Your Canadian real estate private equity firms images are ready. Canadian real estate private equity firms are a topic that is being searched for and liked by netizens now. You can Find and Download the Canadian real estate private equity firms files here. Download all royalty-free vectors.

If you’re searching for canadian real estate private equity firms pictures information connected with to the canadian real estate private equity firms interest, you have come to the ideal blog. Our website always provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Canadian Real Estate Private Equity Firms. For the past 16 years hes held the role of CEO at KingSett Capital a leading Canadian private equity real estate business which co-invests with pension funds and high net worth individual clients. Top Funding Types Post-IPO Equity Venture - Series Unknown Seed Post-IPO Debt Debt Financing. We seek out investments in which we can establish true collaborative partnerships with business owners and management. Desjardins Capital assisted in 145 private equity deals in Canada in 2019.

Canadian Wealthnet Properties Inc Real Estate Investment Company Logo Design Re Company Logo Design Real Estate Investment Companies Real Estate Logo Design From pinterest.com

Canadian Wealthnet Properties Inc Real Estate Investment Company Logo Design Re Company Logo Design Real Estate Investment Companies Real Estate Logo Design From pinterest.com

Blackstone Real Estate Income Trust Inc. For the past 16 years hes held the role of CEO at KingSett Capital a leading Canadian private equity real estate business which co-invests with pension funds and high net worth individual clients. PwC Canada offers Canadian real estate consulting services to owners investors lenders and lease-holders to turn risks into opportunities. Preqins extensive research shows there are currently 92 private equity firms located in Canada. Of the generalist private equity firms Carlyle tends to have the second-biggest presence in real estate after Blackstone. Number of For-Profit Companies 24.

Organizations in this hub have their headquarters located in Toronto Ontario.

The Canadian Governments recent infrastructure plan over Can180 billion over 12 years and the creation of the Canada Infrastructure Bank should generate domestic investment opportunities for Canadian pension funds as well as other domestic and foreign. Our private equity PE team offers integrated solutions to issues across the fund and investment life cycleincluding fund and investment structuring deal origination evaluation and execution value creation portfolio management and exit. The latest data from the Fund Manager Profiles database shows that collectively these firms have raised USD 133 billion in capital commitments over the last 10 years and have USD 28 billion available in dry powder. Of the generalist private equity firms Carlyle tends to have the second-biggest presence in real estate after Blackstone. Canada remains a robust economy with positive demographics and excellent relative fundamentals when compared with other G20 nations. However Blackstone pursues many diversified strategies outside of real estate equity investment.

Source: pinterest.com

Source: pinterest.com

This statistic presents the most active private equity investors in Canada in 2019 by number of deals. After leading and excellent Private Equity firms in Canada in 2016 heres a list of firms which were highly recommended by Leaders League ARC Financial. Pension Funds in Canada. Organizations in this hub have their headquarters located in Canada North America. Notable events and people located.

Source: pinterest.com

Source: pinterest.com

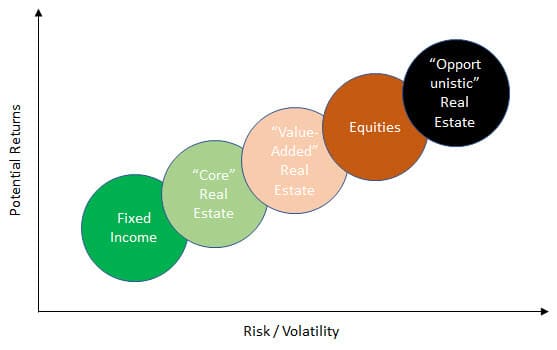

As a result MGI Pacific continues to look for opportunities across geographis and asset classes that meet the firms Canadian investment requirements. Our BPP funds focus on industrial residential office and retail assets in global gateway cities. An increased presence of US investors in Canadian real estate continued in 2018 with the C38 billion acquisition of PIRET a Canadian REIT by Blackstone one of the largest real estate private. This list may not reflect recent changes learn more. However private real estates higher returning strategies value-add and opportunistic have nonetheless attracted record amounts of capital.

Source: pinterest.com

Source: pinterest.com

These opportunities are often sought in higher risk areas including development less liquid real estate asset. Of the generalist private equity firms Carlyle tends to have the second-biggest presence in real estate after Blackstone. Desjardins Capital assisted in 145 private equity deals in Canada in 2019. These opportunities are often sought in higher risk areas including development less liquid real estate asset. The Canadian Governments recent infrastructure plan over Can180 billion over 12 years and the creation of the Canada Infrastructure Bank should generate domestic investment opportunities for Canadian pension funds as well as other domestic and foreign.

