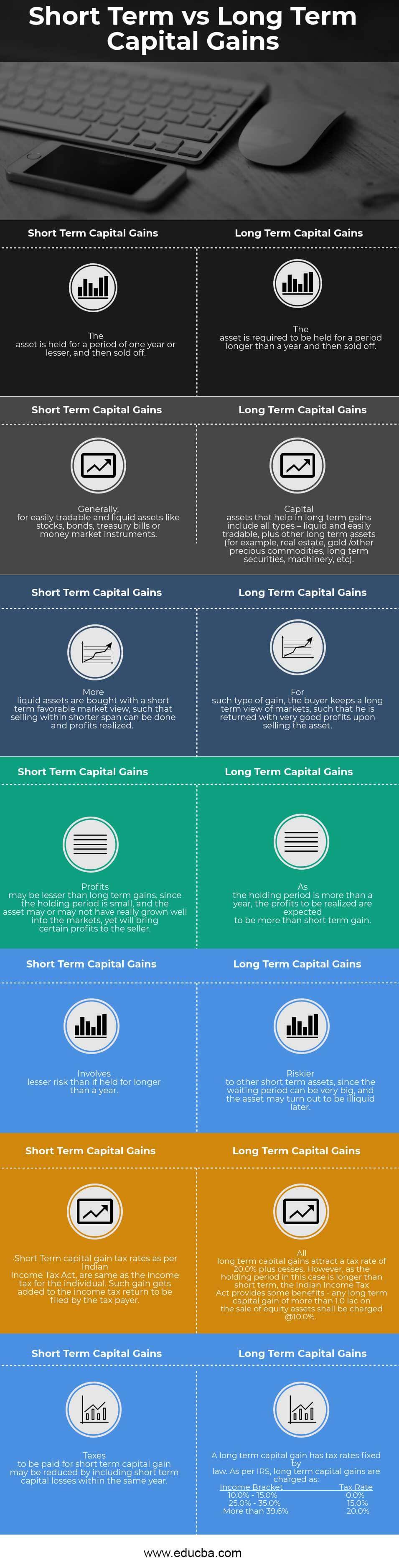

Source: educba.com

Source: educba.com

The time period to keep in mind is one year. For stock the holding period. If the capital gain property is held for more than 12 months gain or loss is long-term according to IRC Sec. Short-Term Capital Gains The tax rate on capital gains depends on how long you hold your property before you sell it. If you own it.

Source: financialexpress.com

Source: financialexpress.com

Beginning after December 31 2017 the holding period for applicable partnership interests APIs must be greater than three years to qualify for long-term capital gains rates. Short Term Capital Gains from Real Estate Investment Real estate investment pertains to properties such as land residential house flat etc. Capital gains are your net profit when selling something you own. In some cases the capital gains tax can reach almost twice as high as those levied on long-term investments. These rules include real estate held for rent or investment as assets subject to this three-year holding period requirement.

Source: goodmoneying.com

Source: goodmoneying.com

So the holding period is calculated from the date of registration in his name to date of Sale. The way capital gains are taxed depends on how long the asset was owned for. If you owned the asset. The capital gains deduction limit on gains arising from dispositions of qualified farm property qualified fishing property or QSBCS after March 18 2007 and before 2014 is 375000 12 of a LCGE of 750000. In some cases the capital gains tax can reach almost twice as high as those levied on long-term investments.

Source: relakhs.com

Source: relakhs.com

Gain on an API sold before the greater-than. For stock the holding period. The resulting number is your capital gain. Begins the day after you buy the shares or the day after the trade date. Capital gains taxes come into play when you sell your property at a profit or gain.

Source: propertycashin.com

Source: propertycashin.com

The holding period is the length of time you own property before you sell it. Held More Than One Year but Less Than Five Years The Internal Revenue Service considers assets held longer than one year to be long-term investments. Especially in the case of real estate holding period makes them specifically long term capital gain. And once you sell the property you get the benefits of indexation concession rate of 20 per cent and tax saving instrument by investing in another property or capital gains bond. If the capital gain property is held for more than 12 months gain or loss is long-term according to IRC Sec.

Source: relakhs.com

Source: relakhs.com

So the holding period is calculated from the date of registration in his name to date of Sale. The holding period of acquired real estate begins the day after the acquisition date which is the earlier of the date when title passes to the taxpayer or when he assumed the legal bundle of rights associated with the ownership of the real estate. The time period to keep in mind is one year. Although only mentioned in passing another element to obtain the favorable lower capital gain rates includes a requirement to show that the holding period of the asset by the taxpayer is long term That is as discussed if the taxpayer can show that the asset is a capital asset and that it was sold or exchanged this will produce a. If you owned the asset.

Source: financialexpress.com

Source: financialexpress.com

If you owned the asset. These rules include real estate held for rent or investment as assets subject to this three-year holding period requirement. State law determines when the title of. With real estate it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. Although only mentioned in passing another element to obtain the favorable lower capital gain rates includes a requirement to show that the holding period of the asset by the taxpayer is long term That is as discussed if the taxpayer can show that the asset is a capital asset and that it was sold or exchanged this will produce a.

Source: apnaplan.com

Source: apnaplan.com

According to IRS Publication 544 holding period is generally speaking the length of time a capital asset is owned. The Holding Period for Gift Property The recipient of the gift also receives the donors holding period in the property for determining whether a gain is long-term or short-term. Gain on an API sold before the greater-than. Long-term gains on most assets are taxed at lower rates than are short-term gains or ordinary income. The resulting number is your capital gain.

Source: madanca.com

Source: madanca.com

In some cases the capital gains tax can reach almost twice as high as those levied on long-term investments. And once you sell the property you get the benefits of indexation concession rate of 20 per cent and tax saving instrument by investing in another property or capital gains bond. Capital gains taxes come into play when you sell your property at a profit or gain. Its a short-term gain if the donor held the asset for one year or less. Equities and real estate obviously are considered long term capital gains since their holding period is generally over 3 years or more.

Source: hackyourwealth.com

Source: hackyourwealth.com

Long-term capital gains give a property seller the benefits of indexation concession rate of 20 and an avenue to save tax by investing in another residential house or capital gains bonds. Gain on an API sold before the greater-than. Its a short-term gain if the donor held the asset for one year or less. For stock the holding period. Equities and real estate obviously are considered long term capital gains since their holding period is generally over 3 years or more.

Source: investopedia.com

Source: investopedia.com

If you hold property for a year or less short-term capital gain or loss rules apply. These rules include real estate held for rent or investment as assets subject to this three-year holding period requirement. Gain on an API sold before the greater-than. It would be a long-term gain if it were held for longer than a year. Its a short-term gain if the donor held the asset for one year or less.

Source: moneycrashers.com

Source: moneycrashers.com

Here the holding period for this transaction is 3 years 2018-2015 and the gains are treated as Long Term Capital Gains. With real estate it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. The Holding Period for Gift Property The recipient of the gift also receives the donors holding period in the property for determining whether a gain is long-term or short-term. Short-Term Capital Gains The tax rate on capital gains depends on how long you hold your property before you sell it. The capital gains deduction limit on gains arising from dispositions of QSBCS and QFFP in 2014 is 400000 12 of a LCGE of 800000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital gains holding period real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.