Source: pinterest.com

Source: pinterest.com

We seek out investments in which we can establish true collaborative partnerships with business owners and management. In 2020 they together raised 1963 billion of discretionary equity over the past five years or just shy of 40 percent of the aggregate 4945 billion amassed by all 100 managers. Organizations in this hub have their headquarters located in Canada North America. Organizations in this hub have their headquarters located in Toronto Ontario. Blackstone Real Estate Income Trust Inc.

Source: pinterest.com

Source: pinterest.com

Pension Funds in Canada. As a premiere private equity boutique partnered with institutions and high net worth clients across Canada rigourous underwriting and disciplined risk management form the foundation of every project we bring to investors. Top Funding Types Post-IPO Equity Venture - Series Unknown Seed Post-IPO Debt Debt Financing. Top Investor Types Private Equity Firm Venture Capital Corporate Venture Capital Investment Bank Family Investment Office. Of their grand total 472B AUM about 29 of their total AUM or 136B is committed to real estate per their website.

Source: pinterest.com

Source: pinterest.com

However Blackstone pursues many diversified strategies outside of real estate equity investment. After leading and excellent Private Equity firms in Canada in 2016 heres a list of firms which were highly recommended by Leaders League ARC Financial. Our private equity PE team offers integrated solutions to issues across the fund and investment life cycleincluding fund and investment structuring deal origination evaluation and execution value creation portfolio management and exit. Our Core strategy features stabilized real estate with a long investment horizon and moderate leverage where we can unlock additional value through focused asset management. Canada remains a robust economy with positive demographics and excellent relative fundamentals when compared with other G20 nations.

Source: ar.pinterest.com

Source: ar.pinterest.com

Blackstone and Brookfield are gigantic firms that do much more than real estate while Starwood is the biggest dedicated real estate investment firm. For the past 16 years hes held the role of CEO at KingSett Capital a leading Canadian private equity real estate business which co-invests with pension funds and high net worth individual clients. Other than ONEX prominent Canadian private equity firms include ONCAP owned by ONEX Brookfield Birch Hill ARC Financial Triwest Forum Capital Northleaf Novacap Catalyst Torquest and CAI. Preqins extensive research shows there are currently 92 private equity firms located in Canada. An increased presence of US investors in Canadian real estate continued in 2018 with the C38 billion acquisition of PIRET a Canadian REIT by Blackstone one of the largest real estate private.

Source: pinterest.com

Source: pinterest.com

Beginning in 1992 Love spent nine years as CEO of the family-run Oxford Properties. Blackstone Real Estate Income Trust Inc. After leading and excellent Private Equity firms in Canada in 2016 heres a list of firms which were highly recommended by Leaders League ARC Financial. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. Preqins extensive research shows there are currently 92 private equity firms located in Canada.

Source: pinterest.com

Source: pinterest.com

Beginning in 1992 Love spent nine years as CEO of the family-run Oxford Properties. The Canadian Governments recent infrastructure plan over Can180 billion over 12 years and the creation of the Canada Infrastructure Bank should generate domestic investment opportunities for Canadian pension funds as well as other domestic and foreign. However Blackstone pursues many diversified strategies outside of real estate equity investment. Of their grand total 472B AUM about 29 of their total AUM or 136B is committed to real estate per their website. In terms of sectors Canadian pension funds are particularly active in real estate utilities and infrastructure investments worldwide.

Source: tr.pinterest.com

Source: tr.pinterest.com

After leading and excellent Private Equity firms in Canada in 2016 heres a list of firms which were highly recommended by Leaders League ARC Financial. Our BPP funds focus on industrial residential office and retail assets in global gateway cities. Our private equity PE team offers integrated solutions to issues across the fund and investment life cycleincluding fund and investment structuring deal origination evaluation and execution value creation portfolio management and exit. In 2020 they together raised 1963 billion of discretionary equity over the past five years or just shy of 40 percent of the aggregate 4945 billion amassed by all 100 managers. As a premiere private equity boutique partnered with institutions and high net worth clients across Canada rigourous underwriting and disciplined risk management form the foundation of every project we bring to investors.

Source: pinterest.com

Source: pinterest.com

Blackstone Real Estate Income Trust Inc. Number of For-Profit Companies 24. As a result MGI Pacific continues to look for opportunities across geographis and asset classes that meet the firms Canadian investment requirements. Notable events and people located. Tyree and DAngelo Partners Private Equity Firm Tyree DAngelo Partners TDP is a private equity investment firm that focuses on control investment opportunities in the lower middle market companies with 1-5M of EBITDA.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Top Funding Types Post-IPO Equity Venture - Series Unknown Seed Post-IPO Debt Debt Financing. Other than ONEX prominent Canadian private equity firms include ONCAP owned by ONEX Brookfield Birch Hill ARC Financial Triwest Forum Capital Northleaf Novacap Catalyst Torquest and CAI. In terms of sectors Canadian pension funds are particularly active in real estate utilities and infrastructure investments worldwide. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. Top Investor Types Private Equity Firm Venture Capital Family Investment Office Investment Bank Corporate Venture Capital.

Source: pinterest.com

Source: pinterest.com

Our Core strategy features stabilized real estate with a long investment horizon and moderate leverage where we can unlock additional value through focused asset management. Pages in category Private equity firms of Canada. Our BPP funds focus on industrial residential office and retail assets in global gateway cities. After leading and excellent Private Equity firms in Canada in 2016 heres a list of firms which were highly recommended by Leaders League ARC Financial. The Canadian Governments recent infrastructure plan over Can180 billion over 12 years and the creation of the Canada Infrastructure Bank should generate domestic investment opportunities for Canadian pension funds as well as other domestic and foreign.

Source: br.pinterest.com

Source: br.pinterest.com

We seek out investments in which we can establish true collaborative partnerships with business owners and management. Equium Capital Real Estate reviews new projects every week advancing less than 10 of files to full due diligence and less than 10 of those to investors. Preqins extensive research shows there are currently 92 private equity firms located in Canada. Our private equity PE team offers integrated solutions to issues across the fund and investment life cycleincluding fund and investment structuring deal origination evaluation and execution value creation portfolio management and exit. However private real estates higher returning strategies value-add and opportunistic have nonetheless attracted record amounts of capital.

Source: pinterest.com

Source: pinterest.com

Organizations in this hub have their headquarters located in Canada North America. This statistic presents the most active private equity investors in Canada in 2019 by number of deals. Organizations in this hub have their headquarters located in Toronto Ontario. Top Investor Types Private Equity Firm Venture Capital Corporate Venture Capital Investment Bank Family Investment Office. Top Funding Types Post-IPO Equity Seed Venture - Series Unknown Post-IPO Debt Private Equity.

Source: pinterest.com

Source: pinterest.com

Top Investor Types Private Equity Firm Venture Capital Corporate Venture Capital Investment Bank Family Investment Office. We seek out investments in which we can establish true collaborative partnerships with business owners and management. Top Investor Types Private Equity Firm Venture Capital Corporate Venture Capital Investment Bank Family Investment Office. Equium Capital Real Estate reviews new projects every week advancing less than 10 of files to full due diligence and less than 10 of those to investors. Our BPP funds focus on industrial residential office and retail assets in global gateway cities.

Source: pinterest.com

Source: pinterest.com

Canada remains a robust economy with positive demographics and excellent relative fundamentals when compared with other G20 nations. Tyree and DAngelo Partners Private Equity Firm Tyree DAngelo Partners TDP is a private equity investment firm that focuses on control investment opportunities in the lower middle market companies with 1-5M of EBITDA. After all the aggregate fundraising of 4945 billion in this years PERE 100 which ranks managers by the amount of equity. Equium Capital Real Estate reviews new projects every week advancing less than 10 of files to full due diligence and less than 10 of those to investors. Preqins extensive research shows there are currently 92 private equity firms located in Canada.

Source: pinterest.com

Source: pinterest.com

Top Funding Types Post-IPO Equity Venture - Series Unknown Seed Post-IPO Debt Debt Financing. Blackstone and Brookfield are gigantic firms that do much more than real estate while Starwood is the biggest dedicated real estate investment firm. For the past 16 years hes held the role of CEO at KingSett Capital a leading Canadian private equity real estate business which co-invests with pension funds and high net worth individual clients. In terms of sectors Canadian pension funds are particularly active in real estate utilities and infrastructure investments worldwide. PwC Canada offers Canadian real estate consulting services to owners investors lenders and lease-holders to turn risks into opportunities.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title canadian real estate private equity firms by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.